End of oil? No, it’s a new day dawning

It’s all over the worldwide headlines:

“Is the World Running Out of Oil?,” TRB, Australia.

“Oilfields Won’t Satisfy World Demand,” Le Monde Diplomatique, France.

“Is the World’s Oil Running Out Fast?,” BBC News, England.

Plenty of people, including informed people, are worried that oil is running out. There is good news and bad news with respect to the future of oil.

The good news is, we are not running out of oil; The world still has over 1 trillion bbl of proved reserves.

The bad news is that access to the world’s remaining oil is getting much more difficult, and serious supply disruptions are highly likely to occur in the future.

On the basis of geoscience and engineering, there is still plenty left. The limits are largely political. This article takes a look at the facts.

Fewer big finds

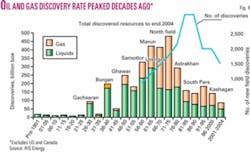

First, it’s true that oil and gas discovery volumes peaked decades ago, oil in the 1960s and gas in the 1970s. The actual number of discoveries peaked in the 1980s-30 years ago (Fig. 1).

We are not finding the elephant fields anymore, either. Today, about half of the world’s oil production is from 116 giant fields that each produces more than 100,000 b/d of oil. All but four of those were found more than 25 years ago.

Maybe a few more elephants exist, but we’re just not discovering those monster fields anymore.

The other half of current world production comes from more than 4,000 not-so-large fields.

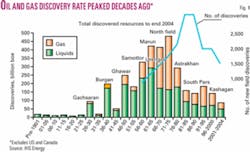

It is true that oil exploration discovery volumes are declining, from about 60 billion bbl/year in the early 1960s to one-fourth that amount today (Fig. 2).

At the same time, production has been climbing to meet demand-from about 10 billion bbl/year in the early 1960s to about three times that much today.

In fact, production has exceeded discovery for the past 20 years. The rising water cut-from 22% in the early ‘60s to more than 40% today-makes it clear that our existing fields are getting old, playing out.

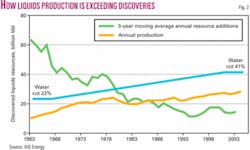

In the US, new fields are providing less than one-fourth of reserve additions, and we can extrapolate that to other mature oil and gas areas worldwide (Fig. 3). So we can’t expect to find many new fields in mature areas like the US. It is depressing to think about, but the news isn’t all bad.

For one thing, even in mature areas, we’re still finding plenty of new reserves: in deeper pools, in extensions, in infill drilling-as well as in adjustments and revisions to our earlier numbers. In fact, over the past 10 years in the US, 75% of new reserves were found in and around old fields.

We still have a lot to gain in these old areas. They’ll continue to increase proved reserves.

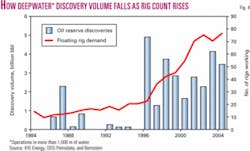

For another, we have ramped up exploration in deep water in the last decade, and we are finding an average of 3 billion bbl/year in more than 1,000 m of water (Fig. 4). That’s replacing fully 10% of the world’s yearly production-a pretty impressive number.

The number of active offshore rigs has continuously increased but not the corresponding reserves found because we tend to find the big fields first and as the rig count increases we find smaller fields. So, while deepwater drilling is important, it doesn’t solve all of our problems.

Spending money well

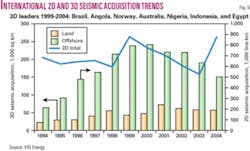

A major solution, though, is seismic technology, which helps us find more prospects-onshore and offshore. Oil companies have been devoting a lot of time and money to seismic and probably should be doing even more of it (Fig. 5).

In fact, as in so many other areas of our lives, technology plays a huge role in solving the problem of “not enough oil.” More about that later.

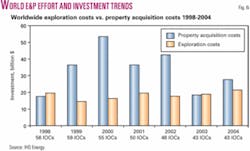

The industry’s spending on exploration has been fairly constant, but that’s because we all know that it is hard to “spend one’s way to success” in exploration (Fig. 6).

The key is spending money well, and for that we need better quality prospects. Seismic exploration “highgrades” our prospects so we can spend money wisely. At Apache, we’ve recently doubled our seismic budget. We’re looking for a quality portfolio so we can choose the best opportunities from within that portfolio. And that’s my second plug for seismic.

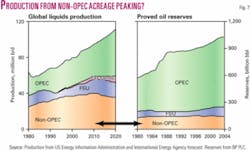

Here is a very telling illustration (Fig. 7). Today, about half the world’s production comes from fields that contain a small fraction (13%) of the world’s proved reserves: non-OPEC reserves. The good news is that we’re maximizing the production of these reserves-and that’s due to advanced technology and some very hard work by oil companies worldwide.

The oil endowment

It is stunning to think of how much oil could be produced if all of the world’s acreage were worked as hard as that non-OPEC acreage. We international oil companies (IOCs) are really squeezing that acreage hard.

As hard as we are working non-OPEC acreage, it also means that this resource will begin to decline soon. This means we will have to change our business strategy as this decline begins.

Yes, we’ll have to make that shift, and we need to start now. The world’s ratio of oil reserves to production has held steady or increased for the past 25 years, and we still have a 40-year supply of proved reserves in the ground. Granted, a lot of this is in the Middle East, but that just means we have to be very aware of how political problems can affect the world’s oil supply.

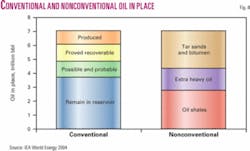

It’s easy to forget about the gigantic numbers we’re talking about (Fig. 8). In terms of conventional oil resources, the experts seem to agree that the earth holds somewhere between 6 trillion and 8 trillion bbl of oil in place. Of that, we’ve produced only about 1 trillion.

We think we have roughly another 1 trillion in proved reserves-and maybe another 1 trillion in probable/possible reserves. That’s a lot of oil. The rest-more than half of the total-will require enhanced oil recovery (EOR), which currently is difficult and expensive but will become easier and more economical in the future.

Then there’s the vast potential of nonconventional resources, which include extra-heavy oil, oil shales, tar sands, and bitumen, and extra-heavy oil. The earth offers about as much in nonconventional resources oil in place as it does in conventional: about 7 trillion bbl. That’s huge.

Role of high prices

In the past, we have not had cost-effective extraction technologies to get much of that oil out of the ground. It’s pie in the sky right now-but probably not for long. Higher prices make these resources attractive enough to overcome the incredible effort and cost required to produce them.

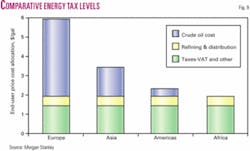

Here’s why: When we look at the demand side of the oil equation, we see evidence in Europe’s gasoline prices (currently about $6/gal-over $250/bbl) that Western consumers are willing to pay the price for this “expensive” nonconventional oil-if and when it becomes necessary (Fig. 9).

Oil is an extremely valuable commodity with no practical alternative at this time. Yes, Europe’s (and Asia’s) gasoline prices are high due to high taxes, but they still demonstrate consumers’ willingness to pay much higher prices if necessary. It’s just a matter of time before the demand price and the supply price for EOR and nonconventional resources match up.

Of course, the other big demand-side factor is world population growth, and increased oil use in China and India. This galloping demand is not going to let up, and we expect other developing countries to use more oil and gas as their economies improve. This trend will give us the price flexibility to develop both enhanced oil recovery techniques and the technology to produce nonconventional resources.

Theoretically, the cushion of recoverable reserves gives us the time needed to develop and prove these new technologies. It also gives us time to build consensus within nations (on import issues, taxes, and the like) and in cooperatives around the world (nations with nations and commercial oil companies with national oil companies). And, finally, it gives us the time to develop new talent in our business-young people who can develop the technologies and build the level of worldwide cooperation that the future of oil will demand. However, as Yogi Berra said, “In theory there is no difference between theory and practice. In practice, there is.”

Political factors

It is foolish to assume that significant supply disruptions will not happen in the future. Consider the War on Terror, Iran, Saudi Arabia, Venezuela’s Chavez, and the nationalization of reserves in Russia and Latin America.

More oil is becoming less available to the most efficient explorers and producers: the IOCs. This is a real problem that will be up to politicians to solve, but the potential for man-made problems makes it imperative that we use all the tools at our disposal to lessen our vulnerability to disruption and the economic see-saw that results.

We are working our conventional reserves hard, and non-OPEC oil production will begin to decline soon. But even that is not the end of oil.

If politicians can address international issues effectively, we can depend on oil from the Middle East and other areas for many decades to come. And, as long as we can develop the technology to produce nonconventional reserves, we’re set to use some amount of oil for much longer-a century or more.

Today, more than ever, our future energy resources are in the hands of the world’s politicians. Our job, in the energy business, is to keep squeezing that oil out of the ground and to continue developing EOR and nonconventional recovery technologies.

Perhaps most importantly, we need to expect and plan for significant supply disruptions due to political events. If we take the critical steps to become well prepared, the headlines can read, “Oil Scare a Nonevent,” “Growth Continues Worldwide,” and, maybe even, “Seismic Saves the Day.”

Expanded and updated from remarks prepared for a panel discussion at the Society of Exploration Geophysicists annual meeting, Nov. 6-11, 2005, Houston.

The author

Mike Bahorich (mike.bahorich @usa.apachecorp.com) is executive vice-president, exploration and production technology, at Apache Corp. He has worked as an explorer, geophysical interpreter, development geophysicist, seismic processor, researcher, software developer, research supervisor, exploration manager, and chief geophysicist. He has patented two technologies used in the seismic industry. He joined Apache in 1996 after working with Amoco Corp. He holds a BS degree in geology from the University of Missouri at Columbia and an MS in geophysics from Virginia Polytechnic Institute.