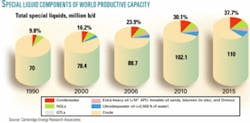

World oil and NGL production capacity could increase by as much as 25% by 2015, with NGLs and extra-heavy oils accounting for much of the capacity growth, said Cambridge Energy Research Associates, Cambridge, Mass.

CERA forecasts productive capacity rising to 110 million b/d in 2015 from 88.74 million b/d in 2006. CERA said its reference case depends upon high investment levels.

In a report entitled, “Expansion Set to Continue, Global Liquids Capacity to 2015,” CERA studied field-by-field data and development plans of major international oil companies.

Developments involved 360 projects expected to be on stream by 2010, of which 110 are planned by members of Organization of Petroleum Exporting Countries, and the remainder are non-OPEC projects. The analysis projects 7.6 million b/d capacity additions in OPEC and 5.7 million b/d in non-OPEC sectors to 2010, with continued expansion of OPEC capacity by 5.3 million b/d during 2010-15. Non-OPEC capacity growth is projected at 2.7 million b/d during 2010-15.

Production capacity

Report authors Peter M. Jackson, CERA director of oil industry activity, and Robert W. Esser, CERA director of global oil and gas resources, noted that their report examined production capacity rather than actual production.

Based on their analysis, Jackson and Esser conclude that the data reinforce CERA’s view that the specter of “peak oil” is not imminent, nor is the start of an “undulating plateau” pattern of supply capacity.

Kjell Aleklett of the Association for the Study of Peak Oil & Gas (ASPO) called CERA’s report “overoptimistic.” He said the extrapolation to 2015 assumes “enormous success in new discoveries and that these discoveries can be put in production very quickly.”

Aleklett said: “Some people say that ASPO is pessimistic when it comes to future supply. We think that we look at the future in a realistic manner. It is clear that CERA is very optimistic, and the fact that they believe that OPEC will increase the production capacity with 12.9 million b/d during the next 9 years is an example of optimism.”

Aleklett is with the Uppsala Hydrocarbon Depletion Study Group of Uppsala University, Sweden (see p. 18).

Meanwhile, CERA analysts estimate a current worldwide aggregate production disruption of 2.3 million b/d, or 2.6% of total world capacity. But despite disruptions in the Gulf of Mexico, Nigeria, Venezuela, Iraq, and Alaska’s North Slope, world total productive capacity continues to grow, the report said.

“The ability of exploration and production companies to collectively grow global production capacity at a rate allowing a comfortable supply-demand buffer that will absorb supply disruptions and manage these risks will be a critical factor in ensuring global energy security,” Jackson and Esser said.

They expect strong continued growth and a gradual improvement in the supply-demand balance. They listed several factors driving strong capacity growth:

- High oil prices and strong competition for access to reserves and pressures on the service sector.

- The search for new sources of conventional crude and nontraditional supply.

- Increasing global gas productive capacity driving up the volumes of associated liquids.

- The pace and scale of deepwater discoveries and development.

Unconventional liquids

“During 2000, unconventional liquids represented 16% of global capacity, and by 2006, this had grown to 24% of the total,” Esser and Jackson said. “We expect this strong growth to continue to over one third of total global capacity (38%) by 2015, especially if [exploration and production] companies believe that the oil price will remain high.”

The report anticipates a geographic shift in the distribution of liquids capacity by 2015, saying 66% of global productive capacity will come from 15 countries compared with 59% today. Those countries largely are outside North America and northwestern Europe, and in some cases distant from India’s and China’s expanding markets.

CERA’s 2006 update projects a short-term rate of capacity growth in 2005-06 that is slightly lower than its May 2005 report as a result of slower Canadian oil sands expansion, a lack of capacity growth in Iraq, new project delays in Iran, political difficulties in Venezuela, lower growth in Russia, lower North Sea performance levels, and hurricane-related difficulties and project delays in the Gulf of Mexico.

The slowdowns are partially offset by faster capacity growth in Africa and Asia.

“We see much of the lost ground being made up by 2010, along with an increase of about 4 million b/d in our global estimate by 2015, with the inclusion of [gas-to-liquids] in the outlook along with new discoveries and existing field reserve upgrades in non-OPEC areas,” Jackson and Esser said.

Light crude

“Contrary to what seems to be a common belief, the overall proportion of lighter liquids is expanding faster than heavy and extra-heavy crudes,” CERA said. “Although the market seems to be very focused on heavy and extra-heavy crudes, there is a strong trend toward an expanding stream of light crude, condensates, and NGLs.”

Jackson and Esser’s analysis indicates that extra-heavy oil productive capacity will more than double to 4.7 million b/d in 2015 from 1.9 million b/d in 2006. They forecast a rise in gas-related liquids capacity to 26 million b/d from 15 million b/d during the same period.