DRILLING MARKET FOCUS: South America drilling pace picking up speed

Companies are rewriting contracts and developing new working relationships to accelerate drilling in South America.

Recent shifts to regain sovereignty in Venezuela, Ecuador, and Bolivia have affected drilling plans, patterns, and fleets. Land drilling is down 21% in Ecuador but, after a few years of depression, is finally on the rise in Venezuela, where land drilling is up 27% and offshore drilling up 42% from a year ago. Brazil is also poised to invest heavily in drilling projects over the next 5 years.

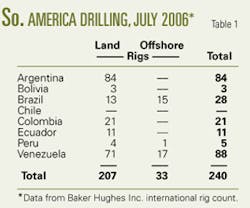

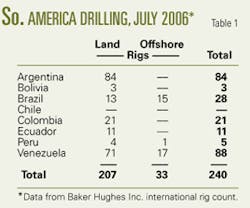

Rig counts

Land drilling has driven the 52% increase in the overall South American rig count from mid-2003 to mid-2006. There were 240 rigs working on and offshore South America in July 2006, up 4 from the previous month and up 28 rigs from a year earlier. This represents a 13% increase in overall drilling in the past year.

According to Baker Hughes Inc., the South American offshore rig count has been fairly steady since mid-2003, fluctuating between 30-35 rigs. In July 2006, there were 33 rigs working offshore, down 1 from the month before, but the same as a year earlier and up just 2 rigs from July 2003 (6% increase in 3 years).

By comparison, BHI land rig counts for South America show a steady increase to 207 rigs working in July 2006 from 127 land rigs in July 2003 (63% increase in 3 years). There was a 5-rig increase from June 2006 and a 28-rig increase from July 2005 (16% increase in 1 year). The land rigs are predominantly working in Argentina, Venezuela, and Colombia (Table 1).

Offshore activity is dominated by Venezuela and Brazil, with a few dozen rigs working in each country.

North American contractor Pride International has rigs offshore Brazil and Venezuela, and land rigs in Colombia, Venezuela, Brazil, Bolivia, and Argentina. The company is moving land rigs out of Colombia and into Venezuela and Argentina.

Houston-based Nabors Industries Ltd. has land rigs in five South American countries: Colombia, Venezuela, Ecuador, Argentina, and Bolivia.

Calgary’s Saxon Energy Services Inc. has 27 active land rigs in Venezuela, Colombia, Ecuador, and Peru, as well as 29 rigs in North America and 7 rigs under construction.

Some of the biggest money will be spent in Brazil, predominantly for domestic development. Petrobras also has plans for joint ventures in other South American countries.

Brazil

There were 26 rigs working offshore Brazil in July 2006 according to Rigzone, including 8 drillships, 16 semisubmersibles, and 2 jack ups. BHI reported only 15 rigs off Brazil (Table 1). Only 7 of the 26 are operated by Brazilian companies: State-owned Petroleo Brasileiro SA (4); Schahin Cury (2); and Queiroz Galvão Perfurações SA (1). The other 19 are owned by North American drilling contractors: Diamond Offshore Drilling Inc. (4); Noble Corp. (4); Pride International Inc. (5); Transocean Inc. (5); and one by Norwegian company Petroserv SA.

Petrobras expects to double exploration spending over the next 5 years and recently signed $4.5 billion in contracts with four Brazilian companies for six drilling rigs (OGJ Online, Aug. 8, 2006).

Petrobras will lease rigs from Queiroz Galvão Perfurações, Construtora Norberto Odebrecht SA, Schahin Engenharia Ltda., and Petroserv:

- Four rigs capable of drilling in 2,000 m water depth, for 7-year terms beginning in 2010 and renewable for another 7 years.

- Two rigs capable of drilling in 2,400 m water depth, for 5-year terms beginning in 2009.

Although Petrobras wants to increase its contracts with domestic companies, it is not going to require national content for newbuild rigs and drilling equipment. Brazilian yards are booked and local manufacturing cannot meet demand.

Guilherme Estrella, Petrobras’s exploration and production director, said that signing long-term rig contracts allows Petrobras to pay rates about 20% lower than the international market (OGJ Online, Aug. 8, 2006).

Other recent contracts include:

- Weatherford International’s Brazilian operations subsidiary was awarded a 5-year contract by Petrobras for drill pipe riser worth about $87 million.

- Petrobras awarded a deepwater drilling contract to Bermuda-based Scorpion Offshore Ltd. and Queiroz Galvao Perfuracioes.

- Petrolia Drilling ASA announced that Petrobras let a $700 million, 5-year contract for PetroRig 1, beginning second-quarter 2009. The sixth-generation, Friede & Goldman F&G ExD design semisub is under construction at the Jurong Shipyard in Singapore for Norway’s PetroMENA AS.

On Aug. 7, Keppel Offshore & Marine Ltd. announced a $270 million contract with Queiroz Galvão Perfurações (QGP) to build a fifth-generation semisubmersible using the new DSS-38 design (Fig. 1). This is KFELS’s first newbuild for Brazilian waters. This will be the fourth semisub owned by QGP, and the Brazilian contractor will provide the drilling and subsea equipment. The rig will be used for a 7-year contract with Petrobras.

The DSS-38 is based on Keppel’s and operators’ experiences with the DSS-20, 21 (Maersk Contractors, part of A/P Moeller-Maersk), and DSS-51 (Global SantaFe Corp.). The new rig will be able to drill to 30,000 ft below mud line in water slightly deeper than 9,000 ft. It will have a maximum variable deckload of 5,550 tonnes, vertical and horizontal riser storage, and a DPS-2 positioning system with eight, 3,000-kW azimuthing thrusters. It will be delivered third-quarter 2009.

Pride International has one moored semisub and five dynamically positioned semisubs off Brazil, according to the company’s Aug. 1 fleet status report.

BG E&P Brasil Ltd. used the Pride South Atlantic semisubmersible to drill two wells in its BM-S-13 campaign: Ipanema and Flamengo North. Ipanema was drilled at elevated temperatures and pressures and is the deepest well ever drilled by the rig. Peter Carson, BG’s well engineering manager, reported that the well was drilled to TD of 6,300 m without and lost-time incidents, TRCFs, or spills.1

US independent operator Newfield Exploration Co. announced in August that it was pulling out of Brazil by year-end. Brazil refused to grant the company permits to acquire seismic and drill in Espirito Santo block BM-ES-20, citing proximity to a marine wildlife preserve in Bahia state. In 2002, Newfield paid $500 million in entrance fees to explore the concession.

Brazil’s national hydrocarbons regulator, ANP, lists 56 operating companies in Brazil.

Colombia

Baker Hughes reported 21 land rigs working in Colombia in July 2006, up from 15 a year earlier and 10 in July 2003.

Pride International had 12 land drilling rigs (600-1,700 hp) and 8 land workover rigs (300-550 hp) in Colombia in mid-August. In early July, the company announced that it was in the process of exiting the Colombian market and would move rigs to neighboring Venezuela and Argentina “where the markets are more favorable.”

Nabors Drilling International Ltd. has seven drilling and two workover rigs in Colombia.

In early July, Petrobank Energy and Resources Ltd. announced that it had contracted two Nabors rigs and recommenced drilling activity on the Orito block.

Ecuador

Baker Hughes reported 11 land rigs drilling in Ecuador in July, down from 14 a year earlier (21% drop).

Nabors has two drilling rigs (1,200 and 2,000 hp) and four workover rigs in the country.

Ecuador’s rolling nationalization of oil and natural gas assets, following prosecution of Texaco and protests against Occidental Petroleum Corp.’s work in the Ecuadorian Amazon, has apparently stymied exploratory and development drilling.

Peru

Baker Hughes reports four land rigs and one offshore rig drilling in Peru in July.

Petrex SA, a subsidiary of Saipem SPA, has four platform rigs ready-stacked and land rigs drilling in the Amazon and coastal regions of Peru.

Houston-based BPZ Energy Inc. paid $5.5 million to mobilize and upgrade a platform drilling rig owned by Petrex in exchange for a fixed-rate, 2-year contract with a 1-year optional extension to drill in the Pacific, off northwest Peru (OGJ Online, Dec. 29, 2005). BPZ plans to drill 11 wells from its CX-11 platform in the Corvina field in Block Z-1, beginning with a three-well program in second-half 2006.

On Aug. 16, BPZ announced it had mobilized the BPZ-01 tender-assist barge to transport the rig and drilling equipment to the platform and assist with drilling. BPZ President and CEO Manolo Zuniga said the company would spud the first of the three wells later in the month.

BPZ is also negotiating with state-owned Perupetrol for an exploration and development license to work in the 248,000-acre onshore Block XXIII, near the Corvina offshore field (OGJ Online, July 19, 2006).

Radial Energy Inc. sent an Ingersoll Rand drilling rig and drilling equipment to Peru and plans to spud a well in September, the company announced in July.

The Block 100 prospect is in the Huaya Anticline area in the Ucayali Basin of eastern Peru. Radial Energy acquired its 20% working interest in Block 100 from Ziegler-Peru Inc., which retained a 10% interest. Ziegler-Peru will act as contract driller and operator. The concession holder, Cia. Consultora de Petroleo (CCP), owns the majority interest.

Radial is focusing on Peru and Colombia, in addition to its properties in North America.

Bolivia

Baker Hughes reported that there were three land rigs drilling in Bolivia, up from two a year earlier.

Nabors has a single drilling rig in the country, a 1,700-hp SCR unit.

Pride International has four land drilling rigs (600-2,000 hp) and two land workover rigs (350-500 hp) in Bolivia.

DLS Drilling Logistics and Services Corp. has 51 rigs in Bolivia and Argentina, many working for Pan American Energy (BP PLC and Bridas Group).

In July, the Bolivian government began auditing foreign-controlled gas fields, related to the nationalization of its natural gas reserves. The audits of more than 50 fields should determine how much foreign companies have invested in Bolivia. In response, Petrobras cancelled plans for new investments in Bolivia, saying it would invest $22 billion from 2007-11 to develop natural gas in Brazil, to reduce its dependence on Bolivia.

In mid-August, Bolivia temporarily suspended its plan to nationalize oil and natural gas assets, saying that the state oil company lacks the necessary funds to carry it out.

Argentina

Baker Hughes reported that there were 84 land rigs drilling in Argentina in July, up from 78 rigs drilling a year earlier, and up from 61 rigs 3 years earlier.

Pride International maintains a large fleet of land drilling and workover rigs in Argentina. In mid-August, the company had 27 drilling rigs (420-2,000 hp) and 50 workover rigs (200-800 hp) in the Mendoza, Salta, and Neuquén areas, and another 21 drilling rigs (500-2,000 hp) and 54 workover rigs (200-650 hp) in the Comodoro Rivadavia and Austral areas.

Nabors International has 5 drilling rigs and 11 workover rigs in Argentina.

In early July, LatAmEnergy eDaily reported that Calgary’s Antrim Energy Inc. and its partners were moving ahead with their Tierra del Fuego plan, and were negotiating to extend the drilling contract for a Petroservicios rig to December 2006. The drilling equipment had been scheduled to leave the area in August.

Chile

RigZone reported only a single rig working off the coast of Chile.

Chilean national oil company Empresa Nacional del Petróleo (ENAP) is using platform Rig M 10.

ENAP announced on Aug. 8 that it would invest an additional $36 million in Ecuadorian fields through 2026. Chilean President Michelle Bachelet and ENAP officials expressed an interest in Ecuador’s Block 15, seized from Occidental Petroleum Corp. in May, Dow Jones reported.

Venezuela

In August, state-owned Petroleos de Venezuela SA said it had new, 5-year contracts for 27 rigs in a $2 billion program which will create 10,800 new jobs. PDVSA sourced the rigs from 13 companies, predominantly Venezuelan. The country wants to double its production by 2012.

Baker Hughes reported 71 land rigs drilling in Venezuela in July, up from 56 rigs a year earlier and up from 32 rigs in July 2003.

Nabors has two, 1,500-hp rigs in the country. Pride has seven land drilling rigs (900-2,000 hp), and 26 land workover rigs (200-750 hp).

According to Rigzone, there were 51 offshore rigs in the country, but only 27 rigs (23 drill barges; 3 jack ups; 1 semisub) were drilling off Venezuela in August.

Pride International has two cantilevered drilling barges working off Venezuela: Pride I and Pride II.

The ENSCO 69 independent-leg slot jack up was drilling for ConocoPhillips.

PDVSA was drilling with two of its own independent-leg cantilever jack ups-the GP-19 and GP-20.

Transocean’s Sovereign Explorer third-generation semisub was drilling for Statoil.

Three drilling barges owned by PDVSA were being used for workovers, two for Delta (L-402, L-408) and one for PDVSA (L-406).

Vinccler Oil & Gas CA, a division of PetroFalcon Corp., plans to drill at least one 4,500-ft exploration well in Venezuela’s West Falcon field in 2006 (OGJ Online, Mar. 22, 2006).

Petrobras began drilling for gas at La Blanca in Venezuela’s Cojedes state with PDVSA, using a rig from Saxon Energy Services Inc. (OGJ, Mar. 20, 2006, p. 8).

Petrobras and PDVSA will cooperate in three exploration and production projects in Venezuela:

- Mariscal Sucre gas project.

- Orinoco Belt project

- Drilling in five old oil fields-Adas, La Paz, Lido, Limon, and Nieblas.

We can expect to see additional drilling under the new Orinoco exploration and production licenses that the Venezuelan oil ministry will award in early 2007.

Reference

- Pride Highlights, www.prde.com/news/highlights.htm.