French beginning to open natural gas market

Recent project announcements suggest that, however small the initial steps, France is finally moving toward liberalization of its natural gas market.

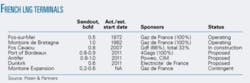

The success of EdF Trading Ltd. in securing terminal capacity at Gaz de France’s LNG terminal at Montoir-de-Bretagne and proposals from several developers to build LNG import facilities at the Port of Bordeaux, Antifer, and Dunkirk are small but significant steps in opening Frence’s gas market (see table).

null

At Montoir

London-based EdFT, a European wholesale trader of electricity, gas, and coal, announced in July 2006 that it had reserved one slot/month at GdF’s Montoire terminal for 2007. Contracting capacity proved relatively straightforward, as GdF published berth availability on its website and offered reasonable terms.

EdFT is to receive regasified product in equal amounts over 30 days, as opposed to the 5-day lifting period that other terminals often allow.

Downstream, EdFT plans to market some gas to parent company Electricité de France, which has been building a retail portfolio since it was allowed to move into the domestic gas business in 2005. EdFT will also sell gas at Belgium’s Zeebrugge hub, where it is one of the most active traders, and expects to move additional quantities into the UK via the Interconnector Pipeline.

Despite tight supply conditions, EdFT is betting that it will be able to secure cargoes to fill the slots at Montoire. “Early on,” said one company official, “we decided that coming up with a nicely packaged suite of contracts with a bow on it wasn’t possible.” Instead, the firm chose to acquire regasification capacity to distinguish itself from other would-be buyers.

EdFT is confident that experience and a large, flexible contract portfolio will give it competitive advantage in the region. “The trick is how to get the gas from Montoire to somewhere actually useful,” the source said. The bet also reflected bullish forward prices for winter gas in Northwest Europe, which tagged it as a premium market, although since then the forward price curve has declined.

More terminals

Another sign of change is the site option secured in August by Rotterdam-based 4Gas, an independent developer of LNG terminals in the UK and on the Continent, for an LNG terminal at Bordeaux.

Although the project is still in the conceptual stage, the firm has said it wants to build an import terminal with initial capacity of 6-9 billion cu m/year. Cost estimates run to €400 million, with additional investment required for a pipeline connection to the regional distribution system.

4Gas chose Bordeaux because it is close to the Spanish market and has good port infrastructure. The specific site is at Le Verdon at the mouth of the La Gironde. This is the company’s fourth terminal project and follows the Dragon LNG venture under construction at Milford Haven, Wales, as well as two other terminals planned in Rotterdam and Canada’s Nova Scotia province.

More recently, the Port of Le Havre Authority tagged a joint venture between Poweo, an electricity and gas supply company based in Paris, and Compagnie Industrielle Maritime for a possible new terminal at Antifer, near the Le Havre petroleum port (OGJ Online, Oct. 10, 2006). According to Poweo, the terminal would have a capacity of 8-10 billion cu m/year and cost about €500 million with start-up slated for 2011.

As with Bordeaux, these parameters are only preliminary, and project scope should be further defined in a meeting with the port authority before yearend. Poweo, a new company, is moving aggressively to position itself in the French gas market. It is building its first combined-cycle gas turbine power plant, for start-up tentatively in 2008, and earlier this year formed a strategic alliance with major Austrian utility Verbund GS, which assisted the French firm in the bidding process.

Earlier last summer, Poweo hired a former executive from Qatargas 2, Luc Poyer, as deputy managing director with responsibility for upstream supply.

On the other hand, CIM SNC, France’s largest oil tank farm owner, has been concessionaire for the oil terminals at Le Havre since 1920 and at Antifer since that facility began operations in 1976. Poweo had proposed to develop the LNG terminal on its own but agreed to form a partnership with CIM when the port authority’s board of directors expressed concern about its lack of experience in terminal management.

Finally, in mid-October EdFT parent Electricité de France won a tender for feasibility studies toward an LNG terminal at Dunkirk. In concept, EdF would build and operate a terminal with an initial capacity of 6 billion cu m/year, starting in 2011. The studies would run for about 3 years, although competition with nearby Antifer could force EdF to accelerate its timetable.

The company obtained its Dunkirk foothold concurrently with terminal and pipeline capacity deals in other countries. The suite of moves is designed to boost its presence in northwest Europe in the medium term and exploit its position astride the English Channel.

First step

France has resisted European Union efforts to liberate gas markets, and an adverse ruling from the European Court of Justice in 2003 was needed to force the government to enact reform measures. Since then, the country has made steady progress, although it still has a considerable way to go.

The most important step is scheduled for July 1, 2007, after when all gas consumers are to have at least nominal freedom to choose suppliers. In the past few years, the government has also restructured GdF into a limited liability company and sold down the state’s equity from 100% to 78%. It established four gas-balancing zones, where virtual Gas Exchange Points (known by their French acronym as PEGs) act as incipient trading hubs, similar to UK’s National Balancing Point. The PEGs as yet do not have enough activity for reliable price signals, but trade volume is growing (diagram).

The government has also unbundled the gas transmission system, forcing GdF and Total SA, which has the second-largest market share, to create subsidiaries to hold and manage their trunklines. These new entities can take independent decisions on matters that affect capacity and service, although the French regulatory authority would like them to be even more independent.

In the south of France, two gas pipelines, the Port-de-Larrau and Euskadour, now straddle the border, and there are big plans to expand the latter. GdF and Total unwound their cross-holdings in joint-venture companies that cover most of southern France and entered into a 3-year gas-release program in 2004 to stimulate competition.

They have offered 150 MMcfd by auction so far, most of which belongs to GdF. Total has further committed to improve third-party access to its transmission and storage facilities.

As a result of these efforts, there are now 28 registered gas suppliers in France, of which 14 are active, in addition to the 22 companies authorized as distributors within a given regional market. The roster of firms that can act nationwide includes subsidiaries of other European gas players, such as E.ON-Ruhrgas, Wingas, Iberdrola, Gas Natural, Eni, and Statoil ASA. There are also traditional French energy players such as BP France, EdF, and Air Liquide as well as start-ups like Altergaz and Poweo.

Resistance

But the French gas industry remains stubbornly concentrated. The top three suppliers have 91% of the market, while foreign-owned suppliers have only 3%. Some 640,000 industrial and business consumers are eligible to select their gas providers. Yet only about 35,000 have made a selection, and most of these opted to stay with their provider. Only about 300 switched to an alternative provider that offers gas at competitively determined prices.

Part of the problem is that GdF contracted gas supplies under long-term agreements, and these will only expire gradually. But EU competition authorities suspect GdF of abusing its dominant position, and the company was among 20 firms raided in May in an antitrust crackdown.

French politicians can only take so much when it comes to market liberalization and reached their limit when they learned that Italy’s Enel planned to acquire utility Suez. Prime Minister Dominique de Villepin subsequently brokered a hasty merger agreement between Suez and GdF. The agreement would reduce the state’s share in the combined entity to less than 50%.

This flagrant economic nationalism brought protests from EU regulators, who are investigating the merger’s likely impact on competition, and from French unions, which say that the government is breaking its pledge-enshrined in Gallic law-to retain a majority stake in GdF. On Oct. 3 the National Assembly, France’s lower house, approved the privatization amid strikes and protests, and the Senate will begin its debate shortly.

Meanwhile, the European Commission has provided detailed objections to the merger. These focus on Belgium, where the combined entity would have a near-monopoly on gas and electricity, but also on France. Aspiring market players, including Gazprom, Enel, and Centrica, are eagerly awaiting the announcement of possible asset sales to comply with the regulatory demands.

The merger, somewhat paradoxically, might further increase competition for LNG imports in the French gas market. As a sweetener to the antimonopoly authority, GdF has offered to expand its Montoire terminal to anywhere from 12 to 16 billion cu m/year from the current 10 billion cu m/year, with the extra capacity to be offered to third parties.

If the merger proceeds, it also said it would functionally separate its French LNG business from other operations. As often occurs when a dominant player makes concessions, though, the olive branch warrants a closer look. Its offer comes on the heels of the Bordeaux, Antifer, and Dunkirk terminal announcements, and could be seen as a move to preempt its competitors as well as a further shove against the half-open door of the French gas market.

Based on an article in LNG in World Markets, August 2006, Poten & Partners Inc., New York (www.poten.com).