US drilling pace to escalate from 20-year high in 2005

Drillers pulled out the stops in 2005 as the year-average rotary rig counts in the US and Texas were the highest in 20 years.

With oil and gas prices soaring, 2006 should be another good year. However, a duplication of 2005’s 16% gain from the 2004 rig count is not likely.

Land and offshore rig counts in Canada were flat compared with 2004 and 2003, while figures for the rest of the world showed a 15% year-to-year gain in 2005 compared with 2004 even though the number of active rigs was steady year to year in Africa and Europe.

Here are highlights of OGJ’s early-year drilling forecast for 2006:

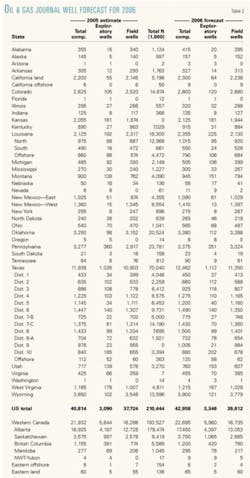

• Operators will drill nearly 43,000 wells in the US, up from an estimated 40,814 wells drilled in 2005.

• All operators will drill 3,352 exploratory wells of all types, up from an estimated 3,096 last year.

• The Baker Hughes Inc. count of active US rotary rigs will average 1,450 rigs/week this year, up from 1,383 rigs/week in 2005.

• Operators will drill 22,695 wells in western Canada, up from an estimated 21,932 wells in 2005.

US drilling

OGJ’s forecast is for a 5.3% increase in 2006 in the number of US wells drilled following increases estimated at more than 11%/year in 2005 and 2004.

This could be conservative if prices hold, if operators can find additional rigs and crews beyond the new rigs scheduled to go in service, and if they can make more-productive use of existing units.

The average 1,383 rigs/week that US land drillers fielded in 2005 was the highest since 1,968 rigs/week worked in 1985, according to Baker Hughes.

In fact, 2005 was only the fifth year since 1985, inclusive, that the count has topped 1,000 rigs since its historic 1980s downward spiral from the record of 4,520 in December 1981.

The US active rig count rose to 1,471 on Dec. 30, the last reporting period of 2005.

The offshore average of 93 rigs/week in 2005 was the lowest since 82 rigs/week in 1993.

Texas averaged 615 rigs/week in 2005, 21.5% more than in 2004, and the state’s count had swelled to 663 units as of Dec. 23.

New Mexico drilling was up 24% at 83 rigs/week in 2005, and Colorado’s 74-rig average was 37% higher on the year.

Oklahoma operators fielded 152 rigs, down 4.2%. Counts also fell in the Texas-North and Texas offshore/inland waters categories.

US plays

The Barnett shale continued as most active US play, although rig count figures indicated that drilling is moving away from the North Texas core area counties of Jack and Wise and into several counties in West Central Texas Dist. 7B to the south and west.

East Texas drillers averaged 173 rigs/week in 2005, up from 131 in 2004, and West Texas had 100, up from 74.

Coalbed methane continued to dominate drilling in Wyoming. Companies drilled an estimated 3,650 wells in the state in 2005, compared with 3,588 wells in 2004. Of the 2005 wells, 2,700 were for CBM. More than 7,170 permits in 2005 and 6,946 permits in 2004 were issued to drill CBM wells in Wyoming, the Wyoming Oil & Gas Conservation Commission reported.

At midyear 2005, seven Wyoming basins had CBM wells. That included 14,700 producing wells in the Powder River basin and a total of 120 producing wells in the Big Horn, Great Divide, Green River, Hanna, Washakie, and Wind River basins.

Colorado hosted a 37% year-to-year increase in rig activity, with an average 74 rigs/week active in 2005. In late December the Colorado Oil & Gas Commission issued an order that could lead to the drilling of 1,800 more gas wells in 20 years in giant Wattenberg field. The order allows a maximum drilling density of 32 wells/sq mile, up from 20.

Units of EnCana Corp., Kerr-McGee Corp., and Noble Energy Inc. brought the application.

Louisiana drilling was up 9% at 182 rigs/week despite the interference of hurricanes.

Canada, international

OGJ sees a 3.4% increase in drilling in western Canada in 2006.

While Baker Hughes does not estimate the number of rigs active in Russia or China, Mexico is the only country outside the US and Canada with 100 or more rigs running. Activity in Mexico averaged 110 rigs/month in 2004 and 108 in 2005.

The Western Hemisphere averaged 334 rigs/month in 2005, up 15% from 2004. Asia-Pacific averaged 224 rigs/month, up 13.7%. The Middle east was up 7.4% on the year at 246 rigs/month in 2005.

The 2005 average figures show that about 61% of the world’s rigs were working outside the US and Canada.✦