Egypt’s petroleum future: Critical assets and well-defined plans will add value to large resources

To keep pace with the relentless growth in global energy demand in the decades ahead, it will be necessary to find, develop and use more oil and gas more efficiently, and with less impact on the environment.

Meeting tomorrow’s energy demand will require a complex array of talents and assets. Adequate oil and gas resources coupled with convenient access to both raw materials and markets will be critical advantages in tomorrow’s competitive global energy marketplace.

Just as important, the leaders that emerge to take up the challenge will be those nations and corporations that encourage innovation, offer attractive investment opportunities and strive to improve living standards for all citizens.

For decades, Egypt has taken advantage of its strategic location to build an important link in the chain that connects large oil reserves with markets around the world. In the last decade, it has begun to implement a long term strategy to add value to its own considerable natural gas resources by building a strong export prominence and a world-class petrochemical industry.

Egypt’s participation in the critical transportation infrastructure built around the Suez Canal and the Suez Mediterranean (Sumed) pipeline is one of the country’s most important physical assets. Egypt’s late President Saddat saw the pipeline as a strategic project and together with the Canal, the two now transfer around 98% of Arabian Gulf crude oil to the Mediterranean.

In addition to its ongoing role as a leading global oil transportation hub, Egypt also has:

- An aggressive exploration effort underway to further define its natural gas resource, much of which lies in deep water

- A Master Plan to develop its petrochemical industry and expand natural gas and liquefied natural gas (LNG) exports

- A reputation as a politically stable, investment-friendly country with a long history of partnering with international companies of all types

- A focus on environmental responsibility that embraces both operations within Egypt and the products it produces for consumers around the world

Adding to the resource

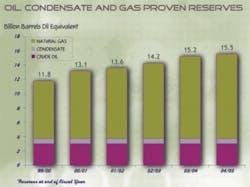

In fiscal year 2004/2005, Egypt’s oil production averaged 641,000 barrels per day (b/d) of crude and condensate; gas production averaged about 3.8 billion cubic feet per day (cu ft/day). At year end, remaining oil reserves were estimated at 3.669 billion barrels (bbl) and natural gas reserves stood at over 66 trillion cubic feet (tcf).

In addition to proven gas reserves, much of the country’s future will be driven by an estimated 100-120 tcf of gas yet to be discovered.

During the last fiscal year, 77 exploration wells resulted in 38 oil and five gas discoveries that added 196 million bbl of oil and 0.8 tcf of gas to Egypt’s reserves base. Production wells drilled or re-completed totaled 230, most of which were completed in the Western Desert.

Also during the year, 23 agreements were signed and amended that include financial obligations totaling $899 million and the commitment to drill 96 wells.

The continued search for new reserves by both Egyptian and international companies in recent years has helped slow the inevitable decline in oil production from fields discovered in the 1960s and 1970s.

In 2003, for example, the biggest oil discovery in 14 years added reserves of about 80 million bbl. When developed, the field is expected to produce 45,000 b/d, according to Minister of Petroleum H.E. Eng. Sameh Fahmy. In 2004, another big oil discovery offshore proved reserves of 60 million bbl. After full development, the field could produce 30,000 b/d.

In early 2006, five new oil discoveries were made in the Gulf of Suez and the Western Desert. The Gulf of Suez accounts for about half of Egypt’s production, the rest is from its three other key areas: The Western Desert, the Eastern Desert and the Sinai Peninsula.

“The Gulf of Suez is likely to continue to be the main oil producing region,” said Petroleum Minister Fahmy.

But aggressive exploration in the Western Desert has resulted in significant oil and gas discoveries in recent years. The search also has been intense in the deep water of the Mediterranean, and onshore in the Nile Delta and Western Desert, resulting in several gas discoveries. Recently, oil discoveries have been made in the Mediterranean and Nile Delta, areas traditionally considered gas-prone.

“These discoveries open more opportunities to find additional oil reserves in the deeper targets,” said Petroleum Minister Fahmy.

Egyptian General Petroleum Corp. (EGPC), in its strategy to achieve the goals of the Ministry of Petroleum to increase the country’s petroleum wealth, will:

- Tender new open areas in different sedimentary basins with international bid rounds

- Improve and upgrade the petroleum agreement process to lure more investment

- Apply the latest exploration and exploitation technologies

- Use exploration theories to reduce risk and increase success

Downstream development

Crude oil and natural gas reserves are fundamental to Egypt’s energy future. But adding value to those raw materials by producing products for a broad range of markets is the key to economic growth and stability.

Being competitive in tomorrow’s refined product market will require a lighter product slate, improved plant efficiency and lower cost, and those are key objectives of expansion and upgrading projects underway and planned for Egypt’s refineries.

“We devote our attention to addressing environmental issues by developing ways to reduce pollution, increasing the production of middle distillates with higher added values, and improving product quality,” said Petroleum Minister Fahmy.

Egypt’s state-of-the art Middle East Oil Refinery (Midor), for example, can produce 5 million metric tons per year of petroleum products that meet European standards.

Other companies also produce high quality refined products. Alexandria National Refining and Petrochemical Co. (Anrpc) makes unleaded high octane gasoline and Alexandria Mineral Oil Co. (AMOC) converts heavy distillates to gas oil and produces naphtha.

Along with the inexorable growth in demand for refined products, global economic expansion and a rising world population will drive increased demand for petrochemical products. Egypt’s Master Plan to become a leading petrochemical manufacturer is designed to take full advantage of that opportunity.

“Egypt’s abundant natural gas resources and its ability to move downstream to produce higher added-value products will have a positive impact on the country’s economy,” said Ms. Sanaa A. Moneim El Banna, Chairperson, Egyptian Petrochemicals Holding Co. (Echem).

As petrochemical feedstock costs rise, proximity to gas supply becomes an important competitive advantage. Areas such as the northeastern coast of Egypt that have relatively low-cost feedstock represent an attractive investment opportunity, said Ms. Moneim El Banna.

Partners and investment welcome

Participation of a broad cross section of international and private companies in exploration and production activities that span 30% of Egypt is just one indication of the opportunities available in the country.

About 58 firms, including BP, BG Group, Eni, Shell, Apache, Petronas and others are currently operating under 102 concession agreements. In the last two years, 63 agreements and amendments were signed that involved financial obligations totaling $2.188 billion and commitments to drill a total of 258 wells.

Since its creation in 2003 to enhance exploration in Upper Egypt, Ganoub El Wadi Petroleum Holding Co. (Ganope) has held three bid rounds and announced a fourth. The company has awarded seven blocks in Upper Egypt and the Red Sea and the first exploratory well will be drilled before the end of this year.

“The company has made great progress in attracting companies to explore within its vast territory,” said Petroleum Minister Fahmy.

Before Ganope was established, only 6% of Egypt’s working area was covered by exploration and production (E&P) agreements; now 26% is under production sharing agreements (PSA).

More than 25 new concessions are planned for 2007.

“Our plan is to issue at least one international bid round per year,” said Eng. Hassan M. Akl, Ganope Chairman. With seven agreements in place; he expects to have 15 by the end of 2006 and 25 agreements by 2008.

Technical competence

Technology is increasingly critical to competitive success throughout the petroleum value chain. In response to that trend, Egypt is becoming an important exporter of expertise, building projects in Saudi Arabia, Syria, Sudan, Jordan and elsewhere.

“Having access to technology means working closely with technology owners, including international companies,” according to EGAS experts. “We often begin with a number of foreign experts, then build our capability to the point where Egyptians dominate operations.” Other Egyptian companies also follow this process, including Engineering for the Petroleum and Process Industries (Enppi), Egyptian Drilling Co., Petroleum Maritime Services (PMS) and Petroleum Projects and Technical Consultation Co. (Petrojet).

Petrojet began working overseas three years ago, and now gets 40% of its revenues from outside Egypt, said Eng. Hany Dahy, Chairman.

By the end of 2006, Enppi’s business abroad will account for 30% of revenue, said Eng. Fakhry Eid, Chairman.

“We are planning to reach 50% abroad in the future,” he said. “Our vision is to make Enppi one of the top 10 engineering/procurement/construction (EPC) contractors in the Middle East/North Africa region.”