OGJ Newsletter

EU warned against Gazprom-Sonatrach linkup

Italy’s Economic Development Minister Pierluigi Bersani wants the European Union to take action against a planned linkup between Russia’s OAO Gazprom and Algeria’s Sonatrach, citing concerns that such a partnership could adversely affect European gas prices.

“The agreement between the two largest gas suppliers to Europe confirms the worry [over] the European gas supply system, and Italy’s in particular, because of the dependence on a limited number of suppliers,” Bersani said in a letter to European Energy Commissioner Andris Piebalgs.

Sonatrach on Aug. 4 signed memorandums of understanding with Gazprom in which it said it envisions the possibility of exchanging assets in the exploration and production sphere, the creation of joint ventures, and participation in tenders to explore for and extract oil and gas.

The Sonatrach-Gazprom MOUs also detail information exchanges about projects, including LNG developments, the optimization of gas supplies to market, research activities, professional training, and enhancement of employee qualifications at the two companies. Bersani said the EU needs more coordination between its energy and foreign policies in its dealing with gas-producing countries because the cooperation between Gazprom and Sonatrach could affect supply.

Iran warns UN of potential oil crisis

Iran warned the US and the UK Aug. 6 that the international community could face a new oil crisis if the United Nations security council imposes sanctions on Tehran for its apparent attempt to acquire a nuclear weapons-making capability.

The warning was issued by Ali Larijani, the country’s chief nuclear negotiator and head of the Supreme National Security Council. Larijani said that if the West did decide on sanctions, “We will react in a way that would be painful for them.... Do not force us to do something that will make people shiver in the cold.”

Larijani said, “We do not want to use the oil weapon. It is them who would impose it upon us.”

The UNSC last week passed a resolution by a vote of 14-1 imposing a deadline of Aug. 31 for Iran to accept a package of incentives in return for suspending uranium enrichment at its Natanz facility, or face the prospect of political, economic, and financial sanctions.

“The resolution that was released lacks any legal basis and effectively makes this international centre insubstantial. Therefore, we reject it and we will not accept suspension [of uranium enrichment],” Larijani said.

Russian court declares Yukos bankrupt

A Moscow arbitration court declared OAO Yukos bankrupt, the latest development in the former oil giant’s 3-year court battles with the Russia government over back taxes.

Russian tax authorities and state-owned OAO Rosneft are the biggest creditors of Yukos. Liquidation proceedings now are expected to result in an auction of its remaining assets.

Rosneft already bought Yukos unit Yuganskneftegas. OAO Gazprom has said it is interested in acquiring some assets, particularly the Tomskneft production subsidiary.

The Russian government seized and sold Yuganskneftegas to Baikal Finance Group at a Dec. 19, 2004, auction in Moscow. Rosneft later bought Baikal (OGJ Online, Mar. 15, 2005).

Meanwhile, former Yukos Chief Executive Mikhail Khodorkovsky remains imprisoned in Russia’s YaG 14/10 prison camp at Krasnokamensk, Chita, near the border with China.

Venezeula, Vietnam to study joint projects

Venezuela and Vietnam signed a petroleum cooperation agreement to assess jointly developing oil and gas assets and building a refinery and storage facilities in Vietnam, Petroleos de Venezuela SA said.

PDVSA issued a statement Aug. 2 saying it would look into the possibility of supplying state-owned Petrovietnam with oil. Specifically, the agreement mentioned heavy oil from the Orinoco belt.

Venezuelan President Hugo Chavez visited Vietnam in late July.

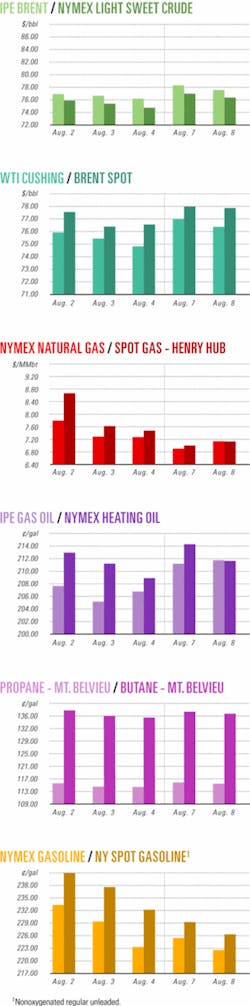

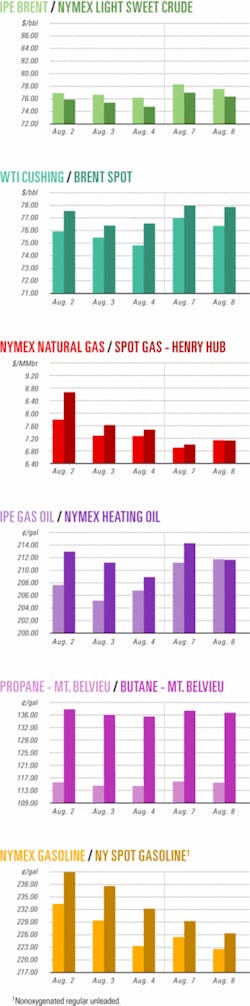

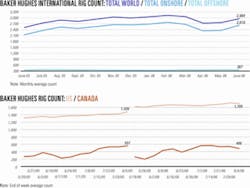

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesNexen encounters gas pay with Ringo prospect

Nexen Inc., Calgary, said the Ringo prospect on Mississippi Canyon Block 546 encountered 150 ft of net gas pay. The well, in 2,500 ft of water, was drilled to 12,808 ft.

Conventional cores were taken throughout the productive intervals, and the analysis indicated good quality reservoir sands. Nexen operates the block with a 50% interest. ENI SPA holds the other 50% interest.

Nexen is installing a production liner and evaluating tieback options. The well is 120 miles northeast of Aspen field.

PDVSA to drill Orinoco belt appraisal wells

Venezuela President Hugo Chavez said on his weekly television broadcast that Petroleos de Venezuela SA (PDVSA) will start drilling appraisal wells on the Ayacucho Block in the Orinoco belt in northeastern Venezuela. The timetable was not given.

Chavez said the drilling program will certify 235 billion bbl of oil reserves in the heavy oil province as part of the country’s Magna Reserva program.

Chavez did not identify which companies would be working with PDVSA in the extensive campaign, but earlier had named seven companies to participate in a quantification program, including Russia’s Gazprom to evaluate Ayacucho Block 3 and Iran’s Petropars Ltd., Ayacucho Block 7. Petropars was granted a 49% interest in the 540-sq-km heavy oil block, and PDVSA retained 51% (OGJ, Nov. 21, 2005, p. 54).

The state oil firm currently is producing 620,000 b/d of oil from the Orinoco, working with Chevron Corp., ConocoPhillips, Brazil’s Petroleo Brasileiro SA (Petrobras), and others.

Talisman, East Resources score in New York

Talisman Energy Inc., Calgary, said its Fortuna Energy Inc. unit is evaluating further drilling near two strong gas completions in western New York.

Fortuna’s 99.6% owned Stoscheck-1 went on line at 22 MMcfd of gas with 2,600 psi flowing pressure. It was drilled vertically and then steered horizontally across a newly identified graben structure in the Ordovician Upper Black River formation. The pressure indicates that the well penetrated a new pool, the company said.

Fortuna has a 49.25% working interest in the Hartman BJ-1 well on which East Resources Inc., Wexford, Pa., was the drilling operator. It went on line at 12 MMcfd of gas at 1,950 psi flowing pressure in what is interpreted to be a new pool, Fortuna said.

Fortuna’s 2006 program calls for drilling or participating in 17 horizontal Trenton-Black River wells and five vertical wells and $10 million in outlays, including two compressor stations. Its current production is 110 MMcfd of gas.

Canadian independent eyes Piceance, Uinta

Brownstone Ventures Inc., Toronto, said its US unit completed the purchase of interests in 267 oil and natural gas leases in the Piceance basin of Colorado and Utah and the Overthrust Belt of Utah for $6.77 million cash plus 2.6 million common shares issued to private Retamco Operating Inc., Billings, Mont.

The acquisition includes 188,422 net acres in a low-risk gas resource play plus the chance for deeper Jurassic reserves and 65,646 net acres in a large, deep Overthrust project analogous to and adjacent to giant Rangely oil and gas field.

Brownstone holds 10% net working interest in each project. Other working interests are: gas resource project, Retamco 65% and Dejour Energy USA Inc., Vancouver, BC, 25%; Overthrust project, Retamco 77.5% and Dejour 12.5%.

Agreements are being finalized to include another partner with key Piceance basin operating capability, Brownstone said.

The three participants plan to start drilling in the fourth quarter.

Drilling & Production - Quick TakesDubai government to operate offshore fields

The international group that operates Dubai’s mature offshore oil fields will relinquish its concession to the emirate’s government next April.

A consortium of Dubai Petroleum Co. (DPC), wholly owned by ConocoPhillips, and Dubai Marine Areas Ltd. (Duma), of which DPC is part, has worked in Dubai since 1961.

DPC/Duma operates four offshore oil fields, Fateh, Southwest Fateh, Falah, and Rashid. Group interests are ConocoPhillips, the operator, 32.5%; Total SA, 27.5%; Repsol YPF SA, 25%; RWE Dea AG, 10%; and Wintershall AG, 5%.

Although Dubai is part of the United Arab Emirates, a member of the Organization of Petroleum Exporting Countries, its production is exempt from OPEC quotas and not widely reported. It peaked at about 400,000 b/d in 1991 and is believed to have fallen recently to just above 100,000 b/d.

UAE production is about 2.5 million b/d, almost all from Abu Dhabi.

Dubai Petroleum Establishment (DPE), a new government entity, will become operator of the fields on Apr. 2, 2007.

DPE has let contract to Petrofac Ltd. of the UK for well and facilities management in the fields, which have about 70 platforms. Petrofac said it will employ the 1,100 persons now working with the operation.

Petrobras to double spending, lease rigs

Brazil’s state-owned oil company Petroleo Brasileiro SA (Petrobras) expects to double exploration expenditures over the next 5 years compared with the past 5 years, said Petrobras Pres. José Sérgio Gabrielli. Exploration expenditures, he said, will increase to $7-8 billion/year through 2011, up from an average of $2.5-3 billion/year during the past 5 years, and he added that the focus of expenditures will be on Brazilian companies.

The company has begun its program by signing leasing contracts totaling $4.5 billion with Brazilian companies for six drilling rigs. Companies include Construtora Norberto Odebrecht SA, Petroserv SA, Queiroz Galvão Perfurações SA, and Schahin Engenharia Ltda.

Four rigs capable of drilling in 2,000 m of water will be leased from Queiroz Galvão, Odebrecht, Schahin, and Petroserv. These are being contracted for 7-year periods, beginning in 2010 and renewable for another 7 years. Two other rigs, capable of drilling in 2,400 m of water, will be leased from Queiroz Galvão and Schahin for 5 years, starting in 2009. Petrobras said that some of the rigs could be mobilized to drill in water as deep as 3,050 m.

Petrobras emphasized the decentralization of contracts these awards represent. Of 23 rigs now chartered by the company, 19 are with four international firms-Transocean Inc., Pride International Inc., Noble Drilling Corp., and Diamond Offshore Drilling Inc.

Petrobras, however, will not require minimum national content for the construction of the new rigs, because Brazilian yards are booked up, and the rigs might have to be built in Singapore or South Korea. But the company said that Brazilian manpower would comprise 90% of the operating phases, with that percentage gradually increasing to 100%.

The increased price of chartering drilling rigs has contributed most to the jump in exploration costs, with rigs representing as much as 80% of the cost of an exploration campaign. However Petrobras said that signing long-term contracts for the rigs has reduced its leasing fees, which are 20% lower than those on the international market.

Ivory Coast W. Espoir oil well comes on stream

The first of five West Espoir oil wells off Ivory Coast was bought on stream on July 26, said Tullow Oil PLC, which has a 21.33% interest in the project. Canadian Natural Resources Ltd., Calgary, is the operator.

The well, drilled on Block CI-26 Special Area E, flowed at more than 5,000 b/d of oil equivalent. The block covers 139 sq km. Development plans call for four additional production wells and two water injection wells. The West Espoir project is expected to reach peak production of 10,000 b/d in late 2007.

The project includes a new wellhead tower tied back via a 5.5-km pipeline to the Espoir floating, production, storage, and offloading vessel, which processes production from both East and West Espoir fields. The two fields together produce more than 35,000 b/d of oil.

Nigeria’s East Area oil-gas project starts

An ExxonMobil Corp. subsidiary started gas reinjection at the East Area Additional Oil Recovery Project off Nigeria in late July.

The gas reinjection has stabilized oil production at 120,000 b/d from six fields that once produced more than 200,000 b/d, the company said. The six fields are Iyak, Ubit, Oso, Usari, Idoho, and Mfem (see map, OGJ, Feb. 16, 2004, p. 31).

The $1.3 billion project is designed to recover more than 530 million bbl of oil from the OML 67 and 70 blocks and reduce routine gas flaring. The fields are in shallow water 17 miles off southeastern Nigeria. OML 67 is near the border with Cameroon and Equatorial Guinea.

Mobil Producing Nigeria Unlimited is reinjecting gas to slow the normal field decline from a number of reservoirs. The project includes a gas compression complex, seven other platforms including crew quarters, and more than 100 miles of new gas-gathering and distribution pipelines.

Project interests are MPN 40% and Nigerian National Petroleum Corp. 60%.

Flow restarted from deep Louisiana well

Sonoran Energy Inc., Phoenix, has restarted production from a deep, high-pressure, high-temperature well in the second phase of a Central Louisiana workover program.

The Strickland 17 well, in which Sonoran holds a 100% interest, is producing 275 boe/d through an 8/64-in. choke at a stable flowing tubing pressure of 6,100 psi. The well is 15,000 ft deep with pressure as high as 15,000 psi and a temperature of about 300º F. The workover included removal of 800 ft of stuck pipe and cleanup of the wellbore.

Workover of the second well in the program’s second phase, which covers Vernon and Beauregard parishes, will require removal of more than 1,000 ft of stuck pipe.

Earlier, the company established production of more than 100 boe/d from three of four wells in the program’s first phase (OGJ, Apr. 10, 2006, Newsletter).

Processing - Quick TakesPetrobras, PDVSA plan refinery in Brazil

Brazil’s state-owned Petroleo Brasileiro SA (Petrobras) and Venezuela’s Petróleos de Venezuela SA jointly plan to build a $2 billion refinery in Brazil’s northern Pernambuco state.

The Abreu e Lima plant, planned to begin operations in 2014, will have a processing capacity of 500,000 b/d and will produce gasoline and diesel having a sulfur content of less than 50 ppm.

Construction is scheduled to begin in 2010, although funding has not yet been allocated, and the specific location is undetermined. Locating it near the coast would facilitate shipping of the product, especially for exports, Petrobras said. Priority would be given to supplying the domestic market, but products would be of export quality, the company said.

The refinery’s construction is consistent with Brazil’s goal of processing 90% of domestic heavy oil in Brazil by 2010. The proportion today is 82%.

Work begins on Singapore chemical plant

ExxonMobil Asia Pacific Pte. has given the go-ahead to Foster Wheeler Ltd. to begin front-end engineering design of selected downstream units and associated plant infrastructure for the Singapore parallel train (SPT) project, a world-scale steam-cracking complex being considered for installation at the ExxonMobil unit’s Singapore refining and chemical plant site. The firm also will undertake FEED for the overall SPT project infrastructure.

The SPT project coordination and services contract was awarded in January to a team of Foster Wheeler and WorleyParsons.

The complex under study includes an ethylene cracker and downstream plants for ethylene and propylene derivatives production.

Repsol YPF to expand Sines petrochem plant

Repsol YPF SA plans to nearly double production of the Sines petrochemical complex 160 km south of Lisbon, Portugal, by 2010.

Repsol YPF officials presented the proposal to the Portuguese Ministry of Economy and Innovation late last month.

The project includes an increase in capacity of the facility’s naphtha cracker to 570,000 tonnes/year of ethylene. The cracker’s capacity is now 350,000 tonnes/year and will rise to 410,000 tonnes/year with projects already under way.

With the cracker expansion and construction of linear polyethylene and polypropylene plants and a power station, output will increase to 590,000 tonnes/year of polyethylene and 300,000 tonnes/year of polypropylene by 2010.

The facility now has 275,000 tonnes/year of polyethylene capacity, growing to 295,000 tonnes/year with current projects, and no polypropylene capacity.

Indonesia courts Malaysian biofuel makers

Indonesian President Susilo Bambang Yudhoyono has held meetings with Malaysia’s top energy companies, offering them incentives to invest in his country’s developing bioenergy industry.

Susilo met Aug. 4 in Kuala Lumpur with executives from Genting Plantation & Biodiesel, Sime Darby Bhd., Khazanah Finance, Telecommunications & Infrastructure, and Petronas.

Indonesia’s Energy and Mineral Resources Minister Purnomo Yusgiantoro said the government could offer investors several incentives. He said Pertamina and state power firm PT PLN would serve as standby buyers of biofuel produced from future plants.

Purnomo also said a team would soon draw up regulations to ease the entry of foreign firms into his country’s bioenergy industry. “We hope that all the necessary regulations will be ready by the year 2008 and we can start production in 2009,” Purnomo said.

Industry Minister Fahmi Idris said, “We consider the biofuel industry to be strategic and labor-intensive and thus deserving of special treatment.”

Transportation - Quick TakesPetrobras, PDVSA to develop Mariscal Sucre gas

Brazil’s state-owned Petroleo Brasileiro SA (Petrobras) and Petroleos de Venezuela SA will form a 35-65% joint venture before yearend to develop Venezuela’s Mariscal Sucre gas project (OGJ, June 24, 2002, p. 24). PDVSA will invest $3 billion and Petrobras, $2 billion, to bring on production the four Norte de Paria fields that comprise the Mariscal Sucre project-Dragon, Mejillones, Patao, and Rio Caribe. The fields, which lie off Venezuela’s northeastern coast in the Caribbean Sea, are believed to hold 11 tcf in gas reserves.

Petrobras said gas produced from Mariscal Sucre beginning in 2009-10 will be sold to the Venezuelan market; surplus production will be exported as LNG, mostly to Brazil.

PHMSA issues order after gas line leak, fire

The US Pipeline and Hazardous Materials Safety Administration issued a corrective action order to Tennessee Gas Pipeline Co. following a July 22 leak and fire on the El Paso Corp. subsidiary’s Line 100-1 system in Kentucky.

The 24-in. line ruptured about 6 miles southeast of Clay City, Ky., resulting in the release and ignition of about 42.9 MMcf of gas, the US Department of Transportation agency said.

The fire was extinguished within 1 hr and no one was injured, although three nearby residences were evacuated and minor property damage occurred, PHMSA added.

A preliminary investigation indicated that pitting and corrosion were present in a 2-3 ft area near the fracture and within 2-3 in. of the pipe’s longitudinal seam, with the fracture following the longitudinal seam near the pitting, according to the July 27 order.

It said that 25 ft of mangled and twisted pipe, with its external coating completely burned off, blew out of the ground and landed 200 ft away during the incident. The line was installed in 1944 and was last inspected and pressure tested in 1986, PHMSA said.

It ordered TGP to not run Line 100-1 at more than 80% of the operating pressure in effect prior to the incident and to keep pressure at the leak site below 572.8 psi until obtaining written approval from PHMSA’s Office of Pipeline Safety Southern Region director. PHMSA also ordered TGP to conduct a detailed metallurgical analysis of the pipe that failed. TGP also will be required to submit a written plan and schedule to verify the integrity of the pipeline segment from Campbellsville Compressor Station 96 to Clay City Compression Station 106.

TEPPCO to expand Jonah gas gathering system

TEPPCO Partners LP and Enterprise Products Partners LP have formed a joint venture to continue to expand the Jonah Gas Gathering Co. system.

Jonah Gas Gathering, in the Greater Green River basin of southwestern Wyoming, gathers and transports gas produced from Jonah and Pinedale fields to processing plants and major interstate pipelines. Enterprise and TEPPCO intend to continue the Phase V expansion, expected to increase the system capacity of the system to 2.4 bcfd of gas from 1.5 bcfd. The $275 million first portion of the expansion, which will increase gathering capacity to 2 bcfd, is scheduled for completion during first quarter 2007. The $140 million second portion is to be completed by yearend 2007.

Upon completion of the expansion project, TEPPCO will have 80% interest, and operator Enterprise will have 20% interest.

Maersk lets Al Shaheen pipeline contract

Maersk Oil Qatar AS has let contract to National Petroleum Construction Co. (NPCC), Abu Dhabi, for pipelines associated with development of Al Shaheen oil and gas field off Qatar.

NPCC will handle design, engineering, procurement, fabrication, and installation and testing of a total of 260 km of 6-24-in. pipelines for the Block 5 field. The contract also covers 60 km of marine power and communication cables and related work in 52-70 m of water. Maersk Oil Qatar operates the block under a production-sharing contract with Qatar Petroleum.

NPCC is providing Al Shaheen jackets, bridges, and risers under a separate contract (OGJ Online, May 31, 2006).

Golden Pass LNG awards major contract

Golden Pass LNG LLC has awarded a lump-sum turnkey contract to Chicago Bridge & Iron Co. NV (CB&I) for an LNG terminal to be built near Sabine Pass, Tex.

CB&I’s work will include the engineering, procurement, and construction of facilities with the capacity to process 15.6 million tonnes/year of LNG. The scope of the $1 billion project includes the construction of two ship unloading berths, five full-containment storage tanks, vaporization facilities, gas send-out, and ship unloading systems.

Golden Pass LNG, owner of the Golden Pass LNG terminal, will likely be 70% owned by an affiliate of Qatar Petroleum, with affiliates of ExxonMobil Corp. and ConocoPhillips each owning a share in the balance of the terminal’s interest.

LNG for the Golden Pass terminal will be supplied primarily from the Ras Laffan 3 and the Qatargas 3 projects in Qatar, which will produce and process gas from Qatar’s offshore North field.