NIGC plans steady growth for Iran’s gas infrastructure

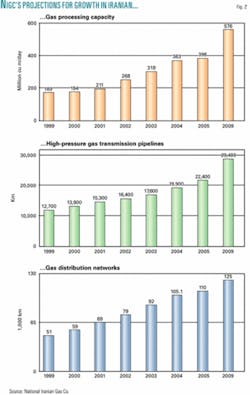

National Iranian Gas Co. plans steady expansion of transmission and processing infrastructure in a program that envisions increases in imports and exports of natural gas.

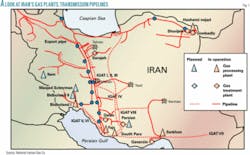

The expansion will take gas service to parts of the Islamic republic not yet reached by distribution systems and boost exports by pipeline and as LNG (Figs. 1, 2).

Much of the gas will come from giant offshore South Pars gas field, which is being developed in stages. Supplementing that supply will be imports already under way from Turkmenistan and starting from Azerbaijan.

Internal consumption represents a rapidly growing call on Iranian gas supply. Domestic gas use last year reached an estimated 105.1 billion cu m (bcm), compared with 65 bcm in 2000. NIGC expects it to rise to 156.2 bcm in 2009. Of the 97.7 bcm of gas used in Iran during 2004, 38.8% was in residential-commercial markets, 34.4% in power plants, and 26.8% in industries.

Market expansion

The number of Iranian cities using gas rose to 550 last year from 379 in 2000 and will reach 690 in 2009.

NIGC believes pipeline exports can reach 70 bcm/year in 2009 and 110 bcm/year in 2020. Export targets are Turkey, Europe, Azerbaijan’s Nakhichevan enclave along the Iranian-Armenian border, Armenia, Pakistan, India, the UAE, Kuwait, and Oman. NIGC is targeting LNG exports from three planned liquefaction projects to China, Thailand, and India of 35 million cu m/day in 2009 and 180 million cu m/day in 2020.

Iran’s gas imports from Turkmenistan soon will peak at 8 bcm/year.

To accommodate market growth, NIGC expects Iran by 2009 to have 29,400 km of gas transmission pipeline in place and a distribution network of 125,000 km. Domestic gas consumption that year will represent 69% of the Iranian energy market. The number of Iranians with gas service then will be 54 million, 80% of the population.

NIGC plans to invest about $18 billion through 2009 in high-pressure gas pipelines, compressor stations, gas processing plants, underground storage, distribution networks, and maintenance.

Pipeline projects

Many of the pipeline projects planned by NIGC attach to the Iranian Gas Transmission (IGAT) system.

The IGAT IV pipeline will carry 110 cu m/day of gas from South Pars and the Parsian gas plants to consumption areas. The project includes 1,030 km of 56-in. pipe in two sections and two compressor stations.

Parts of IGAT IV have begun service. The main part of the pipeline was connected with the Pol Kaleh compressor station in Isfahan in 2004. And a 351-km section to Fars Province became operational in 2004.

A second stage of IGAT IV will include a 42-in. spur line to Kerman, a 24-in. line to serve a Fars petrochemical plant, a second, 40-in. line to Yazd, and a 40-in. Isfahan-Mobarakeh pipeline.

The 56-in. IGAT V trunkline will carry 75 million cu m/day of sour gas from South Pars Phases 6-8 to Khoozestan oil fields for injection. It will connect Assaluye and Agha Jari, a distance of 504 km, and will have five compressor stations.

The IGAT VI pipeline generally will parallel IGAT V to serve gas needs of Bushehr and Khoozestan provinces, including oil field injection. With a length of 492 km and diameter of 56 in., it will be able to carry 90 million cu m/day. Two compressor stations are planned.

IGAT VII, 860 km of 42-56-in. line, will carry gas produced in South Pars Phases 9-10 for use in Sistan and Baluchestan province in southern Iran and possibly for export to the UAE, Pakistan, and India.

IGAT VIII, a 1,050-km, 56-in. line, will carry South Pars gas to the Parsian gas plant and north to a connection with a line serving Tehran. The system will have 10 compressor stations with a total of 1.8 million hp.

To meet growth in gas demand in the northern and eastern provinces of Semnan, Khorasan, Golestan, and Mazandaran, NIGC plans a second pipeline between Parchin and Sangbast, 790 km long with a diameter of 48 in., and a 110-km, 40-in. segment between Miami and Jajarm. The system will have four compressor stations and will handle South Pars gas delivered through IGAT VIII.

To serve the western and northern provinces of Hamadan, Kordestan, Zanjan, and Western and Eastern Azerbaijan provinces, NIGC plans to lay 280 km of 48-in. pipeline between a compressor station at Saveh and the city of Bijar and 192 km of 40-in. pipeline between Bijar and Miandoab. Four compressor stations are planned. Other segments with diameters of at least 30 in. will boost pipeline lengths planned for this region to 950 km.

Gas processing

Seven gas processing plants recently have been completed or are planned and under construction in Iran.

The Parsian plant began treatment operations in 2003, dehydrating 20 million cu m/day of gas from Tabnak field and stabilizing 12,000 b/d of condensates.

Construction of processing facilities will proceed in two phases, one with an inlet capacity of 48 million cu m/day and the other, 28 million cu m/day. The complex is designed to yield 85,000 tonnes/year of ethane, 11 million bbl/year of pentanes-plus, 310,000 tonnes/year of butane, and 450,000 tonnes/year of propane.

The Bidboland II plant will sweeten and process 57 million cu m/day of gas at facilities to be built about 14 km southeast of the existing Bidboland plant. Fed by gas from Pazanan, Gachsaran, and Bibi Hakimeh fields, the new plant has design output capacities of 15 bcm/year of sweet gas, 1.48 million tonnes/year of ethane, 1.51 million tonnes/year of propane and butane, and 860,000 tonnes/year of natural gasoline.

About 6 bcm/year of dry gas from the plant is targeted for oil-field injection, the rest for delivery into the gas grid. Ethane will go to a petrochemical plant at Arvand. The other products will be exported through Bandar Mahshahr.

In a separate project, NIGC plans a gas processing plant 25 km northwest of the city of Ilam and 12 km west of Chavar in western Iran. The Ilam plant will process gas from Tange Bijar and Kamankooh fields. Built in two phases, it will have an inlet capacity of 10 million cu m/day and will supply dry gas to cities in Ilam Province and the transmission network and liquids to a petrochemical plant at Ilam.

NIGC also plans a small processing plant at Masjed Soleiman with inlet capacity of 1 million cu m/day and is studying a plant able to process 14 million cu m/day at South Gesho sour gas field in Hormuzgan Province. The South Gesho facility, near an existing plant at Sarkhon, would have two trains with identical inlet capacities. After removal of 600 tonnes/day of sulfur and 9,000 b/d of condensate, sweet gas would move to markets in the southeastern part of the country, including some to a power plant at Bandar Abbas.

Storage projects

NIGC also has identified several reservoirs that might be converted for use as underground gas storage.

One of them is Sarajeh gas and condensate field, about 40 km east of Qom, which has produced at rates restricted by surface equipment for about 45 years. NIGC believes that by working over old wells and drilling new wells it can deplete the reservoir in 2 years and convert it to storage.

Another prospect for gas storage is the Yortsha Dome saltwater reservoir 25 km south of Varamin. NIGC has acquired 2D and 3D seismic data over the reservoir and plans to drill vertical and horizontal wells to prepare it for storage.

Another saltwater reservoir under study for use as gas storage is the Talkheh Dome in central Iran, which also contains negligible amounts of light and heavy hydrocarbons. A single well drilled in 1960 found the structure. NIGC has 2D seismic data from the area and plans a 3D survey.

Other areas that NIGC thinks might have reservoirs amenable to storage use are in Abardejno, Siahkooh, Marehtapeh, Prandak, and parts of Eastern Azerbaijan provinces.

Expansion of Iran’s gas industry follows a strategy in place since the early 1990s to displace oil with gas in domestic consumption. Gas moved ahead of oil in share of the fuels’ combined portion of total Iranian energy consumption in 2002. Gas now claims 70% and oil 30% of the gas and oil component of energy use.

The author

Hedayat Omidvar is responsible for strategic studies in National Iranian Gas Co.’s Research and Technology Department. An industrial engineer, he has worked with NIGC since 1992. He is a member of the Institute of Industrial Engineers, American Industrial Hygiene Association, and Iran Institute of Industrial Engineering. He also serves on sustainable development and marketing committees of the International Gas Union.