OPEC: Product demand outrunning refining capacity; Part 2 of 2

Oil exporters expect world refining capacity to continue to struggle to keep up with product demand.

The Organization of Petroleum Exporting Countries secretariat developed a programming model that envisions high distillation capacity utilization rates through 2015.

OPEC outlined its findings in a paper entitled “OPEC Oil Outlook to 2025,” delivered in late April during the International Energy Forum in Doha (OGJ, June 12, 2006, p. 20).

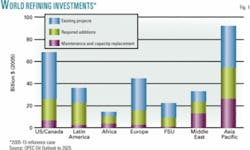

The paper projected investment needs through 2015 for refining capacity at $160 billion and for maintenance and replacement of lost capacity at $150 billion. The estimates exclude pipelines and terminals (Fig. 1).

Inadequate refining capacity leads to high oil prices and market instability, said OPEC, calling on consuming countries and international oil companies to take primary financing responsibility.

“Investments in the refining sector are coming in at a considerably slower pace than warranted by expected growth in demand,” OPEC said. “A more orchestrated effort is clearly required to ensure sufficient capacities are in place in the future.”

Changing product quality standards will continue to raise investment requirements, OPEC noted.

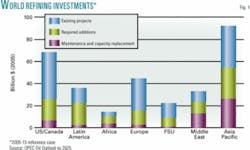

Compared with 2005 levels, an OPEC reference case forecast that worldwide crude runs will need to climb 6.5 million b/d by 2010 and 13 million b/d by 2015.

Distillation capacity

Distillation capacity expansion is not expected to keep pace with demand, despite recently high utilization rates, OPEC said.

The paper’s authors calculated the progress of known refining expansion projects, breaking them into categories of project status. They included capacity creep-unannounced minor capacity expansions.

In the US, capacity creep recently has averaged 0.5-0.75%/year for crude units and 0.75-1.5%/year for upgrading units. It’s plausible that similar capacity creep rates apply in Europe and also in the Organization for Economic Cooperation and Development’s Pacific region, OPEC said.

“Worldwide, it is estimated that creep projects will add within the range of 0.25-0.5% to crude distillation capacity per annum,” OPEC said. “For major secondary units, the range is estimated slightly higher at 0.35-0.75% worldwide.”

Noting uncertainty in the number of refining projects that will be completed and uncertainty in future capacity creep numbers, OPEC outlines “realistic” and “optimistic” scenarios for distillation capacity expansions (Fig. 2).

The realistic scenario assumes project implementation rates from previous years combined with average worldwide capacity creep of 0.25%/year. The optimistic scenario assumes higher than typical implementation rates and average capacity creep of 0.4%/year.

In either scenario, refining tightness is not expected to ease until at least 2010, OPEC said. Numerous projects are planned, but sizeable projects require construction lead times of 4-5 years.

By 2010, crude runs resulting from the reference case demand increase can be met only if existing refining projects are built at least as fast as the optimistic scenario envisions, OPEC added.

“On the other hand, the typical rate of implementation of these projects as represented by the realistic scenario will provide hardly sufficient capacity, even in the lower-growth [oil demand] scenario,” the paper said. “This will place additional pressure on utilization rates with corresponding implications for the price of products and crude oil.”

Desulfurization

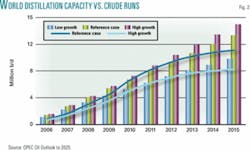

In addition, refinery product yields will shift toward light and middle distillates, gas oil and diesel, naphtha, and LPG. Demand for middle distillates (gas oil, diesel, and kerosine) is expected to increase by more than 8 million b/d between 2005-15, followed by naphtha and LPG (Fig. 3).

Gasoline demand is expected to increase only by around 2.4 million b/d worldwide in that period. But gasoline growth rates will vary widely by region, with negative rates expected in Europe, moderate increases in the US and Canada, and much stronger growth in Asia. Fuel oil and other heavy-product demand is expected to remain relatively flat, OPEC said.

“Required conversion capacity should also be viewed in the context of the expected crude slate,” which is expected to remain stable through 2010 as far as API gravity, OPEC said.

Throughout this decade, incremental non-OPEC production is expected to be mostly medium and light. Most additional OPEC oil also will be light to medium-coming from Algeria, Libya, Nigeria, and Saudi Arabia.

“In terms of sulfur content, the trends may be more predictable as most of the new oil is sour, while the losses are predominately sweet,” OPEC said. But sour crude will become more common after 2010.

Meanwhile, regulatory bodies worldwide seek to reduce sulfur levels in gasoline and auto diesel.

OPEC’s model projected that the world’s refiners will need more than 13 million b/d of additional desulfurization capacity by 2015 compared with 2005 to satisfy ultralow-sulfur gasoline and ultralow-sulfur diesel requirements.

Most new desulfurization units are projected for OECD regions, OPEC said. Elsewhere, considerable capacity additions will be needed to modestly reduce sulfur content.

“This is particularly significant for countries like India and China,” OPEC said. Asia could absorb more than 30% of the global refining investments.

The Middle East’s goal to export clean refined product also requires significant refining investments. OPEC expects that refining investments during 2015-25 will be comparable to 2005-15.