OGJ Newsletter

Iraq establishes buyers for Kirkuk crude

Iraq has sold 4 million bbl of Kirkuk crude to ExxonMobil Corp. and Turkish oil refiner Tupras from a tender for 6 million bbl. State oil marketer SOMO said each company would take 2 million bbl and that the remaining 2 million bbl remained unsold.

The oil sold to ExxonMobil was priced at West Texas Intermediate minus $8.15, while the 2 million sold to Tupras was priced at dated Brent minus $6.55.

The sold oil likely will be lifted during June 28-July 1. Iraqi oil officials said some 7.3 million bbl of Kirkuk crude is stored at Ceyhan, including the sold 4 million bbl.

The sale has raised hopes as Iraq looks to export around 200,000 b/d of Kirkuk oil through its June tender, boosting sales to 1.7 million b/d from around 1.5 million b/d since March-all of it from southern fields.

Shamkhi Faraj, director-general of marketing and economics at Iraq’s Ministry of Oil, said the sale to ExxonMobil and Tupras would boost the country’s export average, but that it did not necessarily signal the start of a new era.

Continued acts of sabotage against Iraq’s northern oil export pipeline system have kept exports from the north shut for most of this year and last year.

One official said Iraqi security forces have been working for some time to improve the flow of oil but that “there is no telling what will happen tomorrow.”

ExxonMobil: Sakhalin-1 exports won’t be delayed

ExxonMobil Corp. denied a report by Russia’s Interfax news agency that oil exports from the Sakhalin-1 project might be delayed until October, saying they are on track to begin by August.

Interfax earlier quoted Lev Brodsky, an official from Russia’s state-owned Rosneft-Exxon’s partner in the 250,000 b/d project-as saying the exports could be delayed to October.

“In October we plan to launch exports from De-Kastri” port in Russia’s Far Eastern Khabarovsk region, Interfax quoted Brodsky as saying, adding that Asia-Pacific will be the main market for the oil.

“The report is wrong,” said ExxonMobil spokesman Bob Davis. “The first lifting from Sakhalin-1 will be in August on schedule.”

ExxonMobil subsidiary ExxonNeftegaz Ltd. holds 30% interest in the Sakhalin-1 project.

JEC: Canada’s unconventional oil ‘good news’

Canada’s unconventional oil reserves and their accelerated development could eventually undermine the Organization of Petroleum Exporting Countries’ influence on world oil prices, suggested a report released on June 26 by Congress’s Joint Economic Committee (JEC).

“The large Canadian reserves of unconventional oil and their rapid development is very good news for consumers in the United States and around the world, said Rep. Jim Saxton (R-NJ), JEC’s chairman. “While these reserves can supply only a limited amount of oil at the current time, their development is exactly the kind of thing the OPEC cartel has hoped to avoid.”

The report noted that Canada’s 1 million b/d of production from oil sands already equals Qatar’s total oil production. “Including conventional oil, Canada’s production currently ranks seventh in the world [at] 3.1 million b/d,” it said.

Citing OGJ’s annual worldwide production report for 2005, JEC’s study said that Canada’s 174.1 billion bbl of oil sands and 4.7 billion of conventional oil reserves rank it second, behind Saudi Arabia with its 264.3 billion bbl of reserves (OGJ, Dec. 19, 2005, p. 24).

“In addition, it is estimated that as-yet unproven quantities of oil thought to be recoverable from the Alberta sands would bring potential reserves to 315 billion bbl out of a total resource base of 1.7-2.5 trillion bbl,” it added.

JEC’s study conceded that a rapid increase in the scale of oil sands production is pushing short-term costs higher. But it suggested that input markets and the infrastructure will catch up and, combined with technical advances, stabilize the cost per barrel.

“At that point, given the high reserves, the oil sands supply will set an upper limit to the world price that OPEC can no longer exceed,” it said, adding that this would not happen for at least another decade “and the timing beyond that will depend on OPEC’s output decisions in the interim.”

The report listed four conditions that it said bode well for development of Canada’s oil sand reserves:

- A privatized oil sector with assured property rights and a reasonable royalty regime.

- Oil sands producers that are price-takers and subject to laws governing competition similar to those in the US.

- Secure and efficient oil export routes.

- Transparency in oil reserve estimates, production activity, and development plans.

Repsol YPF boosts E&P spending in Argentina

Repsol YPF SA reported plans to spend $6 billion on oil and gas investments in Argentina in 2007-09.

Although production in maturing Argentine fields has fallen off in past years, Repsol YPF acquired additional 3D seismic data for Argentine fields over the past year and is earmarking $4.6 billion for oil and gas exploration and production (OGJ, Apr. 4, 2005, p. 40). Repsol YPF will partner with companies employing new secondary and tertiary production technologies and improved operating methods for mature fields.

Projects include heavy crude development onshore in the Neuquen basin and Santa Cruz province and a pilot tight gas extraction project. Repsol YPF also will expand deepwater exploration in the Gulf of San Jorge with state energy company Energia Argentina SA. A “latest-generation” platform has been contracted where the companies expect to obtain commercial gas from low permeability structures (map, OGJ, Mar. 20, 2006, p. 35). The San Jorge basin comprises 170,000 sq km, nearly 34,000 of which is offshore.

The remaining $1.4 billion will be earmarked for upgrading refineries to process heavy crudes and increase production of gas oil, and for improving fuel quality, revamping petrochemical production units, and developing biodiesel projects.

FERC gives nod to LNG projects

The US Federal Energy Regulatory Commission has approved five LNG projects expected to increase US LNG import capacity by at least 8.2 bcfd.

One of the approvals, for expansion of Dominion’s Cove Point terminal in Cove Point, Md., faces opposition.

The other approved projects include:

- BP America Production Co.’s Crown Landing terminal in Logan Township, NJ, including storage capacity of 9.2 bcf and an 11-mile pipeline. Baseload sendout capacity would be 1.2 bcfd.

- Sempra Energy’s terminal in Jefferson County, Tex., near Port Arthur, including six LNG storage tanks, each with capacity of 5.6 bcf. The project would be built in two phases with ultimate sendout capacity of 3 bcfd. Port Arthur Pipeline might lay and operate a 70-mile, 36-in. pipeline from the terminal to a connection with Transcontinental Gas Pipeline Co.’s system in Beauregard Parish, La. FERC also authorized construction of a 3-mile intrastate line from the terminal to the Natural Gas Pipe Line system.

- Expansion of Cheniere Energy Inc.’s Sabine Pass project under construction in Cameron Parish, La., including three additional 160,000 cu m storage tanks and related facilities and an increase in planned sendout capacity to 4 bcfd from 2.6 bcfd. The first phase of construction is to be complete in 2008 and the expansion in 2009.

- Cheniere’s Creole Trail terminal, also in Cameron Parish, La., including four storage tanks with a combined capacity of 13 bcf and sendout capacity of 3.3 bcfd. Also approved was construction of a 116.8-mile, 42-in. pipeline from the terminal through Cameron, Calcasieu, Beauregard, Jefferson Davis, Allen, and Acadia parishes.

The Cove Point expansion would increase sendout capacity to 1.8 bcfd from 1 bcfd and storage capacity to 14.6 bcf from 7.8 bcf. The work includes the addition of vaporizers, two pipelines, and two storage tanks.

Washington Gas Light Co. reported that it is considering an appeal to FERC’s approval of the Cove Point LNG expansion, claiming that the Commission disregarded key facts that link gas from the Cove Point terminal to leaks in a portion of its gas distribution system.

Washington Gas said it began experiencing an increased number of leaks in a 100-sq-mile area of Prince George’s County, Md., in late 2003, shortly after reactivation of the Cove Point terminal. It said independent analysis showed that a change in gas composition contributed to leaks in pipe couplings. The change in composition coincided with the introduction of gas from the Cove Point terminal, the company said.

Washington Gas is challenging FERC’s conclusion that the company’s use of hot tar as a method of corrosion protection and an increase in operating pressure “were the principal causative factors” for the increased leaks.

Washington Gas said, “The increase in leaks has only occurred in the area that consistently receives Cove Point gas as its sole source of supply.” It added that its “operating pressure has remained constant in the affected area since the mid-1980s.”

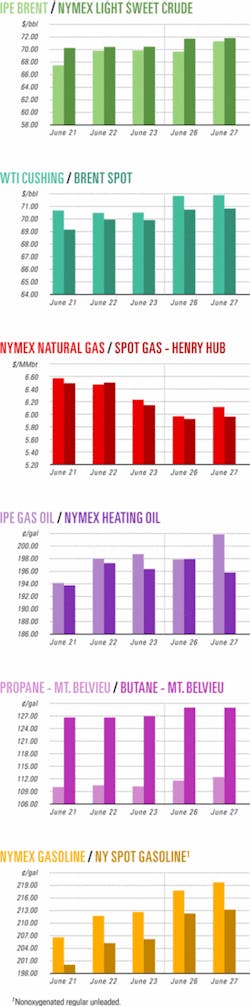

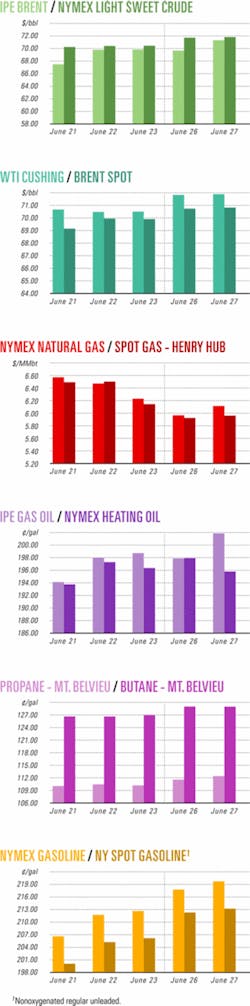

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesMurphy makes oil find at Thunder Bird

Murphy Oil Corp. reported an oil discovery at its Thunder Bird prospect on Mississippi Canyon Block 819 in the Gulf of Mexico. Although development options for the find have not been finalized, the oil found at Thunder Bird will likely be produced as a subsea tieback to a facility nearby.

Thunder Bird lies in Boarshead basin in 5,676 ft of water. MC Block 819 lies three blocks west of giant Thunder Horse oil and gas field.

Murphy reported that Thunder Bird holds reserves of 50-75 million bbl of oil equivalent. The well cost is estimated at $53.6 million.

Murphy, operator, holds 37.5% working interest in the field. Partners are Dominion Exploration & Production Inc. 25%, Hydro Gulf of Mexico LLC 25%, and Marubeni Offshore Production (USA) Inc. 12.5%.

Chevron unveils Frade field development plans

Chevron Corp., through its affiliate Chevron Frade LLC, and partners Petroleo Brasileiro SA (Petrobras) and Frade Japao Petroleo Ltda. (FJPL), have agreed to develop Frade oil field in the Campos basin off Brazil.

Frade field is expected to begin production in late 2008 or early 2009, with production capacity of 100,000 b/d of oil and estimated peak production of 85,000 b/d of oil equivalent.

Chevron said the field, which lies in 3,500 ft of water, contains an estimated 200-300 million bbl of oil. The field is 75 miles off Rio de Janeiro state.

The development concept consists of horizontal production wells along with vertical water injection wells to maintain reservoir pressure.

The wells will be individually tied back to a floating production, storage, and offloading vessel. Oil export will be by tanker, while natural gas will be transported through the local gas pipeline.

First flowing oil gauged in Uganda

Nonproducing Uganda has its first flowing oil test as the Waraga-1 indicated discovery delivers 1,500 b/d of 33.8° gravity oil to surface on a 36/64-in. choke, operator Hardman Resources Ltd., Perth, said June 23.

The apparent discovery, in the Albert graben just off the eastern shore of Lake Albert, also represents the first oil flow in East Africa south of Sudan, Hardman pointed out. The oil could be waxy, it added.

The company plans 14 days of tests at Waraga, which encountered three hydrocarbon-bearing horizons, but Hardman said the early flow stabilized sufficiently “to derive composition, flow characteristics, and key reservoir parameters.”

Without giving depths, Hardman said Waraga encountered a shallow 32-m gross oil interval, a medium-depth 27-m gross oil column with a probable oil-water contact, and the deeper 5-m light oil section, now production tested, with excellent reservoir quality. TD is 2,010 m in basement.

Waraga-1 is on 3,735 sq km Block 2 about 220 km northwest of Kampala. The well is 350 miles south-southeast of nearest production, by a China National Petroleum Co.-led group, in the Muglad basin of southern Sudan. It is also east of the vast unexplored eastern interior of Congo (former Zaire).

Waraga is 19 km northeast of Hardman’s Maputa-1 and Maputa-2, both of which encountered hydrocarbons (OGJ Online, June 2, 2006).

Husky extends White Rose oil field

Husky Energy Inc., Calgary, extended the western section of White Rose oil field off Newfoundland and Labrador with its White Rose O-28 delineation well.

The well was drilled on Significant Discovery License 1044 to a maximum depth of 3,342 m and revealed a 280-m oil column in a multilayered reservoir in the Ben Nevis Avalon formation. The crude is 31° gravity, the same as current production from White Rose field in the Jeanne d’Arc basin (OGJ Online, May 15, 2006).

Interpretation of 3D seismic data and results from the O-28 well indicate a potential recoverable resource base of 40-90 million bbl of crude, said company officials. That is in addition to estimated gross proved and probable reserves of 240 million bbl in White Rose oil field at the end of 2005.

An additional sidetrack well is being drilled and logged for more information on reservoir quality, continuity, and hydrocarbon contacts.

Husky plans to tie this extension back to the SeaRose floating production, storage, and offloading vessel, which is currently producing 85,000 b/d of oil from four wells. A fifth production well is being completed and is slated to come on production later this month, increasing production capacity to 110,000 b/d. A sixth production well, scheduled to come on stream at yearend, will increase production capacity to 125,000 b/d.

Husky will complete performance testing on the SeaRose FPSO this summer to determine its productive capacity and will apply to the Canada-Newfoundland and Labrador Offshore Petroleum Board to increase the annualized daily production limit above the currently approved 100,000 b/d.

Drilling & Production - Quick TakesAlgeria’s In Amenas gas project starts up

BP PLC reported that the In Amenas natural gas project-a joint development with Algeria state-owned Sonatrach and Norway’s Statoil ASA-has started production in southeastern Algeria.

In Amenas lies 850 km south of Hassi Messaoud. The project includes development of four primary gas fields plus gas-gathering and processing facilities. The first of three production trains started up on May 27 followed by a period of final commissioning and testing. Production will build over the next several months to 9 billion cu m/year of gas and 50,000-60,000 b/d of liquids.

In 1998, BP entered into a production-sharing contract with Sonatrach for the In Amenas license. In 2003, BP sold 50% of its initial interest in the project to Statoil (OGJ, July 21, 2003, p. 37).

In April 2005, BP was awarded three blocks in Algeria’s sixth international licensing round (OGJ, Apr. 25, 2005, p. 50). Two of the blocks, South East Illizi and Bourarhat, are in the Illizi basin close to In Amenas. The third block at Hassi Matmat in the Benoud basin lies 160 km northeast of giant Hassi R’Mel gas-condensate field. BP plans seismic surveys and exploratory drilling on each of the blocks.

Deepwater Lobito oil off Angola on stream

Chevron Corp. subsidiary Cabinda Gulf Oil Co. Ltd. (Cabgoc) reported start-up of oil production from Lobito field on deepwater Block 14 off Angola. Benguela, Belize, Lobito, and Tomboco fields form the BBLT Development, one of Chevron’s “Big 5” projects. Chevron announced first oil from the Benguela Belize compliant piled tower in January (OGJ Online, Jan. 24, 2006). First oil from the Lobito-Tomboco subsea project was achieved last month.

The BBLT project, 50 miles offshore in 1,300 ft of water, is being developed in two phases. Phase 2-Lobito-Tomboco-involved the construction and installation of three subsea centers, each with a capability to handle nine subsea wells, tied back to the Benguela-Belize drilling and production platform and compliant tower.

With the addition, the project is currently producing more than 88,000 b/d of oil from a total of 4 wells, and will continue to ramp-up as additional wells and fields are brought on line over the next 2 years, Cabgoc said. The project’s peak production is expected to reach 200,000 b/d of oil.

Cabgoc is operator of Block 14 with 31% interest.

Statoil secures jack up for Troll-Sleipner

Statoil ASA has let a contract to SeaDrill Ltd., Hamilton, Bermuda, for the West Epsilon jack up for exploration and production drilling in the Troll-Sleipner area of the North Sea.

The contract is for up to 4 years, starting in November. It is valued at 1.5-2 billion kroner, depending on whether Statoil chooses a 2-year charter with an option to extend for an additional 2 years, or a 3-year charter, with an option for a 1-year extension. Statoil has 30 days to decide.

The rig, designed to operate in water as deep as 120 m, is currently on assignment for BP PLC.

Processing - Quick TakesSasol, Shenhua consider Chinese CTL project

South Africa’s Sasol Ltd. and a consortium led by China’s Shenhua Corp. agreed to proceed with the second stage of feasibility studies regarding an 80,000 b/d coal-to-liquids (CTL) plant in Shaanxi Province, about 650 km west of Beijing.

Sasol also has signed a similar agreement with Shenhua Ningxia Coal Ltd. to consider a separate 80,000 b/d CTL project in the Ningxia Hui Autonomous region, about 1,000 km west of Beijing.

The signings came while China’s Premier Wen Jiabao visited South Africa. Each proposed plant is expected to cost more than $5 billion. If authorized, the CTL plans could be operational as early as 2012.

Initial feasibility studies confirmed CTL plants are viable in China using Sasol’s low-temperature Fischer-Tropsch technology. Second-stage feasibility studies will go into detailed planning on capital cost, feedstock cost, water supply, and market conditions.

ExxonMobil poses bids for Singapore plant work

Shaw Stone & Webster and the Technip-Chiyoda joint venture, on behalf of ExxonMobil Asia Pacific Pte. Ltd., have invited bids for design, engineering, procurement, and construction work for a proposed second “world-scale” steam cracker at ExxonMobil’s chemical facility adjacent to its 605,000 b/cd Singapore refinery.

The proposed cracker would be integrated with an ethylene plant having a capacity exceeding 900,000 tonnes/year following completion of a 75,000-tonne/year expansion in the fourth quarter (OGJ, Feb. 7, 2005, Newsletter).

In 2005, ExxonMobil awarded a project coordination and services contract to Foster Wheeler Ltd. and WorleyParsons Ltd. joint venture for work associated with the study for the proposed steam cracker (OGJ, Jan. 9, 2006, Newsletter).

Along with the new ethylene cracker, the parallel train would include new world-scale polyethylene, polyproplylene, and speciality elastomer plants, an aromatics extraction unit, and oxo alcohol expansion.

ExxonMobil has awarded front-end engineering design (FEED) contracts for these downstream units associated with the cracker: Aker Kvaerner ASA will perform FEED work for a polyethylene unit; Mitsui Engineering & Shipbuilding for polypropylene and specialty elastomers units; and the Foster Wheeler-WorleyParsons JV for an aromatics extraction unit, an oxo alcohol plant expansion, and associated plant infrastructure. Mustang Engineering Inc., Houston, received the process control and instrumentation contract.

Transportation - Quick TakesConocoPhillips mulls additional trains at Darwin

ConocoPhillips Australia Pty. Ltd., operator of the Darwin LNG plant, could spend as much as $10 billion (Aus.) to build a second and perhaps a third train on site to treble the current capacity of 3.5 million tonnes/year of LNG.

Speaking at the South East Asia Australia Offshore Conference in Darwin, ConocoPhillips Australia Pres. Laura Sugg said the company could build a second train by 2013 using gas from the Greater Sunrise fields or the Caldita discovery in conjunction with yet-to-be discovered fields in the Timor Sea.

The current facility at Wickham Point has government environmental and planning approvals for the manufacture of as much as 10 million tonnes/year. Any greater increase would need to go through a new approvals process.

Greater Sunrise, although still under a cloud of uncertainty because of its location straddling the boundary between Australia and the Joint Petroleum Development Area with East Timor, has reserves of about 7 tcf of gas. It is operated by Woodside Petroleum Ltd., but ConocoPhillips is a partner.

Caldita field, discovered by the ConocoPhillips-Santos Ltd. joint venture on Permit NT/P61 in 2005, is clearly in Australian waters to the northeast of Darwin. No reserves figures have been released, but the discovery well flowed at 33 MMcfd on test.

ConocoPhillips intends to drill an appraisal well at Caldita during the fourth quarter.

The company, along with Santos, is currently drilling a well on the nearby Evans Shoal South prospect in NT/P48 and intends to appraise the gas found in the Lynedoch structure-now renamed Barossa and again with Santos-in NT/P69 further to the east during the third quarter.

It is hoped this aggressive drilling program will prove up sufficient gas reserves to support the second and possibly third LNG train in Darwin.

El Paso eyes gas storage facility in Arizona

El Paso Corp.’s Western Pipeline Group reported plans to develop a new underground natural gas storage facility near Eloy, Ariz.

Plans call for the Arizona Natural Gas Storage project to be built in a currently unincorporated area about 40 miles southeast of Phoenix.

The project could consist of four underground salt caverns capable of storing 3.5 bcf of gas. The facility would be able to deliver 350 MMcfd of gas.

El Paso expects to file an application for project approval with the US Federal Energy Regulatory Commission in the third quarter of 2007. Subject to regulatory approvals, construction could begin in 2008.

The company estimates the first cavern will be in service by mid-2010 and the remaining three caverns by 2011-12.

FERC approves El Paso’s Cypress gas line

FERC has approved the 176-mile Cypress natural gas pipeline expansion in Georgia and Florida planned by Southern Natural Gas Co. (SNG), a unit of El Paso Corp., Houston.

The pipeline will deliver gas from El Paso’s Elba Island LNG terminal near Savannah, Ga., to Jacksonville, Fla., as well as to the US Southeast.

SNG expects to have the line in service by mid-2007.