DRILLING MARKET FOCUS: New projects develop in Canadian Maritimes

New record investments in a deepwater wildcat, shallow water development projects, shipyards, LNG facilities, and even discussion of a new refinery signal continuing belief in Canada’s maritime basins.

Chevron Canada Resources is now drilling the most expensive well to-date in Atlantic Canada, a deepwater wildcat off Newfoundland in the untested East Orphan basin.

Presentations at the recent Canadian Offshore Resources conference in Halifax, NS, and the Atlantic Canada Energy Summit in St. John, NB, suggest that local firms will need to ramp-up operations to handle upcoming oil, gas, and power project requirements. More than 300 firms attended a procurement session on EnCana Corp.’s Deep Panuke project.

Canada is wrestling with the challenge of attracting financial capital to untested basins. Although there is large potential, there is also more inherent risk. Operators continue to pour capital into projects designed to maximize the value of old, depleted fields, or explore for new reservoirs in well-drilled basins.

In 2002, Thomas S. Ahlbrandt classified the conventional natural gas reserves of Atlantic Canada in the same range as the Western Canada Sedimentary Basin and offshore Brazil, thought to contain 6-120 tcf. Ahlbrandt expected 1-20 billion bbl of conventional oil off eastern Canada, akin to reserves in the WCSB and northwest Australia.1

Nova Scotia

According to Kris Kendall, Nova Scotia Department of Energy, there have been 125 wildcats drilled off Nova Scotia, 20 gas discoveries, and 4 oil discoveries.2

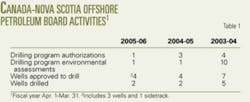

In its 2005-06 annual report, the Canada-Nova Scotia Offshore Petroleum Board reported a slight reduction in activity over the past 3 years (Table 1). C-NSOPB’s Neal Dawe told OGJ in October that 204 wells have been drilled off Nova Scotia

There are 27 active exploration licenses offshore Nova Scotia with a total original work commitment of about $1 billion (Can.).

There was heated discussion of the perpetual nature of “Significant Discovery” licenses at the Canadian Offshore Resources Exhibition & Conference in Halifax last month. Tom Hickey, CORE.06 conference chair and past chair of the Offshore Technology Association of Nova Scotia (OTANS), noted that operators of 11 SDLs had failed to drill any wells for 21-33 years.

BEPCo Canada plans to drill an exploratory well about 200 km south of Halifax in 2007.

Onshore Nova Scotia, Stealth Ventures continues drilling for coalbed methane in Cumberland and Pictou counties (OGJ, Aug. 21, 2006, p. 46). EOG Resources has recently drilled for oil in the East Hants area.

Sable

The Sable Offshore Energy Project (SOEP) encompasses Thebaud, Venture, and North Triumph fields (Tier 1 development); and Alma, South Venture, and Glenelg fields (Tier 2); 28 wells were proposed for the six fields, all to be drilled with jack up rigs (www.soep.com).

At the CORE.06 conference on Oct. 4, Brent Janke, ExxonMobil Canada’s Sable asset manager, said that Sable reached its 1-tcf production milestone in September.

The C-NSOPB reported that September production from SOEP dropped to 279 million cu m gas, from a 12-month high of 380 million cu m in July.

Four other fields could potentially be developed for Tier 3: Arcadia, Chebucto, Citnalta, and Onondaga.

In 2003, CHC Helicopter Corp. opened a new $4 million heliport at the Halifax International Airport, including a 26,000 sq ft hanger for four helicopters. CHC was flying two helicopters to GlobalSantaFe Corp.’s GSF Galaxy II jack up most of this year, according to CHC regional director Barry Clouter.

The rig finished drilling ExxonMobil Canada’s Alma-3 development well in March but has remained on location at the Thebaud platform, serving as the accommodations module during work on the new compression facilities. GlobalSantaFe reported on Oct. 6 that the Galaxy II contract with ExxonMobil, at about $125,000/day, will finish mid-November, followed by a 3-week contract at $300,000/day before the rig moves to the North Sea.

Thebaud’s 7,600-tonne compression platform, which arrived from Europe this past summer aboard the Saipem 7000 heavy lift vessel, has been installed next to the Thebaud central processing platform. The 8-leg jacket was built at Saipem Energy International’s Intermare Sarda division in Sardinia, Italy, and sent by barge to Rotterdam. Daewoo built the topsides and SIF Group BV fabricated the piles.

Deep Panuke

The Deep Panuke gas field discovery was announced in 2000, after four wells were drilled about 250 km southeast of Halifax, 1998-2000. An environmental review completed in December 2002 concluded that the project is unlikely to cause significant adverse environmental effects.

In January 2006, EnCana selected the mobile offshore production unit concept and will probably lease a jack up to serve as the platform, capable of processing 300 MMcfd (down from 400 MMcfd initially proposed) over 13 years. The company plans to award the MOPU contract by late 2007.

EnCana signed the Deep Panuke offshore strategic energy agreement (OSEA) with the Province of Nova Scotia in June 2006, outlining the field development framework (Fig. 1).

In mid-August, EnCana held a procurement session in Halifax to discuss Deep Panuke with potential service companies and contractors, and announced a new initiative to build land drilling rigs in Nova Scotia (OGJ, Sept. 18, 2006, p. 48).

A few weeks later, EnCana filed the project description for Deep Panuke, triggering the start of the environmental assessment process (under the Canadian Environmental Assessment Act).

Dave Kopperson, Encana vice-president for Atlantic Canada, said in a presentation at CORE.06 that the company plans to drill five to eight gas production wells to 3,600-4,000 m, as well as an acid-gas disposal well. The project will also require an offshore sour-gas treatment facility.

Decommissioning

The Cohasset Panuke project was operated 1992-99, producing 7.07 million cu m of oil (44.5 million bbl) in 7 years. The project was operated by PanCanadian (now EnCana); Nova Scotia Resources (Ventures) Ltd. holds 50% interest.

The Rowan Gorilla III jack up drilled wells at both Cohasset and Panuke fields and served as the production processing facility, offloading to the moored Nordic Apollo storage tanker. Platform and facility decommissioning began in 2000 but was suspended temporarily in 2001 while the operator considered use of remaining facilities for the Deep Panuke development. In mid-2003, EnCana abandoned the 14 Cohasset Panuke production wells, but left subsea lines.

NS dry well

EnCana used the Rowan Gorilla VI to drill the Dominion J-14 exploration well, north of Deep Panuke, late last year (OGJ Online, Oct. 5, 2005). Marauder Resources East Coast Inc., which earned a 25% working interest in the EL 2357 (Grand Pre) block, announced Dec. 28 that the 3,700-m well was dry.

The partners drilled a sidetrack to test additional zones in the Abenaki reef margin formation, source of the Deep Panuke natural gas discovery, but announced Jan. 23 that the J-14a reached 4,440-m (measured depth) and was dry.

Orphan basin

Chevron Canada Resources is drilling what will be the most expensive well ever off eastern Canada, a deepwater wildcat off Newfoundland in the untested East Orphan basin.

In August, ExxonMobil Canada secured the fifth-generation Eirik Raude semisubmersible, under 2-year contract from Ocean Rig ASA, to drill the first exploration well in the Orphan basin, on the edge of the continental shelf. The Orphan basin is just north of the Jeanne D’Arc basin, which contains Newfoundland’s three operating offshore developments: Hibernia, Terra Nova, and White Rose.

Four partners hold eight exploration licenses in the Orphan basin: Chevron Canada Resources (50%), ExxonMobil (15%), and Imperial Oil Ventures Ltd. (15%) were the original bidders on the licenses in 2003, and Shell Canada Ltd. farmed into 20% in 2005. Chevron is lead on four of the licenses and is designated operator for the drilling. ExxonMobil is lead on the other four licenses.

Chevron spudded the Great Barasway F-66 well from the Eirik Raude on Aug. 18 in about 2,350 m water. The well is in the EL-1076 license area; the 9-year exploration license began on Jan. 15, 2004, and cost $181.3 million (Can.).3 4

The F-66 well will cost about $140 million (Can.) and take about 4 months to drill in extremely harsh conditions (deep, cold, iceberg-prone waters and high winds).

The well will test Early Cretaceous and Late Jurassic sequences that may contain reservoir and source rocks similar to those in the Jeanne d’Arc and Flemish Pass basins.3

The partners are testing new controlled-source electromagnetic (CSEM) seabed logging technology in the Orphan basin; C-NLOPB approved surveys for all eight license areas.5

An array of electric field receivers is suspended about 50 m above the ocean floor, and a high-powered electro-magnetic source is towed through the water, transmitting a low-frequency signal. The technology was successfully tested in the UK North Sea in summer 2005 (OGJ, Oct. 2, 2006, p. 33).

Chevron and partners in the Great Barasway well are also the first Canadian participants in the “scientific and environmental ROV partnership using existing industrial technology” (SERPENT) project. This international collaborative program involves oil and gas operators, scientific partners, and academic institutions in furthering the understanding of deepwater ecosystems (www.serpentproject.com). The work off Newfoundland will center on the scientific use of an ROV during the deepwater drilling.

BP PLC, Subsea 7, and Transocean Inc. are founding project partners of SERPENT.

White Rose

Husky Energy Inc. reported third-quarter results in October. The company spent about $20 million (Can.) using the Western Geco vessel Western Regent to record 850 sq km of 3D seismic data during its 2006 program. The 3D was shot near White Rose and Terra Nova oil fields to evaluate future exploration opportunities in the Jeanne d’Arc basin. Husky also has the Rowan Gorilla VI jack up drilling rig under contract for about $200,000/day through October.

Husky announced a discovery in June at the White Rose 0-28 delineation well, describing a 280-m oil column in the Ben Nevis Avalon formation. The company spudded the O-28X sidetrack on June 1; it was plugged and abandoned on June 26.

On July 1, the Rowan Gorilla VI spudded the F-12 well at the West Bonne Bay prospect in 100-m water. The well is about 15 km northeast of Terra Nova oil field and was drilled for Husky and Norsk Hydro Canada Gas & Oil Inc. The F-12Z sidetrack was spudded on Aug. 31, reached 4,015 m, and on Oct. 20, Husky announced finding hydrocarbons in the Upper Hibernia reservoir.

In late October, the Rowan Gorilla VI rig was waiting on weather to be towed to BP’s North Amethyst K-15 site in the UK North Sea, where it will work for Talisman at about $285,000/day until November 2007.

The White Rose field contains about 240 million bbl, proved and probable reserves.

Gross production at White Rose in the third quarter averaged 104,700 b/d, with 75,900 b/d net to Husky. The sixth production well, scheduled to come on stream at the end of 2006, will increase reservoir production to 125,000 bo/d.

Husky conducted throughput tests on the White Rose FPSO and plans are in place to debottleneck the facility to about 140,000 bo/d during the turnaround scheduled for summer 2007.

West Newfoundland

In mid-October, St. John’s-based Vulcan Minerals Inc. announced that it would continue its $2.5-million exploration program in the Bay St. George basin on the west coast of Newfoundland with additional financing secured in September. Vulcan is operating its own RD10 land rig with a local crew.

The company began drilling a 900-m well in late October at Flat Bay No. 5, about 2 km east of Flat Bay No. 2, targeting Lower Carboniferous clastics and limestones, and expects to move to a second drillsite before the end of the year.

Canadian Imperial Venture Corp. (CIVC), also based in St. John’s, announced Oct. 17 that it secured a land rig from Precision Drilling Trust to re-enter the Port au Port sidetrack well in the Garden Hill South field, Port au Port Peninsula.

Precision moved the rig to the Garden Hill site from New Brunswick in early November. Drilling is expected to take 14 days, followed by production testing.

Ireland’s PDI Production Inc. operates the Garden Hill development on behalf of partners CIVC, Enegi of St. John’s, and UK-based Gestion Resources under a $4.4-million exploration program.

East Newfoundland

The Bull Arm industrial site in Trinity Bay, about 130 km from St. John’s, will be reevaluated under a new board of directors, announced Oct. 17. The site was built for the Hibernia oil project in 1990 and later contributed to the Terra Nova and White Rose offshore projects.

The Bull Arm Site Corp. will take a more commercial focus under the new board of seven, including president and CEO Joan Cleary and a representative of the Department of Natural Resources.

New Brunswick

According to the New Brunswick Department of Natural Resources, petroleum companies planned to spend $20 million (Can.) on exploration and more than $80 million on development projects in 2006:

- Contact Exploration Inc. Stoney Creek project, Hillsborough area (oil, gas).

- Corridor Resources Inc. McCully field, southern New Brunswick (gas).

- PetroWorth Resources Inc. Southeastern New Brunswick (oil, gas).

On Nov. 7, the company said it had acquired two additional exploration permits covering 7,000 acres in Southern New Brunswick, and had nearly completed a 2D seismic program. In early October, Halifax-based Corridor Resources announced that it had assent from the New Brunswick Board of Commissioners of Public Utilities and would receive a permit to construct pipelines and related facilities to connect the McCully natural gas field with the Maritimes & Northeast pipeline.

Corridor plans to begin production during development Phase 2 by February 2007 and reach gas plant design capacity of 30 MMcfd by early spring.

New Brunswick is also considering a 145-km pipeline that would connect the Canaport LNG facility in Saint John to the Maritimes & Northeast pipeline at the US border near St. Stephen, NB.

The National Energy Board, an independent Canadian federal agency, held a prehearing planning session for the Emera Brunswick pipeline on Oct. 12 in Saint John, NB. The public hearing to consider Emera’s application to build and operate the Brunswick pipeline project began Nov. 6 and will last several weeks.

New Brunswick’s Department of Natural Resources expects provincial participation at the upcoming North American Prospect Expo in Houston, Feb. 1-2, 2007.

Quebec

An historical shipyard on the Saint Lawrence River may become a new source of jack up drilling rigs. In early October, Gilles Gagné, president of the privately-owned Industries Davie yard, said “Our firm designed and built 12 offshore platforms in the early 80s and is fully equipped to deliver jack-up drilling platforms.”

Norway’s Teco Management SA announced its $28.4 million (Can.) acquisition of the shipyard Oct. 13. Teco will provide $13 million and the province of Quebec will guarantee 50% of a $15.5-million loan to get the shipyard back in operation. Teco intends to build offshore drilling platforms at the shipyard, which had been in bankruptcy since 2001.6

Among other projects, the shipyard finished the conversion of Petrobras P-36 from a semisub drilling unit (Spirit of Columbus) into a floating production unit. Now working in 1,500 m water off Brazil, the P-36 is capable of processing 180,000 bo/d and 7.2 million cu m/day of natural gas.

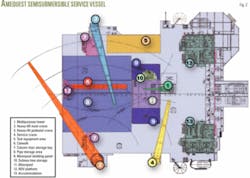

Industries Davie is also promoting a new multiservice semisubmersible vessel design, the Amequest. The new semisub would be capable of well-intervention, completion, and pipelay activities in deep water.

The plans incorporate components from Netherlands-based Huisman-Itrec: a multipurpose tower (1.8-million-lb hook load); heavy-lift mast crane; and heavy-lift pedestal crane (Fig. 2). The Amequest semisub design also features Kongsberg Simrad dynamic positioning systems (main redundant system: SDP-21; backup system: SDP-11).

Amequest is based on Shipyard de Hoop Lobith BV’s Amethyst design; only one was built, now the Pride South America (second-generation semisub).

Pride International Inc. operates four Megathyst-class (revised Amethyst design, fourth-generation semisub) drilling rigs, all working off Brazil for Petrobras. The Pride Carlos Walter and the Pride Brazil (delivered in 2001) began new, 2-year contracts in June 2006 at a base rate of $137,000/day plus a 15% performance bonus potential, for a maximum possible rate of $157,000/day.

The newer Pride Rio De Janeiro and Pride Portland were completed in early 2004 at the Cianbro Corp. shipyard, Pittsfield, Me. and are owned by Petrodrill Offshore Inc. (OGJ, Nov. 22, 2004, p. 51; Jan. 24, 2005, cover). Under new 5-year contracts that began in fall 2005, Pride said it will receive $9,000/day to manage each rig, and Petrobras will pay a base rate of $141,750/day in addition to a 15% performance bonus, for a maximum possible rate of $164,000/day.

Ahead

The market sees mixed signals from operators because of price fluctuations in natural gas. The two largest operators in Canada, EnCana and Canadian Natural Resources Inc., have both announced they are considering capital cutbacks for 2007. If this materializes, it’s more likely to affect drilling plans in western Canada than off the east coast.

RBC Capital Markets analyst Angelo Guo said in September, “we expect to see a widespread reduction in gas drilling into 2007 before things turn better in late 2007 or 2008.”

Sable’s asset manager Janke said that operators will focus on efficiency and cost reduction for all projects and that creativity is necessary to maintain the momentum in Atlantic Canada. He said it’s important to maintain infrastructure “or else the economics of the smaller offshore fields will be untenable.” Janke stressed the government’s role in providing an efficient, value-added regulatory system.

Rowan’s chairman and CEO Danny McNeese noted that although there is very light drilling scheduled off Canada for 2007, he hopes for more activity in 2008, adding that “200 Canadians work for Rowan.”

CORE.06 Chair Tom Hickey said, “Decisions taken now will significantly influence the nature and state of the industry to come.”

References

- Ahlbrandt, Thomas S., “Future petroleum energy resources of the world,” International Geology Review, vol. 44, pp. 1092-1104, 2002.

- Kendell, Kris, “Nova Scotia’s Energy-Securing our future,” NAPE International Forum 2006, Houston, http://energy.ihs.com.

- “Financial data respecting exploration licenses issued,” Canada-Newfoundland and Labrador Offshore Petroleum Board, Oct. 18, 2006, www.cnlopb.nl.ca/land/tables/elfdr.pdf.

- Enachescu, Michael E., “Hebron, Grand Barasway and Beyond,” Atlantic Business Magazine, 2006, www.atlanticbusinessmagazine.com.

- Sullivan, J.M., “Seabed logging,” Ocean Resources, October-November 2006, p. 16.

- Ouellet, Martin, “Quebec’s struggling Davie Industries shipyard sold to Norway’s Teco,” Canadian Press at The Vancouver Sun, Oct. 14, 2006.