Drilling continues in Ecuador

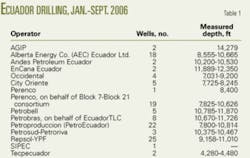

Although several foreign operators have abandoned Ecuador operations this year, 118 wells were drilled during the first 9 months of 2006 (see table).

Ecuador has oil reserves of 4.6 billion bbl, the third largest in South America, and the country’s oil production increased 31% during 2001-05 (OGJ, May 22, 2006, p. 28). Production is now about 175,000 bo/d.

Repsol-YPF has been the most active foreign operator so far this year, drilling 25 wells with Helmerich & Payne rigs to an average MD greater than 10,000 ft.

Perenco drilled 19 wells as operator for the B7-B21 consortium, in the Yuralpa field (Block 21), Oso field, and Lobo field (Block 7).

AEC Ecuador (Alberta Energy Co. Ltd., an EnCana subsidiary), drilled 16 wells with H&P rigs and two with Perforec Rig 59. EnCana Ecuador drilled 2 wells.

Petrobras Energia Ecuador drilled eight wells in the Palo Azul field in the Oriente foreland basin (Block 18) as operator on behalf of partners EcuadorTLC SA and Teikoku Oil Ecuador, a subsidiary of Japan’s Teikoku Oil Co. Ltd.

Occidental Petroleum drilled four wells. AGIP drilled two wells, including the deepest this year, to 14,279 ft.

Nationals

The City of Oriente drilled five wells (four at Blanca) using CPEB Rig 50112. Petroproduccion, the production unit of Ecuador’s state-owned oil company Petroleos de Ecuador (PetroEcuador), drilled 22 wells using Drillfor, Sinopec, and CPEB rigs.

Petrobell Inc. drilled five wells in the Tiguino field with Nabors rigs. Petrosud-Petroriva drilled three wells, all deeper than 10,000 ft, with Drillfor’s Rig 7.

Compañía Sociedad Internacional Petrolera SA (SIPEC) drilled a single well using a CPEB rig.

Tecpecuador drilled two wells at El Rayo with Nabors Rig 818.

Rigs

Active drilling contractors include:

- H&P with eight SCR rigs in Ecuador, including two heli-transportable.

- Nabors International with two electrical and five mechanical rigs in the country.

- Drillfor SA, local Ecuador company.

- Changqing Petroleum Exploration Bureau (CPEB).

- China Petroleum & Chemical Corp. (Sinopec).

- China National Petroleum Corp. (CNPC).

- Petrex, a subsidiary of Eni SPA, with only one rig working for AGIP/Eni.

- Perforec Perforaciones Ecuatorianas SA, a wholly owned subsidiary of Saxon Energy Services Inc.

Petrobras stays

In July, Petrobras signed a 5-year strategic energy agreement with Ecuador’s Petroecuador (OGJ, July 17, 2006, p. 5). Petrobras is focusing on exploration and development of the Ishpingo-Tiputini-Tambochocha (ITT) field complex in northern Ecuador, with 900 million bbl of proven reserves, and several blocks in southeastern Ecuador.

Eden-Yuturi

In 1991, Occidental Petroleum Corp. and Petroecuador initialized an agreement to develop the Eden-Yuturi field in Nueva Loja province, in the upper Amazon basin. The field has estimated oil reserves of 154 million bbl.

In March 2005, PetroEcuador President Hugo Bonilla said the terms of the Eden-Yuturi production sharing contract were “inequitable.” At the time, the field was producing about 70,000 bo/d, with 25% going to PetroEcuador.

Occidental drilled its last four wells in Eden-Yuturi earlier this year with H&P’s Rig 121.

EnCana leaves

EnCana Corp. drilled 20 wells in the beginning of the year before it pulled out of the country. In late February, EnCana announced that it had completed the sale of its Ecuadorian oil and pipeline interests to Andes Petroleum Co., a joint venture of Chinese petroleum companies, for about $1.42 billion.

Andes Petroleum Ecuador, through operator AEC Ecuador Ltd., has drilled two wells this year, the Alice 10H and 11H, using H&P Rig 190 and 191.

Government intervention

On May 15, 2006, Ecuador’s energy minister Ivan Rodriguez cancelled the operating contract with Occidental Petroleum Corp. for the 494,000-acre Amazonian Block 15 (OGJ Online, May 16, 2006). Rodriguez cited the company’s illegal transfer of 40% of its local operations to EnCana in 2000 as one of the infractions.

The government had begun to talk of canceling Oxy’s Block 15 contract in 2004, leading to speculation that the February sale of EnCana’s interests to the Chinese was the culminating force.

Occidental said that Block 15 operations represented about 7% of its first-quarter 2006 worldwide production. The company is the largest exporter of petroleum in Ecuador.

On May 17, Oxy presented a demand for arbitration with the Ecuadorian government at the International Center for the Settlement of Investment Disputes (ICSID), Washington, DC.

On Sept. 28, Galo Chiriboga, president of Ecuadoran state petroleum firm Petroecuador, announced on Ecuador’s national television that it would establish Rio Napo Operations Co. to operate oil fields formerly owned by Occidental (OGJ Online, Sept. 29, 2006).

In early October, Oxy dropped its arbitration claim against Petroecuador but maintained its claim against the Ecuador government at ICSID.

Business News Americas reported on Oct. 30 that PetroEcuador said investment within the country could reach $5 billion, with reforms.

OMV leaves

Last month, Austria’s OMV AG completed the sale of its 5,000-b/d Ecuadorian exploration and production assets to joint-venture partners Burlington Resources Oriente Ltd. and Perenco Ecuador Ltd., a unit of privately held French E&P firm Perenco SA.

OMV said the partial interests in Block 7 and Block 21 in the Oriente basin of Central Ecuador, acquired in 2003, were not core to its E&P business (OGJ Online, Oct. 12, 2006).

Change afoot?

From national elections on Oct. 28, no clear winner emerged. The government announced a runoff, for Nov. 26, between the two top vote-getters: leftist Raphael Correa, US-educated economist; and banana magnate Alvaro Naboa, from the wealthiest family in Ecuador.

Following the election, the announcement of the next energy minister may indicate whether the new administration will focus on promoting foreign oil and gas investment or expand with nationalization.