FACTS: Asia-Pacific refined product demand to rebound in 2006 and later

After experiencing strong growth in 2004, the Asia-Pacific region’s oil demand growth slowed in 2005, particularly during the second half of the year, according to a July 2006 study from FACTS Inc., Honolulu. For 2006 and beyond, the study predicts stronger demand growth, especially in China, South Korea, Indonesia, Malaysia, and Vietnam.

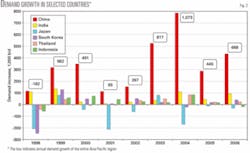

In its “Energy Briefs, Asia-Pacific Petroleum Product Demand: An Update,” FACTS revised downward its 2005 preliminary estimate for the region’s oil demand growth to 445,000 b/d (Fig. 1).

The International Energy Agency revised downward global demand for 2005 to 1.05 million b/d from 1.6 million b/d in mid-2005. The study states that the current slowdown in demand growth is temporary and growth will “rebound to the level of the historical average amid the region’s strong economic conditions.”

High oil prices

There are two major reasons for the sudden slowdown in Asia-Pacific’s oil demand growth, according to the study. First, although oil prices have been rising during the past few years, oil prices stayed at the historically highest levels ever (in nominal terms) in second-half 2005.

Second, although many governments were initially reluctant to take immediate and strong action due to fear of a political backlash, they realized that they must terminate or significantly reduce subsidies due to budgetary constraints (e.g., Thailand and Indonesia).

Subsidies also create another problem, according to the study: “A considerable imbalance between domestic and international prices, created by subsidies, has been causing smuggling or the illegal use of oil products in a few countries, such as Malaysia, Vietnam, and China. As a result, efforts by those countries to reduce budgetary burdens from subsidizing products were diluted.”

In contrast, Indonesia’s smuggling seems to have been eliminated after the government substantially raised retail product prices in late 2005. Because subsidies increase a country’s budgetary burden and indirectly cause smuggling or the illegal use of oil products, the study recommends their elimination soon.

Removal or reduction of subsidies has led to higher domestic product prices in several countries, which has dampened oil product demand. For example, Thailand’s diesel subsidy was removed in July 2005; subsequently, demand growth was revised down by about 25,000 b/d for 2005 and 2006.

Indonesia’s government more than doubled retail gasoline and diesel prices for residents, resulting in a sharp decrease in oil product demand growth; the study revised downward demand growth in 2005 to 18,000 b/d from 71,000 b/d. Demand in 2006 will decline about 20,000 b/d; previous updates projected it to increase 56,000 b/d.

Rising demand and high domestic product prices have accelerated the substitution of fuels, according to the study. In 2005, a few countries (Thailand, Pakistan, and Malaysia) started promoting biofuels and natural gas vehicles to reduce their dependency on oil even though transportation fuels are usually considered the least substitutable.

Country prospects

China is the major driving force of the region’s demand growth; its oil demand growth accounts for about two-thirds of growth in the entire Asia-Pacific region. Fig. 2 shows demand growth for selected Asian countries.

One unique issue has emerged again for China, apparent demand vs. true demand. Apparent demand, used by the IEA in its “Monthly Oil Market Report,” stated that China’s demand growth in 2005 was only about 150,000 b/d (or 2.4%). Accounting for increases in China’s inventories in 2004 and a draw-down in 2005, true demand growth in 2005 was about 290,000 b/d (or 4.7%), according to the study.

This gap in growth rates significantly affects the region’s demand-growth expectations. Although the FACTS estimate for China’s actual growth in 2005 is higher than IEA’s estimate, it is still significantly lower than its 2004 growth (which was almost 800,000 b/d or 14.6%).

The study predicts stronger growth (some 420,000-450,000 b/d) in China’s overall oil demand in 2006.

Subsidies in China have also created market distortions. Because the government-regulated domestic product prices in China are still lower than international market prices, subsidies give incentives to China’s refiners and wholesalers to export or smuggle oil products abroad to reap higher profits, despite the economy’s needing them for growth, thus resulting in product shortages.

For example, truckers and other diesel consumers in Hong Kong purchased diesel in Guangdong, China, which led to an overall decline in Hong Kong’s diesel consumption of 34,000 b/d in 2005. A net result was that Hong Kong’s overall demand declined by about 20,000 b/d in 2005, according to the study.

In 2006, the price imbalance between mainland China and Hong Kong will fall. The decline in Hong Kong’s diesel demand will be offset by a rebounding of diesel demand (about 11,000 b/d) in 2006.

Given India’s high oil-demand growth in 2004 of 111,000 b/d, FACTS expected the country to maintain steady, strong growth of 90,000-110,000 b/d/year during the next decade. Its growth in 2005, however, was revised down to slightly less than 50,000 b/d, despite maintaining its economic growth, most of which is in the less-energy-intensive service sector.

The study also revised downward Pakistan’s oil demand to a decline of 22,000 b/d from a 22,000 b/d increase.

India and Pakistan curbed oil-demand growth primarily by substituting natural gas for oil and improving vehicle efficiency. Easier access to natural gas than other countries in Asia-Pacific will allow the continued substitution of natural gas for oil, such as through the use of compressed natural gas in automobiles.

Oil-demand growth in Japan and South Korea moved in opposite directions. Japan’s oil demand declined 11,000 b/d in 2005 and will decline by another 30,000 b/d in 2006, according to the study.

South Korea’s oil-demand growth turned positive in 2005 and is increasing in 2006 due to its balanced economic conditions and greater consumer confidence; the effects of high oil prices and fuel substitution seems to have peaked.

Australia and New Zealand are posting modest demand growth, about 3% in 2005 and slightly below 2% in 2006, the study predicts. Singapore’s demand growth of 34,000 b/d (4.7%) in 2005 was mostly due to strong demand for fuel oil; FACTS expects this growth to slow to about 10,000 b/d (1.2%) in 2006.

Taiwan’s demand growth in 2005 was 16,000 b/d (1.7%), led by LPG but offset by substitution of natural gas, coal, and hydropower for fuel oil. In 2006, demand growth will bounce back to 28,000 b/d (2.9%), primarily due to a rebound in naphtha demand and a slowdown in natural gas substitution.

Considerable increases in domestic product prices in late 2005 have made Indonesia the only country, other than Japan, registering a decline (19,000 b/d) in 2006. The study expects Indonesia’s oil demand to return to the historical trend (41,000-46,000 b/d/year or an average growth of 3%/year) during 2007-15.

The study projects Thailand’s demand growth to be sluggish through 2010 (about 22,000-25,000 b/d/year or 2.4%/year) after the removal of subsidies for gasoline and diesel in 2004 and 2005, respectively.

Because the Philippines no longer has a subsidy shield to protect its economy from the rising oil prices, its oil demand declined by nearly 8% (or 25,000 b/d) in 2005, according to the study. Because the country is promoting biodiesel and natural gas, oil demand should be flat or modestly increase in the near future.

Because the Malaysian and Vietnam governments are enjoying substantial revenues from crude exports, their concerns about budgetary burdens from subsidies may not be that serious. Despite increases in 2005, retail prices are still low relative to other countries in the region, thereby sustaining smuggling.

The study therefore expects that oil-product demand growth will remain strong in 2005-06: 20,000-22,000 b/d (about 4%) for Malaysia and 16,000-18,000 b/d (about 7%) for Vietnam.

Product prospects

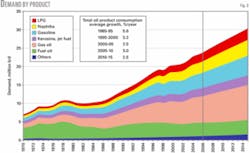

Asia-Pacific’s petroleum product demand is becoming lighter (Fig. 3). In 2005, about 30% of product demand was gas oil, followed by gasoline (17%), and fuel oil (16%, including the direct use of crude oil and NGL), according to the study. Shares of naphtha, LPG, kerosine-jet fuel, and others were 12.7%, 9.7%, 9.6%, and 4.6%, respectively.

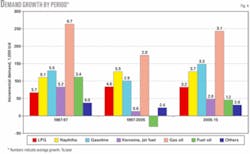

Fig. 4 shows the average annual demand growth for each petroleum product in three different periods: 1987-97, 1997-2005, and 2005-15. Overall demand growth was fastest during 1987-97 (about 810,000 b/d/year or 5.7%/year) and slowest during 1997-2005 (about 500,000 b/d/year or 2.4%/year) due to the Asian financial crisis and a worldwide recession during 2001-02.

Fig. 4 also shows that gas oil’s average growth (in volume) was highest among the products during 1987-2005 and will also be the highest in the future.

In terms of average growth rate, naphtha was the highest during all periods, according to the study. The average growth of fuel oil was -0.8%/year during 1997-2005 due to the substitution of natural gas and other energy sources, particularly in the power sector.

Transportation fuels

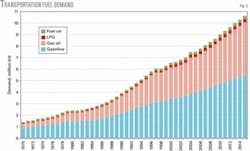

Fig. 5 shows that gasoline has a stable share of 51-53% of the growth in transportation fuels, while gas oil’s share has been around 42%, according to the study.

Combined with the removal or reduction of subsidies for transportation fuels in several countries (Thailand, China, Indonesia, and Vietnam), recent persistent high oil prices have slowed demand growth for both gasoline and diesel. In 2005, demand growth for gasoline and diesel were 1.4% and 1.8%, respectively; however, FACTS expects demand growth for both products to bounce back to 3.6-3.7% in 2006.

In the mid-term, demand for these products will continue to grow at similar rates, according to the study. And because low-sulfur diesel specifications are becoming popular (Japan, South Korea, and Singapore), diesel will continue to register higher consumption rates in the region.

Average growth for gasoline and diesel demand should be about 3.1-3.7%/year by 2010 and should continue to be about 3%/year after that, according to the study.

Kerosine-jet fuel

Jet-fuel demand grew 11% in 2004 and 6% in 2005 due to the surge in international aviation. Similar to transportation fuels, there are no immediate substitutes for jet fuel, and its demand will grow at about 4%/year during 2005-10 despite high oil prices.

Due to its easy substitution, kerosine’s demand has been declining slightly (about 1%/year during 2000-03). The study notes, however, that kerosine consumption increased almost 3% in 2005 due to unexpectedly cold weather in Japan and South Korea during November and December, followed by an expected decline of about 4% in early 2006 due to warmer weather in these two countries.

Fuel oil

Japan, South Korea, Taiwan, Singapore, and even Hong Kong are switching or planning to switch from fuel oil to natural gas for electricity generation. Although they are leaning more towards LNG, however, a further increase in natural gas consumption through LNG might be limited, due to the recent tight supply, according to the study.

Fuel oil used in the industrial sector exhibits a pattern similar to that of the power sector-it has been declining by about 1%/year in the last decade due to substitution of natural gas and other sources. Fuel oil used for bunkering, however, has been steadily increasing since the mid-1980s, with an average growth of about 6%/year. The study projects that fuel oil demand in the industrial sector will grow about 2.4%/year through 2015.

Other uses accounted for about 14% of total fuel oil consumption in 2005; this demand will only slightly increase. The region’s overall demand for fuel oil increased 0.5% in 2005 and will grow modestly (about 1.2%/year) during 2005-15.

LPG

Although LPG’s share of Asia-Pacific’s oil demand is slightly less than 10%, its demand has been growing rapidly in the past 10 years. In 2005, LPG demand grew about 100,000 b/d (or 4.6%), according to the study. Overall, LPG demand will grow at about 4.5%/year through 2010 and 3%/year during 2010-15.

Naphtha

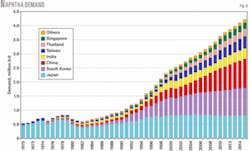

Demand growth for naphtha was the fastest among all products at 9.1%/year and 5.5%/year during 1987-97 and 1997-2005, respectively. Naphtha-demand growth in 2005 was relatively weak because of a significant decline in India due to substitution and a slump in Taiwan, according to the study.

Fig. 6 shows that Japan dominated naphtha consumption before 1990 and that South Korea and China are rapidly catching up. In 2005, Japan and South Korea had nearly equal shares of Asia-Pacific’s naphtha market (29% and 26%, respectively), followed by China (16%), India (9%), and Taiwan (8%).

The study predicts that naphtha demand will continue to increase and show the highest growth rate in the next decade due to rising demand for the product as a petrochemical feedstock. Its demand will to grow about 4.4%/year (or 140,000 b/d/year) during 2005-10, and about 3%/year during 2010-15.