Coalbed methane expands in Canada

Commercial production of coalbed methane (CBM) started only recently in Canada, but this unconventional natural gas resource is now a potentially significant contributor to Canada’s future energy supply.

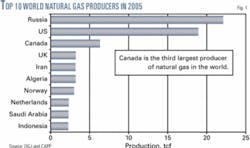

After a decade of rapid production growth through the 1990s, Canada is the third largest natural gas producer in the world at 17.3 bcfd (Fig. 1), supplying both domestic and export markets. The Canadian Association of Petroleum Producers (CAPP) forecasts a record 17,700 gas wells will be drilled in the Western Canada Sedimentary Basin (WCSB) in 2006. During the 1990s, Canadian producers drilled an average of 3,800 gas wells/year.

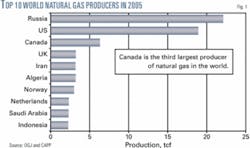

CAPP forecasts that 4,000 of the total gas wells drilled in 2006 in the WCSB will target CBM (Fig. 2). To put that in perspective: Before 2006, the industry drilled about 6,000 CBM wells in Alberta and British Columbia.

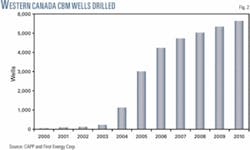

To date, Alberta has the only commercial CBM production in Canada. At 500 MMcfd, CBM will account for an estimated 3.6% of Alberta’s total gas production in 2006 but is predicted to reach 1.6 bcfd by 2010 and 2.5 bcf/d by 2015 (Fig. 3).

In Alberta alone, the estimated CBM resource is more than 500 tcf with 167 tcf deemed recoverable. This relatively untapped resource is close to a well-established infrastructure that will allow producers to supply CBM to the huge North American gas market.

Producers recognize that any significant increases in gas production in Western Canada and much of the ability to maintain current supply will come from unconventional sources such as CBM, tight sands, and gas shales as the conventional basin matures.

As in other countries developing CBM, for this resource to become a major component of Canadian gas supply, industry must address a number of environmental and landowner concerns.

Fortunately, Canada has an excellent regulatory system in place and the industry can adapt existing conventional oil and gas technology as well as CBM technology to address many of these concerns.

Production history

The industry paid little exploration attention to coalbed methane for much of the first century of oil and gas development in Western Canada because of the easy access to conventional sources of natural gas.

In Alberta, producers have been evaluating the prospect for CBM development since the 1970s. As industry became more interested in the CBM potential of Canada, various governments began to develop regulations related directly to CBM development.

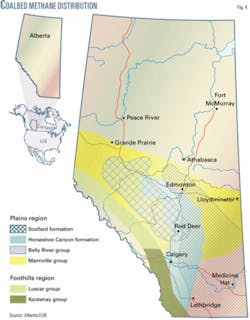

The Alberta Energy and Utilities Board (EUB) issued regulations about CBM development in the 1990s, complementary to the existing regulatory regime for natural gas development. Commercial CBM production, however, did not start on a significant scale until 2002 with the initial developments in the Horseshoe Canyon formation in the southern Alberta plains region (Fig. 4).

Throughout the world, coal-bearing basins with CBM potential have unique geological conditions that determine the technology needed to enable economical gas production. The CBM potential of the WCSB, particularly the shallow coals of the Horseshoe Canyon formation, has properties markedly different from established CBM-producing basins in the US.

For example, more than 90% of current CBM production in Alberta is from dry coals that have almost no water in their fractures and do not require dewatering. To achieve economic production rates, operators typically commingle gas flow from multiple coal seams in the wellbore. This is a major difference from other CBM-producing areas where water production (dewatering) is an integral component of the gas production and where water handling and disposal are potentially major concerns.

In most cases in the WCSB, particularly in the multiseam Horseshoe Canyon play, gas production per well is low. Forecasts, however, indicate that the wells will remain productive for as long as 20-40 years-an attractive characteristic compared with the large production declines per well from conventional pools in the WCSB.

Drilling, completion, and testing of CBM wells in Canada typically require a short duration and often are followed by a quick installation of pipelines and facilities.

Resource characteristics

Alberta, eastern British Columbia, and southeast Saskatchewan coal deposits of varying ages are widespread. Coal within these geographic regions has variable depositional, geological, and geographical settings as well as unique compositional characteristics. The resultant CBM resources vary greatly among townships.

The major coal-bearing formations in the prairies are, from youngest to oldest, the Scollard, Horseshoe Canyon, Belly River, and Mannville. The coal-bearing strata in the foothills and mountain regions of western Alberta and eastern British Columbia are the Mist Mountain formation in the south and the Coalspur and Luscar group or other similar formations in the northwest.

Canadian CBM activity and production in recent years have focused on Alberta’s Horseshoe Canyon and Belly River formation coals. Much of this activity is in the 300-km corridor between Calgary and Edmonton in south-central Alberta.

Most Horseshoe Canyon and Belly River coals are referred to as dry coals. Commonly in areas where the overlying Horseshoe Canyon coals are prospective for CBM, well completions also include Belly River group coals. Where the Belly River coals occur in the absence of the shallower Horseshoe Canyon coals, the coals have not had extensive evaluation. Relative to the laterally extensive, well-developed coal seams of the Horseshoe Canyon formation, the Belly River coals tend to be thin and discontinuous.

Lying stratigraphically above the Horseshoe Canyon formation are the thick, laterally extensive coals of the Scollard formation. In the plains region, these coals commonly are referred to as the Ardley coal zone.

The Ardley coals have similar coal characteristics as the Horseshoe Canyon coals and are in west-central Alberta. During the 1990s, numerous companies conducted preliminary exploration projects to examine the CBM potential of this area. Results were mixed, primarily due to the presence of water within the main coal seams.

The water encountered varies widely in volume and quality-in some cases, saline, and in others, nonsaline. Because of this uncertainty, most of these wells remain shut in awaiting guidance from the Alberta Environment Ministry on how or whether these wells can be produced if they contain nonsaline water.

In the plains region of Alberta, companies also are exploring for the deep CBM resources of the Mannville formation. Mannville coals, with a resource in place of close to 300 tcf, contain more gas than all of Canada’s other coals combined. The play has seen numerous exploratory wells drilled and several ongoing pilot projects. In the Fort Assiniboine region northwest of Edmonton, commercial production of Mannville CBM predominantly involves horizontal drilling technology.

Mannville formation coals generally contain very saline water. Operators have to pump out this saline water from the coal to reduce the pressure in the seams and allow gas production. Consequently, CBM developments in the Mannville coals require additional water lifting, handling, and disposal infrastructure, including wellsite pumping equipment, wellsite gas-water separation equipment, produced water handling equipment (including pipeline and trucking) and deep water disposal wells.

The foothills and mountain regions of eastern British Columbia and western Alberta have seen limited CBM exploration activity, and these regions have no operating commercial production projects. The geology of the coal deposits is complex structurally, and the topography leads to significant problems for developing the CBM resources.

Public considerations

As with all oil and gas developments in Canada, CBM development must be managed responsibly. Various provincial government departments, such as Alberta Energy and the EUB in Alberta and the Ministry of Energy, Mines, and Petroleum Resources in British Columbia regulate Canada’s oil and gas industry.

The oil and gas industry has a long history in Western Canada and all aspects of petroleum development have been regulated closely for many years. Regulations require effective environmental protection for groundwater, surface water, produced-water disposal, emissions and waste management, land disturbance, and reclamation. The Canadian oil and gas industry has adapted technologies and operating practices to meet these requirements.

With the increase in the number of wells drilled annually in Western Canada, particularly in Alberta, stakeholders have expressed concern that the number of well sites, roads, pipelines, compressors, and other infrastructure have cumulative effects on private and public lands.

Development of shallow CBM resources in central Alberta has been the focus of much of this attention, specifically relating to shallow groundwater resources. In recognition of these concerns, the provincial government in May 2006 accepted a number of recommendations from a report from the provincially appointed CBM Multistakeholder Advisory Committee (MAC) designed to enhance regulation of CBM development in Alberta.

One key recommendation in the MAC report was development of a Best Management Practice (BMP) document to guide industry in developing this resource. Industry has taken the lead in development of the BMP, published by CAPP in May 2006, with input from all the stakeholders represented at the MAC.

This BMP will assist greatly not only the industry, but also the regulators and the general public, who can use it as a guide to what performance they should expect from industry and what they should discuss when approached by industry to develop the resource.

Focus on water

Water has become a primary focus of public concerns about CBM development, primarily in the south-central region of Alberta where the Horseshoe Canyon formation coals are being developed. The province’s MAC report included more than a dozen recommendations focused on water protection.

The oil and gas industry has dealt with water production and consumption as part of developing Canada’s hydrocarbon resources for many years and does so within a regulatory environment that requires responsible use. It is important to note that this regulatory framework, administered and enforced by government departments, was established long before the water management problems cited by some as having occurred in other jurisdictions.

In believing it is critical the long-term viability of Alberta’s groundwater supply be protected, the industry has been a strong supporter of the province’s Water for Life strategy, introduced in 2002.

Industry employs a number of practices to ensure the protection of groundwater resources. For example, it isolates oil and gas wells from aquifers with cemented casing strings.

CBM well completions in the Horseshoe Canyon involve the use of nitrogen to fracture the coal seams for increasing gas flow into the well bore. A strict set of rules established and enforced by the EUB governs this fracturing process.

The oil and gas industry also is contributing to efforts to better understand and quantify Alberta’s groundwater resource. Alberta Environment is developing a complete registry of water well locations that includes whether the wells were drilled in a manner that supports the long-term viability of the aquifer, their current condition, and whether they provide an easy route for aquifer contamination.

Collected baseline data on water wells, as recommended by the province’s MAC report, will contribute to the development of a comprehensive database that will serve as a foundation for understanding Alberta’s groundwater resources.

It is important to be aware that long before coalbed methane development began in Alberta, the province had gassy water wells. Alberta Environment reports that more than 26,000 water wells drilled in Alberta have encountered coal seams, while more than 900 water wells have reported gas that is assumed to be methane. Many of these wells are not near any coalbed methane operations. Alberta Environment has not identified any water well that has encountered gas that can be traced to CBM activities.

Alberta’s oil and gas industry has been responsibly producing and disposing of salt water encountered during its operations for decades and its techniques for the development of the deep CBM resources of the Mannville formation are no different. Existing EUB and Alberta Environment regulations for managing this process and protecting the nonsaline ground and surface waters are strict and actively enforced.

Disposal of saline water can add substantial costs to the daily operations of CBM developments. Companies are developing centralized disposal infrastructure facilities to minimize these additional operational costs. They then can store the water temporarily at the facility site before injecting it into deep saline-aquifer disposal wells.

Optimistic future

The development of CBM resources is taking place within the context of unprecedented growth in Canada’s oil and natural gas industry. Almost three-quarters of the drilling in 2006 will target natural gas, reflecting a growing trend that saw natural gas accounting for two-thirds of the drilling by 2004. Record sales of petroleum and natural gas leases and licenses across Canada in 2005, including an unprecedented $544-million sale in Alberta in December, demonstrate the strength of interest in Canada’s petroleum resources. The pursuit of natural gas is a key component of that demand.

Although unconventional gas such as CBM still is a relatively small proportion of Canada’s total gas production, it is increasing rapidly and contributing to Canada’s ability to maintain its position as one of the world’s major producers of natural gas.

Acknowledgment

Sources for this article include CAAP, Canadian Society for Unconventional Gas (CSUG), Canadian Centre for Energy Information, and Government of Alberta.

The authors

John Squarek is manager, Alberta operations, for the Canadian Association of Petroleum Producers. He is a former chairman of the Small Explorers and Producers Association of Canada and a past director of the Clean Air Strategic Alliance. He previously was involved with both public and private oil and gas companies at the chief executive level. Squarek has an MBA from Adelaide University and a BS in petroleum engineering from the University of Oklahoma.

Mike Dawson is president of the Canadian Society for Unconventional Gas, a nonprofit organization that provides information on this new resource. Dawson currently is also the manager of coal gas projects with Advantage Energy Income Fund, Calgary. Previously he worked in the coal industry in Alberta before joining the Geological Survey of Canada as a research scientist studying coal resources and coalbed methane. Dawson has a BS in geology from the University of Calgary.