First flow test buttresses estimates of gulf’s Lower Tertiary potential

Rising confidence in discovering and producing oil and gas from deep Lower Tertiary formations in the deepwater Gulf of Mexico could make a large but costly impact on US reserves, Devon Energy Corp. said in early September.

Even with the play still in its infancy, industry is estimating that it might ultimately recover 9-15 billion bbl of oil equivalent. US proved crude oil reserves are 21.4 billion bbl. The play area covers more than 10 million acres, much of it near Mexican waters.

Devon, which entered a joint venture to explore the play with Chevron Corp. in September 2002, expects four discoveries in which it has participated to add 300-900 million bbl of oil equivalent to the company’s resource base. It has booked no reserves so far but expects production to start in 2009.

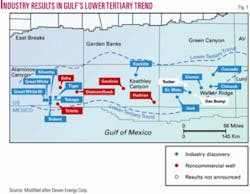

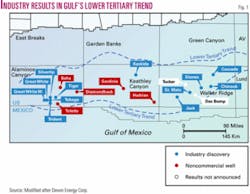

The industry overall has made 12 discoveries in 19 wells drilled in the trend for a 63% geologic success rate (Fig. 1, Table 1).

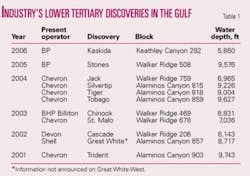

Devon, which holds interests in 273 blocks in the Lower Tertiary trend, plans to participate in or drill at least 19 other prospects in the next 3-5 years that have a combined 2-5 billion boe in unrisked exploration potential (Fig. 2).

null

Extended test

Chevron, Devon, and Statoil ASA just completed the only extended well test of a Lower Tertiary well to date. The Jack-2 well in Walker Ridge Block 758 sustained flow rates of more than 6,000 b/d of oil from 40% of the total measured net pay of more than 350 ft.

The test set several world records even though the test equipment capacity led to the decision to test only 40% of the net pay. The well is 270 miles southwest of New Orleans.

Chevron said the well test set several records for test equipment pressure, depth, and duration in deepwater (Fig. 3). Perforating guns were fired at world record depths and pressures. The test tree and other drillstem test tools set world records, helping the operating group conduct the deepest extended drillstem test in deepwater Gulf of Mexico history.

More than 99% of Gulf of Mexico production has come from Tertiary Pleistocene, Pliocene, and Miocene formations. As recently as the early 2000s, few observers believed that the Lower Tertiary sands would be present or productive at great depths, Devon noted.

String of discoveries

Chevron and partners made the initial Jack field discovery in September 2004.

The extended drillstem test took place in the second quarter of 2006 at Jack-2, an appraisal well drilled in 2005 that encountered thicker net pay than the discovery well.

The four discovery wells in which Devon has participated-Cascade, Jack, Kaskida, and St. Malo-went to total depths of 27,929 ft to 32,500 ft. They are in 5,800-8,200 ft of water.

Demonstrating the play’s relatively early stage, Cascade, Jack, and St. Malo are the only three of the 12 industry discoveries to have more than a single penetration, Devon said.

Kaskida, on Keathley Canyon Block 292, cut more than 800 ft of net hydrocarbon-bearing sands (OGJ Online, Aug. 31, 2006). It may be the best of industry’s 12 discoveries so far in the play, Devon said.

Devon initially held 20-25% working interests in the four discoveries, but it holds 43% average working interest in the 19 identified prospects.

Reservoirs and development

Devon declined to provide technical information on oil quality and reservoir parameters.

It said that it has seen no undue complexity in either but that the reservoirs are very different from one another. It also didn’t define the oil:gas ratio of the reservoirs but implied they are oil-dominant.

Salt is a prominent feature in the play. Two play types in the 19 prospects are four-way closures under salt and three-way closures against salt, Devon said. The subsalt type is dominant.

Two thirds of the 19 prospects are in Keathley Canyon, but not all have reached drillable status, the company said.

Devon said it acquired more than half of its 19 identified prospects at US Minerals Management Service lease sales.

Chevron and Devon are discussing development plans and potentially the first use in the gulf of floating production, storage, and offloading vessels with the MMS. Many of the discoveries are remote from oil pipelines.

Early-stage figures on field development costs are $80-120 million/well plus as much as $1.3-1.5 billion for subsea facilities, Devon said.

Near-term plans are to appraise Kaskida in late 2006, drill more appraisal wells on Jack and St. Malo in 2007, and obtain formal approval of the Cascade deepwater operating plan.

Cascade, leading candidate to become the first Lower Tertiary trend field to be placed on production, went to TD 27,929 ft in 8,143 ft of water on Walker Ridge Block 206.

Chevron noted that it is the largest lease holder in the deepwater Gulf of Mexico and in the emerging Lower Tertiary trend.