CGES: Global crude supplies will continue to get heavier

According to a report from the Centre for Global Energy Studies (CGES), the global crude supply barrel got heavier during 2000-04. The July 5, 2006, report entitled “Global Oil Report: Market Watch-Trends in crude oil quality” said that increased amounts of heavier crudes would make their way to refiners in the coming years.

The crude supply barrel has changed substantially since 2000, according to a 2005 OPEC report.1 That report concluded that there is currently a “mismatch between the installed refinery capacity and crude type.” The CGES report examines in detail the changes that have occurred to the crude stream coming to market during the last 5 years.

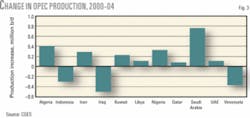

Non-OPEC supply barrel

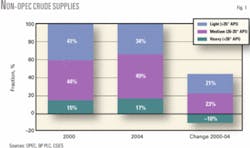

Medium and heavy crudes, which in 2000 accounted for 59% of non-OPEC oil supplies, made up 66% of the crude brought to the market by non-OPEC producers in 2004, according to the report (Fig. 1). The increase in heavy crude supplied to 17% from 15% of the total crude barrel is an increase of 23% in the actual volumes of heavy crude entering the market during 2000-04. In contrast, the volume of light crude produced by non-OPEC countries decreased 10%.

According to the report, the shift in crude gravity was due to:

- Growth in heavy, sour crude production that reflects increases in Canadian bitumen and output from Chad, Brazil, Ecuador, and Mexico.

- Growth of medium-API sour crude production that mainly reflects the increased output of Russian Urals (33° API with 1.3% sulfur).

- Other contributors to the growth in medium-API crude include Angola, Canada (syncrude), Equatorial Guinea, and Sudan, although all of this was actually low-sulfur crude.

- The net loss in light API, sweet crude is due to declines in OECD oil production mainly in the North Sea, Australia, Canada, and US, as well as in Colombia. The only two countries that showed a significant net increase in light crude production were Kazakhstan and Vietnam, but were predominantly sour crudes.

The report stated that the quality of non-OPEC crude has been falling since 2000. The average gravity of non-OPEC crude production slipped to less than 31.5° API in 2005 from around 33.2° API in 2000.

“New non-OPEC oil from countries like Russia, Kazakhstan, Equatorial Guinea, Sudan, Angola, and others has been inferior in quality to the oil lost from places like the North Sea, Australia, Canada, and the US,” according to the report. “The picture is similar for North America, where the average quality of the crude oil produced has fallen from 28.4° API to 27.7° API between 2000 and 2005.”

Although output of light West Texas Intermediate (WTI) has declined, incremental production has come from conventional sources in the Gulf of Mexico and from Canada’s extra-heavy oil deposits, which are syncrude that has an API of between 31° and 33°, according to CGES.

OPEC supply barrel

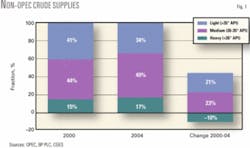

During the 4-year period, the proportion of heavy crude produced by OPEC member states dropped to 6% from 9%, while the share of light crude increased to 32% from 30% of supply in 2004 (Fig. 2).

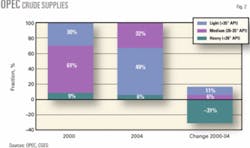

In volume terms, OPEC’s production of light crude increased by 0.9 million b/d and of medium gravity crude by 1 million b/d from 2000 to 2004, while production of heavy crude fell by close to 0.8 million b/d, according to the report.

The increase in OPEC’s light oil production reflects rising output from Algeria and Libya. The decline in heavy oil production is due to a drop in output in Venezuela (Fig. 3).

CGES’s analysis of OPEC’s production figures indicates that these production patterns held through 2005.

More recently, incremental OPEC output, which has averaged slightly more than 850,000 b/d/year during 2004-05, has been dominated by Saudi Arabia, which has boosted its oil production to around 9.5 million b/d. OPEC oil production in 2005 again consisted predominantly of light and medium grades, but the remaining spare production capacity, which is almost entirely concentrated in Saudi Arabia, is much heavier.

According to the report, until new capacity is brought on stream, which is taking place but relatively slowly, any incremental OPEC output will be predominantly heavy oil. The rise in the quality of OPEC supply is therefore insufficient to offset the declining quality of non-OPEC supplies.

Total OPEC and non-OPEC heavy-oil production for 2000-04 increased by 0.7 million b/d, output of medium grade crude increased nearly 5 million b/d, and the production of light crude declined 0.9 million b/d. This trend towards heavier crude oil production will continue in the short and medium term, according to CGES.

Future supply barrel

Through yearend 2006, OPEC forecasts that light crude would account for 49% of the increase in its own oil production capacity, with medium grades making up 43% and heavy crude the remaining 8%. “This seems a positive step in view of what the market wants,” according to the report. “But again it is important to take into account both the change occurring in the non-OPEC barrel over the same period and the relative amounts of oil brought to the market by the two groups of producers.”

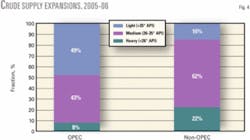

OPEC forecasts that light crude will account for just 16% of non-OPEC’s capacity expansion 2005-06. Most of the growth, 62%, will come from medium crudes, while heavy oil will make up the remaining 22%, further changing the overall make-up of the non-OPEC supply barrel (Fig. 4). OPEC estimates its own crude oil capacity expansion 2005-06 at 2.1 million b/d, while predicting that non-OPEC oil production would increase 1.7 million b/d during the same time, a forecast that now looks overly optimistic.

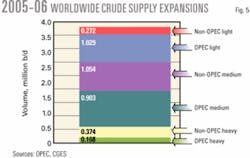

The report states that-looking at the breakdown of OPEC’s predicted oil-production capacity expansion by all producers over the short term-it is important to note that 65% of incremental production will come from medium and heavy crudes. In the medium term, medium crude will to continue to provide most of the non-OPEC production growth (Fig. 5), with the FSU (Russia, Kazakhstan, and Azerbaijan), West Africa (Angola, Equatorial Guinea, Chad, and Mauritania), Brazil, and Canadian syncrude all expected to contribute to non-OPEC output growth.

Offsetting some of these output increases is the decline in production of light, sweet crude from the North Sea and the Lower 48 states. North Sea oil production has been falling about 10%/year and the decline of this light, sweet crude will likely continue. OPEC’s own medium-term production capacity expansion, however, will be overwhelmingly of medium and heavy, and predominantly sour, crudes. The most significant capacity expansion will come from the Middle East producers, led by Saudi Arabia.

Although Saudi Arabia is targeting lighter grades, additional oil from other regional producers, such as Kuwait and Iran, is likely to be significantly heavier, according to CGES. Iraq, however, will not add much to OPEC’s oil production capacity during the next 2-3 years.

Any significant increase in the country’s oil production will require foreign investment. This is unlikely to materialize on a large scale until the country is secure, the newly elected government is firmly established, a new hydrocarbons law has been adopted to manage the relationship between Iraq and foreign investors, and individual project negotiations have been completed. These necessary steps will likely take several years.

Despite these changes, it is clear that the overall weight of the global supply barrel will continue to increase over the coming years, whereas the world’s demand barrel will continue to get lighter, according to the report. Refiners will, therefore, have to keep adjusting their upgrading capacity to be able to match the heavier supply barrel to the growing requirement for lighter products with less and less sulfur.

Reference

- “Evolving crude quality and implications for refineries,” Monthly Oil Market Report, OPEC, August 2005.