OGJ Newsletter

NEB: Oil sands output to triple by 2015

Canada’s oil sands can make the country a world leader in oil production, said Canada’s National Energy Board (NEB) in a report issued June 1 (www.neb-one.gc.ca).

Alberta’s oil sands production is expected to rise to 3 million b/d in 2015 from 1.1 million b/d in 2005. The projection is almost 40% more than NEB predicted in 2004.

Elevated oil prices, global oil demand growth, and the potential for market expansion are stimulating investment and development.

At the same time, said NEB Chairman Kenneth Vollman, escalating capital and operating costs, labor constraints, and infrastructure and environmental concerns will affect future development decisions. And price uncertainty remains a challenge.

Increased production and market expansion will require additional transportation facilities to augment the currently capacity-constricted major export pipeline system, NEB cautioned.

In addition, greenhouse gas emissions, reduced through technological improvements, will rise again. And access to water for enhanced operations will present challenges, as the Athabasca River has insufficient flows to support the needs of all planned oil sands mining operations.

Venezuela, Ecuador sign oil deals

Venezuela President Hugo Chavez has signed refining and technical assistance contracts with Ecuador President Alfredo Palacio.

Venezuela will refine as much as 100,000 b/d of crude from Ecuador under favorable terms, which officials say will save Ecuador at least $300 million/year.

Venezuela also will provide technical advice to state-run Petroecuador.

Ecuadorean officials have said the agreements are economic and do not indicate a political alliance with Chavez.

Workers kidnapped from rig off Nigeria

Eight foreign workers were kidnapped June 1 from the Bulford Dolphin semisubmersible off Nigeria, days after a well drilled by the rig was confirmed to be a gas discovery. All have been freed.

Fred Olsen Energy ASA of Norway owns the rig, operating it through Dolphin Drilling Ltd., an Aberdeen subsidiary.

The rig owner said contact had been established with the abducted personnel. The kidnappers sought negotiations with local representatives of Peak Petroleum Industries Nigeria and Equator Exploration, which hold the rig under contract.

The workers, six British, one American, and one Canadian, were aboard the rig when it was attacked during the night of June 1, Fred Olsen Energy said. The remaining crew was safe aboard the rig. Drilling was suspended.

Equator Exploration and Peak Petroleum had signed a contract with Dolphin Drilling in September 2005 for five wells. Last November, the Bulford Dolphin commenced drilling an appraisal well on the Bilabri discovery in OML 122, 25-60 km off Nigeria on the Western Niger Delta (OGJ Online, Dec. 7, 2005).

On May 24, Peak Petroleum and Equator Exploration announced the discovery of gas in the exploratory Owanare 1 well, on OML 122. They said Owanare 1, the second well drilled on OML 122 by the Peak-Equator combine, encountered high pressures and temperatures at 4,100 m and was suspended for possible production.

The well cut pay at 1,683-1,732 m and 2,183-96 m below the rotary table.

Horizon Energy Partners BV, independent advisers to Equator, estimated gas in place at 185 bcf.

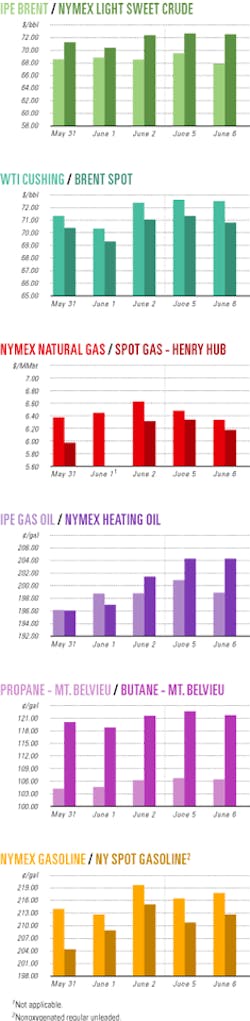

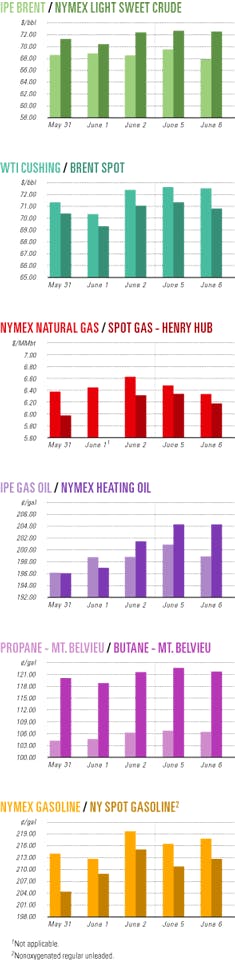

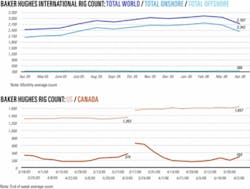

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesBP Migas approves Cepu Block working plan

Indonesia’s upstream oil and gas regulatory body BP Migas has approved the working plan proposed by ExxonMobil Corp. and state-run PT Pertamina for development of the offshore Cepu Block.

ExxonMobil and Pertamina are soon expected to open drilling tenders starting with 37 wells in Banyu Urip oil field, believed to be the largest on the block.

In April 2001, ExxonMobil said that Mobil Cepu Ltd., an affiliated company, had a major oil discovery at the Banyu Urip No. 3 (BU-3) well. It said with estimated reserves of more than 250 million bbl, the BU-3 well is one of the most significant oil discoveries in Indonesia in the past decade (OGJ Online, Apr. 12, 2001).

In March, Pertamina Pres. Ari Soemarno said Pertamina would sign an agreement with ExxonMobil Indonesia for operation of the block (OGJ Online, Mar. 13, 2006).

Pertamina and ExxonMobil each have a 45% share of the Cepu project with the remaining 10% held by the Central Java and East Java administrations.

Total has oil strike on block off Cameroon

Total E&P Cameroon has struck oil with the first exploration well drilled on the Dissoni Block in the Rio del Rey basin off Cameroon.

The well encountered 50 m of sandstone oil pay. Total, block operator, is considering development.

Cameroon awarded the Dissoni Block to Total and Pecten Cameroon Co. in April 2005 (OGJ Online, Apr. 11, 2005, Newsletter).

RWE Dea spuds exploration well in Libya

RWE DEA AG has began drilling exploration well A1-NC 193, the first in a multiwell program planned in Concession NC 193 in the Sirte basin 500 km southeast of Tripoli, Libya.

RWE DEA is using Arab Drilling & Workover Co. Adwoc Rig 2 to carry out the 10-well minimum license commitment. It has completed a 2D seismic survey over 2,400 km, acquired 2,392 sq km of 3D seismic data, and analyzed 2,200 geological samples.

RWE DEA North Africa/Middle East GMBH and Libyan National Oil Corp. signed a contract to jointly exploit and produce hydrocarbons in six blocks-three in the Sirte basin, two in the Cyrenaica basin, and one in the Kufra basin.

RWE DEA operates the blocks, which combined cover 30,270 sq km, with a 100% interest.

East Timor awards six offshore permits

East Timor has offered six offshore petroleum exploration permits in its inaugural bidding round.

Eni SPA has been awarded five blocks, and India’s Reliance Industries Ltd. has received one. A total of nine bids were made for the six blocks. Five other permits on offer for the licensing round were not awarded. All permits lie off East Timor’s southern coast. They do not enter the controversial joint development area (JDA) administered with Australia.

Reliance received Block K in the far east of the offshore region.

Eni received Blocks A, B, C, E, and H. Blocks A and B are in the north, abutting the southern East Timorese coast. Blocks C and E are contiguous to the south against the JDA, while Block H is farther east and also borders the JDA. Eni’s work program involves an expenditure of $9.5 million over the first 3 years and includes 3,000 km of 2D seismic survey and 8,000 sq km of 3D work. Block C has a two-well commitment.

Blocks A, B, and H have no imminent well commitments, but the East Timor government has made its Block E offer conditional on Eni’s increasing its work program to include a well in the third year drilled to 4,000 m. Water depths in the awarded blocks vary from very shallow to areas as deep as 3,000 m in the Timor Trench.

Pagoreni development drilling starts in Peru

The consortium that operates Peru’s giant Camisea gas-condensate project is reported to have begun drilling the first of six production wells in Pagoreni gas-condensate field on nearby Block 56. The Camisea fields are on Block 88 of the Peruvian Amazon region.

Pluspetrol, operator of the 2.75-tcf Pagoreni field-called Camisea 2-completed the initial phase of development with acquisition of 363 sq km of 3D seismic data, due to be finished in September (OGJ, July 11, 2005, Newsletter).

It launched the drilling program last week. The group expects to invest $600-700 million in the development of Block 56 and Pagoreni field.

Pluspetrol’s Chief Executive Officer Norberto Benito said the field will produce about 600 MMcfd of natural gas, which will be transported to the Malvinas processing plant and then to the Peru liquefaction facility.

Pluspetrol is operator of the consortium operating Blocks 56 and 88 and the Camisea-Pagoreni complex, with 36% interest.

Devon to accelerate Polvo field development

Devon Energy Corp., Oklahoma City, and SK Corp. of South Korea plan to accelerate development of Polvo oil field on Block BM-C-8 in the Campos basin off Brazil. Production from the shallow-water field, discovered in June 2004, is expected to begin in July 2007 and reach 40,000 b/d of oil.

Devon, the operator, will use a refurbished 3,000 hp platform rig to drill 10 producing wells and three injectors in the first development phase in early 2007.

It will install a 24-slot fixed platform in 345 ft of water with production capacity of 50,000 b/d.

The platform jacket topsides will have three multiphase pumps to move produced fluids without separation to a floating production, storage, and offloading vessel.

Prosafe of Norway will supply the FPSO, which will be designed to handle 90,000 b/d of production and store 1.5 million bbl.

Drilling & Production - Quick TakesSyncrude unit repair might take 1-2 months

Syncrude Canada Ltd. could take 1-2 months to repair a problem associated with odorous emissions at its Mildred Lake oil sands plant north of Fort McMurray, Alta., reported Canadian Oil Sands Trust.

The problem forced Syncrude to shut down a third-stage expansion that was starting up in May. Syncrude believes the problem relates to a coker flue-gas desulfurization unit using technology not applied before at the plant.

Alberta Environmental Protection ordered the shutdown following complaints by Fort McMurray residents of strong odors (OGJ Online, May 22, 2006).

Canadian Oil Sands Trust, a partner, has lowered its outlook for 2006 Syncrude production to 90-100 million bbl. The estimate for second-quarter Syncrude production has been lowered to 22 million bbl from 24 million bbl.

Chevron lets Tahiti control system contract

Chevron USA Inc. has let a contract to John Wood Group PLC subsidiary Mustang Engineering, Houston, for design and procurement of the integrated control safety system for the Tahiti deepwater oil and gas processing facilities.

The Tahiti truss spar will be tethered in 4,000 ft of water in the Gulf of Mexico about 190 miles southwest of New Orleans on Green Canyon Block 640 to handle as much as 125,000 b/d of oil and 70 MMscfd of gas production from Green Canyon Blocks 640, 641, 596, and 597.

Mustang performed front-end engineering design for the truss spar and is performing detailed design, engineering, procurement, and project management support services for the spar’s topsides oil and gas facilities (OGJ, Feb. 6, 2006, Newsletter).

Aramco lets contract for four jack ups

Saudi Aramco has let a contract to GlobalSantaFe Corp. for four jack ups to drill off Saudi Arabia for 4 years.

The rigs-GSF Main Pass I, GSF Main Pass IV, GSF High Island I, and GSF High Island II-are scheduled to leave in pairs in the fourth quarter from the Gulf of Mexico to a Middle East shipyard for 60 days of upgrades. Drilling is expected to start in March and April 2007.

Pemex lets contract for two light platforms

Fluor Corp. reported that ICA Fluor, its joint venture with Empresas ICA Sociedad Controladora, has received a $24 million contract from Pemex Exploration & Production for the fabrication of two lightweight offshore platforms, May D and Sinan NE, to be installed off Mexico.

ICA Fluor subsidiary Industria del Hierro will perform engineering, procurement, construction, load-out, and seabed fastening. Scheduled completion is November.

The platforms, with a total weight of about 1,600 tons, will be installed in Pemex’s southwest region of the Gulf of Mexico.

Letter signed for Frade FPSO off Brazil

A Chevron Corp. unit signed a letter of intent with SBM Offshore of the Netherlands for engineering, procurement, construction, and installation of a floating production, storage, and offloading vessel in Frade oil field in the Campos basin off Brazil.

SBM will convert its Lusan vessel into a unit with capacities of 100,000 b/d of oil production, 106 MMscfd of gas treatment and compression, 150,000 b/d of water injection, and 2 million bbl of storage.

Installation in 1,080 m of water is scheduled for second-quarter 2008, with first production due in 2009.

SBM will sell the FPSO to Chevron. It leases four other FPSOs in Brazil for Marlim Sul, Espadarte, Brasil, and Capixaba fields.

Processing - Quick TakesPDVSA considers building three refineries

Petroleos de Venezuela SA is considering spending $10.5 billion to build refineries in Cabruta, Caripito, and Barinas with total capacities of 700,000 b/d, according to Alejandro Granado, PDVSA refining vice-president.

Granado also said the Venezuelan and Cuban governments also are working together to reactivate the island nation’s Cienfuegos refinery, which has a processing capacity of 70,000 b/d.

Venezuela also is considering processing 50,000 b/d from the eastern Franja de Orinoco region at Uruguay’s La Teja refinery, as well as building new refineries in Brazil through its alliance with Petroleo Brasileiro SA.

Central American refinery under discussion

Ten Latin American countries led by Mexico and Colombia agreed to build a refinery as large as 350,000 b/d in Central America designed to ensure energy supplies at preferential prices.

The leaders of Mexico, Colombia, Dominican Republic, and seven Central American countries were present at the launching of the Mesoamerican Energy Integration Program, which aims to invest at least $7 billion in the facility.

Mexico has offered to supply 230,000 b/d of oil at market prices to the refinery by the planned completion year of 2011, according to Mexico’s Deputy Energy Minister Hector Moreira.

The proposed refinery is part of an ambitious energy development initiative that also includes pipeline transportation of natural gas along the Pacific Coast. The $7-9 billion program would provide outlets for oil and gas. It could clash with plans by the Venezuelan government to supply in the region.

“We are going to sell at market prices. In no way will we subsidize the refinery,” Moreira said.

Central American presidents planned to meet in the Dominican Republic to discuss the refinery’s location and size.

Chevron creates biofuels business unit

Chevron Corp. has formed a biofuels business unit to pursue advanced technology and opportunities for production and distribution of ethanol and biodiesel in the US.

The biofuels unit will operate in the Chevron Technology Ventures LLC subsidiary.

Chevron made the announcement in Galveston, Tex., where the company is participating in the construction of what it calls the first large-scale biodiesel plant in the US. The plant will have an initial production capacity of 20 million gal/year and be expandable to 100 million gal/year (OGJ Online, May 12, 2006).

Shomar plans Philippines biodiesel plant

Shomar International Trading Corp. of Japan plans to construct facilities valued at $189.3 million in the Philippines to produce biodiesel fuel made from the jathropa or “tuba-tuba” plant.

The company reported it would build the facilities in Hermosa after an inspection by Japanese experts who are evaluating the effects of its proximity to the seaport of the Subic Bay Metropolitan Authority.

Some 5,000 hectares of idle land in Hermosa will be planted with jathropa, and the company will seek an additional 70,000 hectares to maximize production.

In the interim, Shomar will establish warehouses and a press-out factory in Hermosa where jathropa oil will be extracted.

Last month, Philippines President Gloria Macapagal-Arroyo announced that Saudi Aramco had agreed to erect a jathropa processing plant and an ethanol distillery in Mindanao.

She said Saudi Aramco could secure its jathropa supply from North Luzon, where idle military camps have been converted into jathropha plantations.

Macapagal-Arroyo pushed for large-scale cultivation of the jathropa plant as a substitute for diesel, saying, “We could muster the vast agricultural prowess of the Philippines to our advantage.”

At the same time, she asked the Philippine Congress to expedite the passage of the Biofuel Act “to encourage more investments in alternative fuel sources.”

Atlantic LNG’s Train 4 starts production

Atlantic LNG Co. of Trinidad & Tobago has begun LNG production from its $1.2 billion Train 4 at Point Fortin, Trinidad. The plant, commissioned earlier this year, has been transferred to Atlantic LNG 4 following a performance test by Bechtel Corp., which handled engineering and construction.

Train 4 has production capacities of 5.2 million tonnes/year of LNG and 12,000 b/d of natural gas liquids, increasing Trinidad and Tobago’s total LNG capacity to 15 million tonnes/year (OGJ, Feb. 27, 2006, Newsletter).

Oil spill forces production cut in Nigeria

A pipeline oil spill has forced Royal Dutch Shell PLC’s Nigerian subsidiary to cut oil production by 50,000 b/d in southern Nigeria.

A company spokesman said the firm had closed down four flow stations-Nembe 1, 2, 3, and 4-as a result of a spill at its Nembe Creek trunkline.

The spokesman could not immediately say if the spill was due to an accident or to sabotage by militant gangs active in the region.

He said the company had dispatched experts to contain the spill.

CenterPoint, Duke eye Midcontinent gas line

CenterPoint Energy Gas Transmission Co. and Duke Energy Gas Transmission signed a memorandum of understanding to lay a natural gas pipeline from the Waha hub in Texas to as far away as Oakford-Delmont, Pa.

Previously, CenterPoint launched an open season for a Midcontinent Crossing (MCX) pipeline stretching from Dumas, Tex., to Barton, Ala. Potential shippers demonstrated interest in extending the proposed pipeline to the northeastern US.

Duke Energy became involved because its Texas Eastern Transmission system has pipeline rights of way from Arkansas to Pennsylvania. The revised MCX proposes a pipeline from Waha to Dumas via Bald Knob, Ark., and on to Pennsylvania.

The two companies launched a 60-day nonbinding open season on June 1 to solicit interest for a pipeline delivering gas to northern US markets. The proposed 1,600-mile, 42 and 36-in. pipeline would have a capacity of 1.5-1.75 bcfd.

The 1,600-mile MCX could be in service as early as late 2008.

Line-by-line approach urged on gas quality

The associations representing US interstate natural gas pipelines and local distribution companies have called for a pipeline-by-pipeline approach to gas quality issues.

The Interstate Natural Gas Association of America and the American Gas Association endorsed the concept in a joint statement they filed June 2 with the US Federal Energy Regulatory Commission.

INGAA and AGA began with a proposed Natural Gas Council “Plus” technical framework on hydrocarbon liquid dropout and interchangeability specifications, INGAA Pres. Donald F. Santa Jr. and AGA Pres. David N. Parker said in a cover letter.

The associations said NGC white papers have created a technical framework for establishing the specifications. They also said standards of the North American Energy Standards Board provide customers information about the current quality of pipeline gas.

The statement urges pipelines and customers to notify each other promptly if they want to discuss hydrocarbon liquid dropout and interchangeability specifications. The discussions might lead to tariff revisions.

A pipeline would not be required to initiate gas quality discussions if no customer has expressed concern, the statement said.

W. Australia opposes Gorgon-Jansz LNG plant

The Environmental Protection Authority of Western Australia has recommended for the second time against Chevron Corp. group’s Gorgon-Jansz LNG Project on Barrow Island off Western Australia.

The EPA first rejected the proposal in July 2003. This was overridden 2 months later by the Western Australian Cabinet, which said restricted access to the island could be set aside for the project subject to the Chevron group’s demonstrating that environmental issues could be managed.

After studying a 3,000-page environmental impact statement subsequently tendered by Chevron, the EPA has reiterated its concerns on four main counts:

- Potential interference with the rare, threatened Flatback turtle.

- Potential impact to the marine ecosystem from dredging.

- Potential for introduction of nonindigenous species on Barrow Island, a nature reserve.

- The possibility of loss of subterranean and short-range endemic invertebrate fauna species.

On the first count, EPA Chairman Wally Cox said two of the most important nesting beaches of the Flatback turtle are adjacent to the proposed LNG plant site and the materials off-loading facility.

He said that because the life cycle, behavior, and feeding habits of the turtle were little known it is impossible to identify measures that would ensure survival of the species in this region.

Cox said Chevron and its joint venturers had not demonstrated that risks could be reduced to satisfactory levels on each of the other three points.

Chevron has said it is confident it can appeal the EPA’s recommendations. It says it has operated safely at Barrow Island oil field for 40 years and suggests that without its presence the island’s plant and animal life would have been degraded long ago.

The Western Australia government has the final decision on the project and can veto the EPA recommendations.

The two-train, 10 million-tonne/year LNG project, expected to cost in excess of $11 billion (Aus.), has earmarked customers in Japan, North America, and India. A final investment decision was to have been made early next year, subject to government approvals. On-stream date for LNG is nominally 2010, although there are now indications this could slip to 2011-12 (OGJ, May 15, 2006, Newsletter).