OGJ Newsletter

DOI to assemble royalty policies review panel

The US Department of the Interior is forming an independent panel to examine royalty policies and procedures on federal and Indian lands, the federal department announced on Nov. 14.

The Subcommittee on Royalty Management will operate under the Royalty Policy Committee, an independent advisory board that the Interior secretary appoints to advise the US Minerals Management Service on royalty management and other mineral-related policies.

“Recently, there has been much interest regarding the accuracy and effectiveness of the minerals management program within [MMS],” said C. Stephen Allred, assistant Interior secretary for land and minerals management.

“We have decided that a review of the procedures and policies surrounding management of mineral revenue at [DOI] is in order,” he wrote in a letter to incoming Royalty Policy Committee Chairman Daniel Reimer.

MMS attracted heavy criticism earlier this year following the discovery that price thresholds were omitted from federal deepwater oil and gas leases issued in 1998-99. Thomas M. Davis (R-Va.), chairman of the House Government Reform Committee, and Darrell E. Issa (R-Calif.), chairman of the committee’s energy subcommittee, have asked the Government Accountability Office for an investigation.

Allred said that the panel specifically would review:

- The extent to which existing reporting and accounting procedures and processes are sufficient to assure that MMS receives the correct amount.

- MMS audit, compliance, and reporting procedures to ensure that lessees comply with existing statutes, terms, and regulations governing royalties.

- Operations of the royalty in-kind program to assure that adequate policies, procedures, and controls are in place.

Subcommittee members will be announced soon, Allred said. He added that the group would spend 6 months on its review before reporting to the full Royalty Policy Committee.

Iraq to boost oil output, develop Al Ahdab field

Iraqi oil minister Hussein al-Shahristani, fresh from a tour of Asia, said he expects his country to produce 3 million b/d of crude oil by yearend and, with new investment, some 4.5 million b/d by 2010.

He said Iraq produced an average of 2.3 million b/d in October, and exported 1.6-1.7 million b/d despite 2-3 insurgent attacks/week on the country’s pipelines.

Sharistani has just returned from a tour of Asian countries where he won support for increased investment in Iraq’s oil industry, in particular from China and Japan.

In China, he brokered an agreement with the China National Petroleum Corp. for new exploration rights over al-Ahdab field in southern Iraq. He said a joint Iraqi-Chinese committee will hold meetings in Baghdad, beginning on Nov. 11, to determine how to develop the oil field.

In June 1997 China signed a $700 million contract to explore al-Ahdab over 23 years. Plans originally called for 90,000 b/d of oil production, but field development was suspended due to UN sanctions on Iraq and to security problems since the beginning of the US-led war in 2002.

Al-Ahdab field, in the middle and southern regions of Iraq, has estimated reserves of as much as 1 billion bbl of oil and is considered commercially viable, especially because of its proximity to existing pipelines and refineries.

During Sharastani’s swing through Asia, he also held talks with Sinopec Group and CNOOC to seek more energy investment in Iraq once the new Iraqi energy investment law is approved.

In Japan, Shahristani said, the government promised to give a soft loan of $3.5 billion to help Iraq build a refinery and a floating loading platform off Basra in the Persian Gulf.

UK still studying 24th-round license bids

The UK government will publish the results of its 24th licensing round “within weeks,” Energy Minister Malcolm Wicks said in Aberdeen during a conference by the UK Offshore Operators’ Association. Operators had hoped he would report bid results.

The Department for Trade and Industry (DTI), which issues the licenses, is carrying out further environmental checks against the 147 applications received from 121 companies, he said. The round closed June 16 (OGJ, Aug. 7, 2006, p. 37).

A DTI spokesman told OGJ that the agency has sought comments on environmental issues raised by its licenses as stipulated by the European Union’s recently clarified Habitat Directive.

Baltimore marketer settles EPA tank charges

Carroll Independent Fuel Co. reached a consent agreement with the US Environmental Protection Agency Nov. 14 in which the Baltimore-based heating oil, gasoline, and products distributor agreed to pay a $284,156 civil penalty and complete a special environmental project at 32 of its facilities in Maryland.

EPA’s regional office in Philadelphia cited Carroll for several underground storage tank (UST) violations including failure to perform release detection, meet new UST system standards for spill and over-fill prevention, provide corrosion protection on metal piping, investigate a suspected release, report a suspected release, and perform lint tightness testing.

The alleged violations were documented through multifacility underground storage tank audits submitted to EPA by Carroll’s auditor after the company entered into a consent agreement and final order on June 30 to audit all of its facilities for compliance. As part of the settlement, Carroll neither admitted nor denied liability for the violations. The company also agreed to implement a $447,000 environmental project to be determined, to secure significant environmental or public health protections, EPA said.

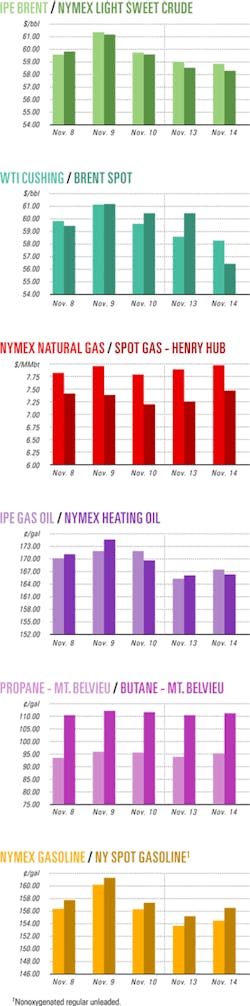

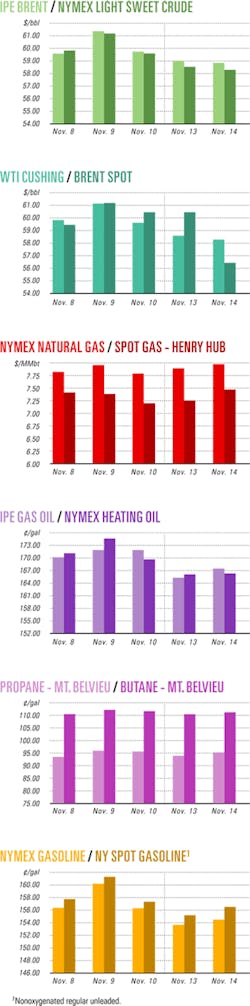

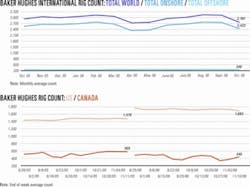

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesStatoil gets stake in deepwater block off Angola

Statoil ASA has signed a production-sharing agreement (PSA) with Angola’s Sonangol for a 5% interest in deepwater Bock 15/06 off Angola.

The 2,984-sq-km block, in 300-1,800 m of water about 100 km from Luanda, is composed of relinquished parts of Block 15. These parts were relinquished in 2002, when the exploration period of that acreage of Block 15 expired.

The work program for Block 15/06 includes 3D seismic surveys and drilling eight wells in the first 5 years of the exploration phase.

Chevron strikes gas with wildcat off Australia

Chevron Corp. has made a natural gas discovery with its Clio-1 wildcat in 3,000 ft of water on permit WA-205-P, 90 miles off northwestern Australia.

Clio-1, which was completed in September, 20 km northwest of Gorgon gas field, encountered 623 ft of net gas sands in the Triassic Mungaroo formation.

Transocean Inc.’s Jack Bates semisubmersible, capable of drilling in water as deep as 5,400 ft, drilled the well to a TVD of 15,500 ft.

Chevron plans to conduct a 3D seismic survey program, starting in mid-December, to better determine the potential of the gas find and subsequent development options.

Total confirms Tunu field extension off Indonesia

Total SA confirmed an extension of Tunu gas field’s southern zone with a gas discovery between Tunu and Peciko fields off East Kalimantan.

The Tunu Great South-1 well, drilled in very shallow water 8 km southwest of Tunu field’s southernmost platform, encountered numerous gas reservoirs on Mahakam block.

Total E&P Indonesia plans a production test and also plans to drill appraisal wells. The extension could come on stream by 2009, it said.

Last year, Total said it planned to spend $1.5 billion on gas development in Indonesia, much of that on Mahakam block.

Indago has successful well tests off Oman

Indago Petroleum Ltd. subsidiary Indago Oman Ltd. has begun testing the West Bukha-2A (WB2A) well on Block 8 off Oman, as it pursues a production target of first-quarter 2008.

WB2A, a sidetrack of the original West Bukha-2 wellbore, penetrated the Shuaiba and Kharaib reservoirs of the Lower Cretaceous Thamama formation.

The WB2A sidetrack, a result of the drill string parting while drilling, reached a depth of 4,529 m and was plugged back to 4,383 m after electric wireline logs were obtained.

On the first of two 4-hr flow tests of the uppermost Shuaiba section of the Thamama, over an open-hole interval from 4,363 m to 4,383 m, the well achieved an average stable flow rate of 3,524 b/d of 42° gravity oil and 1 MMscfd of gas on a 36/64-in. choke at 2,512 psi. This success followed acidization and initial clean-up period.

On the second test, the well’s flow rate increased to an average 4,392 b/d of oil and 1.4 MMscfd of gas through a 50/64-in. choke at 1,711 psi.

After completing flow testing, Indago, the block operator, will shut in the well to conduct a pressure build-up survey.

Both the primary reservoir (Mishrif-Mauddud) and secondary target (Thamama) were encountered higher to prognosis, resulting in a longer hydrocarbon-bearing interval in the Thamama than expected. However, the Shuaiba section of the Thamama was not previously part of Indago’s audited 2P reserve estimates, plus, the reservoir has yet to be assigned commercial reserves, Indago said.

It plans to conduct a second flow test in the Mishrif-Mauddud following the Thamama testing period. Previously, flow rates of as much as 13.6 MMscfd and 2,910 b/d of condensate have been obtained in the Mishrif formation, which lies above the Thamama, in the 1976 discovery well.

PTTEP Bongkot gas well to extend field life

The first exploration well drilled in 8 years on the Bongkot concession block in the Gulf of Thailand, about 600 km south of Bangkok, has resulted in an additional natural gas find, said Thailand’s state-controlled PTT Exploration & Production PLC (PTTEP).

Ton Chan-1X, drilled to 3,442 m TD in a new structure at the northern section of the block, found gas-bearing sands with 143 m total thickness in the stratigraphic trap.

The company said the well’s results indicate a potential for discovery of additional gas reserves in Bongkot’s production areas.

PTTEP will conduct additional drilling to estimate the petroleum reserves there and prepare a development plan for future production in due course, said Pres. Maroot Mrigadat.

The discovery will increase production and prolong the life of Bongkot, which has been on stream since July 1993 and is producing 600 MMcfd of gas and 19,259 b/d of condensate.

Austral Pacific completes another Cheal B well

Austral Pacific Energy Ltd. on Nov. 7 achieved a TD of 1,866 m with its Cheal B2 well, the second of four wells to be drilled back-to-back from the Cheal B site. The program is part of Cheal oil field development in New Zealand’s Taranaki basin.

This well targeted and intersected the late Miocene Mount Messenger sands over a gross interval of 1,709-1,735 m.

Wireline logs indicate these sands are oil bearing. The logs also showed that thinly bedded sands from the secondary target-the Urenui formation-over a gross interval of 1,278-1,383 m were oil bearing as well.

Production casing has been run at the Cheal B2 well, and the Ensign Energy Services Rig 19 is being mobilized to the adjacent Cheal B3 site. Drilling of the Cheal B3 well is expected to begin by Nov. 17.

The four wells are expected to produce a combined 1,000 b/d in first quarter 2007, rising to 1,900 b/d in second quarter 2007 (OGJ Online, Oct. 12, 2006).

Urals Energy granted access to ESPO Pipeline

OAO Transneft has authorized Urals Energy Public Co. Ltd.’s Dulisma oil field to be connected to the planned East Siberian Pacific Ocean (ESPO) Pipeline.

Dulisma field, 350 km northeast of Ust-Kut, is expected to produce 12,000 b/d by yearend 2008, and production is expected to reach 30,000 b/d by 2011.

Urals Energy plans to sell the oil to Pacific Rim consumers, probably China.

China and Russia are studying construction of an oil pipeline spur from Skovorodino to the Chinese border. The spur would be part of ESPO Pipeline connecting eastern Siberian oil deposits with an export terminal on Russia’s Pacific coast (OGJ Online, Oct. 26, 2006).

Urals Energy said it would soon begin project design work for the Dulisma-ESPO interconnect, commencing procurement of pipe and other facilities by April 2007.

The ESPO line, which will be built in phases, is expected to start delivering oil in mid-2008.

Interim field production prior to connecting Dulisma to ESPO will continue to be transported to Ust-Kut via a temporary pipeline operated by an adjoining producer, Urals Energy said.

Drilling & Production - Quick TakesTerra Nova production resumes off St. John’s

Production from Terra Nova oil field resumed Nov. 12, following completion of a planned maintenance turnaround on the Terra Nova floating production, storage, and offloading vessel (OGJ, Sept. 11, 2006, Newsletter).

The FPSO returned to the field Sept. 25 and was reconnected to its mooring system Oct. 1. Operator Petro-Canada expects Terra Nova average fourth quarter production to be 33,000 b/d gross.

“Over the course of the fourth quarter, we expect to restart all the wells and ramp up to peak production volumes in the 100,000 to 110,000 b/d range,” said Bill Fleming, Petro-Canada’s vice-president, East Coast oil. “Along with the work done in the turnaround, the 40 new beds on the FPSO will permit improved inspection and preventative maintenance programs aimed at reducing future downtime.”

Regulators approve Suncor’s oil sands projects

Suncor Energy Inc. said the Alberta Energy and Utilities Board (EUB) on Nov. 14 approved the company’s application to build a third oil sands upgrader, Voyageur, and approved plans to develop the Steepbank mine expansion.

Voyageur is the centerpiece in Suncor’s plans to boost oil sands production to 500,000 b/d by 2012. Suncor plans to begin preparation for both Voyageur and Steepbank next year.

Meanwhile, work continues on the Athabasca oil sands expansion north of Fort McMurray (OGJ, Sept. 25, 2006, p. 39). With commissioning targeted for 2008, that expansion is expected to increase production to 350,000 b/d from 260,000 b/d.

Construction was 65% complete as of Sept. 30. Other work under way includes expansion of Suncor’s in situ operations, with completion expected in 2007.

In granting Voyageur and Steepbank project approvals, the EUB outlined several conditions for Suncor. Three conditions specifically deal with managing tailings: the mixture of water, clay, sand, and residual bitumen produced during the extraction process. Separately, Suncor announced 2007 spending plans of $5.3 billion (Can.), of which $4.4 billion will be dedicated to oil sands.

Fortune Oil begins CBM drilling in China

A unit of Fortune Oil PLC has begun drilling its first pilot well on the Liulin Block in the eastern Ordos basin of Shanxi Province, China. The Ordos basin is one of the world’s largest CBM resource areas.

Fortune Liulin Gas Co. Ltd., which entered into a production-sharing contract for development of the coalbed methane (CBM) block, spudded the FL-EP2 vertical production well on Nov. 7. The company plans to drill this well to a TD of 1,155 m and take core samples from coal seams numbers 4, 5, and 8.

A second vertical pilot production well-FL-EP1, targeting 610 m TD-will be drilled later this year.

After the two wells are complete, Fortune will fracture stimulate Seam 8 in both wells and will monitor production rates of CBM gas and water over the following months.

More than 70 coal coreholes and several CBM exploration wells have been drilled in the Liulin Block. The available data indicate that coal seam thickness, depth, gas content, and permeability appear to be highly prospective.

Fortune recently completed a joint study with the Shanxi Coal Bureau to analyze and map this data, which was used to optimize the locations for FL-EP1 and FL-EP2. The wells should provide significant reservoir and production data to assist in certification of gas reserves on the block, although it will not be possible to properly quantify the results until second quarter 2007.

The company has procured all necessary environmental permits for drilling in 2006-07. Further pilot production and slim-hole data wells are planned for 2007, with the aim of declaring commerciality for the block in 2008.

GlobalSantaFe, BHP agree to extend rig contracts

GlobalSantaFe Corp. has signed agreements with BHP Billiton Ltd. to extend the contracts on two ultradeepwater drilling rigs for additional 4-year terms. The rigs currently are operating in the Gulf of Mexico. The combined total value of the contracts is about $1.5 billion. The GSF Development Driller I semisubmersible is scheduled to start work under its contract extension in June 2008 and continue until June 2012. The contract extension for the GSF C.R. Luigs drillship is scheduled to begin in September 2009 and end in September 2013.

Petrofac lifts first oil cargo from Cendor field

Petrofac Malaysia has lifted its first cargo totaling 311,000 bbl of oil from Cendor oil field on Block PM304 off Malaysia.

The field’s production averages 12,000 b/d of oil, with an established peak rate of 16,000 b/d from the H15 and H20 formations. In October, the company began oil production of 3,500 b/d from one of the five wells in the field (OGJ Online, Oct. 5, 2006).

Petrofac recently completed the remaining two of the seven development wells comprising the field’s first phase.

Petrofac, in a partnership with Petronas, is undertaking detailed analysis of the reservoir to reevaluate the extent of the estimated proven reserves.

Processing - Quick TakesChevron plans further Pascagoula refinery upgrades

Chevron USA Inc. has applied for an environmental permit to construct a continuous catalyst regeneration (CCR) unit and several other minor units at its 325,000 b/cd refinery in Pascagoula, Miss.

These projects are to follow the refinery’s $150 million fluid catalytic cracking (FCC) project, which remains on track to be completed by yearend and will increase the plant’s gasoline production capacity by 10% to 5.5 million gal/day.

The CCR project is expected to further boost gasoline production capacity at the refinery by about 15%, adding 725,000 gal/day. The project will not increase the plant’s crude oil capacity.

The CCR unit would replace two process units constructed more than 30 years ago, improving the refinery’s ability to provide reliable supplies of gasoline to key markets in the eastern US, said general manager Roland Kell.

Chevron has selected WorleyParsons to complete the engineering for the CCR project, for which construction, if approved by the Mississippi Department of Environmental Quality, would likely begin in first quarter 2008.

Environmental permitting will run concurrently with Chevron’s evaluation process.

Kell said Chevron plans to use appropriate air emission controls, installing best available control technology as required by the environmental authorities and is also proposing to voluntarily reduce certain emissions above current requirements. Meetings to discuss these plans are currently being organized with community groups.

Meanwhile, Chevron’s FCC project, along with another project completed earlier this year at the company’s refinery in El Segundo, Calif., will collectively bring online for Chevron about 1 million gal/day of additional gasoline manufacturing capacity-a 7% increase relative to the company’s total US refinery gasoline production in 2005.

Transportation - Quick TakesGas find could feed LNG in Papua New Guinea

InterOil Corp.’s Elk-1 gas discovery in the onshore eastern Papuan basin could potentially kick-start an LNG industry in the country, according to Papua New Guinea Prime Minister Michael Somare.

He said the project could be a driving force towards the creation of an industrialized nation.

The facility, proposed by Toronto-based InterOil and international investment bank Merrill Lynch last month for a site near Port Moresby, could be delivering LNG cargos by second quarter 2011 (OGJ, Oct, 23, 2006, p. 32)

Papua New Guinea authorities likely will officially declare Elk-1 a discovery once the technical staff completes a review of drillstem test data that indicated an open flow potential of 28.5 MMcfd of gas.

Reserves are reported at 3 tcf of gas.

InterOil intends to drill appraisal wells on Elk and conduct more exploration on adjoining structures.

Interestingly, Papua New Guinea’s endorsement of Elk coincides with the increasing unlikelihood that the long-proposed Papua New Guinea-Australia gas pipeline project will go ahead.

Somare also had a dig at the world’s oil majors when he said Papua New Guinea needed to be proactive in the development of its natural resources.

He said the country could not allow supermajors to place the country’s projects on a list with other targets worldwide and leave them on the back burner for a decade.

LNG Ltd. moving into Middle East

LNG Ltd., Perth, and Iran’s state-owned National Iranian Oil Co. (NIOC) have signed a gas supply deal by which NIOC will provide as much as 530 MMcfd of gas to LNG Ltd.’s proposed LNG production project on Qeshm Island, off Iran. NIOC has identified several gas fields for potential development near the proposed plant.

The project marks LNG Ltd.’s initial move into the Middle East. The company plans to construct a 3.5 million tonne/year LNG liquefaction plant at Qeshm, to produce LNG for sale in India or East Africa.

It will develop the facility in three stages: The first, scheduled to come on stream in first quarter 2010, will have an annual production capacity of 1.15 million tonnes. LNG Ltd. expects financial close to be reached within a year.

To fast-track the project, the company will immediately select its preferred site on Qeshm Island.

It will benefit from work already done during the last 18 months on its proposed Padang LNG Project in central Sulawesi, Indonesia.

Both projects involve similar-sized production trains, construction techniques, and scheduling and are expected to take 2 years to build.