OGJ Newsletter

Alaskan lawmakers hold session on gas line

Alaska’s legislature convened in special session in Juneau July 12 to discuss issues about partial state ownership of a proposed pipeline to carry gas from the North Slope to the Lower 48.

Gov. Frank H. Murkowski called the session to address a proposed 20% income tax on oil producers associated with a proposed gas pipeline contract agreement (OGJ, Mar. 6, 2006, p. 32).

In a previous special session that ended last month, lawmakers could not agree on how much to tax oil company profits. Murkowski also wants lawmakers to lock in a tax for 30 years as part of a gas contract under the state’s Stranded Gas Development Act.

On May 10, Murkowski made public for the first time a draft gas-pipeline agreement between the state and the three North Slope producers: BP PLC, ConocoPhillips, and ExxonMobil Corp.

DOE selects UT, MIT tight gas R&D projects

The US Department of Energy has selected projects from the University of Texas at Austin and the Massachusetts Institute of Technology as cost-shared research and development efforts targeting low-permeability or tight gas formations.

Tight gas represents the largest of three domestic unconventional gas resources, the other two being coalbed methane and gas shales, DOE’s fossil energy office said.

DOE said tight gas production represented about 40% of total US output in 2004 but could grow to as much as 50% by 2030 if advanced technologies are developed and implemented.

The agency said UT Austin’s project would focus on potential techniques to enhance the fracturing process, while MIT would examine methods to better locate naturally fractured sweet spots in tight gas formations.

Algeria working on windfall profits tax

Algeria is working toward implementing a windfall profits tax retroactively on oil and gas contracts signed under an old energy law. The proposed change would be made through amendments to a new law.

Chekib Khelil, Algeria’s energy and mines minister, mentioned the proposed changes during a July 12 briefing at Chatham House (Royal Institute of International Affairs) in London. He did not outline specifics about the suggested tax.

In response to questions, Khelil acknowledged that “it’s possible” the proposed change could discourage investment by international oil companies. “It’s a political decision.”

Algeria’s cabinet approved a bill earlier this month to ensure state oil company Sonatrach keep a major upstream role. The amendments must be passed by the parliament and approved by President Abdelaziz Bouteflika to become law.

Algeria’s reformist hydrocarbons law, passed in 2005, reduced the level of participation Sonatrach could claim in production-sharing agreements. The amendment is aimed at preserving hydrocarbons for Algeria’s future generations, Khelil said.

Venezuelan oil exports to US down 6%

Venezuela’s oil exports to the US decreased by 6% in the first quarter of 2006, according to the US Department of Energy. Venezuela shipped 178.2 million bbl of oil and oil products to the US in the first quarter, compared with 190.1 million bbl in the same period of 2005.

State-owned Petroleos de Venezuela SA (PDVSA) is sending more oil tankers to India and China-seven times more distant than US markets, a traditional importer of some 60% of Venezuela’s oil exports (OGJ Online, July 13, 2006).

Venezuela accounts for about 11% of US oil imports and owns five refineries in the US through PDVSA subsidiary Citgo. Capacities total about 750,000 b/d-4% of the US total.

Venezuela has signed new oil export contracts with China, India, Jamaica, Haiti, Paraguay, and Bolivia even though Venezuela’s oil production has not increased.

PDVSA also has suspended sales to 2,000 gasoline stations that operate under Citgo’s brand. Citgo must purchase 130,000 b/d of oil from other refiners to distribute to its 13,000 US retail outlets, which it doesn’t own. According to Citgo, it “is no longer attractive” to maintain distribution of oil products to its outlets in several American states.

Citgo made the decision to interrupt part of its distribution after Venezuelan President Hugo Chavez claimed that the PDVSA subsidiary’s businesses indirectly subsidize the US economy.

During the next 8 months Citgo will withdraw from Iowa, Kansas, Kentucky, Minnesota, Missouri, Nebraska, North Dakota, Ohio, Oklahoma, and South Dakota and will diminish sales in Illinois, Texas, Arkansas, and Iowa.

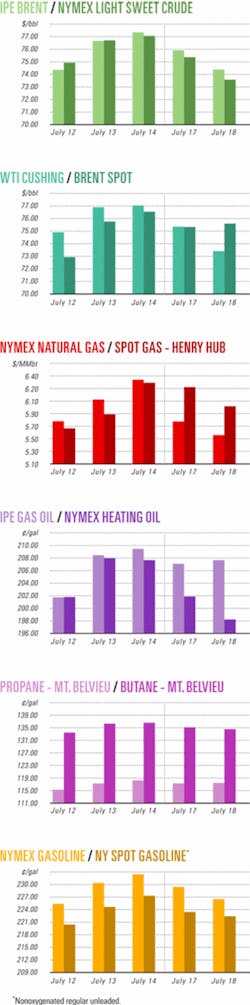

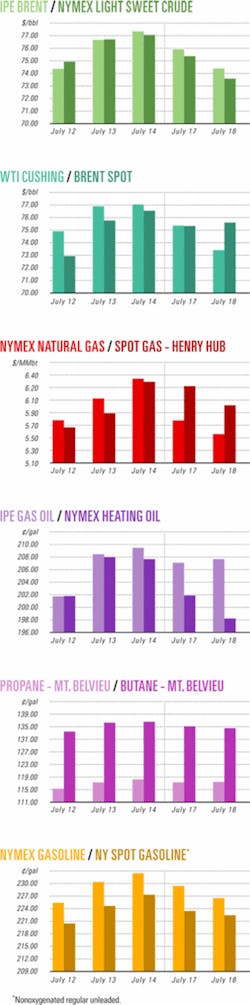

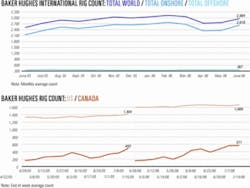

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesFox-hailed deepwater well a modest gas find

Noxal-1, a deepwater Gulf of Mexico well trumpeted in March by Mexican President Vicente Fox as being a major oil discovery, appears to be a modest gas find.

Speaking on Mar. 14 from the drilling rig in 935 m of water 63 miles off Coatzacoalcos, Fox said the then as-yet-untested well had the potential to produce 10 billion bbl of oil (OGJ, Apr. 17, 2006, p. 35). However, after the well operated by state-owned Petroleos Mexicanos reached a total depth of 4,000 m, the fourth interval tested has flowed 9 MMcfd of gas from a reserve estimated at 245 bcf, said IHS Energy, Houston.

Noxal-1 is a new field wildcat in the Catemaco fold belt, previously considered an oil-prone sector of the Sureste basin. It is Mexico’s first deepwater gas discovery.

The new producing region is to be known as Coatzacoalcos Profundo, or deepwater Coatzacoalcos, IHS Energy said.

Petrobras Santos basin well taps light oil

A well drilled by Petroleo Brasileiro SA (Petrobras) and partners encountered light oil in ultradeep water in a frontier section of the Santos basin 250 km off Rio de Janeiro.

The well, designated 1-BRSA-369A-RJS (1-RJS-628A), is not yet completed. It is expected to reach a TVD of 6,000 m in 2,140 m of water on the BM-S-11 Block.

Petrobras called the well Brazil’s first to penetrate an evaporitic salt sequence more than 2,000 m thick.

Drilling followed a study at the Petrobras Research and Development Center in Rio de Janeiro of drilling and casing plans for the first of four deep exploratory wells in the Santos basin that would penetrate salt (OGJ, June 5, 2006, p. 36).

Qannik satellite tested on North Slope

ConocoPhillips and Anadarko Petroleum Corp. reported the discovery of and test production from the Qannik oil accumulation overlying Alpine oil field on the Alaskan North Slope.

The Qannik deposit was tested for 19 days in June by the CD2-404 well, which flowed an average 1,200 b/d of 30° gravity oil from a 25-ft thick sandstone at 4,000 ft subsea.

The Qannik accumulation would be the third satellite field to be developed near Alpine. The previously announced Fiord and Nanuq satellites are currently being drilled with first production scheduled for later this year (OGJ Online, Jan. 3, 2005).

Current plans are to develop Qannik from the Alpine CD2 drillsite. First production could occur by late 2008.

Chevron reports gas find on North West Shelf

ChevronTexaco Australia Pty. Ltd. reported an indicated gas discovery at its Chandon-1 wildcat on permit WA-268-P in the Greater Gorgon region of the North West Shelf off Western Australia.

It did not run tests but called the discovery “sizable” on the basis of the well logs.

Consequently, there is no knowledge of the carbon dioxide content, although the new find is geographically closer to the Io-Jansz gas complex than to Gorgon field. Io-Jansz has about 2% CO2 and is less problematic than Gorgon, which has 12-14% CO2.

The Chandon-1 wildcat was drilled in 1,200 m of water about 260 km from the coast and 30 km northwest of Io-Jansz.

Several wells around the Greater Gorgon area are intended to back up the Chevron group’s reserves for the proposed Jansz development. Greater Gorgon gas reserves (before Chandon-1) total 40 tcf.

Chevron has appealed recent recommendations by the Western Australia Environmental Protection Agency against the Gorgon-Jansz development and LNG project on Barrow Island and is awaiting a government decision on the matter (OGJ, June 12, 2006, Newsletter).

The company is spending $190 million this year on all its North West Shelf permits in a program that involves 11 exploration and appraisal wells and 8,500 sq km of 3D and 2D seismic survey.

Lukoil starts development on Uzbek block

Lukoil Overseas has started development drilling in the Khauzak contract area of Dengizkul gas field in southwestern Uzbekistan.

Khauzak is the first field to be developed under the Kandym-Khauzak-Shady-Kungrad production-sharing agreement (PSA) signed in midyear 2004 by a group of investors including Lukoil Overseas (90%) and Uzbekneftegaz (10%) (OGJ Online, Nov. 29, 2004). The consortium’s share in profit production is 50%.

Original gas in place in the contract area is estimated at 329 billion cu m (bcm). Commercial production is expected to start in fourth quarter 2007. Peak gas production will exceed 10 bcm/year, while cumulative production could reach 207 bcm of gas, Lukoil said.

Lukoil formed Lukoil Uzbekistan Operating to oversee project management and will create a marketing company for joint sales of production.

China’s TUHA is the drilling contractor. The partners plan to drill 37 development wells on the Khauzak contract area.

The Kandym-Khauzak-Shady-Kungrad project involves drilling of more than 180 development wells and construction of more than 1,500 km of pipeline. The project also involves construction of an 8 bcm/year capacity gas processing plant in the Kandym area.

Total well confirms oil discovery off Texas

Total SA has confirmed an oil discovery with its Alaminos Canyon Block 856 No. 2 appraisal well drilled in 7,800 ft of water to 15,625 ft TD about 140 miles off Texas. The well found 85 ft of oil pay in the main objective.

Total said the new well confirms the extent of the structure discovered by its Alaminos Canyon Block 856 No. 1 well, which it tested earlier this year. That well was drilled to 14,600 TD in 7,600 ft of water and encountered 290 ft of oil pay in two zones (OGJ Online, May 4, 2006).

Hess logs oil pay in deepwater gulf well

Hess Corp. said wireline logs of its deepwater Pony prospect on Green Canyon Block 468 in the Gulf of Mexico indicate 475 ft of oil-saturated sandstones in Miocene age reservoirs. Hess drilled the well to 32,448 ft TD.

Hess next will drill a sidetrack appraisal well about 4,000 ft to the northeast of the wildcat. It will cut whole rock cores and run wireline logs in the sidetrack. The acreage lies in 800-1,599 m of water.

Trindad and Tobago delays bid round again

Trinidad and Tobago has announced another delay in the closing of bids for exploration licenses for 11 onshore and nearshore blocks.

Helena Innis-King, director of resource management at the Ministry of Energy and Energy Industries, said there was steady interest in the blocks from major oil and gas companies and large independents. The government, however, was trying to maximize benefits from the new production-sharing contracts (PSCs) that it will have to negotiate with companies when the blocks are eventually awarded.

Citing record crude prices, Innis-King told OGJ, “We are getting a fair amount from our present PSCs, which are much better than the old E&P licenses we had with the likes of BP (Trinidad & Tobago). But we feel can get more at the upper end, and that is what we are going for.”

Originally scheduled to close Mar. 31, the deadline has been extended three times and is now due to close Aug. 28.

Drilling & Production - Quick TakesHusky boosts White Rose field production

Husky Energy Inc., Calgary, has increased production of White Rose oil field off Newfoundland to 110,000 b/d by bringing a fifth well online.

Crude oil from the White Rose SP1 well, 350 km southeast of St. John’s, began flowing in late June to the SeaRose floating production, storage, and offloading vessel.

Husky will conduct performance tests on the SeaRose FPSO to determine its productive capacity and during the third quarter will apply to the Canada-Newfoundland and Labrador Offshore Petroleum Board to increase the annualized production limit above the currently approved 100,000 b/d (OGJ Online, July 3, 2006, Newsletter).

A sixth production well, scheduled to come on stream at yearend, is expected to increase White Rose production capacity to 125,000 b/d of oil.

Qatar launches Al Khaleej gas project phase

Qatar Petroleum Co. and ExxonMobil Middle East Gas Marketing Ltd. have signed a development plan and initiated the second phase of the Al Khaleej Gas (AKG-2) project in giant offshore North field.

AKG-2, estimated to cost more than $3 billion, is scheduled to be operational in 2009. It is expected to produce 1.58 bcfd of wet gas and recover associated condensate and natural gas liquids for local sale. The project will yield about 1.25 bcfd of sales gas; 15 million bbl/year of field condensate; 1 million tonnes/year of , including propane, butane, and plant condensate; and 870,000 tonnes/year of NGLs ethane for use as petrochemical feedstock.

The AKG-2 development will involve the construction of offshore and onshore facilities, including two wellhead platforms, gas treating and liquids recovery facilities, and fractionation operations.

The first phase of Al Khaleej Gas (AKG-1) began production of 750 MMcfd pipeline sales gas in November 2005.

Avouma platform in place off Gabon

The production platform for Avouma oil field off Gabon has arrived at the field, Pan-Ocean Energy Corp. Ltd. said.

Production is to start late this year from two horizontal wells at 10,000 b/d (3,136 b/d net to Pan-Ocean). Drilling is expected in October.

Avouma will be the second field on the Etame Marin Permit to come on production. Etame field produces 18,000 b/d.

A 16-km pipeline connecting the Avouma platform with a floating production, storage, and offloading facility on Etame field is expected to be completed soon, Pan-Ocean said.

Pan-Ocean said Etame coventurers received Gabon government approval for an exclusive exploitation area around the Ebouri discovery. A development plan is expected to be filed with the government in September.

Ebouri oil field is expected to come on stream in late 2007 at 5,000 b/d.

Statoil modifying platforms for Tyrihans field

Statoil ASA has awarded a 440 million kroner contract to Norway’s Aker Reinertsen-a joint venture of Aker Maritime ASA and Reinertsen AS-to integrate development of Tyrihans oil and gas field onto the Kristin and Aasgard B platforms in the Norwegian Sea.

Tyrihans gas will be processed on Kristin, and liquids on Aasgard B for transfer to Aasgard C storage and offloading (OGJ, Mar. 13, 2006, Newsletter).

The contractor will build and install a new manifold module for receiving the Tyrihans well stream on Kristin, a tie-in to existing systems, and a new outlet facility for gas injection on Aasgard B, including a gas meter. Gas from Aasgard B will be injected into the Tyrihans reservoir for pressure support.

In addition, the company will install equipment for direct electric heating of the tubing and electrical equipment for the newly awarded subsea water injection pumps (OGJ Online, June 16, 2006).

The work will begin immediately and complete by yearend 2008. Some steel fabrication will take place at Aker Reinertsen’s workshop in Murmansk, Russia.

Tyrihans reserves are put at 182 million bbl of oil and condensate and 34.8 billion cu m of rich gas. Its development will cost about 14.5 billion kroner.

Production will begin in 2009 when spare capacity is available in Kristin’s topside facilities.

Processing - Quick TakesConocoPhillips mulls building UAE refinery

ConocoPhillips and International Petroleum Investment Co. (IPIC) of Abu Dhabi agreed to conduct a feasibility study regarding construction of a 500,000 b/d refinery in Fujairah, UAE.

If the firms decide to proceed with the project after completion of the study, it is expected that ConocoPhillips and IPIC would form a joint venture to own and operate the refinery, with IPIC owning 51% and ConocoPhillips holding 49%.

ConocoPhillips and IPIC also signed a memorandum of understanding to identify upstream and downstream opportunities for joint investment.

ONGC shelves refinery plans in Rajasthan

India’s state-owned Oil & Natural Gas Corp. (ONGC) has placed on hold plans to build a 7.5 million tonne/year refinery near Barmer to handle crude oil produced in Rajasthan state, citing costs estimated at $1.96 billion.

Rajasthan crude would be available for only a limited period, ONGC said, and the cost of importing crude for an inland refinery would be prohibitive.

The company said it could instead transport the heavy, waxy crude from Rajasthan to a subsidiary, Mangalore Refinery & Petrochemicals Ltd. (MRPL), for processing in India’s southern Karnataka state. ONGC proposes a specialized pipeline to Mundra port in Gujarat for further shipment to MRPL’s refinery.

ONGC is negotiating a long-term sales and supply agreement between MRPL and Cairn Energy PLC, Edinburgh, its partner in an oil and gas block in Rajasthan. Cairn operates the block, holding a 70% share, while ONGC owns 30% (OGJ, Jan. 23, 2006, p. 35).

ONGC is seeking concessions from Cairn, including a $4-5/bbl discount on the crude, arguing that it would otherwise be uneconomical to transport it to MRPL. Cairn, however, wants an international price. It expects first production of 150,000 b/d of oil at yearend 2008.

BASF-Sinopec JV to expand Verbund capacity

BASF-YPC Co. Ltd., a 50-50 joint venture of BASF AG and China Petroleum & Chemical Corp. (Sinopec), plans to expand the capacity of a 600,000 tonne/year steam cracker and invest in additional downstream plants at the chemical Verbund site in Nanjing, China.

The $500 million project involves expanding the steam cracker’s capacity to 750,000 tonnes/year of ethylene. Also, plans call for expansion of the ethylene oxide (EO) plant and development of EO derivatives, development of the C4 value chain, including C4-specialties, and extension of the acrylics value chain to produce super-absorbent polymers.

The expanded facilities are expected to come on stream in 2009.

Transportation - Quick TakesBTC oil pipeline commissioned

Azerbaijan, Georgia, and Turkey officially inaugurated the Baku-Tbilisi-Ceyhan oil pipeline July 13 at Ceyhan, Turkey (see map, June 27, 2005, p. 61).

The pipeline, early envisioned as part of a US strategy to diversify the sources and flow of oil imports, is expected particularly to increase the efficiency of the European energy market. The first shipment of oil from the pipeline was loaded onto the British Hawthorn oil tanker in June.

Turkish Prime Minister Recep Tayyip Erdogan noted that the world’s energy demand is expected to grow 60% by 2030, increasing the importance of the 1-million b/d line.

The BTC pipeline extends 443 km through Azerbaijan, 249 km through Georgia, and 1,076 km through Turkey to the Ceyhan marine terminal on the Mediterranean.

Millennium gas pipeline project faces delays

Columbia Gas Transmission Corp. (CGT), a unit of NiSource Inc., and operator of the Millennium natural gas pipeline project, said it has informed the US Federal Energy Regulatory Commission that the anticipated Nov. 1, 2007, in-service date for the proposed Millennium Phase 1 project will be pushed back to Nov. 1, 2008.

In a joint letter to FERC, the project partners urged the agency to continue on its current review schedule to assure all necessary regulatory approvals are in place to enable preconstruction or construction activities during 2007.

Along with CGT, Millennium Pipeline Co., Empire State Pipeline Co., Empire Pipeline Co., Algonquin Gas Transmission System, and Iroquois Gas Transmission Systems LP are involved in the project.

In early 2004, CGT announced plans for a two-phase delivery expansion whereby Buffalo, NY-based National Fuel Gas Co.’s Empire State Pipeline will be a key upstream supply link and Brooklyn-based KeySpan Corp., a major new anchor customer (OGJ, Feb. 23, 2004, Newsletter).

Phase 1 will transport 500 MMcfd of gas from the Dawn, Ont., trading hub and several supply and storage basins and includes the upgrade of a 186 mile Corning-Ramapo, NY, pipeline section on Millennium, which will replace an existing CGT line, and an 83 mile extension of the 24-in. Empire system from a point near Rochester to Corning, NY. Empire connects to the TransCanada PipeLines Ltd. system at Chippawa on the US-Canada border.

Trunkline LNG lets contract for terminal upgrade

Trunkline LNG Co. has awarded a contract to Mustang Engineering Inc., Houston, to provide engineering design, procurement, and construction management services for a $250 million enhancement of Trunkline’s Lake Charles, La., LNG terminal. Operation is scheduled for third quarter 2008.

Mustang will install its LNG vaporization technology designed to increase fuel efficiency and cost savings by using ambient air temperature to warm and regasify the LNG. This will reduce the amount of fuel needed for the regasification process.

Mustang also will install a natural gas liquids extraction plant to recover ethane and other heavier hydrocarbons from the LNG stream, increasing the terminal’s sendout flexibility. Because of the worldwide variability in LNG composition, adding the ability to extract NGLs will allow the terminal’s customer BG LNG Services to import supply from more diverse locations. The terminal has a storage capacity of 9 bcf of natural gas equivalent.

This project is supplemental to the Phase I capacity expansion completed Apr. 5 and the Phase II expansion completed July 8. Phase II has increased the terminal’s peak gas sendout capability to 2.1 bcfd from 1.5 bcfd and firm sustained sendout capability to 1.8 bcfd from 1.2 bcfd. Trunkline also added unloading arms to the berth under Phase II.