OGJ Newsletter

Sakhalin-2 environmental damage: $10-50 billion

Russia’s Federal Service for the Regulation of the Use of Natural Resources (Rosprirodnadzor) estimates the cost of rectifying environmental damage at the Sakhalin-2 project at $10-50 billion.

“This sum is determined by the high cost of land reclamation and the cleaning of the seabed in the Aniva bay,” said Oleg Mitvol, Rosprirodnadzor deputy head, who led an inspection carried out by the agency at the facilities of project operator Sakhalin Energy Co.

The final damage figure cannot be calculated until the end of next summer, Mitvol said, adding that the Sakhalin Energy “has not proposed any engineering solutions for eliminating the environmental violations.”

Meanwhile, Russian Natural Resources Minister Yuriy Trutnev plans to visit Sakhalin on Oct. 24-26. His aim will be to determine the degree to which environmental protection legislation has been implemented at the two oil and gas deposits of the Sakhalin-2 project.

Algeria moves toward oil windfall profits tax

Algerian Energy Minster Chakib Khelil said told reporters in Algiers this month that he has received no comment from international oil companies regarding a windfall profits oil tax slated to take effect next year.

The windfall profits tax was part of a law enacted during September. The same law provides state firm Sonatrach to take a 51% interest in contracts involving IOCs.

Companies from outside Algeria will have to pay the oil tax in any month when the price of Brent crude averages more than $30/bbl. The tax rate will vary at 5-50%, depending upon a company’s total production.

Anadarko Petroleum Corp., Royal Dutch Shell PLC, BHP Billiton Ltd., ENI SPA, and Hess Corp. all have oil operations in Algeria. Analysts said the companies are awaiting an explanation of the new tax structure.

Reporting of fixed-price gas deals at issue

Mandatory reporting of fixed-price gas transactions to the US Federal Energy Regulatory Commission remains an unsettled issue.

A technical conference on the subject at FERC headquarters Oct. 13 revealed lingering disagreement in the gas industry over reporting requirements discussed at a similar conference 2 years earlier.

The most significant change from 2004 came from the American Gas Association, whose members now believe mandatory reports to FERC are needed to provide a more representative market picture than exists with the current voluntary reporting to private entities that gather prices and sell the information to subscribers.

Jane R. Lewis-Raymond, vice-president, general counsel, corporate secretary, and chief compliance officer at Piedmont Natural Gas Co., said many of the 197 local energy utilities in AGA’s membership believe that gas markets, while more transparent than 4 years ago, still need to be improved.

“The shift in policy occurred because we’re still getting questions about confidence in prices from our customers, which suggests that the only way to increase that is to make reporting mandatory,” Lewis-Raymond told commissioners and others at FERC’s recent conference on markets and prices.

Chris Conway, chairman of the Natural Gas Supply Association, who also testified on behalf of the Independent Petroleum Association of America, said a 60% decline in gas prices this year shows the market is transparent and robust.

“It would be a serious miscalculation to assume that seasonal price swings and volatility indicate a lack of transparency or some other dysfunction in the marketplace,” said Conway, president of the gas and power division at ConocoPhillips. “Most often, it signifies quite the opposite, sending accurate information that allows for an appropriate supply response.”

Donald F. Santa, president of the Interstate Natural Gas Association of America, said that, while interstate gas pipelines have not been major gas market participants since FERC unbundled their services, “there already is tremendous transparency in the natural gas pricing transaction because of existing posting requirements for pipelines.”

While the Energy Policy Act of 2005 gave FERC clear jurisdiction over commodity price reporting, he continued, the commission “should think long and hard before it crosses the threshold and uses its new authority.” Santa said, noting, “Once regulation begins, it is hard to step back from it.”

SPE posts reserves definitions for comment

The Society of Petroleum Engineers has posted the proposed 2007 Petroleum Reserves and Resources Classification, Definitions, and Guidelines on its web site for comment from industry.

The draft involved 2 years of work and cooperation between SPE and other sponsoring organizations: the World Petroleum Council, the American Association of Petroleum Geologists, and the Society of Petroleum Evaluation Engineers.

The organizations seek comment from their international memberships by Feb. 1, 2007. Later boards of the various organizations will consider final approval of the definitions.

The proposed system would update and replace guidelines outlined in the 1997 SPE-WPC Petroleum Reserves Definitions and the 2000 SPE-WPC-AAPG Petroleum Resources Classification and Definitions.

In updating the definitions, SPE’s oil and gas reserves committee compared definitions used worldwide. The primary updates include the following:

- The system is project-based.

- The class is based on the project chance of commerciality.

- Categorization is based on quantities recovered by applying a defined project to a reservoir base case that uses evaluator’s forecast of future conditions (including prices and costs, technology available, environmental standards, fiscal terms, and regulatory constraints).

- Guidelines are applicable to unconventional resources (including bitumen, oil shale, coalbed methane, and gas hydrates).

The draft definitions are posted at www.spe.org/reserves.

Statoil introduces new Asgard Blend

Statoil ASA introduced a new light, low-sulfur oil grade, Asgard Blend, based on condensate and crude from Asgard, Kristin, and Mikkel fields in the Norwegian Sea.

It consists of Asgard Crude, Asgard Condensate, and Kristin Crude, replacing the previous practice of separate crude and condensate liftings from the field, and will be marketed as a crude mix, the company said.

The oil is stored on Asgard, where the Kristin and Mikkel well streams are also processed. Output from the Asgard A oil production ship and B gas platform was previously piped to two separate stores, with Kristin production held on the Asgard C storage ship.

The first consignment of the new grade left Asgard earlier this month for Statoil’s Kalundborg refinery in Denmark. The next two loadings are to go to a Dutch plant in Rotterdam and Statoil’s Mongstad facility near Bergen. Statoil expects 80-90 Asgard Blend cargoes of 500,000-855,000 bbl to be lifted annually. Production is 180,000 b/d.

The Asgard Blend assay is based on samples taken from each stream contributing to the blend. Since Kristin production is not as high as expected, Asgard Blend export quality will most likely be slightly lighter than shown in assay, a difference of about 1° API, Statoil said.

Characteristics of the new crude blend are: gravity, 48.9°; specific gravity, 0.7842; sulfur content, 0.08 mass %; pour point, -27° C.; total acid number, <0.01 mg KOH/g; nickel, <0.1 ppm (wt); vanadium, <0.1 ppm (wt); viscosity at 20° C., 1.63 cst.

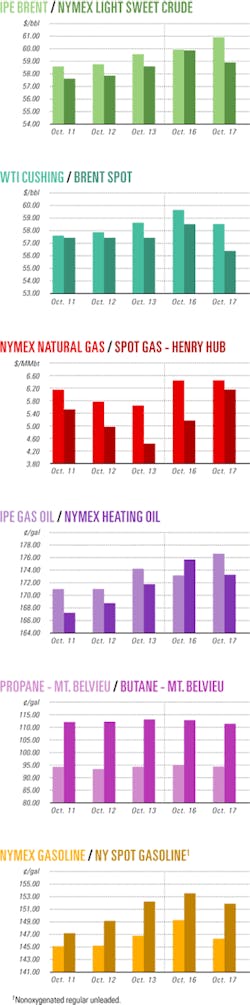

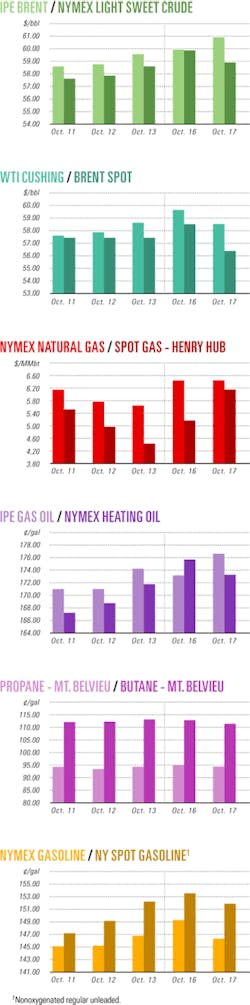

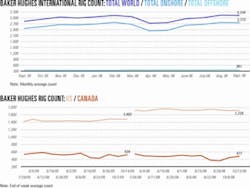

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesNorsk Hydro still awaiting Shtokman rebuff

Norsk Hydro AS-one of the companies interested in developing Shtokman gas field with OAO Gazprom in the Barents Sea-has not received official confirmation from Gazprom that its offer has been rejected, Eivind Reiten, CEO and president of Norsk Hydro told OGJ.

Speaking Oct. 16 at the inauguration of the Langeled pipeline, which delivers Norwegian gas from the Sleipner hub to the UK, Reiten said there was no timetable in place to negotiate with Gazprom until Hydro receives its communication about its status on the ambitious project.

He added: “We will discuss providing technology if that’s an avenue that Gazprom wants to explore, but before I can comment any more specifically on that, we have to engage in dialogue.”

On Oct. 9 Gazprom issued a press release stating that it would solely develop the Shtokman field for gas exports to Europe despite keen interest from international companies such as ConocoPhillips, Total SA, Chevron Corp., Statoil ASA, and Norsk Hydro Oil & Energy (OGJ Online, Oct. 10, 2006).

The announcement shocked the international petroleum industry, considering the technical and logistical challenges facing the project and the estimated $10-20 billion required to bring it to fruition. Hydro was viewed as holding a strong advantage over its competitors because it was experienced in developing such challenging projects; it had drilled the fourth Shtokman appraisal well with Gazprom and is providing the rig for the seventh well. The other major surprise was the loss of LNG supplies to North America, as this had been the primary original market for Shtokman gas (OGJ, Oct. 16, 2006, p. 20).

Gazprom Chief Executive Alexei Miller said earlier that the contenders had been rejected because they “were unable to provide the capital required.” Miller said, “Foreign companies could not offer us assets that corresponded in size and quality with the reserves of the Shtokman field.” Miller added that foreign companies would be considered “only as contractors” for the project.

Total confirms Block 17 oil find off Angola

State-owned Sonangol and Total E&P Angola reported that the Orquidea-2 appraisal well has confirmed and expanded the potential of the Orquidea oil discovery on Block 17 off Angola.

Drilled in 1,165 m of water 2 km from the discovery well, Orquidea-2 encountered the same Miocene objectives as did Orquidea-1 and also identified deeper Oligocene reservoir levels. Both the Tertiary Miocene and Oligocene objectives are oil-bearing.

The two-well success on the Orquidea structure, near the Lirio, Cravo, and Violeta finds, confirms the potential for development of a fourth production zone on Block 17, for which preliminary design is under way (see map, OGJ, Mar. 18, 2002, p. 53).

The production zone is in the northwestern area of the block and will complete the Girassol and Dalia zones, soon to be followed by the Pazflor production zone.

Total E&P is operator with a 40% interest in the block.

Lundin Petroleum to delay Caspian drilling

Lundin Petroleum AB delayed drilling the Morskoye prospect on the Lagansky block off Russia in the Caspian Sea until next year.

A two-well drilling program is scheduled to start during second quarter 2007, targeting three main Cretaceous and Jurassic reservoirs at 800-1,600 m.

Earlier this year, Lundin of Stockholm bought Valkyries Petroleum Corp., a company with exploration and producing interests in Russia and a 70% stake in Lagansky block.

Valkyries planned to spud the Morskoye well in the third quarter, but drilling was delayed pending conversion of shallow draft barges to drill in 2 m of water.

That conversion is done, but the impending onset of winter prompted the drilling delay until next year.

Anadarko produces oil from more Bohai fields

Anadarko Petroleum Corp. has started oil production from the CFD 11-6/CFD 12-1S development project off China in Bohai Bay. The development project straddles Blocks 04/36 and 05/36 in 75 ft of water.

Anadarko expects 10 wells to be producing a total 15,000 b/d by Oct. 31. Development drilling continues, with 22,000 b/d of gross oil production from 22 wells expected by mid-2007. The Bohai Bay holdings were acquired when Anadarko bought Kerr-McGee Corp., Oklahoma City (OGJ, July 10, 2006, p. 27).

The project involves producing from a gathering platform and two smaller, unmanned satellite platforms tied back 13 km to the Hai Yang Shi You 112 floating production, storage, and offloading vessel (OGJ, July 11, 2005, p. 35).

Anadarko operates the unitized development project with a 29.18% interest.

Drilling & Production - Quick TakesFPSO due deepwater field off Angola

BP PLC is set to install what is being called a superlarge floating production, storage, and offloading vessel on deepwater Block 18 in its Greater Plutonio fields off Angola.

The 360,000-dwt FPSO, named after the fields, is 310 m long, 58 m wide, and 32 m high.

Built by Hyundai Heavy Industries, the Greater Plutonio vessel has a storage capacity of 2 million bbl of crude oil and can handle production of about 200,000 b/d. Its living quarters can accommodate 120 crew members.

Toreador to start gas production off Turkey

With gas production scheduled to begin in late December, Toreador Resources Corp., Dallas, has entered the final stages of construction of the South Akcakoca subbasin project in the Black Sea off Turkey.

First-phase production of 50 MMcfd is expected in the first 60-90 days from startup, project operator Toreador, said.

Stratic Energy Corp., Calgary, a 12.25% interest partner, said construction of the onshore production facility is progressing well with major equipment scheduled to be on site during late October.

An 18-km onshore pipeline, already constructed and tested, links the production facility to the national grid. Toreador expects to finalize gas plan installation and precommissioning in mid-December. Installation of the offshore pipeline is scheduled to begin the week of Oct. 23 when the Regina pipelay barge is expected to arrive on location.

Most of the coated pipe has been delivered to Toreador’s offshore logistics base in Eregli, and the final shipment of pipe is in transit from Italy, Stratic said. Completion of the offshore pipeline is expected in mid-December.

Meanwhile, the Prometheus jack up is completing operations on the Akkaya production tripod and has completed and tied back the three Akkaya production wells. The rig is preparing to move to the Dogu Ayazli location to install the second production tripod.

The Dogu Ayazli tripod will be floated into the field area in preparation for installation over the coming weeks. Following tripod installation and completion and tieback of the Dogu Ayazli-1 and Dogu Ayazli-2 production wells, the rig will then be moved to the Ayazli location to set the third tripod and tie back the two Ayazli production wells.

Drilling of the Dogu Ayazli-3 development well to a target on the eastern flank of the Dogu Ayazli accumulation has been delayed due to the tight schedule. In fact, the project partners are considering drilling the well after Dogu Ayazli field is on stream.

Stratic said the production platforms will be commissioned in stages, starting with the Akkaya and Dogu Ayazli platforms in December and followed by the Ayazli platform in January 2007.

Processing - Quick TakesIrving looks into second St. John refinery

Irving Oil Ltd., St. John, NB, confirmed that it is exploring the possibility of building a second refinery at St. John.

The project would be the first major refinery built in North America in nearly a quarter century and would be the largest private-sector investment in Atlantic Canada.

The new refinery could supply as much as 300,000 b/d of products to the US Northeast and would cost $5-7 billion to build.

Irving said it is conducting market, feasibility, environmental, and socioeconomic studies, including a site selection determination for a possible refinery.

Irving will continue to invest in its existing, 250,000-b/d refinery at St. John. That refinery, which is Canada’s largest, supplies more than 75% of Canada’s gasoline exports to the US and 19% of all US gasoline imports.

BP’s Texas City refinery due steam generator

BP PLC plans to build a 250 Mw steam turbine power generating plant next to the existing South Houston Green Power LP cogeneration facility at BP’s 446,500 b/cd Texas City, Tex., refinery.

The $100 million unit will boost total electric power generating capacity at the site to 1,000 Mw. Power not required for refining operations will be sold into the local markets, BP said.

BP’s Alternative Energy business will oversee the design, construction, installation, commissioning, and start-up of the new steam generator plant, which is expected to come on stream in second quarter 2008.

Chevron to build at least three biofuel plants

A Chevron Corp. subsidiary has agreed to conduct proposal preparation for the development of at least three biofuel production plants for Ethanex Energy Inc., a renewable energy company engaged in low-cost ethanol production.

The agreement calls for Chevron Energy Solutions (CES) to perform engineering, geotechnical studies, and site and civil design work to prepare a detailed proposal for developing and building ethanol plants that use advanced technology to maximize efficiency.

The proposal will include authorization for CES to negotiate contracts to engineer, procure, and build the biofuel plants by 2008.

The plants, which are to be built in Missouri, Illinois, and Kansas, will each produce about 132 million gal/year of fuel-grade ethanol. Currently, the total production capacity of ethanol facilities in the US is about 5 billion gal/year, Chevron said.

QP, ExxonMobil to build petrochemical complex

Qatar Petroleum and ExxonMobil Chemical Qatar Ltd. have signed a heads of agreement to progress studies for a proposed $3 billion world-scale petrochemical complex in Ras Laffan Industrial City, Qatar.

The complex will include a 1.3 million tonne/year steam cracker and associated derivative units, including polyethylene and ethylene glycol, which will employ ExxonMobil’s proprietary steam cracking furnace and polyethylene technologies.

The facility will utilize feedstock from gas development projects in Qatar’s North field and will serve Asia and Europe.

Start-up of the facility is expected in 2012.

Transportation - Quick TakesDominion, Statoil start Cove Point LNG expansion

Dominion Cove Point LNG LP and Statoil ASA began construction Oct. 5 on facilities to almost double the capacity of Dominion Cove Point LNG terminal in southern Maryland. Capacity is being increased to 1.8 bcfd of gas from 1 bcfd and storage capacity to 14.6 bcf from 7.8 bcf. The terminal is at Lusby on Chesapeake Bay south of Baltimore.

Dominion will add two storage tanks to the five existing tanks, additional vaporizers at the plant, and two electric generator units to the existing three units.

The project also includes expanding the Dominion Transmission Inc. gas pipeline delivery system. Dominion would build a 47.8-mile, 36-in. pipeline duplicating the existing 36-in. line from Cove Point to Marshall Hall Gate in Calvert, Prince George’s, and Charles counties, Md., to deliver more gas to interstate pipeline connections in Virginia.

It also will add storage capacity in Pennsylvania along with two compressor stations, a pipeline in Greene County, Pa., two sections of pipeline in Potter County, and an 81-mile, 24-in. transmission line from its Perulack compressor station in Juniata County to Dominion’s South Point market hub, other interstate pipelines, and major gas storage fields at Leidy in Clinton County, Pa. Leidy is a major storage center for gas used in the US Northeast.

Dominion and a subsidiary of Statoil this summer signed 20-year service agreements for the plant expansion and increased pipeline capacity in Maryland and Pennsylvania. Statoil will provide 100% of the LNG for Cove Point. The service agreements will begin when the expansion is activated, Dominion said. Work is scheduled for completion in fall 2008.

SNG to build pipeline, expand LNG terminal

Two subsidiaries of Southern Natural Gas Co. (SNG) have filed separate applications with the US Federal Energy Regulatory Commission to build a pipeline and to expand an LNG receiving terminal near Savannah, Ga., reported El Paso Corp., Houston, SNG’s parent company.

The proposed Elba Express Pipeline, to be built by Elba Express Co. LLC (EEC), will have a total capacity of 1.2 bcfd of gas. The 190-mile 36-42-in. pipeline will transport gas from EEC’s Elba Island LNG terminal to Georgia and South Carolina, and to the US Southeast and Northeast via its interconnects. The Elba Island LNG receiving terminal expansion, planned by Southern LNG, will add 8.4 bcf of LNG storage capacity, which will more than double to 15.7 bcf. This expansion project will increase sendout capacity to 2.1 bcfd, representing an addition of about 0.9 bcfd.

The projects will be constructed in phases with the in-service date of the first phase of each scheduled for 2010 and the second phase of each expected to be in 2012. The estimated cost for all phases of both projects is $930 million.

Cochin to convert oil terminal to LNG use

Cochin Port Trust (CPT), the Indian government department that manages the port of Kochi, reported plans to convert the existing oil terminal into a receiving terminal for LNG.

According to CPT Chairman N. Ramachandran, Indian Oil Corp. (IOC) has approached CPT with a proposal to provide an exclusive terminal to handle imported LNG.

“We have already had three rounds of discussions with IOC and will soon finalize the proposal,” Ramachandran said.

“There is some urgency in converting the oil terminal to LNG, since the Single Point Mooring project of Bharat Petroleum Corp. Ltd. (BPCL) at Puthuvypeen (near Kochi) will be commissioned by next year.”

After the commissioning of the SPM project, CPT’s oil terminal would become superfluous. BPCL would no longer use it, and the port would lose almost 40% of its total earned revenues.

Converting the terminal to handle LNG, with or without a regasification facility, would bring CPT substantial revenues, because Petronet LNG’s Kochi terminal is still on the drawing-board and will require at least 2 years more to become operational.

“IOC could take imported bulk LNG from the port to its bottling unit at Irimpanam, from which it can be redistributed,” said Ramachandran. Currently, the company is importing LNG through New Mangalore port for distribution in the four southern states.

CPT also is exploring the possibility of optimum utilization of the land available on Willingdon Island, where the port is located. Unlike other ports, land shortage is a major concern with Cochin.