DRILLING MARKET FOCUS: New jack ups will soon hit the water

Without accounting for likely attrition of older units, the world’s supply of jack ups will expand more than 16% by 2009, adding 61 jack ups now under construction, in addition to 3 delivered earlier this year.

Nearly two-thirds (39) are being built in Southeast Asia, chiefly at Keppel FELS, Jurong Shipyard Pte. Ltd., and PPL Shipyard Pte. Ltd. in Singapore. Twelve jack ups are being built on the US Gulf coast, about 20% of the total. Yards in China and United Arab Emirates are each building 4 rigs, a yard in Indonesia is building 2, and India and Russia are each building 1 (Table 1).

Most of these newbuilds will come to market in 2007 (21 rigs) and 2008 (27 rigs).

Analysts have been concerned that an increasing number of rigs built on spec, without firm contracts, might flood the market and drive down day rates. However, given the robust demand for modern, efficient units, it is unlikely that there will be any softening of contract pricing in 2007-08. Many of the contractors have announced contracts over the last 6 months, while the jack ups are still in early stages of construction.

Some of the rigs are being sold by speculators to drilling contractors, such as A.P. Moeller-Maersk’s recent $420-million purchase of two Baker Marine Pacific Class jack ups under construction at the Jurong shipyard for Petrojack ASA.

Matt Simmons, chairman of Simmons & Co. International, told attendees at the Canadian Offshore Resources Exhibition & Conference in Halifax on Oct. 4 that the international offshore rig fleet is too small, too old, and insufficient to drill the existing portfolio and meet future needs. He stressed continuing attrition of older units and a dearth of arctic-class rigs, and noted that two jack ups will be leaving the Canadian Maritimes in the next 6 months.

It seems likely that the newbuilds will have only a small impact on the market and that will probably not appear until first or second-quarter 2008, in the middle of the surge.

Lately, many jack ups have been moving to the Middle East for contracts. Rigzone reports that about 18% of the worldwide jack up fleet is working in the Persian Gulf (73 rigs) and about 3% (11 rigs) is working in the Red Sea.

Saudi Aramco announced in early July that it had 101 rigs working, a new record, including 16 jack ups. By the end of the year, Fahad A. Al-Moosa, vice-president of drilling and workover said, “We expect to have 121 rigs in the field.”

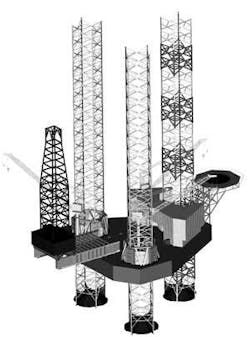

Designs

Independent leg cantilever (ILC) rigs comprise about 74% of the jack up fleet, followed by independent leg slot (ILS) with about 7%, and mat cantilever (MC) and mat slot (MS) rigs, which together comprise about 18% of the fleet (mostly found in the Gulf of Mexico).

The Keppel FELS Modified V B and Super B-Class jack ups are the most popular designs, accounting for nearly one third of the current newbuilds (20).

Baker Marine’s Pacific Class 375 is also among the most popular designs chosen by drilling contractors and operators, with 13 under construction.

Several LeTourneau designs are being built on the Gulf Coast at Keppel AmFELS in Texas and LeTourneau’s yard in Mississippi. Six of the Super 116 and 116E designs, two 240C, and two Tarzan Class jack ups are under way.

Houston-based Friede & Goldman have four JU-2000E jack ups and four Super M2 jack ups under construction in China and the UAE.

Drillers ordered six jack ups following two designs by Marine Structure Consultants BV: the CJ50 (four rigs for Maersk under construction at KFELS in Singapore) and CJ46 (two rigs for Standard Drilling ASA at Labroy’s new yard in Indonesia).

SCORE

Utilization of jack ups remains high, driving day rates and profitability to rosy levels for fleet owners.

GlobalSantaFe Corp.’s worldwide SCORE, or Summary of Current Offshore Rig Economics, increased 3.6% to 128.1 in August 2006 from the previous month’s SCORE of 123.6. The SCORE for jack ups increased 5.8% month-to-month, nearly three times the improvement for semisubmersibles (2.1%). The jack up SCORE has increased 47.4% in the past year, and 98.6% in the past 5 years.

Regionally, Southeast Asia and the Gulf of Mexico led demand for offshore rigs; the SCOREs were up 7% and 6.1% respectively, month-to-month, reflecting increasing profitability in those markets.

Average rates for jack ups working in August were just under $90,000/day. About half of the jack up fleet is contracted through 2007, at rates averaging $132,000/day.

USA, Rowan

Rowan Cos. Inc. and LeTourneau Inc. Marine Group are building four jack ups in Vicksburg, Miss., and Sabine Pass, Tex., including two Tarzan-class 225C rigs and two new LeTourneau 240C rigs.

Tarzan rigs can drill to 35,000 ft. The first two, Scooter Yeargain and Bob Keller, were completed in 2004 and 2005. The Scooter Yeargain began working at $80,000/day, but the Bob Keller received an advance, single-well contract of $95,000/day.

The third Tarzan rig, Hank Boswell, was christened in Sabine Pass, Tex., on Sept. 23.

The fourth Tarzan rig, JP Bussell, will be delivered in 2007.

Rowan announced it would build two rigs in the new 240C design in December 2005, at $165 million each. The new rigs are designed for high-pressure, high-temperature (HPHT) drilling, and with legs up to 535-ft long, they will be able to work in water as deep as 400 ft.

Compared to the 116C, Rowan said the 240C has more deck space, greater drilling capacity (2 million lb hookload), further cantilever reach (as much as 85 ft), and more accommodation space (for 120 personnel). The 116C has been the “workhorse” jack up for the offshore drilling industry for 25 years, and now there are several robust designs on the market to replace it.

Keppel Corp.’s Keppel AmFELS yard in Brownsville, Tex., is building:

- Five LeTourneau Super 116 jack ups for Scorpion Offshore Ltd., to be delivered in 2007 (Offshore Courageous, Offshore Defender) and 2008 (Offshore Resolute, Offshore Vigilant, Offshore Intrepid).

- A KFELS modified V Super B Class jack up for Diamond Offshore Drilling Inc., the Ocean Scepter, to be delivered in February 2008, for $117 million.

- A Super 116E jack up for Atwood Oceanic, the Atwood Aurora, to be delivered in September 2008, for $100 million.

Singapore

There are 23 jack ups currently under construction at Keppel FELS Ltd. yard; 9 at SembCorp Marine’s PPL Shipyard Pte. Ltd.; and 4 at Jurong Shipyard Pte. Ltd. in Singapore (Table 1).

Keppel FELS is building KFELS modified V B, V Super B Class, V B Bigfoot, and MSC CJ-50 design jack ups.

Customers include Qatar’s Gulf Drilling International Ltd., DDI Holding AS, Awilco Offshore ASA, PetroVietNam, ENSCO Inc., SeaDrill Invest, Stella Shipping International Inc., A.P. Moeller-Maersk, Diamond OffshoreDrilling Inc., SeaDrill Ltd., Discovery Hydrocarbons Pvt. Ltd. (a subsidiary of Jindal Group), Jindal Pipes Ltd., Mercator Lines Ltd., and India’s Great Eastern Shipping Co. Ltd. Group.

PPL Shipyard is building Baker Marine Pacific Class 375 jack ups, and customers include: PT Apexindo Pratama Duta, Awilco Offshore, DDI Holding, Caleb Maritime SA (a subsidiary of SeaDrill Ltd.), Japan Drilling Co. Ltd., and Aban Offshore.

Jurong Shipyard is also building Baker Marine 375 jack ups, for A.P. Moeller, Petrojack, and JackInvest 1 Pte.

In July A.P. Moeller-Maersk announced it bought two jack ups under construction for Petrojack at Jurong Shipyard in Singapore. The PetroJack I and PetroJack III Baker Pacific Class 375 rigs sold for $420 million. The rigs cost Petrojack about $238 million; so the sale netted them a cool $182 million, a 76% profit margin.

Indonesia

Labroy Offshore Ltd., a subsidiary of Labroy Marine Pte Ltd., has developed a new 40-hectare rig construction yard at Batam, Indonesia, south of Singapore. In March, Tan Boy Tee, chairman and managing director of Labroy, said the yard has the capacity to accommodate construction of “a minimum of six jack ups.” Labroy has received orders to build its first four jack ups (www.labroy.com.sg).

In March, the company announced it would build two jack up drilling rigs for Norway’s Standard Drilling ASA for S$475 million ($292 million). The contract covers platform and leg construction, and proprietary hardware components, such as the skidding, fixation, and jacking systems.

The MSC CJ-46-X 100D design jack ups will be capable of drilling to a total depth of 30,000 ft in water to 350 ft deep. The rigs will be delivered to Standard Drilling in fourth-quarter 2008 and second-quarter 2009.

In June, Labroy announced that it has an $18-million contract for two more jack up platforms from a Dutch company. Labroy will build the platforms, but the customer will supply the jacking system, legs, machinery, and equipment. These two jack ups are scheduled for delivery in 2007.

Tan said, “We are confident of more orders from the jack up segment.”

China

Noble Corp. has three new jack ups under construction by China Shipbuilding at the Dalian shipyard in China. All three are Friede & Goldman JU-2000E design and capable of working in water as deep as 400 ft and drilling to 30,000 ft. Derricks, drawworks (4,600 hp), mud pumps (three 2,200 hp), and rotary tables (49.5 in.) are all from National Oilwell.

These new heavy-duty, harsh-environment (HDHE) jack ups will be delivered in 2007 (Noble Roger Lewis), 2008 (Nobel Hans Deul), and 2009 (Noble Scott Marks).

The Noble Scott Marks has a construction cost of about $190 million. Under a 2-year contract with Aberdeen-based Venture Production PLC announced June 27, the rig will be available for Venture’s 2009-11 drilling campaign in the southern and central North Sea.

Mike Wagstaff, chief executive of Venture Production, said the contract “will bring the first dedicated newly built drilling rig into the UKCS for many years” and indicates the company’s “significant long-term commitment to the North Sea.”

China Oilfield Services Ltd. also has a JU-2000 jack up under construction at the Dalian New Shipyard. The COSL 942 jack up will be delivered in 2008.

Persian Gulf

Four jack up drilling rigs are under construction at two new yards in the emirate of Sharjah, UAE. All four are based on the Friede & Goldman (F&G) Super M2 rig design. The Super M2 is an updated version of F&G’s L 780 Mod II jack up rig, of which there are more than 30 operating worldwide.

The Super M2 has a modular hull with wrap-around living quarters, enhanced leg design, and an extended-reach cantilever. It is designed to work in 300 ft water depth, drilling down to 30,000 ft.

Matthew Hemker is the F&G project manager.1

The rigs are being built for Thule Drilling ASA and for Mosvold Drilling Ltd.

Thule’s rigs (Thule Energy and Thule Force) are being built at the QGM Group LLC’s rig construction yard in the Hamriyah Free Zone, UAE, to be delivered in 2007 and 2008.

Mosvold’s rigs are being built at Maritime Industrial Services Co. Ltd. Inc. (MIS) yard and will both be delivered in 2008. They will feature 3,000-hp drawworks and three 2,200-hp mud pumps.

The American Bureau of Shipping announced in July that it would class all four of the rigs. Viro Valian, ABS project manager for the Mosvold drilling rigs being built at MIS, told OGJ that work began on the rigs in August 2006.

ABS said that it had about 76% market share of the worldwide drilling rig fleet.1

New yards

New yard capacity is opening up in Indonesia, China, and South Africa, and may be a future possibility for Venezuela.

In addition to Labroy Offshore’s new capacity at Batam, Keppel is planning to build a fabrication yard on the southeast coast of Bintan Island, Indonesia. It will operate under the name Bintan Offshore Fabricators Pte. Ltd.2

A subsidiary of Germany’s MAN Group, Ferrostaal, is planning to build a rig fabrication yard at Saldanha Bay and a rig repair facility in Cape Town. Ferrostaal Chairman Matthias Mitscherlich announced the plans at the Oil Africa 2006 conference in Cape Town in March. The company will spend R200 million (about $27 million) on both yards.3

Aveng’s Grinaker-LTA Ltd., South Africa’s largest construction company, will be the main rig builder and South African engineering giant DCD-Dorbyl (Pty.) Ltd. will work at both facilities, which should be complete by first-half 2007.

In addition to the new yards in Indonesia, South Africa, and China, new yards may be under construction soon in Venezuela, according to a June 12 BNAmericas story. Armando Valladares, director of PDV Marina Transport, a subsidiary of Venezuela’s PdVSA, said that the country could either expand Venezuela’s state-owned shipyard, Dianca, or create a new shipyard with China or Iran.

Top operators

Based on jack up expenditures 2001-05, the top 10 operators are Chevron Corp., Total SA, Petróleos Mexicanos (Pemex), India’s Oil and Natural Gas Corp., ExxonMobil Corp., BP PLC, Royal Dutch/Shell, Maersk Olie og Gas AS, Apache Corp., and Belgium’s Petrobel NV. These 10 companies spent $8.7 billion on jack up rig expenses over the 5-year period, compared to $10.7 billion spent by all other operators.

References

- “First Jack up Rigs to be Built in United Arab Emirates,” ABS Energy News, July 2006, www.eagle.org/prodserv/EnergyNews/uae.html.

- “Offshore Projects-June 2006,” June 20, 2006, www.ndtcabin.com/articles/oil/0603011.php.

- “Europe’s Ferrostaal to build oil rig yard in SA,” Mar. 22, 2006, www.dailytenders.co.za/General/News.