Supply gap looms for South Korea

While buyers in Japan have been willing to make long-term purchase commitments in early 2006, Korea Gas Corp. (Kogas) and other private importers in Korea were still sitting on the sidelines. This hesitancy came as demand for LNG in the country increased rapidly and the winter supply gap was widening.

Supply outlook

Consumption in Korea has been rising at nearly 10%/year since 2000, reaching 23 million tonnes in 2005, while Kogas has been scrambling every year to fill the winter shortfall with expensive cargoes purchased on spot terms. There has been growing concern that Indonesia, Korea’s second largest supplier, would be unable to meet its contractual obligations over the next several years, although Kogas has so far escaped Jakarta’s export cutbacks relatively unscathed. In 2005, Indonesia supplied Korea with 5.6 million tonnes, equivalent to one-quarter of the nation’s total imports.

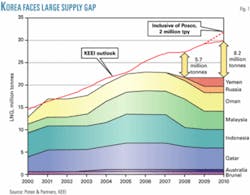

South Korea’s supply outlook becomes particularly precarious in 2008, when short-term deals totaling about 2.8 million tonnes/year (tpy) with Qatar’s RasGas and Malaysia LNG’s Tiga end, along with another 2.3-million-tpy contract with Pertamina come to an end. The loss of these supplies will be offset by start-up of new long-term supplies from Yemen LNG, MLNG Tiga, and Russia’s Sakhalin II, totaling 5.5 million tpy. But these purchases, which begin in 2008 and 2009, leave Kogas virtually no room to cover demand growth.

Poten & Partners forecasts further supply reductions for 2010, when another 2.5 million tpy in medium-term sales from MLNG Tiga and Australia’s North West Shelf cease. While Kogas and Korea’s Ministry of Commerce, Industry, and Energy (Mocie) have acknowledged the need for up to 5 million tpy in new long-term supplies beginning in 2010, this may be “too little, too late.”

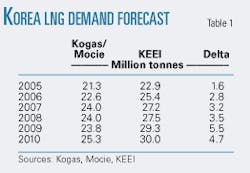

A forecast prepared by the Korea Energy Economics Institute in December 2005 highlighted the country’s growing supply needs. According to the Mocie think tank, demand will rise to 30 million tpy by 2010 from 25.4 million tonnes in 2006. This is about 5 million tonnes higher in 2010 than the latest official projection from Kogas and Mocie, which was put together in 2004 and is still being used by Korea in its long-term planning.

By law, this forecast must be updated every 2 years; a new version is set for release later this year. If it reflects the new KEEI figures, which Poten considers likely, the next official forecast will show a supply gap of nearly 6 million tonnes in 2008, rising to 8-10 million tonnes in 2010 (Fig. 1).

Kogas fills its annual supply deficit with spot purchases that range from 20 to 40 cargoes, depending on the market. When this gap looks like it is getting out of hand, Mocie typically allows Kogas to line up more term supply.

In 2004, when Kogas was forced to purchase 38 spot cargoes, the firm convinced Mocie to let it negotiate the short-term deals now in effect with RasGas and MLNG Tiga. These began in late 2004 and reduced spot purchases to only 21 cargoes in 2005. But Kogas did not get off so lightly in winter 2005-06.

Winter woes

Extremely cold weather hit the peninsula beginning in December 2005, forcing the importer to secure 10 extra cargoes to cover its first-quarter 2006 requirements. These supplemented 8 optional cargoes that were part of the short-term deal with MLNG Tiga. Kogas paid dearly for the extra shipments, in one case reportedly paying $25/MMbtu for a delivery from Oman’s Qalhat LNG.

In spite of the obvious need for more term supply, Kogas and the private importers remain stymied by Mocie. The long struggle to restructure Korea’s gas industry, which commenced in the late 1990s and continues today, is still at a stalemate. Early this year, top Mocie officials in charge of this restructuring effort were replaced, and as of last month all decisions remain on hold.

For the time being, it appears that the near-monopoly supply position held by Kogas is safe: As third-quarter 2006 began, Mocie had an official in the No. 2 slot at the firm. At the same time, several private companies were importing LNG for their own use or had received approval to do so. These included Pohang Iron & Steel Co., which had been importing since June 2005, as well as K-Power, which received its first cargo from BP PLC in December 2005. GS Caltex Corp. also received permission in 2004 to begin importing LNG.

But Mocie has put off letting Kogas or the private importers make further commitments. This wouldn’t be such a problem in a buyer’s market, but sentiment has shifted decisively in favor of sellers and the Koreans have no time to waste. The window of opportunity to tie up bargain LNG was already long gone in first-quarter 2006 (LNGWM, January-February 2006).

Indeed, securing 5.5-6.0 million tpy of term supply by 2008 probably isn’t even possible now. Kogas may have no choice but to continue relying on spot product. And buying 2.5 million tpy on the spot market is one thing, but obtaining 6 million tpy would be altogether different. At the very least, it will be expensive because the Korean firm has to bid cargoes away from other buyers in Japan, Europe, and the US. Even if it succeeds in lining up an additional 40 cargoes/year, Kogas will still be short 3.3 million tonnes in 2008 and potentially as much as 7.8 million tonnes in 2010.

Private importers could fill part of this supply gap. GS Caltex has been authorized to import 1.9 million tpy by 2008 and wants to increase this figure. The firm was talking to multiple suppliers earlier this spring but was still in the initial stages of its buying effort. Steel manufacturer Posco has also been canvassing sellers for another 2 million tpy for its power-plant expansion, so far without any luck.

The various regional generators under Korea Electric Power Co. have also been lobbying Mocie for authorization to secure their own supplies. Mocie has given Kogas “tacit consent” to negotiate extension of its medium-term deals with MLNG Tiga and North West Shelf.

The Korean importer has approached the sellers about extending these contracts. While they have been encouraging, Kogas has so far come away empty handed.

Based on an article in LNG in World Markets, March 2006, Poten & Partners Inc., New York (www.poten.com).