S&P says $100/bbl oil would slow economy

A crude oil price spike to $100/bbl on the New York Mercantile Exchange would slow the US economy but probably not cause a recession, Standard & Poor’s Rating Services analysts said.

Stressing that S&P was not forecasting $100/bbl oil, analysts have considered what might happen if world political events were to trigger such an oil spike.

S&P Chief Economist David Wyss said oil prices at that level could shave 1.5 percentage points off real US gross domestic product growth by yearend 2007, bringing growth down as low as 1%.

“That is not drastic enough, by itself, to throw the US into a recession,” Wyss said.

Louisiana seeks to stop Lease Sale 200

Louisiana Gov. Kathleen Babineaux Blanco requested a preliminary injunction against the US Minerals Management Service to stop the Western Gulf of Mexico Lease Sale 200 scheduled for Aug. 16 in New Orleans.

“The complaint states the ways in which the MMS has violated the National Environmental Protection Act, the Coastal Zone Management Act, and the Outer Continental Shelf Lands Act in moving forward,” Blanco said in a July 20 news release.

The state’s complaint, filed with the US District Court for the Eastern District of Louisiana, asks the court to prevent the opening of bids and awarding of leases for the upcoming sale.

Previously Blanco threatened to block the sale unless Louisiana receives what she calls its “fair share of revenues from offshore oil and gas drilling” (OGJ, Apr. 17, 2006, p. 26). Louisiana is pushing to receive 50% of the federal revenues from production off its coast.

Blanco had recommended postponing the sale, citing persistent land loss in coastal Louisiana and devastating effects of Hurricanes Katrina and Rita. Blanco said production resulting from the lease sale would impact the state’s coast.

Alaska lawmakers asked to ponder pipeline spur

Alaska Gov. Frank H. Murkowski has expanded the call of the legislative special session now under way to study the feasibility of a natural gas spur line to south-central Alaska from the proposed Alaska gas pipeline.

The state’s legislature convened in special session in Juneau July 12 to discuss issues about partial state ownership of a proposed pipeline to carry gas from the North Slope to the Lower 48 (OGJ, July 24, 2006, Newsletter).

On July 25, Murkowski added a $4 million appropriation bill for the Alaska Department of Natural Resources for the feasibility study of a spur line.

“This appropriation will help show all Alaskans we are committed to providing the best information for getting a line built to our most vital region,” Murkowski said. “The Kenai Peninsula will be the engine that drives the economics of a spur line.”

The special session initially was called to consider oil tax changes and other legislation related to a proposed pipeline contract. In May, Murkowski made public a draft gas pipeline agreement between the state and BP PLC, ConocoPhillips, and ExxonMobil Corp.

Audits key to future Bolivian E&D contracts

Bolivian Hydrocarbon Minister Andre Soliz reported that audits of multinational oil companies operating in Bolivia will enable the country to establish new contracts with companies such as Repsol YPF SA, Petroleo Brasileiro SA (Petrobas), British Gas PLC, and Total SA.

Bolivian authorities said they would check international company investments in 56 oil areas.

Soliz said this measure is part of the hydrocarbons nationalization strategy announced May 1 by Bolivia President Evo Morales.

Morales has inaugurated the “Unity of monitoring and control” for company oversight by the hydrocarbon ministry, which is coordinating the work of private consultants hired for the evaluations. The Bolivian Hydrocarbon Ministry has a budget of $5.2 million, according to official sources.

Indonesia pressed to develop new energy policy

Indonesia has been urged to take advantage of current high oil and gas prices and develop a new policy aimed at encouraging domestic firms to boost production of the country’s own reserves.

“The high oil prices should motivate Indonesia to revise its policy on oil and gas with a view to empowering Indonesian private firms to take part in oil exploration and production,” said Effendi Siradjuddin, chairman of the Association of Indonesian Oil & Gas Companies (Aspermigas).

In particular, Effendi said Indonesia could increase its oil production if the government created a new policy involving more local companies to carry out exploration of new fields or to operate so-called brown oil fields left behind by foreign oil companies.

“We should have the aim that by 2020 Indonesian firms become majority shareholders, or own at least 70% of the country’s oil fields instead of the current 15%,” he said.

Effendi estimated there are at least 60 brown oil fields that could still be exploited by local firms, and that additional production of some 300 b/d could come from those fields, if they were managed well.

Indonesia asked to limit IOC contract lengths

Indonesian firms have asked the government to restrict oil and gas contracts with international companies to a maximum of 1 year, according to the head of the National Oil & Gas Caucus.

“If such contracts are to be extended, then the relevant foreign companies have to be required to involve private local firms,” said Effendi Siradjuddin, chairman of NOGC and the Association of Indonesian Oil & Gas Companies.

Siradjuddin said the proposal will be submitted to the government in a document entitled “2020 Indonesia Incorporated in Oil and Gas,” which lists efforts needed to develop local oil and gas companies.

Siradjuddin did not say when the document would be submitted, but he observed that private Indonesian oil and gas companies’ participation currently is limited despite Indonesian firms’ relative mastery of the necessary technology and quality human resources.

Siradjuddin said involvement of local firms that understand the country’s environmental conditions will generate confidence that they can realize sustainable development in Indonesia.

Kuwait trying to clarify oil reserves

Kuwait officials are working to clarify the volume of Kuwaiti estimated oil reserves, Energy Minister Ali al-Jarah al-Sabah said in a statement posted on the ministry’s web site.

“The volume and truth of oil reserves will be announced based on clear scientific studies, characterized by reality and credibility, and supported by international documents and certificates,” he said. Al-Jarah, a former banker and diplomat, was appointed to the cabinet on July 10.

“Everything will be presented clearly in front of the official and national bodies,” al-Jarah said, adding that the Council of Ministers and the National Assembly are involved. He plans to discuss reserves with Kuwait Petroleum Corp. executives, adding he has “full confidence in KPC’s ability and competencies.”

Kuwait has estimated its oil reserves at 100 billion bbl, but it has been reported in the media that internal Kuwaiti records indicate reserves of 48 billion bbl.

Former Energy Minister Ahmad al-Fahd al-Sabah said the report painted only a partial picture, and other oil officials called the report inaccurate.

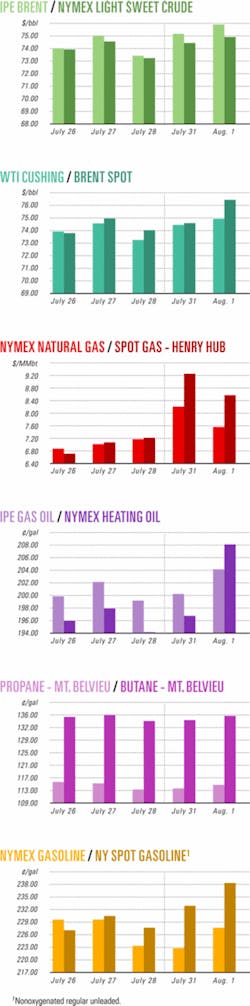

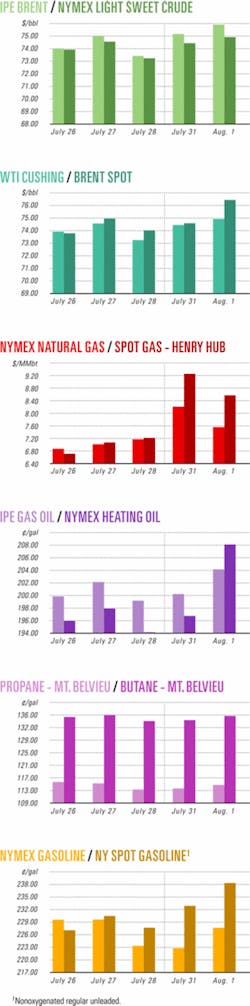

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesChevron completes Big Foot sidetrack well

Chevron USA Inc. reported that operations have concluded on Big Foot Well No. 2, sidetrack 3, at the Big Foot discovery on Walker Ridge Block 29 in the Gulf of Mexico. The well lies in 5,000 ft of water about 225 miles south of New Orleans.

The well was drilled to 24,434 ft TVD and reached about ½ mile north and significantly downdip of the discovery well. The sidetrack found the same pay intervals as seen in the discovery well with about 300 ft of net oil pay, Chevron said (OGJ, Jan. 9, 2006, Newsletter). Further appraisal drilling will be conducted.

MMS issues final notice for Lease Sale 200

The US Minerals Management Service has issued the final notice for Western Gulf of Mexico Outer Continental Shelf Lease Sale 200, scheduled for Aug. 16 in New Orleans.

Sale 200 offers 3,865 blocks covering 20.87 million acres 9-210 miles off Texas and Louisiana in 8-3,000 m of water. MMS estimates the sale could result in the production of 136-262 million bbl of oil and 0.81-1.44 tcf of gas (OGJ Online, Apr. 17, 2006, Newsletter).

MMS said Sale 200 is expected to be the last western gulf sale to contain certain blocks in the Garden Banks, Keathley Canyon, and Sigsbee Escarpment map areas. The blocks in question will transfer from the western gulf planning area to the central gulf planning area if the Draft Proposed Oil and Gas Leasing Program for 2007-12, as currently formulated, is implemented in July 2007.

Brazil sets date for eighth licensing round

Brazil’s National Petroleum Agency (ANP) has set the country’s eighth exploration licensing round for Nov. 28 in Rio de Janeiro, ANP said July 26.

ANP said it is offering as much as 400,000 sq km for exploration and production-nearly double the acreage offered when the round was originally set for August.

Ultra gauges Tuscarora, eyes Pennsylvania

Ultra Petroleum Corp., Houston, gauged a Silurian Tuscarora natural gas discovery in Tioga County, Pa., and has greatly expanded its acreage position in the area.

Ultra’s Marshlands Unit-1, on a 17,982-acre prospect in which the company holds 100% working interest, went on line May 25. Ultra gradually increased the flow rate, now stable at 3.9 MMcfd of gas with 3,247 psi flowing casing pressure. Cumulative production exceeds 150 MMcf.

The company drilled to TD 11,141 ft and attempted completion in Upper Ordovician Bald Eagle before hydraulically fracturing three Tuscarora zones at 8,925-9,144 ft. It plans to spud a second well on the structure later this year using a larger rig capable of reaching Ordovician Trenton-Black River, the $6 million discovery well’s unreached primary objective.

Only one other well in a large surrounding area of the Appalachian basin produces from Tuscarora, an Ultra official said.

Meanwhile, Ultra forged a 50-50 joint venture with private East Resources Inc., Wexford, Pa., to further explore in northern Pennsylvania, where Ultra’s total landholding is 234,827 acres, up from 26,868 acres at the end of 2005. As operator, East Resources plans to spud the first well later this year on a seismically defined structure. Ultra hiked its 2006 capital budget $25 million to $450 million to support the Pennsylvanian exploration effort.

PDVSA begins prospecting in Bolivia

State-owned Petroleos de Venezuela SA (PDVSA) has started surveys in Bolivia to identify prospective hydrocarbon areas under control of Bolivian state firm YPFB, said Miguel Tarazona, PDVSA general manager.

Following the survey, PDVSA is to determine both the amount of future investments and the organization of a joint venture with YPFB, Tarazona told Bolivian news agency ABI.

“A survey is under way to assess reserves in four blocks YPFB has designated for...drilling of gas and oil. Depending on the result, we are to quantify our investment and the way investment will be made, which could be through a joint venture,” Tarazona said.

In late May, Venezuelan President Hugo Chávez and his Bolivian counterpart Evo Morales initialed an energy agreement in La Paz. The pact provides for PDVSA participation in hydrocarbon exploration and marketing activities in Bolivia as well as the likely creation of a bilateral oil firm Petroandina.

At that time, Venezuelan and Bolivian authorities estimated Venezuelan investment at $1.2 billion.

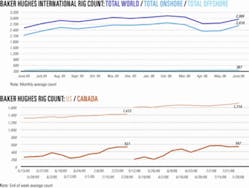

Drilling & Production - Quick TakesAPI: US drilling reaches 20-year high

High crude oil prices pushed US drilling activity to its highest level in 2 decades during the first half of 2006, the American Petroleum Institute reported on July 26.

An estimated 24,729 oil wells, natural gas wells, and dry holes were completed in the US during that period, API said in its latest quarterly well completion report.

Completions totaled 12,681 during the second quarter, the highest for a single 3-month period since 1986’s first quarter and 14% more than in 2005’s second quarter, it added.

Natural gas remains the primary domestic drilling target, API said. Gas well completions reached a record estimated 14,784 in 2006’s first half. API estimated 7,489 gas wells were drilled during the second quarter, 10% more than a year earlier.

API said while gas drilling continued to be strong, US oil well completions grew to levels not reached since the late 1980s. It said an estimated 7,265 oil wells were drilled in the US during the first half, and that 3,795 of those were completed during the second quarter, 21% more than in 2005’s second quarter.

The 1,397 dry holes drilled in the US during the second quarter represented a 12% year-to-year increase, it added.

API said total estimated footage reached levels not seen since 1985 during 2006’s first half (136,806 ft) and second quarter (70,055 ft).

Shell to lift in situ oil sands production

Shell Canada Ltd. has updated its overall portfolio of in situ oil sands, following completion of the BlackRock Ventures acquisition (OGJ, July 3, 2006, Newsletter). Shell plans over the next 2 years to raise in situ production to nearly 50,000 b/d, primarily from the Peace River area, the newly acquired Seal and Chipmunk assets, and the first phase of the Orion SAGD project in the Cold Lake region.

The company’s longer-term upgrading strategy calls for additional future production growth from planned Peace River thermal expansions, expanded cold production opportunities, and other recovery projects. The longer-term upgrading includes plans to evaluate the use of enhanced recovery techniques such as waterflood, miscible flood, and steam injection to maximize recovery from the entire in situ portfolio. This will provide a longer term in situ production potential of 150,000 b/d, Shell said.

With its growing heavy oil holdings, Shell Canada is considering incorporating in situ production growth into future upgrading plans, which would include potential expansions at several locations, including its 97,900 b/d Scotford, Alta., refinery. Beyond the currently proposed 100,000 b/d upgrader expansion at Scotford, Shell Canada intends that future upgrader developments will be dedicated to Shell Canada’s equity production from both mining and in situ growth plans.

Shell Canada also may expand its manufacturing facilities in Eastern Canada to maximize value from increased production of synthetic crude feedstock.

The company estimates that its total in situ oil in place is more than 25 billion bbl. This includes the resources in the BlackRock leases of the Peace River, Cold Lake, and Athabasca oil sands regions, along with about 7 billion bbl of oil in place in Shell Canada’s Peace River leases.

Petrobras, Venezuelan oil firms sign JV deal

Two Venezuelan oil companies have signed contracts with Brazil’s state-owned Petroleo Brasileiro SA (Petrobras) to jointly exploit oil deposits in La Concepcion oil field in Venezuela.

Venezuela’s state-owned Petroleos de Venezuela SA (PDVSA) said the new joint venture, Petrowayu, would operate La Concepcion oil field in the Western state of Zulia. The field produces 12,300 b/d of oil.

Plans are to increase La Concepcion’s extraction of oil. PDVSA unit Companhia Venezuelana de Petroleo (CVP) and privately owned Williams International Oil & Gas Ltd. respectively would hold 60% and 4% of the shares in Petroway, the new company. Petrobras, meanwhile, would hold 36%, CVP said in a statement.

CPV said the company planned to sign another four JV contracts with Petrobras, without specifying any details about the partners involved.

On Mar. 31, Venezuela signed 17 similar JV contracts with domestic and international companies under a new Organic Hydrocarbons Law. Since then, CVP has signed six JV contracts with a majority share of the operations.

Venezuelan President Hugo Chavez has sought to create a regional energy consortium to counter the influence of foreign energy companies and the US on Venezuelan oil exports. Caracas also is seeking to expand its business with Asia, most notably with China.

Sherritt looks toward EOR in Cuban fields

Sherritt International Corp., Toronto, is evaluating the commercial potential of various enhanced oil recovery technologies for its fields on the North Cuba fold belt.

The company said it is contemplating programs that involve carbon dioxide, steam, or gas reinjection. Such projects will require significant capital investment, the company noted.

The company expects its 2006 gross working interest oil production to be flat with 2005 production.

Sherritt plans capital spending of $44 million in the quarter ending Sept. 30, up from $33 million in the quarter ended June 30. It is on track for the planned $140 million in capital outlays in 2006.

Meanwhile, Sherritt plans to drill a multilateral appraisal well at Majaguillar-Corajol, an oil field discovered in 1996 east of Cardenas.

Three rigs are drilling development wells in Santa Cruz field, four rigs are running in other fields, and an exploration well is under way at Playa Larga (see map, OGJ, Jan. 7, 2002, p. 38).

Processing - Quick TakesShell to build ethylene cracker in Singapore

Shell Eastern Petroleum (Pte.) Ltd. announced a final investment decision to construct an ethylene cracker on Bukom Island, Singapore. The value of the project was not specified.

The Shell Eastern Petrochemicals Complex will be an integrated refinery and petrochemicals project that includes modifications and additions to the 458,000 b/cd Pulau Bukom refinery and a new 750,000-tonne/year monoethylene glycol (MEG) plant on Jurong Island.

The cracker and MEG plant will be integrated with the Bukom refinery. The 800,000 tonne/year cracker will supply products to the MEG plant.

Construction on the ethylene cracker is slated for later this year with start-up anticipated during 2009-10.

Brisbane refiner to get diesel hydrotreater

Caltex Australia Petroleum Pty. Ltd., Sydney, has let a contract to Haldor Topsoe for a grassroots 3,000-tonne/day diesel hydrotreater at its 105,000 b/d Lytton refinery in Brisbane, Australia.

Haldor Topsoe will provide license, basic engineering, reactor internals, catalyst, and technical services for a unit to produce diesel with a maximum 8 ppm sulfur in 2009 as required by the Australian government.

The refinery’s diesel hydrotreater unit currently is producing diesel to the new limit of 50 ppm sulfur, down from 500 ppm in 2005.

Frontier producing ULSD at Kansas refinery

Frontier El Dorado Refining Co. has begun ultralow-sulfur diesel production from a new diesel hydrotreater at the company’s 110,000 b/cd El Dorado refinery in Kansas.

Frontier is licensing the ULSD process from Haldor Topsoe AS, Lyngby, Denmark.

The 24,000 b/d hydrotreater operates on a blend of coker diesel, FCC light cycle oil, and straight run diesel, with 15,000-18,000 b/d (63-75%) of the total throughput cracked stocks. Topsoe provided a reactor design package, catalysts, and reactor internals for this unit.

Statoil launches biodiesel in Sweden

Statoil ASA expects to reduce carbon emissions in Sweden by 115,000 tonnes/year by replacing 46 million l./year of diesel with a biodiesel containing 5% rape methyl ester (rapeseed oil).

On Aug. 1 the company began adding 5% of the renewable fuel to diesel sold at the company’s retail outlets in Sweden. Statoil also sells rapeseed oil-enhanced diesel at four Norwegian outlets.

The fuel, derived from rape oil, is added to diesel and marketed as Biodiesel 5, which will replace standard diesel sold at Statoil’s retail outlets and truck diesel facilities this fall. Statoil said all diesel-powered vehicles could run on Biodiesel 5 with no required engine adjustments.

Transportation - Quick TakesFirst oil piped through China-Kazakhstan line

PetroChina has successfully transported its first shipment of crude oil along the 963-km China-Kazakhstan pipeline to its oil tank farm and refinery in northwestern Xinjiang Uygur Autonomous Region.

The arrival of the oil July 29 marks the full commercial operation for China’s first cross-country crude pipeline.

The 10-million tonne/year pipeline originates at Atasu in west Kazakhstan, enters China at Alashankou port on the Sino-Kazakhstan border, and terminates at PetroChina’s Dushanzi Petrochemical Co. site.

Diesel-biodiesel mix moves through pipeline

Countrymark Cooperative Inc. claimed a US first for moving soy biodiesel blended with conventional diesel through a private pipeline.

Its 8-in., 238-mile pipeline carried 210,000 gal of a blend of 5% biodiesel and 95% conventional diesel from the 23,500 b/d refinery it operates in Mount Vernon, Ind., to a terminal in Jolietville, Ind.

Qatar, Shell launch Pearl GTL project

Qatar Petroleum Co. and Royal Dutch Shell PLC have launched the Pearl gas to liquids (GTL) project in Qatar’s Ras Laffan Industrial City.

Shell will fund 100% of the project, which is now estimated to cost $18 billion-triple the original estimate. The award of various engineering, procurement, construction, and management contracts for execution of the world-scale project has begun, Shell said.

The Pearl GTL complex will have two 70,000 b/d GTL trains and associated facilities. Products will include naphtha, diesel-like GTL fuel, normal paraffins, kerosine, and lubricant base oils.

The GTL plant will receive dry gas from a processing plant that will extract about 120,000 boe/d of condensate, LPG, and ethane from 1.6 bcfd of production from offshore North field.

Production from the first train is expected to begin in 2009-10, with start-up of the second train due a year later.