OGJ Newsletter

Alaska approves BP bypass plan

The Regulatory Commission of Alaska granted temporary permits for BP PLC to connect the east side of Prudhoe Bay field to the nearby Endicott pipeline, enabling the restart of 105,000 b/d of oil production.

About half of the normal 400,000 b/d of oil production from Prudhoe Bay has been shut down since August because of corrosion problems in an oil transit line.

The permits grant BP permission to install connections between the Endicott pipeline and Prudhoe Bay field Flow Stations 1 and 2.

BP executives said they expect field output to be restored by the end of October (OGJ Online, Sept. 8, 2006).

In addition, BP must get approval from the US Department of Transportation before it restarts any portion of the transit line in the eastern part of Prudhoe Bay field.

EPA proposes higher renewable fuel market share

The US Environmental Protection Agency Sept. 7 proposed a renewable fuel standard (RFS) that would raise the total share of renewable fuels in the US to 3.71% in 2007 from 2.78% in 2006 by doubling the use of ethanol, biodiesel, and other renewables.

The proposal, which would implement a provision of the 2005 Energy Policy Act, could potentially reduce US petroleum demand by 3.9 million gal/year and greenhouse gas emissions by 14 billion tons/year by 2012, EPA said.

The proposed RFS aims to increase the amount of renewable motor fuel used in the US to at least 7.5 billion gal in 2012 from about 4.5 billion gal in 2006. It contains compliance tools and a credit and trading system that allows renewables to be used where they’re most economical, while providing industry flexibility, EPA said.

The National Petrochemical & Refiners Association said it appreciates EPA’s effort to provide greater certainty about RFS operations by proposing a standard. But it questioned the wisdom of mandating proposed levels for ethanol, biodiesel, and other renewables as part of the nation’s total fuel mix.

“The mandate requires that consumers pay more for renewable materials that would have been available at lower, market-based prices if no mandate existed,” said NPRA Pres. Bob Slaughter. “The fact that ethanol was selling for a considerably higher price than gasoline earlier this year (despite its mileage per gallon penalty) indicates that our concerns about the unintended consequences of mandates are valid.”

Slaughter said NPRA also questions EPA’s GHG emissions projections under the proposal. “Experts who have studied the impact of renewables’ use on greenhouse gas emissions strongly disagree on whether any reduction occurs if all factors, including crop production, are considered,” he said. “The consensus on this point would appear to be that there is only a marginal reduction, if any.”

HNR reports higher taxes from Venezuela

Harvest Vinccler, a unit of Harvest Natural Resources Inc. (HNR), received a final $56 million assessment for 2001-04 in additional taxes and related interest from Seniat, Venezuela’s tax authority.

HNR’s 80% stake in Harvest Vinccler amounts to $45 million, the Houston company said. Previously Seniat issued a preliminary $94 million tax assessment against Harvest Vinccler for 2001-04 (OGJ, Sept. 4, 2006, p. 54).

Last year, the HNR unit paid $5.3 million for two items in the preliminary tax assessment. The company took a 2006 second-quarter charge of $43 million for resolution of 2001-04 tax issues and an additional $18 million for increased taxes and interest for 2005-06.

The charge was based on a negotiated agreement between Harvest Vinccler and Seniat. The recent $56 million final assessment exceeds that agreement. HNR said the additional taxes for 2001-06 stemmed from retroactive tax rate increases.

HNR Pres. and Chief Executive Officer James A. Edmiston said, “We are extremely disappointed that the Seniat did not honor the agreement reached in July after several months of negotiation.”

The company continues working with Seniat. Resolution of the tax issues is a step in the transition of Harvest Vinccler’s operations as a mixed company. Mixed companies were formed as part of Venezuela’s changing arrangements with international oil companies (OGJ, Apr. 25, 2005, p. 48).

Tax system needs update, La. commissioner says

Louisiana’s outdated system for taxing oil and gas means the state will collect no tax revenues on the new oil field discovered off the state’s coast, said Louisiana Public Service Commissioner Foster Campbell.

He referred to a Gulf of Mexico Lower Tertiary play announced this month by Chevron Corp. (OGJ, Sept. 4, 2006, Newsletter).

Devon, which entered a joint venture to explore the play with Chevron in September 2002, expects four discoveries in which it has participated to add 300-900 million bbl of oil equivalent to the company’s resource base. It has booked no reserves so far but expects production to start in 2009.

“But when that oil comes ashore, it won’t raise a dollar for the state treasury,” Campbell said. “Our state continues to rely on the severance tax enacted in 1921, meaning we tax only the oil and gas produced in our state and within 3 miles of our coast. This new Chevron find is 270 miles southwest of New Orleans.

“This development is absolute proof that Louisiana must move away from a system that taxes our declining in-state oil and gas production and toward a lower and broader tax on all oil and gas processed in the state,” he said.

Campbell suggested a 4% processing tax that he estimates would yield $6 billion/year. Analysts for the state have studied a broad-based tax that would apply to hydrocarbons produced within the state as well as refined products via tankers coming into Louisiana ports and gas delivered via pipelines across the state.

The Legislature would have to approve such a tax proposal, which then would be presented as a state constitutional amendment. Similar measures have failed several times within the last 10 years, a spokesman for Campbell told OGJ.

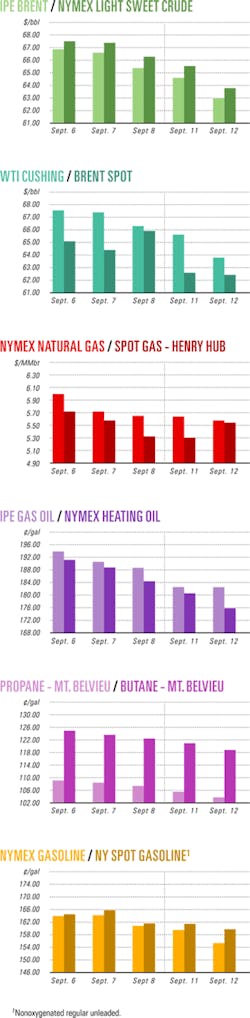

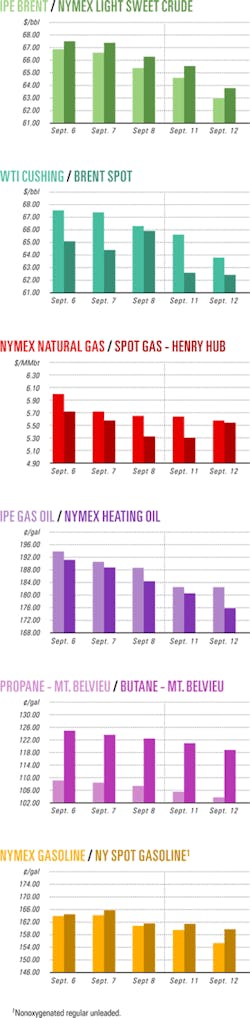

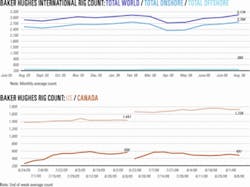

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesPertamina told to seek out new Natuna partner

Indonesia Vice-President Jusuf Kalla has advised state-owned PT Pertamina to seek a new partner if ExxonMobil Oil Indonesie fails to carry out its contractual obligations to develop the Natuna D-Alpha natural gas block.

The offshore project east of Natuna in the South China Sea-a joint venture of ExxonMobil Corp. 74% and Pertamina 26%-reportedly has been delayed for several years due to lack of funds.

Kalla said Pertamina will need a new partner with more advanced technology to develop the reserves, but he also acknowledged that the search for a new partner would be difficult, as few oil companies could offer the technology needed.

It is the second warning in less than a week from Indonesian officials.

Energy and Mineral Resources Minister Purnomo Yusgiantoro said the Indonesian government would cancel ExxonMobil’s contract at the Natuna D-Alpha block if the firm does not meet a Jan. 8, 2007, deadline to begin production from the field.

For their part, ExxonMobil said it has until 2009 to begin production under terms of the company’s production-sharing contract with Pertamina. Last December, ExxonMobil Oil Indonesie Pres. and General Manager Peter J. Coleman said the company was proceeding with a 4-year plan to supply foreign buyers with gas from the block by 2014.

S. Australia exploration program to target oil

Adelaide Energy Pty. Ltd. plans to drill as many as four onshore wells over the next 5 years targeting oil in southeast South Australia.

The $13 million exploration program follows the company’s recent award of Petroleum Exploration License (PEL) 255, which includes Block OT2006-A in the Otway basin.

The block’s two-stage work program involves $7.3 million of guaranteed requirements, including 3D seismic acquisition, an aeromagnetic survey, the drilling of two wells, along with geoscientific studies in the first 2 years. The nonguaranteed portion of the program includes two additional exploration wells and geoscientific studies.

The first appraisal well is to spud by March 2007.

Adelaide Energy Director Carl Dorsch said PEL 255 covers the Jacaranda Ridge oil discovery that initially flowed at 420 b/d of oil on a 1999 drillstem test but at that time was deemed uneconomic.

“Reinterpretation of petroleum drilling and seismic data by Primary Industries & Resources SA has revealed the prospect has significant potential and would benefit from advanced drilling and production technologies currently available to define new leads,” Dorsch said.

He said, “Gas and oil discoveries in South Australia during the past 20 years, coupled by recent exploration successes in the Victorian sector of the onshore Otway basin, support an optimistic view of the resource potential of this area.”

Dorsch added, “The majority of discoveries in Otway basin have been gas. In fact, current production is restricted to Katnook gas field, which is relatively mature and produces gas and condensate, so new oil discoveries in the area will have the potential to attract renewed interest in oil exploration opportunities.”

In 2005 Adelaide Energy secured one of the largest prospective Cooper basin gas acreage ever awarded and the last major petroleum block to be released under the South Australia government’s 1998 initiative, which was created to attract more aggressive, independent oil and gas explorers into the Cooper basin.

The southwestern perimeter of Adelaide’s Cooper basin tenements-the 1,600 sq km CO2005-A Block in the Nappamerri Trough-is just 25 km northeast of the Moomba gas processing plant. The holding covers one of the two primary source areas for gas for the wider Cooper basin blocks in South Australia. The gas in the area is held in tight sands, thus only seven wells have been drilled, most with old technology and seismic.

The company could drill its first Cooper basin well in late 2007, targeting potential oil accumulations in the overlying Eromanga sediments. Subsequent wells will test the basin’s deeper gas formations to a TD of 3,500 m.

Whiting joins Central Utah hingeline play

Whiting Petroleum Corp., Denver, acquired from an unnamed private independent oil company a 15% working interest in 170,000 leased acres in the Central Utah hingeline play for an undisclosed sum.

Drilling of the first of three planned wells, on seismically defined prospects on trend with play’s only oil field, Covenant field in Sevier County, is to start in the fourth quarter, Whiting said.

Covenant field, discovered in 2004 and now producing 7,000 b/d from 10 wells, is pegged to have ultimate recovery of 70 million bbl of oil, said Whiting, quoting published reports (see map, OGJ, Jan. 17, 2005, p. 43).

A third-party oil company owns 65% working interest in the acreage and will be operator for the majority of the acreage. The seller of the acreage retained 20% working interest.

The operator will pay 100% of Whiting’s drilling and completion cost on the first three wells.

Petrogulf to drill soon on Wyandotte prospect

Private Houston independent Petrogulf Corp. expects to begin drilling operations soon on a well in the Wyandotte prospect in St. Mary Parish, La., after purchasing a 50% working interest from Falcon Natural Gas Corp., Houston. Petrogulf was named operator in that sales agreement.

Independent contractors have completed 3D seismic studies on the Wyandotte property, and in June 2005 an independent petroleum engineering firm completed a reserves report that indicated estimated proved undeveloped reserves of 26.3 bcf of gas in the reservoirs comprising the Discorbis Bol Sands, Falcon said in its quarterly report.

The well scheduled to be drilled will replace the Inglewood 2 well drilled in 1980, because an engineering study concluded that reentry of the old well would be too risky.

The $5.5 million replacement well will be drilled a few yards away from the existing well to a depth of at least 17,000 ft to develop the Discorbis Bol Sands. If commercial, salable quantities of natural gas are produced, the companies will drill a second production well to accelerate recovery.

Drilling & Production - Quick TakesOregon coalbed methane drilling planned

A Seattle independent has received 15 drilling permits and built the first six locations for coalbed methane drilling to start this month in Coos County, Ore.

Torrent Energy Corp. said its Methane Energy Corp. subsidiary will drill and complete wells in five-well batches. The vertical wells will go to Eocene Upper and Lower Coaledo coals at 1,500-3,000 ft. The drillsites are in the Coos Bay basin near the Coos County gas pipeline system.

Production testing continued at the Beaver Hill No. 2 and Radio Hill No. 1 wells, Torrent said, but the company has not reported rates (OGJ Online, Oct. 26, 2005).

MPF lets contract for multipurpose floating vessel

MPF Corp. Ltd. has awarded a contract valued at over €50 million to Wärtsilä Corp., Helsinki, to provide a total power system for the MPF 1000 multipurpose floating vessel.

Dragados Offshore SA, Spain, is constructing the comprehensive MPF 1000 deepwater floater, which will combine drilling, production, and offloading capabilities with storage of as much as 1 million bbl of oil. One of the largest and most versatile offshore drilling units ever built, the 290-m-long MPF 1000 is scheduled for delivery in fourth quarter 2008.

Wärtsilä’s contract involves detail design, products, systems, and commissioning of the power plant, propulsion, electrical and automation systems. The major components, to be delivered in first quarter 2008, include eight 16-cylinder Wärtsilä 32 diesel engines with a combined power output of 58,880 kw, generators, medium voltage switchgear, low voltage distribution boards, frequency converters, safety and automation systems, a DP3 dynamic positioning system, thruster control, and information management systems.

Processing - Quick TakesSinclair Tulsa refinery to get delayed coker

Sinclair Oil Corp., Salt Lake City, has let a reimbursable engineering, procurement, and construction contract to Foster Wheeler USA Corp. for a 30,000 b/sd delayed coker, gas plant, and coke-handling facilities at its 60,000 b/d refinery in Tulsa.

The coker will use Foster Wheeler’s Selective Yield Delayed Coking process.

Sinclair expects the unit to be in operation in 2009.

Shell lets contract for Singapore ethylene cracker

Shell Eastern Petroleum Pte. Ltd. has awarded a contract to ABB Lummus Global and joint venture partner Toyo Engineering Corp. for the implementation phase of a world-scale 800,000 tonne/year ethylene cracker on Bukom Island, Singapore (OGJ Online, July 27, 2006).

The contract’s value was not disclosed.

The contract’s scope includes engineering, procurement, and construction management services for the cracker, which will use ABB Lummus’s proprietary liquid feedstock steam cracking technology.

Engineering and procurement work on the unit has already begun, with construction slated to begin in 2007. Start-up of the unit is scheduled for 2009-10.

Chennai plans $1 billion in refinery upgrades

Chennai Petroleum Corp. Ltd. (CPCL), formerly known as Madras Refineries Ltd. and a subsidiary of India’s state-owned refiner Indian Oil Corp. (IOC), has committed to invest more than $1 billion on various upgrading projects at its 130,660 (total) b/d refinery complex at Manali. The refineries produce fuel products, lubricants, and additives.

Chennai also has a preliminary feasibility study under way for a 15 million-tonne/year refinery-petrochemical complex near Ennore, 100 km from Chennai (Madras).

Planned Manali complex upgrade investments include a $647 million residue upgrade, and $61 million to expand Refinery I and Refinery III refining capacity to 11.2 million tonnes/year from 9.5 million tonnes/year.

Refinery III capacity will be increased to 4 million tonnes/year from 3 million tonnes/year at a cost of $29 million by September 2008. CPCL will expand Refinery I capacity to 3.5 million tonne/year from 2.8 million tonne/year at a cost of $32 million.

IOC Chairman and Managing director Sarthak Behuria, who also is CPCL chairman, said the high-conversion residue upgrade will increase the distillate yield and reduce fuel oil production. The project is scheduled for completion in 2010.

CPCL also will expend $359 million for the addition of diesel and naphtha hydrotreating units and $18 million for a wind power program.

Another investment calls for a 1.5 million-tonne/year diesel hydrotreating unit and a 150,000-tonne naphtha hydrotreating unit and isomerization unit to meet European fuel standards. These projects are slated for completion by Dec. 31, 2009.

CPCL also plans to enhance the polypropylene plant at Manali to produce other olefins.

Transportation - Quick TakesSakhalin-1 oil export system commissioned

An international consortium led by Exxon Neftegas Ltd. has announced the commissioning of the oil export system for the multiphase Sakhalin-1 project off Eastern Russia.

It said construction has been completed on a 24-in., 225-km pipeline that will transport crude produced from wells in the Sea of Okhotsk and processed onshore at Chayvo, west across Sakhalin Island and the Tatar Strait to the newly constructed DeKastri terminal in the Khabarovsk Krai in the Russian Far East.

It said Nippon Steel Corp. and its Russian affiliate, NS Nephtegazstroy Ltd., as well as two Russian companies-Global Stroy Engineering and SMU-4-were involved in the construction of the pipeline, with more than 50% of the pipe supplied by the Russian Vyksa Metallurgical Plant.

First oil entered the line Aug. 29, and the consortium expects loading of the first tanker to begin this month at the DeKastri terminal, which provides storage in two 650,000 bbl tanks and a single-point mooring tanker loading facility.

The consortium said oil production will ramp up to an estimated peak rate of 250,000 b/d by yearend on completion of its onshore processing facility.

The Sakhalin-1 project began operations last October, and it has been producing as much as 50,000 b/d of oil, along with natural gas production of some 60 MMcfd.

The consortium has been selling its oil the Russian Far East and marketing its gas to two domestic customers in the Khabarovsk Krai: OAO Khabarovskenergo and OAO Khabarovskkraigas.

The ExxonMobil Corp. unit serves as project operator with 30%. Partners are Japan’s Sakhalin Oil & Gas Development Co. Ltd. 30%, Russia’s RN-Astra 8.5% and Sakhalinmorneftegas-Shelf 11.5%, and India’s ONGC Videsh Ltd. 20%.

JV to study viability of Croatia LNG terminal

A joint venture led by OMV AG has agreed with Germany’s E.ON Ruhrgas AS to study the feasibility of building an 8-10 billion cu m/year LNG regasification terminal in Croatia.

The studies, which will be based on investigations started in 1995, could be followed by an intensive technical and economic planning stage, in which other companies from Croatia will also participate.

The feasibility and basic engineering studies are expected to be complete by yearend 2008, with the commissioning of the terminal slated for yearend 2011.

The terminal will deliver gas to Croatia and other countries in southern and Eastern Europe.

Gassco takes over Langeled pipeline operations

Gassco AS on Sept. 1 assumed operation of the Langeled gas pipeline between Norway and the UK and is now operator of the new receiving terminal for Norwegian gas in Easington, UK.

The operating change was necessitated by the incorporation of the 1,200-km subsea pipeline and the Easington terminal in the Gassled joint venture. This JV, established Jan. 1, 2003, owns most of the infrastructure for gas transportation from the Norwegian continental shelf.

The JV partners are Petoro SA, Statoil ASA, Norsk Hydro ASA, Total SA, ExxonMobil Corp., Royal Dutch/Shell, ConocoPhillips, Eni SPA, Dansk Olie & Naturgas AS, and Norsea Gas.

Gassco has appointed Statoil technical service provider (TSP) for Langeled. Statoil said it will perform the TSP functions from its pipeline operations unit, based at the Karsto plant in southwestern Norway.

Britain’s Centrica PLC will be responsible for day-to-day operations at the terminal.

Hydro and Statoil, along with Gassco as operator, will complete the work on the Langeled system. Up to 20% of UK gas requirements will be met in coming years by Norwegian deliveries via this pipeline.

Deliveries of Norwegian gas through Langeled to the UK will begin in late September or early October.

The northern leg of Langeled is due to become operational in 2007 to coincide with the start of gas deliveries from Ormen Lange field in the Norwegian Sea. Bringing Ormen Lange on stream will make Norway the second largest gas exporter after Russia.

Contract let for pipelay work off India

British Gas Exploration & Production India Ltd. (BGEPIL) has let an $87 million contract to Global Industries Ltd. subsidiary Global Offshore International Ltd. for pipelay work in Mid Tapti gas field off India.

Global will execute the offshore installation in water 15-40 m deep, 160 km northwest of Mumbai. Lay barge mobilization is scheduled for December.

Corrections

Occidental Petroleum Corp. figures for oil and natural gas reserves and production were incorrectly stated in the OGJ200 report (OGJ, Sept. 4, 2006, p. 20). Following are the corrected figures and their respective rankings (in parentheses): US liquids reserves (million bbl), 1,636.0 (5); worldwide liquids reserves, 2,127.0 (4); US liquids production, 92.0 (4); worldwide liquids production, 165.0 (4); US gas reserves (bcf), 2,338.0 (16); worldwide gas reserves, 3,478.0 (13); US gas production, 202.0 (16); and worldwide gas production, 252.0 (15).

Equitable Supply should have appeared in the No. 15 position in the Top 20 in gas reserves table of the OGJ200 (Sept. 4, 2006, p. 20), with 2,359.2 bcf of US gas reserves.