How Kazakhstan’s contractual arrangements have changed

Two types of contractual arrangements govern E&P activity in Kazakhstan: an excess profit tax (EPT) contract, also called a Model 1 tax regime, and production sharing contracts (PSC), or a Model 2 tax regime.

Under an EPT contract, the international oil company (IOC) will typically form an operating company with the host government (HG) and carry the HG participation until discovery. If exploration is successful, the subsurface user will pay various taxes and other obligatory payments according to the tax legislation.

A subsurface user is required to pay a subscription (signature) and discovery bonus, royalty, economic rent tax on oil and gas condensate for export, excess profit tax, corporate income tax, and all other taxes. The HG contributes its proportional share of development, or may also be carried through development by the IOC.

Under a PSC, the IOC acts as contractor on behalf of the HG while still accepting all geologic and fiscal risk. If exploration is successful, the IOC expects to recover its initial investment, interest in funds before payout, and a profit commensurate with the risk of the venture.

Usually, differences of opinion arise between perceptions of risk and what each party considers a reasonable return on investment. The IOC recovers its costs from a negotiated fraction of production (cost oil), and the IOC and HG share the remaining production (profit oil) according to an agreed formula.

Under Model 2 contracts, the subsurface user is exempt from the economic rent tax, excise tax, excess profit tax, land tax, and property tax but is required to carry Kazmunaigas without investment, for a mandatory 50% participation through at least the exploratory phase.

The maximum duration of an E&P contract is 35 years and for production-only contracts is 25 years. Cost recovery is limited to 75% gross production before payback and 50% gross production after payback, where payback is defined as the time when all costs have been recovered through the cost oil.

The profit oil split is also a negotiated quantity, depending upon the perceptions of risk and estimated development cost, but the government’s total tax take must exceed at least 10% before payback and 40% after payback.

Signature bonus

Subsurface users pay signature and discovery bonuses in Kazakhstan.

The signature bonus is a single fixed payment due at the time the contract is signed for the right to use the subsurface. A discovery bonus is paid when a commercial discovery is announced on the contract territory.

The government determines the amount of the signature bonus based on the area’s geologic prospectivity. The bonus is established by a commission at the conclusion of a tender to award the subsurface rights, with the stipulation that the final amount of the bonus cannot be lower than the initial amount set by the government.

The discovery bonus is assessed at 0.1% of the value of the proven reserves contained on the contract area. The value of the mineral resources is determined using the market price of comparable crude established at the International Petroleum Exchange on the day the bonus is made (usually at Declaration of Commerciality). If the market price cannot be established, then the value of the minerals is determined from the estimated cost of extraction adjusted by the expected profitability of the field.

Royalty

Royalties are payments made to the government for the right to produce petroleum after a discovery is made.

Royalties are typically either specific levies (based on the volume of oil and gas extracted) or ad valorem taxes (based on the value of oil and gas extracted). In EPT contracts, royalty payments are calculated on an ad valorem basis and apply to each type of mineral resource extracted; e.g., oil, gas, condensate. Royalties are normally paid in cash, but in-kind payments are possible.

Value is calculated based on the average selling price in the reporting period, exclusive of indirect taxes, and reduced by the transportation expenses to the place of sale. The reporting period may be a calendar month or a quarter, depending on the volume of production. Associated gas hydrocarbons are converted to their crude oil “equivalent” using an appropriate thermal factor. Reinjected gas is exempt from royalty.

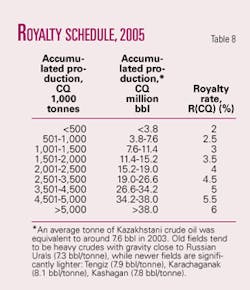

A sliding scale of royalty rates was introduced Jan. 1, 2004, and then revised under the 2005 Tax Code Amendments (Table 8). The sliding scale is an incremental scale based on the volume of accumulated oil production, including gas condensate, for each calendar year.

Economic rent tax

Legal entities and individuals exporting crude oil and gas condensate under Model 1 contracts are subject to an economic rent tax (ERT), or export tax.

The tax base is determined as the value of the exported crude netted back for transportation costs and adjusted for quality. The market price is defined by a market basket established by the government and weighted according to the average daily sales price.

The ERT is based on a sliding scale with 19 individual tranches, ranging from 1% when the price of oil is less than $19/bbl, to 33% when the oil price is greater than $40/bbl, as shown in Table 9.

Excess profit tax

Model 1 subsurface users are subject to an excess profit tax (EPT) based on net income in excess of 20% of tax deductions, with adjustments allowed for training and increased value of fixed assets.

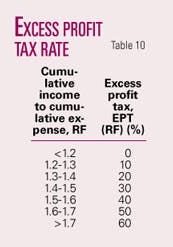

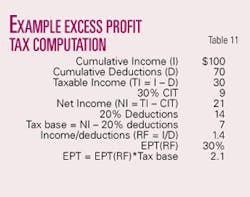

The tax rates are based on a sliding scale ranging from zero to 60% using the ratio of cumulative aggregate income to cumulative tax deductions (Table 10). An example EPT calculation is shown in Table 11.

null

Corporate income tax

Corporate income tax (CIT) in Kazakhstan is 30%. Taxable income is calculated as the difference between aggregate annual income and statutory deductions.

All expenses related to the generation of aggregate income are deductible. These expenses include interest expense; contributions to a decommissioning fund; expenditures for research and development, foreign exchange losses; social payments, insurance premiums; doubtful receivables, and charitable contributions.

Expenditures on geological studies, exploration, and preparatory operations for production (including appraisal, administrative expenses, and bonus payment) are deducted using declining balance depreciation at a rate not exceeding 25% beginning from first production. The depreciation of fixed assets is calculated in accord with their group categorization; e.g., oil and gas wells and storage facilities are depreciated using a 7-20% rate; gas flowlines and thermal energy networks under a 7-10% rate; machinery and equipment for extraction and processing a 8-25% rate. Losses may be carried forward for up to 7 years.

Branch profit tax

If a foreign company carries out business through a permanent establishment, it is assessed a 15% branch profit tax. The part of the company’s profit attributable to the establishment is taxed to the state where the establishment is located/registered.

Fiscal stability

EPT contracts written after Jan. 1, 2004, are not stabilized, meaning that they are subject to taxes and other obligatory payments in accord with the tax legislation in effect on the date the tax liabilities arise.