DEEPWATER RISKS-1: Challenges, risks can be managed in deepwater oil and gas projects

Deepwater projects typically face technical and financial challenges to their viability. Such challenges are now increasingly significant for operators, consultants, and contractors as exploration moves into ever deeper water.

It is essential that these challenges are assessed, mitigated, and managed throughout project execution by selecting appropriate field development plans, risk management, and modifying project implementation methods. A clear understanding of risks throughout project execution is a key component of deepwater development.

The aims of this two-part article are to provide an insight into the various risks involved in deepwater field development as well as to help engineers and managers develop strategic risk management models.

Offshore risks

Offshore field development is a complex activity that involves uncertainties from a wide range of sources.

These uncertainties comprise potentially both hazards (unwanted consequences) and opportunities (desired consequences) for success. Managing these uncertainties in a systematic and efficient manner with higher focus on the most critical uncertainties is the objective of project risk management.

The uncertainties come from a wide range of areas and disciplines, and may be of a complete different nature:

- Technical.

- Financial.

- Organizational.

- Contract/procurement.

- Subcontractors.

- Political/cultural, etc.

Nevertheless, they all contribute to the overall uncertainty in the planning and execution of the project as well as the success of the final product.1

Deepwater field development projects face special challenges, specifically:

- High investment costs (capex).

- Introduction of new technology elements or usage of known technology in new conditions.

- Long lead times for spares and installation resources.

- High consequences of operational failure.

- Flow assurance.

- Fabrication, installation, and operation in new deepwater frontier basins.

- Deepwater development may be located in countries with high political instability.

Deepwater developments require large reserves, and the total number of wells needs to be kept small in order to make the project economically viable. The drilling capex can be typically in excess of 50% of the total capital expenditure. Hence, the oil recovery per well needs to be high along with a high production rate per well, typically 10,000-15,000 b/d of oil.

Today’s deepwater completions must maximize ultimate recovery for projects to be economically viable. Newly discovered deepwater reservoirs are capable of high flow rates, and the wells must be designed accordingly.

The cost and inaccessibility of deepwater subsea wells also require the industry to rely heavily on new technology to optimize the capital expenses on projects. Completion design and equipment reliability are critical to the success of a development. While new technology is essential, there are risks in using technology that has not been rigorously tested for reliability in the environments in which it is being deployed.

Reliability problems during the life of a well show up in the form of reentry and workovers, which must be minimized to achieve project economics. Problems may result in formation damage, lost reserves, safety, and environmental exposure.2

A project risk management methodology addresses the management of uncertainties at different project phases depending on the level of information that is available and the type of decisions to be made.1

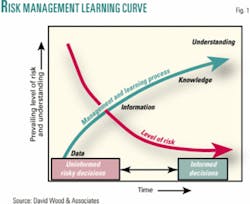

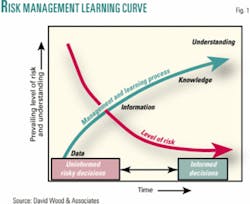

Effectively understanding risk is all about moving up the learning curve and being in a position to make informed decisions (Fig. 1). However, in the project-managed field development context some key decisions must be made early in the planning process if they are to ultimately influence project schedules and costs (Fig. 2).

Figs. 1 and 2 show that risk management is a crucial early phase activity in the project cycle if we are to reap the benefits of the knowledge it provides in time to inform decisions that will prove crucial in the ultimate cost, time, and quality performance of a project. The importance and urgency of risk management in deepwater projects cannot therefore be overestimated.

On technically complex deepwater projects that require large sums of capital expended over long periods of time, there is no substitute for closely monitoring costs, assessing financial risks, and implementing mitigation plans based on robust decision intelligence as early as possible in the project. Yale and Knudsen3 illustrate how the influence of strategic planning and risk assessment on project expenditures decreases over time using cost-risk analysis performed on a midsize subsea tieback project in the Gulf of Mexico.

Oil and gas exploration and exploitation is generally a high-risk but highly rewarding business. The uncertainties with regard to the presence and quantities of recoverable reserves, the cost of developing reservoirs, and the product prices are enormous. Cost-risk curves demonstrate that investment in reservoir identification and delineation, plus early engineering studies, are the best way to mitigate risks. The risks may be broadly classified4 as:

- Revenue risks: uncertainties in the quantity of recoverable reserves (initial-oil-in-place and recovery factor), the rate of recovery (plateau rate, early production, etc.), and the product price (oil and gas sales price).

- Cost risks: uncertainties related to the cost of developing the field through the value chain and the income recovered at market prices.

Technological risks can be considered a third type of risk. However, the use of new technology is considered either to reduce costs relative to traditional technology or increase the uncertainty and potentially the costs on the performance and reliability of the new technology.

Technology risk is therefore in this discussion included as a cost risk. An offshore development project generally goes through three distinct phases:4

- The exploration phase, in which the focus is on revenue risk, i.e., determining the reservoir production potential.

- The development phase, during which most of the investment takes place, focuses on the cost risk and the technology needed to develop the field in an economically robust manner.

- The production phase, during which the revenue risk is represented by the product price and the production profile.

Deepwater project revenue and cost risks are influenced by the following factors: field reserves; reservoir complexity; development design and engineering; oil and gas price volatility; drilling and well completions; subsea infrastructure, flowlines, and risers; processing facilities and support structures; transportation and storage; and project schedule.

The risks can, to a certain degree, be managed and mitigated by selection of different field development plans, as well as project implementation methods.4 Under discussion of each type of risk, the potential for risk mitigation will be briefly addressed.

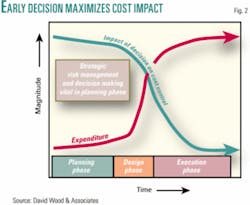

Risks that are specific to deepwater developments and to the specific technology that can mitigate them are identified in more detail. It is also essential to take a broader and more holistic view of risk (including opportunity) that goes beyond the subsurface, technological, and project risks when assessing project feasibilities. Fig. 3 illustrates the spectrum of risks that oil and gas projects encounter and must accommodate.

While our focus here is upon the technical and project risks that are most readily managed from an engineering perspective there is no doubt that risk management has to go beyond the engineering level. The more holistic approaches to risk are beyond the scope of this article but are covered elsewhere.5 6

It is impossible to identify and mitigate against all facets of risk, but it helps to be aware of as many as possible and formulate contingency plans and strategies.

Project risk management can employ a range of analytical techniques and software. There is no one right way to do it but plenty of inconsistent and haphazard approaches that hinder rather than help in risk management. The key is to be systematic and consistent.

Development framework

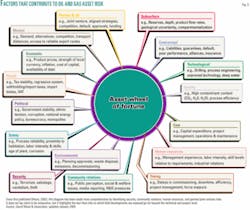

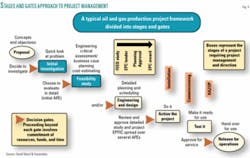

A stages and gates approach (Fig. 4) to the project management of oil and gas field and facilities emphasizes the importance of the planning stages (feasibility, FEED) leading into engineering, procurement, and construction (EPC) contracting, construction and fabrication activity, on to HAZOP and ultimately plant commissioning.

To move from one stage to another requires a gate to be passed where decisions and approvals have to be made associated with funding, technical design, and project priority. Such approvals are usually structured in the form of authorities for expenditure (AFEs) to be signed-off by the project owners (and often other stakeholders-e.g., government authorities) as positive approval to proceed under stages of a project budget. Although the diagram for simplicity suggests a linear process proceeding from one stage to another, in practice there are often loops and feedbacks to the work of earlier stages that require adjustments to design, etc.

Design criteria and options

Design criteria must be robust and flexible, with the development concept demonstrating operating flexibility and operability. It should include the establishment and management of a facilities weight budget and address how the facilities are to be controlled.

A key pre-FEED question is how much redundancy is needed to accommodate potential production capacity expansion? A high degree of redundancy automatically entails a high degree of complexity.

Some design tradeoffs in a field development framework can substantially impact the weight of the structure, (e.g., dual versus single process trains) with negative weight gains, but positive flexibility gains. In general terms, to reduce the total installed capital cost of an offshore facility; it should be made smaller and lighter.

The skidded or modular approach is common in the Gulf of Mexico, where there is an abundance of quality speciality fabricators in the region. While adding weight, modular construction can have overall benefits to the project in terms of distributing the project workforce, improving the competitive bidding process and quality of the facilities and dramatically shortening fabrication schedules.

Offshore processing can be prohibitively expensive. In extremely remote locations it may be the only option but, depending on the distance to shore, a subsea development may be the least expensive solution for gas field developments.

Tying back deepwater subsea field developments long distances to shallow water or even to shore is becoming an increasingly attractive design option in some areas. For example, in the Gulf of Mexico, Mensa field developed by Shell in 1,600 m of water is quite an innovative development with subsea wells tied back 100 km to a shallow water platform, West Delta 143.

Giant Ormen Lange gas field in 800-1,200 m of water in the Norwegian North Sea lies 140 km west of Kristiansund and is being developed with a subsea template linked to shore-based processing facilities. Farther north, in the Barents Sea, the Snohvit gas field complex is also being developed with subsea facilities to a land-based LNG facility under construction. Such a design concept is being considered for the Shtokman field 560 km north of Murmansk in the Russian Barents Sea.

Scarab and Saffron gas fields form part of the West Delta Deep development in 650 m of water 90 km off Egypt. They were also developed using subsea manifolds with wells tied in and lines to shore. This development came on-stream in 2003. Popular design concepts for fields in hostile and remote (including deepwater) environments are to exploit subsea technology with pipelines to shore where possible.

Understanding how the risks and technical challenges (discussed below) fit and are to be addressed within the field development project framework and with specific design concepts are essential to achieving projects on-time and within budget without major surprises and to mitigate threats and exploit opportunities.

Reservoir uncertainties

The process of estimating oil and gas reserves is complex and involves a significant number of assumptions in evaluating available geological, geophysical, petroleum engineering, and economic data. Therefore, reserves estimates are inherently uncertain.

The reservoir size field reserves pose the fundamental technical aspect to revenue risk. Reservoir complexity, depth, and remoteness from existing infrastructure are the major factors that influence cost risk. Reservoir models that link engineering and 3D seismic data sets help mitigate risk by optimizing reserves recovery through careful well location and spacing.

Some reservoir types, such as narrow channels, can be hard to resolve which means that such models are far from foolproof. Invariably reservoir characteristic assumptions used at the planning stage differ from those that manifest themselves during a field’s production life.4 Post first oil production, reservoir dynamic behavior determines reserves size.

A phased field development can often offer an attractive development strategy in deepwater environments as such an approach can eliminate many of the recoverable volume and production flow risks and issues confronting reservoir engineers. Even though it may cost more in total it can effectively spread risks and costs.

Oil and gas prices

Product prices represent the fundamental commercial aspect of revenue risk.

Estimates for life of field product prices should be conservative enough to mitigate the impacts of low price intervals in volatile product markets.

In risked economic evaluations and justifications for sanctioning deepwater field developments, sensitivity cases and/or a probabilistic approach help to identify potential product price impacts on life of field investment returns.4

Wells and completions

Drilling and completion costs account for some 50% of total deepwater field development costs (much more than for shallow water fields). Hence drilling and completion activities make a significant contribution to overall risk.

In addition, subsea well technology and services commonly account for some 25% of the overall cost. Up to 75% of the costs are therefore incurred on items at the sea bed or below. With rigs commanding premium prices for deepwater operations, making full use of reservoir models to optimize well locations becomes an essential means of reducing well risks.

The cost and resources deployed in building quality reservoir models is justified by reducing the number of wells required and optimising the performance of those wells drilled.

Costs and risks associated with production and injection wells will depend on the technologies deployed and the environment. Platform-drilled wells generally pose less risk and are more flexible in design than wells drilled from mobile drilling units. Large wellbore subsea wells are more risky and costly to drill with fewer contractors offering proven capabilities.

International deepwater wells frequently cost more than $25 million to drill and complete. In such cases technologies and models that facilitate increased recovery from individual wells and enable a reduction in the number of wells can offer huge cost and risk reduction benefits.

Cromb2 was adamant: “Complex drilling/completion systems should not be acceptable for subsea equipment-period.” To ignore this undoubtedly increases risk and cost over the life of the well, which invariably offset any engineering gains made by doing so.

Technological demands that are frequently crucial for deepwater drilling are:

- Drilling of extended reach and multilateral wells.

- Drilling and completion of wells in deep and ultradeep water, especially using smart/slender wells and underbalanced drilling.

- Design, construction and installation of lighter and smaller subsea equipment for ultradeep water.

Plans that call for fewer deepwater wells (assuming higher unit recovery can be achieved from each well) are an obvious way to try to reduce capital and operating cost requirements. With a good reservoir and model, it should be possible to optimally locate wells and by employing large-offset subsea wells the total number of wells (and floating facilities) can be reduced.

Flowlines and risers

Long-reach satellite developments (more than 100 km in some cases) of fields in deep and ultradeep water rely heavily on flowlines and risers to make production possible.

The maintenance and integrity of these facilities is a risk and a cost that cannot be ignored for deepwater fields. Generic characteristics of deepwater fields include:

- Remote locations.

- Deep columns of cold water with strong ocean currents.

- Limited or difficult to access infrastructure.

- Complex supply, manpower, and service logistics.

- Costly support vessels.

- Long flowline tiebacks to floating production and storage systems from outlying wells.

Flow assurance is critical for flowlines and risers in deep and cold water and can be costly. Blockages due to wax, hydrates, and sand can shut down production and be expensive to remedy unless remedial measures are designed into the facilities.

Potential multifunction of risers, flowlines, and umbilical cables are undoubtedly some of the most critical concerns associated with equipment components of the floating production systems being developed for ultradeep water field developments.4

Next: More aspects discussed on managing risks in deepwater projects.