OGJ Newsletter

China urged to broaden onshore access

An advisory group to China’s government has suggested the country improve access by international investors to its onshore oil and gas opportunities, said attorney Mitchell Silk of Allen & Overy LLP in New York.

The Development Research Center, an advisory group to the State Council-China’s highest governing body-recently recommended this along with reduced government control over domestic energy prices, Silk said.

“The fact that this is even being considered is a step in the right direction for China,” Silk said. “If implemented, the program would not only impact the domestic Chinese market but would also send waves through the global geopolitical landscape.”

Silk does not expect a completely open Chinese market. Having worked in China for more than 20 years, he represents foreign companies investing in China and also Chinese companies investing abroad.

Foreign investors have been involved with exploration and production in the South China Sea and onshore in western China for decades. Foreign investors also have pursued opportunities in Chinese pipelines and LNG receiving terminals, but transactions involving foreign investment have been modest, he said.

Silk is watching how state-owned Chinese companies assume the role of investor and gauge political risk in other countries.

Brazil, Ecuador ink strategic alliance

Brazil’s state-owned Petroleo Brasileiro SA (Petrobras) has signed an agreement with Ecuador’s Petroecuador establishing a 5-year strategic energy alliance covering every aspect of the petroleum industry, including new exploration and production initiatives.

Ecuador’s ministry of energy said the two companies will form a joint committee to determine which projects to recommend to the two countries’ presidents.

According to Petrobras sources, primary among its interests is the exploration and development of the Ishpingo-Tiputini-Tambochocha (ITT) field complex in northern Ecuador and several blocks in southeastern Ecuador. The ITT complex is thought to contain about 900 million bbl of proven reserves, which would require $2 billion to produce.

After projects are proposed for development under the strategic alliance, Ecuador President Alfredo Palacio will decide which will be carried out under the alliance and which will be put up for international bids. Petroecuador has been told to prepare for licensing the southeastern blocks sometime next year.

Marathon to enter ethanol joint venture

Marathon Oil Corp. signed a letter of intent to form a 50:50 joint venture with The Andersons Inc., an Ohio-based company with agriculture interests, to construct and operate an unspecified number of fuel ethanol plants.

Marathon described the joint venture as an important step in maintaining the reliability of future ethanol supplies. Marathon has been blending ethanol into gasoline for 15 years.

The Andersons has interests in the grain, ethanol, and plant nutrient businesses, along with railcar leasing and repair, turf products production, and general merchandise retailing. Formation of the joint venture is subject to approval by each company’s board and the execution of definitive agreements.

The Andersons will provide day-to-day management of the ethanol plants, as well as corn supplies, risk management, and dry distillers grain and ethanol marketing services. Site selection is expected to be finalized soon for the initial plant with a nameplate production capacity of 110 million gal/year of ethanol.

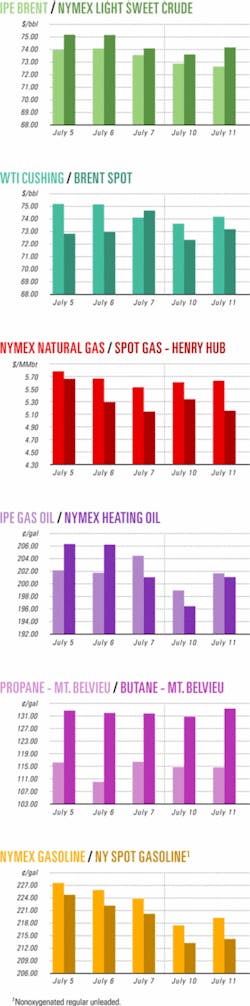

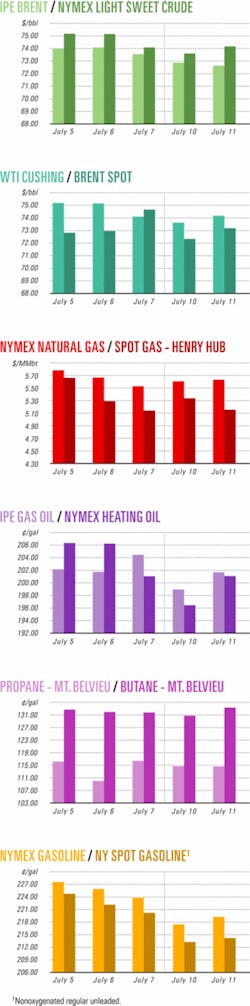

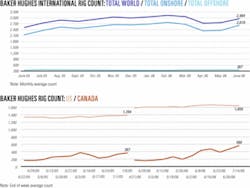

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesSinopec lets Sichuan basin imaging contract

A unit of China’s Sinopec let a contract to GX Technology Corp., Houston, to carry out a comprehensive interpretive imaging program at the largest gas field in western Sichuan Province, China.

GXT’s charge is to identify high-potential, drillable prospects based on seismic data previously acquired using parent Input/Output Inc.’s VectorSeis digital full-wave sensors. Awarded after competitive tender, it is GXT’s largest full-wave imaging project.

Input/Output had nearly 20,000 live seismic channels in operation at times during the survey to provide the sampling density needed to properly illuminate the reservoir on behalf of Sinopec’s Southwest Branch Co.

The contractor will apply a full suite of processing steps to resolve subtle reservoir properties, including mapping fracture density that is believed to correlate with well productivity. It will apply advanced noise attenuation algorithms to extract broadband, high-resolution P-wave data and image the converted shear waves, map subsurface anisotropy using a proprietary technique, and analyze shear wave splitting in the reservoirs to determine fracture orientation and intensity.

Initial imaging is starting, with final results to be delivered in first half 2007.

Eni Australia developing Blacktip gas field

Eni Australia Ltd. has begun development of Blacktip natural gas field in the southern Bonaparte Gulf of Western Australia.

Plans include two initial development wells, a fixed production platform, and a 108-km subsea pipeline to an onshore treatment plant to be built at Wadeye on the Northern Territory shore.

Blacktip, 330 km southwest of Darwin, was discovered in 2001. The onshore treatment plant will have a capacity to treat 1.3 billion cu m/year of gas.

Eni did not release a cost estimate, although an earlier plan to develop the field (with Woodside Petroleum Ltd. as operator) was estimated to cost $750 million (Aus.).

Eni bought Woodside’s stake last year for $40 million and now has 100% interest in the field, which has a reserves estimate of 1.2 tcf of gas plus 150 million bbl of condensate.

Eni has signed a 25-year agreement to sell the gas to Northern Territory’s Power & Water Corp.

Meanwhile, Sydney-based Australian Pipeline Trust (APT) has signed a $400 million (Aus.) gas transportation deal with Power & Water Corp. to pipe the gas from Wadeye across the Northern Territory to intersect the existing Amadeus basin (central Australia)-to-Darwin pipeline at a point about 150 km south of Darwin.

APT said the 227-km onshore pipeline will initially be capable of delivering 30 PJ/year of gas. Capital cost of construction is about $130 million (Aus.).

First gas from the Blacktip project is expected on stream at the beginning of 2009.

Bankers plans frac jobs in Texas Panhandle

The US subsidiary of Bankers Petroleum Ltd., Calgary, plans several fracture stimulations during the third quarter in the Palo Duro basin of the Texas Panhandle.

Bankers acquired the Palo Duro acreage through its purchase of 250,000 net acres of unconventional shale gas prospects from Vintage Petroleum LLC for $30 million in cash and stock (OGJ Online, Apr. 25, 2006). The transaction also included prospects in the Arkoma and Ardmore basins of Oklahoma, the Black Warrior basin in Mississippi and Alabama, and the Appalachian basin in New York.

Palo Duro fracture stimulations will further define the potential scope and size of the basin. In the third quarter, Bankers has scheduled two fracs of the Misener 1 well. The first is a small stimulation of the Granite Wash sands in the Lower Pennsylvanian Bend group. Two Granite Wash sands previously were perforated, and the well produced 15 b/d of oil, some gas, and decreasing amounts of water during a 5-day test.

The main frac will be of the Bend shale interval, which preliminary analysis indicates is naturally fractured in the well and has no underlying water formation.

Logs of another well in the area, Jones 1, indicate 56 bcf/section of gas in place in the Bend shale and 33 bcf/section of gas in place for the Permian Wolfcamp shale interval. Bankers intends to schedule a fracture stimulation of the Jones well in the fourth quarter.

Bankers expects to finish drilling the third well in its exploratory program, Stansell 1, soon.

Roc Oil, partners test oil well off China

Roc Oil Co. Ltd. and partners were to begin the appraisal phase of the Wei-6-12S-1 exploration well on Block 22/12 in 30 m of water in the Beibu Gulf off China.

On test, the well, drilled to 2,535 m TD, flowed at a combined, stabilized 5,750 b/d of oil from three separate hydrocarbon columns.

Roc Oil operates the well with a 40% interest on behalf of Block 22/12 Joint Venture that includes Horizon Oil Ltd. 30%, Petsec Energy Ltd. 25%, and Oil Australia Pty. Ltd. 5%.

In June, the joint venture began drilling a sidetrack, primarily to obtain core data from the oil reservoirs. Afterwards, it expects to drill a second sidetrack to intersect the various reservoir sands downdip of the discovery well 3 km away.

This sidetrack also will test the possible downdip development of a small sand section intersected in the lower part of the upper sand package in the discovery well that was not production tested but had oil recovered during wireline sampling.

Roc Oil said that the Wei-6-12S-1 well tests were designed to provide the maximum amount of technical data for possible field development rather than for maximum flow rates.

The first test in the lower sand package perforated 12 m between 2,435.5 m and 2,447.7 m of the 111 m gross column (35 m net pay) and flowed 35º gravity oil at a stabilized 1,725 b/d through choke sizes as large as 32/64-in.

The second test of the middle sand package was to obtain productivity data from the 65 m gross oil column (31 m net pay) encountered. It perforated a total of 28 m over two zones, 2,228.5-2,241.5 m and 2,201-16 m. The column produced flow at stabilized rates as high as 2,575 b/d of 39º gravity oil through choke sizes as large as 48/64-in., with no associated water production.

The third test of the upper sands was to provide productivity data from the lower part of the 71 m gross oil column (14.5 m net pay) and to determine the extent of the downdip of the oil-bearing reservoir. This test perforated 16 m between 2,054 m and 2,070 m and flowed at stabilized rates as high as 1,450 b/d of 38º gravity oil, through choke sizes as large as 44/64-in.

The test results indicate a reasonably productive reservoir, Roc Oil said, and the pressure gradient information suggests that the oil column extends downdip from the discovery well.

ONGC recaps the year’s offshore discoveries

India’s Oil & Natural Gas Corp. (ONGC) made 10 discoveries in 2005-06, including five natural gas finds in the deep waters off the Andhra coast in the Krishna-Godavari basin.

Other ONGC discoveries in 2005-06 include RV-1 in the Mumbai offshore, B-9-1 in the Saurashtra offshore, and GS-15-E in the Krishna-Godavari offshore, Turputallu-I in the Krishna-Godavari onshore, and Mekeypore-3 in the Assam shelf. ONGC said the five Krishna-Godavari basin discoveries on Block KG-DWN-98/2-D-1, A-1, U-1, W-1, and E-1-together with two earlier finds, have reserves of as much as 3 tcf of gas.

ONGC acquired Block KG-DWN-98/2 from Cairn Energy PLC, which earlier made two discoveries with reserves of slightly less than 2 tcf of gas.

Firm to explore Goose Creek

Foothills Resources Inc., Bakersfield, Calif., will seek to recover more reserves in Upper Texas Gulf Coast fields it plans to acquire from an affiliate of Texas American Resources Co.

Consideration is $62 million in cash and stock.

The acquisition includes 95-100% working interests in four fields with more than 30 productive reservoirs at 800-4,500 ft, and 4,000 gross acres of leasehold or fee interests.

Foothills Resources will operate the four fields and will immediately begin planning and permitting for a 3D seismic survey at Goose Creek and Goose Creek East oil fields at Baytown, Tex.

The 3D data are expected to lead to the identification of undeveloped opportunities and deeper oil prospects. Seismic shows direct hydrocarbon indicators over gas reservoirs in the area, and old wellbores found gas shows in Oligocene Vicksburg.

This DHI effect contributed to the discovery of two Vicksburg fields, Hematite field, which has produced 22 bcf of gas from 8 wells adjacent to Goose Creek East, and Eagle Bay field, which has produced 156 bcf from 15 wells in western Galveston Bay.

The properties being acquired produced 820 b/d from 5.1 million bbl of proved reserves.

Drilling & Production - Quick TakesAvouma platform in place off Gabon

The production platform for Avouma oil field off Gabon has arrived at the field, Pan-Ocean Energy Corp. Ltd. said.

Production is to start late this year from two horizontal wells at 10,000 b/d (3,136 b/d net to Pan-Ocean). Drilling is expected in October.

Avouma will be the second field on the Etame Marin Permit to come on production. Etame field produces 18,000 b/d.

A 16-km pipeline connecting the Avouma platform with a floating production, storage, and offloading facility on Etame field is expected to be completed soon, Pan-Ocean said.

Pan-Ocean said Etame coventurers received Gabon government approval for an exclusive exploitation area around the Ebouri discovery. A development plan is expected to be filed with the government in September.

Ebouri oil field is expected to come on stream in late 2007 at 5,000 b/d.

Syncrude to restart new coker FGD unit

Syncrude Canada Ltd. is preparing to restart a coker flue-gas desulfurization (FGD) unit at its Mildred Lake oil sands plant in Alberta, reported Canadian Oil Sands Trust.

The FGD unit has been shut down to resolve problems of odorous emissions resulting from the start of new equipment associated with Syncrude’s Stage 3 expansion project (OGJ Online, June 5, 2006, Newsletter).

Syncrude obtained regulatory approval from Alberta Environmental Protection to resume operations of the expansion facilities following modifications and other steps taken to prevent recurrence of strong odors.

The FGD start-up will be gradual so Syncrude can monitor and mitigate odors.

Once the units reach stable operation, Syncrude plans to introduce bitumen feed into Coker 8-3, probably in late-July, with incremental production from Stage 3 coming on-stream shortly thereafter.

PRB plans 300 CBM wells in Wyoming

PRB Energy Inc. plans to drill 300 Moyer coalbed methane (CBM) wells on 29,500 acres it has acquired from Pennaco Energy Inc., a Marathon Oil Corp. subsidiary, in the Powder River basin in Wyoming. Moyer is a Paleocene Fort Union coal.

The acquisition includes 630 CBM wells, fewer than 200 of which are on line and producing 2.5-3 MMcfd of gas. PRB is the principal gas gatherer for these wells.

PRB also soon will close its $1 million purchase of Storm Cat Energy Corp. natural gas gathering assets, including 70 miles of gathering lines near Recluse, Wyo. (OGJ Online, Jan. 27, 2006).

Oudna oil field to come on line off Tunisia

Lundin Petroleum and Atlantis Holding Norway AS plan to start production from Oudna oil field off Tunisia in September.

The field’s initial gross production is expected to be 20,000 b/d of 41.5º gravity oil from Miocene Lower Birsa sands. The field has estimated proved and probable reserves of 11.5 million bbl of oil (OGJ Online, Feb. 20, 2006, Newsletter).

Oudna has a single subsea production well with a 7-in. downhole jet pump tied back to a floating production, storage, and offloading vessel formerly on nearby Isis field. It also has a water injection well.

Firm to frac three wells in Chinese field

China North East Petroleum Holdings Ltd. (CNEH) soon will begin fracing three wells in Qian 112 oil field southeast of Qian’an in Jilin Province.

The Qian 5-2, 3-5, and 12-16 wells, drilled by Rising Sun Oil Exploration & Production Ltd., follow the recently completed Qian 12-14 well, which is producing 38 b/d of oil, double the expected initial output, CNEH said.

Qian 5-2, an exploration well drilled to 5,905 ft, encountered 59 ft of net pay and confirmed an additional pay stringer in an upper reservoir that was previously discovered. Logging data from Qian 3-5 and 12-16 are not yet available.

CNEH said Qian 112 field has proved reserves of 1.2 million bbl in the Cretaceous Fuyu and Gaotaizi formations. It said the Gaotaizi is the main target in the production wells.

The company currently operates 21 producers in northern China, with estimated output of 420 b/d of oil. It has a firm commitment with PetroChina’s Jilin Refinery to sell its crude oil.

CNEH Pres. Hongjun Wang said the company’s 2006 drilling program involves completion of 40 wells by the end of the third quarter. This will at least double production and revenue, he said.

By yearend 2007, the company plans to complete a further 81 wells, bringing its total producing wells to 102.

Denmark wildcat to drill on wavelet data

Tethys Oil AB, Stockholm, plans to spud its Karlebo-1 wildcat on the 533 sq km onshore License 1/02 in Denmark in late August-early September using a rig to be moved from Lithuania.

Karlebo-1 is to be drilled to 1,800-2,400 m at a site 30 km north of Copenhagen and 8 km from a gas pipeline.

The Lavo-1 well on the 1,655 sq km License 1/03 adjacent to the west and held by the same companies encountered Cretaceous, Jurassic, and Triassic sandstones with around 20% porosity.

The seismic acquisition commitment from the 1/02 license’s first phase was waived in exchange for having tested a new seismic reprocessing technique, wavelet energy absorption (WEA), on an existing seismic line (OGJ, Jan. 5, 2004, p. 32). WEA identified amplitude anomalies that correspond to the structural closure of two of the prospective reservoir horizons.

Tethys Oil is interpreting results of a late 2005 surface geochemical hydrocarbon gas survey of License 1/03.

Tethys Oil operates the licenses with 70% interest. Partners are DONG E&P 20% and Odin Energi AS 10%.

Processing - Quick TakesTotal unit to halt Antwerp elastomer production

Total Petrochemicals will cease elastomer production at its Antwerp, Belgium, facility “after several years operating in increasingly tough economic and competitive conditions.”

The Antwerp facility produces synthetic thermoplastic rubbers, which are used for bitumen modifications, technical compounds, and improving the technical qualities of some plastics.

The decision to shut production came despite Total refocusing its sales on Europe in December 2004 “in an attempt to restore the financial equilibrium of the business,” the company said.

Military aircraft to test Syntroleum fuel

The US Department of Defense has ordered 100,000 gal of Fischer-Tropsch synthetic aviation fuel from Syntroleum Corp., Tulsa, for performance testing in military turbines. The deal caps Syntroleum’s 4 years of research and development to produce an acceptable alternative fuel for military applications.

The fuel is a synthetic liquid hydrocarbon converted in the Fischer-Tropsch process from natural gas or synthesis gas derived from coal and other carbon-based feedstock (OGJ, Sept. 19, 2005, Newsletter).

DOD will evaluate the fuel, test it in a B-52 flight at Edwards Air Force Base later this year, and determine the feasibility of setting up long-term domestic manufacture and supply. The government currently is seeking up to 200 million gal of the synthetic alternate fuel, which would be supplied in 2008 from Syntroleum’s plant near Tulsa.

Transportation - Quick TakesLukoil begins new Karachaganak crude route

The Seasong tanker, chartered by an undisclosed company, departed from Ukraine’s Odessa terminal on the Black Sea loaded with 10,000 tonnes of Russian export blend crude from Karachaganak field in Northwest Kazakhstan.

This new export route allows for crude to be pumped via the Karachaganak Bolshoy Chagan pipeline to Samara. From Samara, the crude can be transported either to Black Sea or Baltic ports or directly to Central Europe via the Druzhba pipeline, subject to Transneft’s export schedule.

The initial route allowed for Karachaganak crude to depart from the South Ozereyka terminal near Novorossiysk via the Caspian Pipeline Consortium (CPC) export system (OGJ Online, July 13, 2004).

The new route resulted from an extended joint effort by Karachaganak Petroleum Operating (KPO), the international operating consortium in which LUKOIL has a 15% interest, and KazTransOil (Kazakhstan). It complements the existing Karachaganak crude shipping system through the CPC system to the Orenburg Gas Plant.

The KPO and KazTransOil long-term agreement calls for shipping volumes, currently at 20,000 tonnes/month, to be increased gradually.

Suez unit eyes LNG terminal in Chile

Suez Energy International has presented to the Chilean Mines and Energy Ministry a $700 million plan to build an onshore LNG regasification terminal in the northern part of the country. First deliveries could take place as early as July 2008.

The plan also proposes construction of two coal and petroleum coke-fired electrical power generators, each with a capacity of 200 Mw.

The first unit could come on stream in 2011.

Suez hopes to secure energy markets in northern Chile, where supplies have been destabilized by reduced gas deliveries from Argentina.

Gas tariffs have dropped as a result of the government’s switching contracts from dollars to pesos.

LNG will be supplied under Suez contracts, possibly with Yemen or Trinidad and Tobago. The LNG carrier for this project will also serve as storage.

Approval and construction of the gasification unit should take about 18 months. Capacities weren’t immediately available.

Talisman commissions Lynx gas pipeline

Talisman Energy Inc. has commissioned its 45%-owned Lynx natural gas pipeline, which will gather gas in the Grande Cache area of the northern Alberta Foothills.

The $97.5 million project consists of a 72 km, 12-in. sour gas pipeline and a 72 km, 4-in. fuel gas line extending from the Findley dehydration facility to a new Lynx dehydration facility. It has a nominal capacity of 130 MMcfd of raw gas.

The Lynx system opens about 20 townships for gas exploration, Talisman said. The company has identified 50 prospects and leads on acreage along the pipeline corridor.