SPECIAL REPORT: World’s Arctic basins pose array of unique work opportunities

The Arctic is often considered as a single frontier for the oil and gas industry with a unique set of challenges that require unique exploration and development solutions. However, during the course of completing a recent study “Future of the Arctic-A New Dawn for Exploration,” it became clear to UK consultants Wood Mackenzie that the Arctic is far from being homogenous and there exists a range of distinct opportunities that fit very different strategic aims.

Arctic basins

A number of the Arctic basins, notably the North Slope of Alaska, the South Kara/Yamal subbasin to the north of Western Siberia, and the West Barents and East Barents basins in Norway and Russia, respectively, have large discovered resources that are at different stages of development (Fig. 1).

Both the North Slope and the southern part of South Kara/Yamal are well established as oil and gas provinces and have pipelines that link them to global markets.

At the other end of the spectrum a number of sedimentary basins in the Arctic, such as the North Greenland basin, the East Siberian Sea, and the North Chukchi Sea, are virtually untouched by the oil and gas industry. In these basins there is extremely limited data on the subsurface, and none of the infrastructure associated with the industry.

The degree of development in each basin reflects the relative severity of the challenges faced in different parts of the Arctic.

Remoteness is perhaps the greatest challenge for the oil and gas industry in the Arctic. The great distance from the Arctic to population centers is a challenge in terms of shipping hydrocarbons to markets, either by pipeline or sea transport. This remoteness is also a challenge when it comes to mobilizing the people and equipment needed to explore for oil and gas. Mobilizing the necessary items to the Arctic in order to collect seismic data or drill wells can take a long time and cost a great deal of money.

Ice challenges

The challenges presented by ice vary greatly across the Arctic.

North Greenland ice is permanent, and the ice is thicker than that in other parts of the Arctic. There the ice sheet is constantly pushing against the coast.

By contrast, in other parts of the Arctic such as the West Barents, Southwest Greenland, and the Labrador shelf there is often no pack ice, or limited seasonal ice which remains frozen for a short period. Pack ice can limit drilling to certain times of year and also require that installations be able to resist the load placed on them by the movement of the ice sheet.

Icebergs are also an issue in some basins, such as Baffin Bay, but not in others. Rigs and platforms that are positioned in an area affected by icebergs must be detachable in order to avoid impact, or they need a significant investment in iceberg management that ensures that icebergs are deflected away from the installation.

License availability

A further constraint on the level of exploration in a basin is whether or not an area is available for licensing.

While all the governments that have jurisdiction over the Arctic are broadly in favor of oil and gas exploration, the availability of licenses varies greatly from basin to basin.

Canada publishes an annual call for nominations covering the majority of the Beaufort-Mackenzie and Franklinian-Sverdrup basins, while there is no active licensing in Baffin Bay.

Similarly, the Greenland Bureau of Minerals & Petroleum is actively promoting Southwest Greenland but has no plans to license North Greenland or the Kronprins Christian basin.

Licensing restrictions often reflect local issues, such are environmental sensitivity and the needs of local landowners.

Basin economics

The variety of licensing approaches manifests itself in the economics of oil and gas development in each basin.

The average breakeven price for the development of an oil field in the Arctic, assuming a 15% return on investment, is around $25/boe. However the average for individual basins varies from around $19/boe to $46/boe depending primarily on the remoteness of the basin and the ice challenges presented.

Different challenges and economics create a range of distinct opportunities for companies to invest in the Arctic.

In this article we consider three strategies for upstream growth in the Arctic: Major Resource Capture, Niche Operations, and Frontier Exploration, and we consider which basins offer the best opportunities for companies following each of these strategies.

Resource capture

Major Resource Capture focuses on gaining access to large volumes, either by negotiating access with the current resource holder or by licensing exploration rights in a highly prospective but underexplored basin.

The key to executing this strategy successfully is to identify resource holders who are either unable to fund development and exploration for financial reasons or unwilling to explore and develop a basin on their own for strategic or technical reasons.

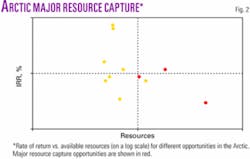

This strategy will generally involve a commitment to make a massive investment in the basin, as this will be necessary to extract the large resources (Fig. 2). Strong technological and project management credentials will also be key to gaining the acceptance of the current resource holder.

It is also likely that such a strategy will involve giving a significant fraction of the potential value of the resource to the current resource holder, either in the form of carried equity or high government take.

These factors mean that it is unlikely that this strategy will generate high returns, but the investing company should still generate large profits due to the scale of the resource being developed.

The other key aspect of this strategy is that it must be executed over the long term. Gaining access to prized resource means gaining the trust of the current resource holder through demonstration of a track record of developing particular types of resources and often showing a commitment to the broader development of the region where the resources are located.

Executing this strategy does involve some costs, and it often requires a significant amount of focus from senior executives. The investment in capturing the resources is typically small in comparison to the investment needed to execute the actual development of resources. The risks in pursuing this strategy are relatively low before the development gets under way.

The companies who are able to execute this strategy are generally the supermajors. These have both the need to replace their large production base and also the balance sheet strength that enables them to make the massive investments needed to develop major resources.

The supermajors are also at the forefront of technologies such as subsea-to-shore development and extended-reach drilling, which have the potential to unlock previously stranded or subeconomic reserves.

The other group that may also look to this strategy in the future are the expansionist national oil companies. These have a need for large amounts of production and are not subject to the same cost of capital constraints as publicly listed companies when making investments.

Major resource basins

The two most obvious Arctic basins for the Major Resource Capture strategy are the offshore part of the South Kara/Yamal basin and the East Barents basin in Russia.

Both of these basins have large discovered resources that are currently undeveloped, and both also have a large yet-to-find potential in areas that are not being actively explored at present.

The resources in these basins are primarily controlled by the Russian gas supplier, Gazprom. Gazprom has massive financial resources and strong cash flows from production at its supergiant fields in Western Siberia. However, Gazprom’s development and production experience is entirely onshore.

Recent announcements concerning the bids for partnership in Shtokman field in the East Barents will be viewed as a setback for companies that had hoped to participate with Gazprom in developing its resources.

The fact remains that Gazprom will need to expand its capabilities in order to develop these resources, and this can be achieved by working with those companies who have experience in developing fields in similar environments in Alaska, the West Barents, and at Sakhalin Island.

Gazprom has stated in recent times that it will need to learn from experienced offshore operators in order to effectively exploit its resource base in the Arctic seas. This means that there remains an opportunity for companies who are willing to pursue a long-term strategy of becoming a partner in Gazprom’s offshore ventures.

Niche opportunities

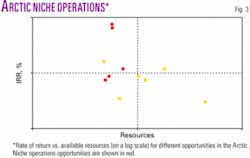

Niche Operations are focused more on generating high returns as opposed to achieving a large scale of production (Fig. 3).

A niche strategy is successful when a company identifies a competitive advantage in a particular area and successfully exploits this to generate higher returns than its competitors.

In the Arctic basins these opportunities often involve exploration close to existing infrastructure and being able to develop nearby fields, or by combining new discoveries with existing discoveries that cannot achieve economic returns as stand-alone developments. As the Arctic is a largely gas-prone region, identifying medium-sized oil prospects and exploiting these can also be considered a niche opportunity in the Arctic.

The companies that will execute this strategy will be those who have ownership of, or access to, export infrastructure, such as the Trans Alaska Pipeline System from the North Slope, the Melkoya LNG plant in the West Barents, or the proposed Mackenzie Valley Pipeline in Canada. Companies that own undeveloped resources, particularly in Canada or Russia, may also be able to execute this strategy.

Niche provinces

The North Slope has continued to deliver new discoveries for the last 40 years, and exploration in this basin continues as new areas, such as the southern part of the Chukchi Sea and the Naval Petroleum Reserve, are opened to exploration.

The Trans Alaskan Pipeline System that transports oil from the North Slope to a tanker terminal in southern Alaska has increasing spare capacity as Prudhoe Bay field has declined, and this means that oil from new discoveries in this basin can be exploited and exported much more easily than in other parts of the Arctic.

The existence of rigs and personnel in Alaska also means that exploration can be carried out more easily, and all of this reduces the investment needed and can deliver higher returns.

The Pechora Sea in Russia has a significant yet-to-find potential, and the development of Prirazlomnoye field is providing the infrastructure needed to encourage further exploration in this basin. The Pechora Sea is also connected to markets in Western Europe by largely ice-free sea routes, and it is also the most oil prone of the Russian Arctic basins.

The West Barents basin already has an LNG development at Melkøya Island, which will export gas from Snohvit field. This facility has space for a second LNG train that could handle gas from other discoveries, making the exploration of this basin more attractive. The Goliat discovery has also indicated the potential for oil discoveries that can be developed in the largely ice-free waters and easily exported to markets in Western Europe.

The Mackenzie Valley Pipeline will have capacity for new discoveries as well as the anchor fields that will underwrite the development of the pipeline. This provides an opportunity for monetizing gas in this basin. There also exists potential for oil discoveries in the offshore part of the Beaufort-Mackenzie basin, although an oil export pipeline would be unlikely to be constructed before the planned gas pipeline.

The Labrador shelf off eastern Canada has some large gas deposits that have remained undeveloped for a number of years. Further exploration of this basin could provide the volumes for an integrated development using either LNG or CNG, which would monetize the existing reserves as well as the new discoveries.

All of these basins provide opportunities for exploration success, and the players who are already established in these areas will have a competitive advantage in exploiting new discoveries with higher rates of return.

Arctic frontiers

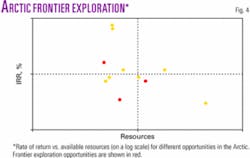

Frontier Exploration is the entry into largely unexplored areas and beginning the search for new resources (Fig. 4).

In many basins of the Arctic, difficulties in obtaining exploration licenses presents the most immediate barrier to frontier exploration (Fig. 5).

The absence of seismic data in many of these basins is also significant. Acquisition of new seismic can present serious challenges, as operations may be limited to summer months in areas of seasonal ice, or require expensive icebreaker support in areas of permanent ice.

Once prospects have been identified drilling exploration wells is also expensive, as there is a limited supply of Arctic-class drilling rigs. Mobilizing these in the most remote parts of the Arctic can be very expensive. An alternative is to drill from spray-ice islands, although this technology has not been used widely outside Canada.

The high costs of drilling and seismic acquisition in the Arctic mean that the upfront costs will be large. The fact that the frontier basins do not contain proven plays means that this is a very high-risk strategy, and this will only be successful if large and profitable fields need to be discovered.

Only the frontier basins with the highest yet-to-find potential can be considered as attractive opportunities for Frontier Exploration.

Most companies will have Frontier Exploration as part of their overall resource capture strategy, but only small specialist companies would focus on this exclusively. The companies that consider Frontier Exploration in the Arctic will be those that have the greatest appetite for risk because these basins contain some of the most high-risk opportunities in the world.

Arctic frontier basins

The frontier basins with the best yet-to-find potential are the Kronprins Christian basin east of northern Greenland, the Southwest Greenland basin, and the Laptev Sea, which lies north of Eastern Siberia.

All of these have material yet-to-find potential, but their specific advantages are very distinct.

Kronprins Christian is attractive mainly because of the sheer size of its yet-to-find potential. This basin faces many of the most severe challenges in the Arctic, with permanent ice along the entire coastline, extreme remoteness from markets and population centers, and no active licensing at present.

In contrast Southwest Greenland has around half of the resource potential of Kronprins Christian, but it is close to the markets in the eastern US, is ice free for much of the year, and is actively promoted by Greenland authorities. All of this makes it more likely that discoveries will be developed.

The Laptev Sea is attractive mainly because of the presence of a small number of large oil prospects that could prove highly profitable despite the difficultly in exporting oil from such a remote part of the world.

These basins present the potential to be profitable for explorers, but the risks both below ground and above ground are very high.

The Arctic is rightly considered to be a difficult environment for oil and gas companies to prosper. By understanding the differences between the different Arctic basins, companies can find opportunities to grow their business in the Arctic areas that fit best with their chosen growth strategies.

The authors

Alan Murray (alan.murray @woodmac.com) is senior petroleum economist with Wood Mackenzie’s Petroleum Economics team, responsible for maintaining and developing Wood Mackenzie’s Global Economic Model. He has contributed to and led a number of consultancy assignments covering a range of exploration, fiscal, and valuation issues. He joined Wood Mackenzie in July 2002 from Ernst & Young’s Energy, Chemicals and Utilities group, where he was an audit manager. He is a graduate in physics from the University of Glasgow.

Andrew Latham ([email protected]) is vice-president of upstream consultancy at Wood Mackenzie. He heads Wood Mackenzie’s exploration strategy practice. Until the end of 2001, he managed the team responsible for Sub-Saharan Africa research projects and consultancy. He began his career in 1990 as an international new ventures geologist with Ranger Oil Ltd. and later became project geologist for Angola. He has a BSc (Hons.) from Imperial College and a PhD from University College, both in geology.