Natural gas, LNG to play support role in meeting India’s increasing energy needs

India’s energy balance is fundamentally changing due to the adoption of market-based economics, rapid economic growth, and a shift away from traditional biomass energy sources.

Natural gas and LNG show promise as energy sources that can provide a clean, efficient solution to India’s energy demand.

However, there are challenges to increasing the supply of natural gas in India. These include a lack of foreign investment and necessary infrastructure, remnants of nonmarket pricing policies, and difficulties in negotiations with foreign suppliers and transit countries such as Bangladesh, Iran, and Pakistan.

To address these challenges, India has begun to encourage competitive pricing, provide incentives for foreign companies to explore through the New Exploration Licensing Policy (NELP), and relax regulation. These initiatives, in concert with higher world prices for natural gas and renewed negotiations with foreign suppliers, have stimulated activity. Recent progress includes:

• The development of a spot market, with contracts traded on the National Commodity & Derivative Exchange Ltd. (NCDEX).

• Keen interest among foreign companies to build LNG terminals.

• Increasing domestic exploration.

• Development of pipeline infrastructure.

• A move toward investment in gas-fired power plants.

Continued access to natural gas and LNG supplies thus will be critical to India’s sustained energy growth.

This article discusses the energy market outlook for India, as well as natural gas pricing evolution and status, and challenges for domestic and imported gas supplies, including LNG.

Trends in global LNG trade and the level and timing of LNG imports by India discussed here come from the proprietary World LNG Model (WLNG) developed by Science Applications International Corp. (SAIC) to depict global optimal flows of LNG and prices. WLNG contains over 60 global supply and demand nodes and systematically evaluates LNG trade patterns, chokepoints, tanker constraints, and future tanker needs given worldwide LNG and energy demand.

The energy challenge

As India’s economy grows, so does the quest for energy resources. Surging demand is outstripping supply, raising questions about how India can sustain its robust growth.

One of the country’s greatest energy challenges is meeting demand for electric power. Published estimates indicate that India will need an additional 90-100 Gw of new electric power capacity by 2012-nearly double today’s capacity.

Such huge demand for electricity will require greater access to energy resources. Yet hydropower capabilities are limited and can only be a meaningful energy source in mountainous terrain such as in Uttaranchal, Himachal Pradesh, and Jammu and Kashmir.

Biomass and waste, which account for about 50% of India’s total energy supply, are used primarily for residential requirements, and their use in the power sector will continue to be less than 1%.

Although India’s nuclear power industry received a recent boost from renewed US technological assistance, implementation will take many years.

This leaves natural gas and coal as options for meeting India’s growing energy needs.

Energy market forecast

Although the latest integrated forecast of international energy markets by the US Energy Information Administration (EIA) and Paris-based International Energy Agency (IEA) reduced Indian energy and gas market growth forecasts from previous years, the forecasts still indicate a robust increase in economic, energy, and natural gas growth in India.

According to EIA’s 2005 International Energy Outlook (IEO 2005), total energy demand in India will grow by 3.3%/year to 29.3 quadrillion btu (quads) in 2025 from 14 quads in 2002.

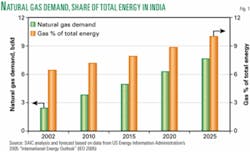

Natural gas represents 6.5% of total primary energy consumption, but EIA expects this share to grow to 10% by 2025 (Fig. 1). Overall, India’s total gas demand is projected to grow at an average rate of 5.1%/year to 7.7 bcfd in 2025 from 2.5 bcfd in 2002.

The electric power sector is projected to account for 70% of this total incremental gas demand growth.

Natural gas demand growth in India’s electricity sector cannot be studied without understanding the status, drivers, and growth issues associated with the country’s massive coal industry. Growth in natural gas use is highly dependent upon coal-gas competition and governmental policy shaping the overall evolution of the electricity sector.

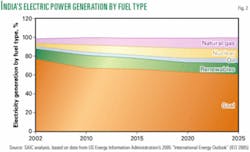

Natural gas-fired generation during 2002-25 will increase to 1.7 quads from 0.3 quads. This is a doubling of gas-fired electric power generation to over 12% in 2025 from 5% in 2002, representing an increase in fuel diversity in thermal power generation in India (Fig. 2).

At the same time, the use of coal for electric power generation is projected to rise by 2.2%/year compared with natural gas-fired generation growth of 7.5%/year. During 2002-25, coal-fired electric power generation will increase by 5.1 quads to 8.5 quads. On a percentage basis, however, this represents an overall decrease to 60% from 77% of total coal-fired electricity generation because of the natural gas increases.

Coal currently meets more than half of India’s electricity needs and will remain important to meeting the country’s energy demand. India has 102 billion tons of coal reserves, which represents about 10% of the 1,001 billion tons of total worldwide coal reserves.

Nevertheless, India’s coal production has consistently lagged demand, and imports have grown over time. India’s state-owned monopoly Coal India Ltd. has been unable to meet its full commitments of deliveries for thermal generation at power plants. The shortage of coal suitable for thermal power plants has led to imports from sources such as Australia, Indonesia, and South Africa.

Coal imports might fill the gap in the short run but could pose problems later, as India’s ports and railroads are overburdened. Nevertheless, India will continue to utilize coal in large percentage for its power generation because of its vast reserves. This would, however, require the Indian State Electricity Boards to improve and streamline operations and the government to continue electricity sector structural and regulatory reforms.

Gas price evolution

The pricing of natural gas has undergone major changes in the past few years. The final consumer price of gas in India is a combination of the landfall price, applicable royalty, transportation charges, taxes, and duties.

New gas discoveries, increased exploration through NELP rounds, extensive work on LNG terminals, commercial use of LNG, and developments in the private electric and fertilizer sectors have transformed the overall pricing structure from a subsidized, controlled regime to a market-based regime for private and joint venture (JV) gas and “low” administered prices for domestic non-NELP gas, which is subsidized.

India’s Ministry of Petroleum and Natural Gas has been slowly moving the gas industry toward deregulation for almost a decade. As the energy sector deregulates, natural gas prices are expected to rise as customers are willing and possibly would be required to pay higher prices than those regulated by government.

However, growth in a gas-based energy economy in India, as projected by EIA and IEA, is highly dependent upon whether end-use customers can afford the gas. Industrial customers would find it difficult to afford gas priced at more than $5/MMbtu because of the regulated market price for their products.

Supply options in India include gas produced by national oil companies (NOCs), gas produced by public-private JVs, LNG imports, and gas imports through international pipelines-all with substantial variations in pricing. Gas prices vary by source. And gas competes with other fuels such as coal, fuel oil, and naphtha. So a separate, almost entirely decontrolled natural gas market works alongside the controlled sector.

Private power plants and some industrial users have begun to shift to private, more costly but more reliable natural gas supplies. The question remains, however, whether these industries can raise their product prices enough to absorb higher market-based gas prices.

The Indian government is contemplating regulatory changes that could bring in more competition and market-based pricing for all natural gas. Higher prices enable import options such as LNG, and international pipelines become viable. However, these are capital-intensive options and face hurdles due to price uncertainties and industry’s potential inability to increase product prices in response to higher gas prices.

In the administered market-gas produced domestically by the NOCs in the non-NELP environment-consumer prices remained at 2,850 rupees/trillion cu m (tcm) ($1.81/MMbtu) plus a transportation surcharge of 1,150 rupees/tcm (73¢/MMbtu), from 1999 until the end of 2005. Consumer prices recently were raised to 3,200 rupees/tcm ($2.04/MMbtu) from 2,850 rupees/tcm.

Oil India Ltd. (OIL), however, produces and sells gas in the northeastern part of the country at a discount-1,700 rupees/tcm ($1.07/MMbtu)-because this market is relatively small and remains disconnected from major gas markets in western India.

The limited gas available in the administered market leaves consumers vulnerable to supply disruptions from political factors because supplies are allocated by governmental entities that do not have a “supply-or-pay” obligation.

In the private market, prices are set by individual contracts between suppliers and customers. These prices-$2.97-5.05/MMbtu-are considerably higher than those in the administered public market (Table 1). Private gas supplies are sold under long-term contracts and include both take-or-pay and supply-or-pay obligations. Notable in Table 1 is the Reliance Industries Ltd. delivered price of $2.97/MMbtu. This price is based on the contract Reliance, Mumbai, signed with National Thermal Power Corp. to enable gas-fired power plant expansion in Gujrat. Future Reliance contracts are likely to fetch a higher price.

Incentives for moving natural gas pricing from fixed government control to the development of a spot market with a trading and online exchange are coming from suppliers and consumers. Given the number of projects that have failed because of pricing problems, developing a spot market with an online exchange and trading could prevent much of the risk to both suppliers and consumers.

India’s government recognizes this need, and new regulatory actions are forcing the state-owned transmission company Gas Authority of India Ltd. (GAIL) to begin unbundling its trading business from transmission activities. In 2005, GAIL and national commodities exchange NCDEX signed a memorandum of understanding to start a spot market for natural gas. This move to competition and open trading signals the maturing of the gas market and can open new doors for private investment.

Indigenous gas supply

India’s robust gas demand forecast is highly dependent upon the access of low-cost supplies and the success of India’s NOCs-Oil & Natural Gas Corp. (ONGC) and OIL-and new entrants such as Reliance, London-based Cairn Energy PLC, Royal Dutch Shell PLC, and BG India, Mumbai. Natural gas is a new industry relatively free of the bureaucracy otherwise found in India’s energy sector.

Historically, natural gas has been the fastest growing energy source in India as a result of the upstream hydrocarbon sector’s opening up, competitive bidding for exploration blocks through NELP, and the environmental benefits of natural gas for electricity generation. Gas demand tripled to an estimated 3.3 bcfd in 2005 from 1 bcfd in 1995-a robust 12.8%/year average growth rate in the last 10 years (OGJ, Dec. 19, 2005, p. 65).

Growth in the domestic supply of natural gas lags demand, however. Supply is needed to alleviate shortages in the power sector; to expand gas use in the residential sector, replacing wood and other traditional household fuel; to support a growing economy; and to provide a cleaner transportation fuel in India’s polluted cities.

Domestic production is increasing with new gas discoveries, and imports must compete with this relatively inexpensive new indigenous gas supply. However, indigenous gas supply remains unable to meet Indian demand.

Some domestic production is an unreliable supply. Natural gas production from pre-NELP fields and from NOCs is subject to government curtailment, and suppliers have no supply obligation.

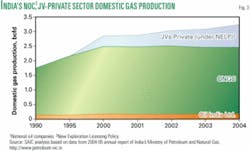

Indigenous production fills most of India’s current gas needs, and until 2003 met all of its demand. India’s historic production trend is shown in Fig. 3. ONGC and OIL historically have produced the bulk of natural gas in the country. State-produced gas is sold at artificially low rates to GAIL, which transports close to 90% of the gas consumed in India and sells it to end-users at rates set by the central government. Most consumption occurs along GAIL’s Hazira-Vijaipur-Jagdishpur pipeline, which supplies gas to end-use consumers. GAIL also operates a number of regional distribution grids, including those in Mumbai, Ahmedabad, and Andhra Pradesh.

Until the early 1990s, the Indian hydrocarbon sector was not open for private participation; therefore, ONGC and OIL produced virtually all of India’s natural gas.

The successful reform of India’s hydrocarbon sector through NELP facilitated the level playing field for NOCs as well as international players and has indicated that a combination of competition, efficient policies, and leadership can produce results. This has raised investment in upstream hydrocarbon activities by domestic and international oil and gas companies, improved the performance of ONGC and OIL, and spurred the discovery of reserves where none were thought to exist before.

With the opening of the hydrocarbon sector in the mid-1990s, private companies formed JVs with multinationals or India’s NOCs to explore, develop, and produce gas. JVs’ and private companies’ share of natural gas production has been increasing and is currently at about 25% or 800 MMcfd.

India’s proven gas reserves are currently estimated at 38.8 tcf. Its reserves-to-production ratio is 31 years (OGJ, Dec. 19, 2005, p. 65). Most reserves lie off northwest Mumbai in the Arabian Sea and in the state of Gujarat.

Overseas reserves

The quest for energy security has taken India’s ONGC in search of equity oil and gas and has led to teaming with international oil and gas companies in exploration and development.

India’s neighbor, energy-hungry China, has proved adept at this strategy, besting ONGC’s international arm ONGC Videsh on several major licenses and in the purchase of companies holding oil and gas assets.

But India is catching up and recently has won exploration rights in Egypt, Qatar, and Cuba. India’s equity participation in Vietnam, Russia, and Myanmar is primarily for natural gas. The majority of other investments are for oil, as shown in Table 2.

India also is pushing for longer-term supply contracts from Persian Gulf producers that would give the country and its suppliers 5-10 year supply agreements instead of the 12-month (or less) horizons that are currently normal in other parts of the world.

Part 2 of this special report (Feb. 6) will assess the growing role natural gas importation via pipelines and LNG will play in meeting India’s future demand.

Acknowledgments

The authors prepared this article for information and discussion purposes only. The authors’ views and opinions do not necessarily reflect those of SAIC.

Some insights in the article are drawn from research conducted at the Energy Resources Management and Policy program at the University of Maryland University College, where Vikas also serves as an adjunct faculty member. ✦

Bibliography

Airy, A., “GAIL-NCDEX pact soon for natural gas spot market.” Financial Express. February 2005.

Directorate General of Hydrocarbons (DGH), India Ministry of Petroleum & Natural Gas, “Recent discoveries,” 2004 (www.dghindia.org).

Gupta, S.P., “Report on the Committee of India Vision 2020,” Planning Commission, Government of India, New Delhi, 2002.

Hayes, M.H., “India’s Natural Gas Sector: Historical Development, Options, and Obstacles to Reform, and Supply Alternatives,” Stanford’s program on energy and sustainable development, 2002.

“India’s terminal story: First-time lucky, tough road ahead,” LNG Daily, Platts, July 25, 2005, (www. Platts.com).

“India and China Forge an Energy Tie,” Wall Street Journal, Aug. 18, 2005.

“International Energy Outlook-2005 (IEO 2005),” US Energy Information Administration (www.eia.doe.gov/oiaf/ieo/index.html).

Jackson, M., “Natural Gas Sector Reform in India: Case Study of a Hybrid Market Design,” Stanford’s Program on Energy and Sustainable Development, Working Paper No. 43, 2005.

Joshi, P., “What’s new in India’s energy sector?” Journal of Structured and Project Finance, Institutional Investor Inc., Mar. 22, 2004, pp. 28-33.

Ministry of Petroleum and Natural Gas, 2004-05 Petroleum and Natural Gas Annual Report, Government of India, (http://petroleum.nic.in/ng.htm).

“Myanmar-India gas pipeline likely to bypass Bangladesh.” Khaleej Times Online, June 30, 2005 (www.khaleejtimes.com).

Naik, S.R., Sinha, S.Y., Singh, S.J., Pant, S.K.C., Singh, S.N.K., “Report of the Group on India-Hydrocarbon Vision 2025,” Government of India, Feb. 25, 2000 (www.petrowatch.com/ftp/vision2025part1.pdf).

Petronet LNG Ltd., (www.petronetlng.com).

“Putting energy in the spotlight: BP statistical review of world energy,” BP PLC, June 14, 2005 (www.bp.com/statisticalreview).

Rediff.com, “Petronet LNG: fuelling future growth!” (www.rediff.com/money/2004/mar/01perfin2/htm).

Rediff.com, “Shell not shutting down Hazira,” (http://in.rediff.com/money/2006/jan/05shell.htm).

“Shell-Total partnership commissions Hazira LNG terminal: Hazira LNG terminal and port dedicated to nation,” Shell press release (http://www.shell.com).

Uplenchwar, A., “India Gas-1: Domestic projects pursued; import prospects limited,” OGJ, Dec.19, 2005, p. 65.

US Energy Information Administration (EIA), US Department of Energy, “India country analysis brief (CAB),” 2005.

This is the first in a two part series. The second part of this special will appear in the Feb. 6 issue.

The authors

Shree Vikas ([email protected]) is manager and director of energy market services at SAIC. He has more than 10 years of experience in evaluating energy market trends, resource evaluation and pricing, gas-power convergence, and market due diligence and has led efforts for competitively connecting gas reserves to markets. He also teaches as an adjunct faculty member in the energy resources management and policy program at University of Maryland University College. Vikas has a PhD in petroleum and natural gas engineering and a masters in environmental policy from Penn State.

Chris Ellsworth ([email protected]) is a director of natural gas and LNG services at SAIC, where he provides international gas, LNG, and power market analysis and project due diligence. He has served as lead analyst for a number of energy projects, including assessments of natural gas markets in Asia, North America, South America, Europe, and Russia to support infrastructure finance and construction projects. Ellsworth is a regular speaker at industry conferences. He has an MS in economics from the University of Houston and a BS in geology from King’s College, London.