US, Canada drilling increases sharply in first half of year

The US and Canada posted good gains in drilling in the first half of 2006 compared with the same period of 2005, while drilling elsewhere in the world was nearly flat year on year.

The US increase, however, was not uniform. Seventeen states or areas had lower rig activity than in 2005, which may be an indication that more rigs are moving into heavily drilled play areas on multiwell or even multiyear contracts.

Among the busier areas are Texas, Wyoming, Colorado, and New Mexico, according to year-to-year rig counts.

Here are highlights of OGJ’s midyear drilling forecast for 2006:

- Operators will drill 46,225 wells in the US this year, up from OGJ’s estimate of 40,814 wells drilled in 2005 (OGJ, Jan. 16, 2006, p. 34).

- All operators will drill 3,625 exploratory wells of all types, up from an estimated 3,090 in 2005.

- The count of surveyed rotary rigs as compiled by Baker Hughes will average 1,525/week in 2006, up from the official average of 1,383/week in 2005.

- Operators will drill an estimated 25,785 wells in western Canada, up from an estimated 22,695 in 2005.

Active areas

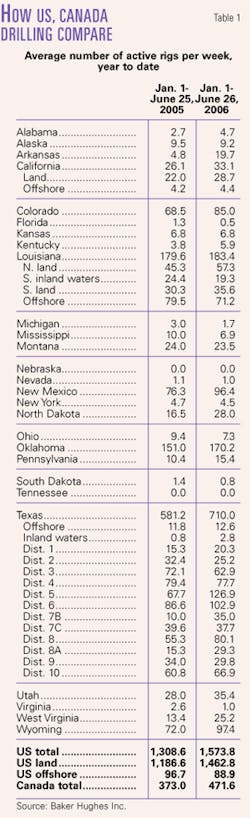

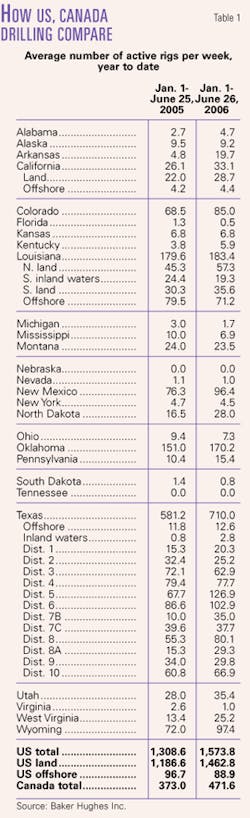

Year-to-year drilling rig activity in the US was up just over 20% through the end of June, Baker Hughes reported.

The Texas rotary rig count is up 22% year to year, with late June figures showing increases in all but five of the 14 Texas Railroad Commission operating districts (Table 1).

Dist. 5, which takes in the western half of East Texas, had 127 rigs operating, 83% more than in late June 2005. West Central Texas Dist. 7B had 35 rigs running compared with 10 a year earlier.

The country-leading Mississippian Barnett shale gas play in the Fort Worth basin has extended north into Montague County and southeastward into Coryell and nonproducing Lampasas counties.

Besides the TRC districts that showed lower drilling in 2006 through June than in the corresponding period of 2005, areas off Texas and Louisiana also showed lackluster performance.

Infill gas drilling and a Mississippian Fayetteville shale gas play produced a sharp gain in Arkansas. OGJ looks for drilling of 355 wells in Arkansas in 2006 compared with 170 in 2005 (Table 3).

null

Rockies drilling

Operators drilled 1,639 wells in Wyoming through June 6, including 1,064 coalbed methane wells, 478 other gas wells, and 75 oil wells. The rest are injection and disposal wells.

Probable total for the year is 4,210 wells, 3,075 for CBM, 885 other gas wells, and 200 oil wells, said the Wyoming Oil & Gas Conservation Commission.

Wyoming had 15,900 CBM wells that produced 950 MMcfd of gas and 1.6 million b/d of water in February. Another 6,000 wells were shut-in, half of which have never produced because they are awaiting water management approval, federal drilling permits, or installation of production facilities.

At the end of February, 24,100 CBM wells had been drilled and 1,400 wells had been plugged and abandoned, the commission said.

Utah operators were running 35 rigs, up from 25 in May 2005. They drilled 877 new wells in 2005, the Utah Geological Survey reported. OGJ’s 2006 estimate is 1,035 wells.

The six fastest growing fields in Utah in 2004-05 were Natural Buttes, Brundage Canyon, Eight Mile Flat North, Monument Butte, Wonsits Valley, and Antelope Creek, all in the Uinta basin, the Utah survey said.

Canada’s outlook

Canadian drillers are off to a busy start.

The Petroleum Services Association of Canada in late April boosted its 2006 drilling forecast to 26,725 wells, or 8% more than the number of wells rig-released in calendar 2005.

The forecast includes 20,935 wells in Alberta and 3,800 for Saskatchewan, PSAC said.

Meanwhile, Canadian drilling rig fleet utilization jumped 9 percentage points to 71% in January through March, said the Canadian Association of Oilwell Drilling Contractors.

International action

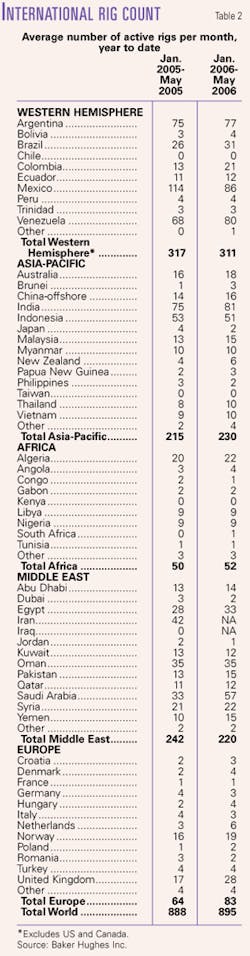

Non-US areas averaged 895 active rigs in January-May, an increase of less than 1% from the same period in 2005 (Table 2).

Western Hemisphere, Asia-Pacific, Africa, Middle East, and Europe all showed minor changes from a year earlier.

Saudi Arabia averaged 57 active rigs, up 72% on the year, despite a 22-rig drop in the Middle East total to 220 rigs.

Venezuela, rife with political uncertainty, posted a gain of 12 rigs on the year to 80 rigs/month in 2006. Mexico fell 24% to 86 active rigs/month.

The UK had 28 active rigs, up from 17 in 2005.

Algeria had 22 active rigs, up from 20. Libya, still getting its exploration legs under it after reopening and holding license rounds, was unchanged year to year at 9 rigs. Operators have big drilling plans, but rigs are scarce.

Sixteen rigs were operating off China compared with 14 in the first half of 2005, Baker Hughes reported. The company does not estimate the number of onshore rigs operating in China or the number of rigs running in and off Russia.