Rising profits also raise pressures on producers

High oil and gas prices and record profits are generating complex challenges for producers, said Petroleum Industry Research Foundation Inc. (Pirinc) in a recent report.

Although shareholders and energy pension fund participants are benefiting from the industry’s good fortune, the Pirinc report said, a nagging public concern remains: “What is the industry doing with its higher profits to improve supply?”

Negative public opinion is encouraging governments to expand their claims on production revenues, raising political risk, and adding foreign-policy concerns.

These changes in the political climate add to pressures on the industry from near-term capacity constraint; rising costs for labor, critical services, and equipment; and growing competition from state-supported companies for promising acreage.

And because numerous state-owned producers now have enough cash to develop relatively easy prospects, said Pirinc, major private companies will be challenged to employ their experience, skill, and advanced technology to find and develop oil and gas in more-problematic areas.

Price projections

While high prices encourage short-term investment in reserves exploitation, longer-term investment decisions cannot be based solely on current prices. Because the time from securing a lease to discovery and production is usually lengthy, companies must try to determine how long crude oil prices are apt to remain at their currently lofty levels.

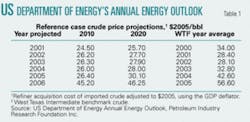

The US Department of Energy’s yearend Annual Energy Outlook (AEO) forecasts crude price projections for 2010 and 2020. Table 1 compares these with the average prices (in 2005 dollars) for the years in which the predictions were made.

“The evolution of prices over the course of the AEOs corresponds broadly to the shifts in the long-term price structure of the futures market over the same period,” said Pirinc. Although changes were small during 2001-04, the projection at yearend 2005 has substantial price variations. Projected prices are well below current near-term levels, but “since [early 2004], the futures market has been signaling increasing confidence that high prices will persist,” said Pirinc.

Income and investment

Major US and international oil companies have shown an investment pattern consistent with a long-term market perspective. This translates to a less volatile investment profile for the industry because there is less sensitivity to near-term price developments, Pirinc said.

Worldwide net after-tax income of major oil and gas producers fell about 30% during 2000-02, recovered in 2003, and jumped to nearly $60 billion in 2004 (Fig. 1). At the same time, worldwide oil and gas exploration and development spending by majors exceeded income by about $35 billion/year during 2000-02, with the slight decline each year mirroring income decline. Spending on acquisitions of acreage with proved reserves is excluded from the evaluations.

The three largest private oil companies, ExxonMobil Corp., BP PLC, and Royal Dutch Shell PLC, each reported total assets as of yearend 2004 of $191-195 billion. They were followed by Total SA at $114 billion and Chevron Corp. and ConocoPhillips at $93 billion.

Majors account for less than half of US oil and gas production, however. Income and investment cycles for independent companies more sensitive to cash flow fluctuations are more volatile. Independents generally adopt projects with shorter lead times and modify plans in response to short-term income variations. Publicly traded independents increased net income in 2005 over 2004 by 78% and oil field service companies, by 139%.

High price responses

Increased revenues from elevated oil and gas prices have encouraged producers to substantially increase exploration and development activities. This, in turn, has raised needs for equipment and personnel, the shortages of which are creating near-term capacity constraints and accelerating costs.

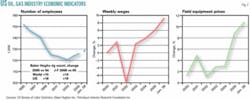

The number of employees in the US oil and gas industry declined during 1995-2003 then grew by 5% during 2004-05, Pirinc said (Fig. 2). Predictably, employment in support services grew even more-by 19% during that time.

Weekly earnings growth for the 12 months ended in January of this year approached 10% vs. about 4% for all private sector employees. And the producer price index for oil and gas field equipment, which rose 3% in 2003-04, jumped by almost 9% in 2004-05 and nearly 11% to January 2006, reported Pirinc.

Baker-Hughes reports that the worldwide rig count in 2005 was up 15% over 2004, while the first 2 months of 2006 showed a 14% gain over the same 2 months in 2005. The US rig count grew 19% over the same 2-month period.

ODS Petrodata’s semisubmersible day rate index shows even sharper cost accelerations, with rates in February more than twice the rates charged in February 2005 for rigs working in water 2,000-5,000 ft deep and twice the rates for rigs in water deeper than 5,000 ft. Fleet utilization was about 100% in both these areas, where many of the most promising and technologically challenging prospects for new oil and gas supplies are to be found.

Although such growth pressure and higher costs imply greater incentives for machinery and equipment suppliers to expand their productive capacity, Pirinc said, “in the short term, they limit the pace at which exploration and development activity can expand-in effect imposing their own ‘smoothing’ influence on the industry response to higher prices and incomes.”

Other complications

High commodity prices and long-term supply concerns also have raised US foreign-policy issues. State oil companies are limiting the exploration and production opportunities they make available to international oil companies.

They’re also growing. OAO Gazprom of Russia, Petroleos Mexicanos, Petroleos de Venezuela SA, Petronas of Malaysia, Petróleo Brasileiro SA of Brazil, and PetroChina Co. Ltd. each reported total assets in 2004 exceeding $50 billion. High oil prices reduce the immediate pressures on such companies and their governments to attract, or even accept, private investment, and there is a greater use of state-favored companies to promote supply security.

Resource-rich countries have more development options available to them than they had before prices rose and may perceive less reason to change course, said Pirinc. Flush with higher revenues, some are tightening terms, making unilateral changes to existing arrangements, and reducing their openness and attractiveness to foreign investors.

New participants

The increased role of well-financed state-owned companies in the world oil market has mixed implications for the US, Pirinc said. Additional resources for exploration and development promote greater and more diverse sources of supply in the market. But for major western companies, more participants mean more-intense competition for access to potentially less available promising acreage.

Where some state-owned companies may be acting as instruments of state policy rather than autonomous entities, this competition can go beyond simply offering better commercial terms. Governments often make partnership with their state companies a condition of access by outsiders to business opportunities in their countries. And as the state companies gain financial strength, their bargaining power grows.

“While financial strength plays a critical role, the future competitive success of the major companies rests on retaining leadership in ability to mobilize the skills and advanced technology required to find and develop resources in the more challenging environments,” said Pirinc. “Too many others already have the cash to deal with the easier prospects.”