OGJ Newsletter

Democrats propose bill to boost nonoil energy

Forty-three US Senate Democrats proposed energy legislation May 17 that would accelerate development of nonpetroleum motor fuels, make price-gouging a federal crime, and provide emergency energy assistance to low-income families and emergency energy loans to farmers and small businesses.

Called the Clean Energy Development for a Growing Economy (Clean EDGE) initiative, the legislation also would revoke subsidies for major oil companies and transfer the money to renewable energy and energy efficiency programs.

Senate Minority Leader Harry Reid (D-Nev.) declared, “With this bill, and under our leadership, America will be energy-independent by 2020.”

Senate Republicans immediately criticized the measure. Energy and Natural Resources Committee Chairman Pete V. Domenici (R-NM) called it “a sprinkling of good ideas, a heavy helping of bad ideas, and a pathetic absence of any effort to increase American energy supplies.”

In part the Senate Democrats’ bill would:

- Accelerate vehicle conversions by mandating that 25% of new vehicle sales be flexible-fuel capable by 2010, rising to 50% by 2010.

- Make gasoline “price-gouging” a federal crime, extend federal authority to prevent and prosecute supply and market manipulation, and make petroleum markets more transparent.

- Revoke federal subsidies to major oil companies and more aggressively monitor federal oil and gas royalty payments.

- Require the federal government to reduce its petroleum consumption by 20% in 5 years and 40% by 2020 and increase electricity from renewable sources’ share of total federal consumption to 10% by 2013.

- Diversify energy sources by requiring that 10% of the electricity consumed in the US come from renewable sources by 2020.

Relief signs seen in US summer gas market

Record underground storage at the start of the US cooling season and prospects for milder, but still above-average, temperatures could give natural gas consumers relief in 2006 after 4 summers of rising costs, the Natural Gas Supply Association says.

But US markets still could feel pressure from hurricanes and potential overseas supply disruptions, NGSA warned as it issued its summer gas outlook.

NGSA Chairman Chris Conway told reporters that projected gas demand is close to last summer’s level.

“Cooler weather this summer will likely result in lower demand for electricity and, consequently, lower levels of gas-fired generation, leaving room for the return of some industrial demand,” he said.

Conway, president of the gas and power division at ConocoPhillips, said the National Oceanic and Atmospheric Administration expects summer temperatures to be 15.7% higher than normal but below last year’s record levels.

NGSA said gas in storage is approaching a record 1.695 tcf as summer begins, compared with 1.249 tcf last year at this time. Weekly injections in coming months thus could average 59.7 bcf, nearly 7.9% less than last summer, which would reduce pressure on prices, NGSA said.

NGSA expects overall US gas consumption to fall by 0.2% to 51.3 bcfd this summer, with electric power generation representing the only swing demand sector.

It projects a 1% rise in US gas production to an average 50.4 bcfd and a 2% increase in LNG imports to an average 1.6 bcfd this summer.

Iran warns Japanese firms on Azadegan delays

An Iranian oil executive has warned Japanese companies against delaying development of Azadegan oil field, suggesting that the massive project could be transferred to China or another country.

Mehdi Bazargan, managing director of Petroleum Engineering & Development Co. (PEDC), a subsidiary of National Iranian Oil Co., said the deal called for significant work completion by September, barring which “the contract will be terminated automatically.”

PEDC manages project negotiations with Japanese companies.

“Extending the deadline is not written in the contract. We haven’t thought of it,” Bazargan told Japan’s Kyodo News in Tehran. Asked if Iran could turn instead to China or another country, Bazargan said, “What is available in the market we will use, of course.”

Inpex Corp. and its partners want to start production from the field in 2007 and plan to produce more than 400,000 b/d eventually, but key project phases have not been implemented.

Inpex, Tokyo, says the project has been delayed because Iran has not removed all land mines in critical areas. Bazargan agreed that NIOC is obligated to remove mines. “But I don’t think the main obstacle is mine-clearing or demining,” he said.

The US, which is trying to bring international pressure on Iran to abandon its nuclear ambitions, opposes the $2 billion oil development deal between Japan and Iran.

US Ambassador to the United Nations John Bolton said Iran is using its oil and gas reserves to manipulate Japan, and he questioned Tokyo’s decision to help develop Azadegan field (OGJ Online, May 22, 2006).

Occidental files claim against Ecuador

Occidental Petroleum Corp. filed an arbitration claim against Ecuador May 17, seeking reparation for losses following the country’s abrupt termination of Oxy’s exploration-development contract May 15 and the immediate confiscation of the company’s Amazon oil field operations in Block 15 (OGJ Online, May 16, 2006).

Vowing to “vigorously pursue redress for damages resulting from Ecuador’s illegal seizure,” Oxy filed with the Washington, DC-based International Centre for Settlement of Investment Disputes, invoking the US-Ecuador Bilateral Investment Treaty to try to restore the company’s rights in Ecuador and prevent the Ecuadorian government from turning operations over to a third party until the claim is settled. That process could take more than a year, spokesman Lawrence Meriage said.

Ecuador’s actions followed a clash between the parties over taxes and other contract disputes going back to 2004. They also reflect Ecuador’s growing discontent with earnings received by 13 foreign oil companies under current contracts. Other international companies having contracts and assets in Ecuador include Brazil’s Petroleo Brasileiro SA, Repsol YPF SA, Encana Corp., Agip SPA, and Perenco SA, Paris (OGJ, Sept. 12, 2005, p. 30).

“The process resulting in this unlawful act of expropriation began more than 2 years ago shortly after Occidental prevailed, by unanimous decision of an international arbitration panel, in a legal dispute over tax refunds that the government of Ecuador wrongfully withheld from Occidental,” Oxy said. A London court upheld that panel’s decision.

After Ecuador Atty. Gen. Jose Maria Borja called for revocation of Oxy’s contract, state-owned Petroecuador began the seizure of Block 15 and its Eden-Yuturi, Limonchcha, Indillana, Paca Norte, Paca Sur, and Yanaquincha fields.

Oxy said it recently has produced 100,000 b/d from the blocks, 42,000 b/d net to its interest.

Bolivia demands retail networks, refineries

Bolivia President Evo Morales decreed that Brazil’s state-run Petroleo Brasileiro SA (Petrobras), Royal Dutch Shell PLC, and other private firms within a month must turn over their Bolivian retail networks to state-owned Yacimientos Petroliferas Fiscales Bolivianos (YPFB).

He also demanded that Petrobras, which owns 25% of the country’s retail outlets, hand over its 27,250 b/d refinery at Cochabamba and 20,000 b/d refinery at Santa Cruz de la Sierra.

The transfer of the fuel distribution business also hits the companies Copenac, Pisco, Refipet, and Pexim.

On May 29, Morales ordered the removal of all military personnel from Bolivian oil and gas facilities. For 4 weeks, more than 3,000 soldiers have peacefully occupied 56 facilities.

On May 1, Morales nationalized the country’s oil and gas industry after issuing a decree that calls for foreign energy companies to sign new operating contracts within 180 days or leave Bolivia (OGJ Online, May 2, 2006).

Revised Alaskan gas pipeline accord issued

Alaska Gov. Frank H. Murkowski has released a revised natural gas pipeline accord negotiated with the three North Slope producers, which he said the oil companies are ready to sign if the state legislature approves it.

On May 24, Murkowski released a second draft that was 460 pages long. The first draft, released May 10, was 356 pages. The second draft includes oil tax rates and credits in a section that Murkowski calls “the oil fiscal certainty piece.”

The companies would pay a proposed 20% tax on their Alaska oil profits, and they also could subtract investment credits of 20%.

As previously reported, the accord would freeze oil and gas taxes for up to 45 years (OGJ, May 22, 2006, Newsletter). Murkowski told reporters during a news conference in Juneau that he is “very optimistic about the gas pipeline contract going forward.”

He also noted that BP Chief Executive John Browne affirmed in a May 22 Wall Street Journal article that BP would increase its investment in Alaska from a current level of $600 million/year to $1.5 billion over a 10-year period if the gas pipeline is approved.

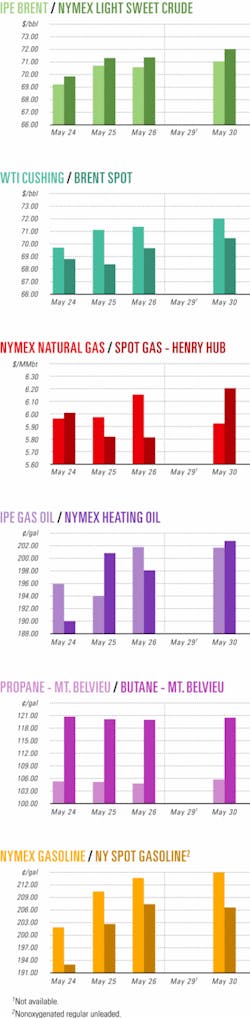

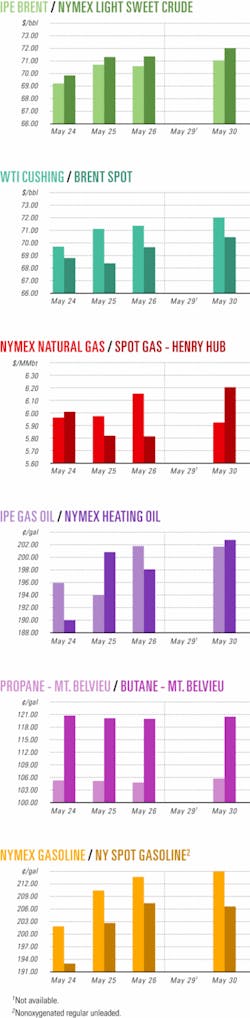

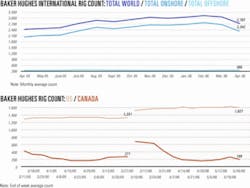

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesDominion has Gulf of Mexico gas discovery

Dominion Exploration & Production is completing for production a deeper-pool gas discovery in West Cameron 130 field on the Gulf of Mexico shelf.

The West Cameron 130 No. 3, drilled to 19,365 ft in 40 ft of water 250 miles southwest of New Orleans, cut 250 ft of net pay in multiple sands.

On test, the well flowed at restricted rates of 11.8 MMcfd of gas and 40 b/d of oil.

Dominion E&P plans to tie the well back to its West Cameron 130 B platform. It also plans further drilling to appraise the newly productive sands in the field and elsewhere on the shelf.

Dominion E&P, operator, owns a 50% working interest in the well. Other interests are Hydro Gulf of Mexico LLC 35% and Mariner Energy Inc. 15%.

Contract let for Kizomba C subsea systems

ExxonMobil Corp. has let an engineering, procurement, and construction contract to Vetco Gray for subsea systems in Mondo oil field in the first phase of the Kizomba C deepwater development project off Angola.

Kizomba C is on Block 15 in 740 m of water about 370 km west of Luanda (see map, OGJ, Oct. 10, 2005, p. 45). In addition to Mondo, it will develop the Saxi and Batuque discoveries, all with subsea wells tied back to floating production, storage, and offloading vessels in use in the Kizomba A and B developments.

Vetco Gray’s contract covers the supply of 17 subsea trees, five manifolds, topside and subsea control systems, and flowline connection systems.

Deliveries are to start later this year.

BG Group wins deepwater license off Nigeria

BG Group, through a partnership with Sahara Energy Exploration & Production Ltd., has been awarded a deepwater license off the western Niger Delta of Nigeria.

OPL 286-DO, previously OPL 213, is in 200-1,000 m of water about 250 km southeast of Lagos.

BG Exploration & Production Nigeria Ltd. will become block operator. Its work program includes drilling an exploration well in the first 5 years.

A signature bonus of $55 million is due upon signing of a production-sharing contract.

Deepwater Nigerian block yields oil strike

Esso Exploration & Production Nigeria Deepwater West Ltd. and partners have made the first oil discovery on deepwater Oil Prospecting License 214 about 70 miles off Nigeria.

The Uge-1 well, drilled to 16,831 ft TD in 4,144 ft of water, encountered more than 300 net ft of oil pay.

Uge-1 is about 90 miles south-southeast of Esso’s Erha deepwater oil and gas field, which recently began production and is expected to ramp up to 150,000 b/d by the third quarter (OGJ, May 8, 2006, p. 9).

Block operator Esso, Chevron Nigeria Deepwater B Ltd., Phillips Deepwater Exploration (Nigeria) Ltd., and Oxy Nigeria Exploration & Production Ltd. each hold a 20% interest in the block. Nigerian Petroleum Development Co. holds 15%, and Sasol E&P Nigeria Ltd. holds 5%.

Husky assesses two Mackenzie Valley finds

Husky Energy Inc., Calgary, is evaluating two discoveries in the Central Mackenzie Valley in Canada’s Northwest Territories.

Husky made a hydrocarbon discovery with the Stewart D-57 (formerly Tehwa D-57) wildcat on Tulita District Land Corp. Freehold Block M-38. The well is 35 km southeast of the Summit Creek B-44 discovery well (OGJ Online, Jan. 9, 2006).

Husky drilled and cased Stewart D-57 to 3,147 m and suspended the well. On open-hole testing, natural gas flowed from two Cretaceous intervals at a combined rate of 5 MMcfd, the company said, “confirming a hydrocarbon-bearing column of at least 50 m.” Husky said it is “the first successful Cretaceous hydrocarbon discovery in the Central Mackenzie region.”

This summer Husky will acquire 200 km of low-impact 2D seismic data in the Summit Creek area of Northwest Territories, 26 km northwest of the Stewart D-57 discovery.

The company is evaluating results from the Summit Creek K-44 well drilled this winter on Exploration License 397 to appraise the Devonian formation and to test deeper-pool Ordovician targets. It is about 1.4 km updip of the Summit Creek B-44 discovery. Summit Creek K-44 was drilled and cased to 3,130 m TD and suspended.

Husky said the group also would commit $10.5 million over the next 4 years to exploration of Block CMV-6, acquired at a May 9 land sale.

Drilling & Production - Quick TakesIndonesian gas disruption forces fuel switch

A disruption of gas supplies from BP Offshore North West Java (ONWJ) has forced Indonesia’s state-run power utility PT Perusahaan Listrik Negara (PLN) to buy diesel for its power plants.

PLN Pres. Djuanda Nugraha Ibrahim said the company would have to spend $12.63 million to buy 1,600 kl of diesel.

ONWJ reduced gas deliveries to PLN’s combined-cycle power plants in Tanjung Priok and Muara Karang-both in North Jakarta-to 130 MMcfd from 260 MMcfd due to a leak in its gas transmission pipeline, which was reported to have been ruptured by a ship’s anchor.

BP operates and holds a 46% interest in the large ONWJ concession, which has 670 production wells, 170 platforms, over 40 processing and service facilities, and 1,600 km of subsea pipelines. Partners include China’s CNOOC 36.72%, Inpex Corp. 7.25%, and Itochu Oil Exploration 2.58%.

Shell brings Mars production back on line

Shell Exploration & Production Co. has restarted oil and gas production from its Mars tension leg platform (TLP) on Mississippi Canyon Block 807 in the Gulf of Mexico.

Mars production of 140,000 b/d of oil and 156 MMcfd of gas had been shut in since late August 2005 due to damage from Hurricane Katrina.

Shell plans to restore Mars production to pre-Katrina rates by the end of June. Shell, operator, has a 71.5% interest in the TLP. BP has the remaining 28.5%.

Sixth platform starts up in Bohai Bay field

CNOOC Ltd. has brought on stream Platform A, part of second-phase development of Bo Zhong (BZ) 25-1/25-1S field in 20 m of water in southeast Bohai Bay, 127 km southeast of Long Kou City, China.

Platform A is producing more than 2,200 b/d of light crude oil from two wells. The platform’s start-up concludes the field’s development period, which includes six platforms. Platforms B, D, E in Phase I and Platforms C and F in Phase II started production in 2004 and 2005.

BZ 25-1/25-1S field oil production, now 30,000 b/d, is expected to increase as additional wells are brought on line.

CNOOC holds 83.3% interest in the field and is operator.

Processing - Quick TakesAramco, Total to build Saudi export refinery

Saudi Aramco signed an agreement May 21 with Total SA to jointly construct a 400,000 b/d export refinery at Jubail with a start-up date of 2011.

The companies agreed to form a joint venture to implement the project, valued at $6 billion. Each will hold a 35% interest. The rest will be offered for public subscription by Saudi nationals.

Aramco and Total agreed to begin a comprehensive front-end engineering and design (FEED) study immediately. The definitive documents to implement the project will be negotiated in parallel with the joint FEED study.

The full-conversion refinery will be designed to process Arabian heavy crude supplied by Aramco. The partners will share the marketing of products.

Aramco officials said they hoped to sign a memorandum of understanding with ConocoPhillips for a 400,000 b/d export refinery in Yanbu.

Syncrude shuts down new desulfurization unit

On orders of Alberta Environmental Protection (AEP), Syncrude Canada Ltd., Calgary, has shut down its new Coker 8-3 flue-gas desulfurization unit and associated equipment, one of three fluid coker units at its Mildred Lake oil sands plant north of Fort McMurray, Alta.

AEP ordered the shutdown following complaints by Fort McKay and Fort McMurray residents of strong odors after Syncrude started up new equipment May 6 following completion of its $8.4 billion plant expansion (OGJ, May 15, 2006, Newsletter). The plant had been upgraded to 350,000 b/d of synthetic crude.

Syncrude base plant operations are continuing to produce 250,000 b/d while Syncrude investigates the source of the emissions.

The flue-gas desulfurization unit uses new technology designed to eliminate most sulfur dioxide emissions from the expanded facility. Additional expansions are planned to bring eventual production at the facility to 500,000 b/d.

Syncrude Canada Ltd. operates the Syncrude project, which is owned by Canadian Oil Sands Ltd., ConocoPhillips Oilsands Partnership II, Imperial Oil Resources Ltd., Mocal Energy Ltd., Murphy Oil Co. Ltd., Nexen Oil Sands Partnership, and Petro-Canada Oil & Gas.

Upgrades due Kårstø gas facility in Norway

Statoil ASA, on behalf of Norway’s state-owned gas company Gassco AS, has let an engineering contract to MW Kellogg Ltd., UK, for the upgrading and possible development of the gas treatment plant at Kårstø, north of Stavanger.

The 130-million kroner contract is for preliminary engineering with an option for detailed engineering. A 20% expansion of the gas plant last year boosted capacity to 88 million cu m/day.

No capacities were specified in the announcement of the new contract, but Arnulf Østensen, Gassco vice-president for technical operations, said, “Kårstø will be upgraded and expanded in coming years.”

Transportation - Quick TakesBidding halted for Bolivia-Brazil gas line work

Brazilian Gas Transport Co. (BGT) has canceled bidding for contracts to expand the 3,150-km Bolivia-Brazil pipeline after Bolivia announced the nationalization of its gas sector.

Jose Zonis, BGT director, said the companies that use the pipeline had all waived their contracts with his company in response to Bolivia’s nationalization plan, including Petroleo Brasileiro SA (Petrobras), Repsol YPF SA, and Total SA.

Two other companies that operate in Bolivia-Pan Energy and British Gas-had not canceled their contracts but had asked for a 180-day grace period while they analyzed the situation in Bolivia.

Bolivian President Evo Morales unveiled a plan on May 1 forcing foreign gas producers to sign new operating contracts or leave the country within 180 days (OGJ Online, May 2, 2006).

Zonis said BGT could restart the bidding process only if there were changes in Bolivia. BGT has paid off all construction costs of the pipeline, which is projected to start making money next year.

Gas pipeline in West Java under study

Indonesia is considering plans for a 220-km natural gas pipeline between Cirebon and Bekasi in West Java at a cost of $200-300 million.

The Cirebon-Bekasi proposal is part of the government’s plan for a national transmission and distribution network.

The proposed line would be linked to the South Sumatra-Cilegon network and would complete the connection of the national network.

BPH Migas Chairman Tubagus Haryono, however, said the government needed to discuss the project since state-run PT Pertamina already has an underused 180-km gas pipeline from Cirebon to Kandanghaur Timur.

Haryono said meetings have been scheduled June 8-10 to discuss the matter and determine whether the tender will be to extend the existing pipeline or construct a new one.

The government is currently constructing or considering four other gas pipelines: the 1,219-km Gresik-to-Kalimantan line; the 366.5-km Pagar Dewa, South Sumatra-to-Cilegon, West Java, line; the 290-km Cirebon-to-Semarang, Central Java, line; and the 390-km Semarang-to-Gresik, East Java, line.

Indonesia said it would launch the tender for construction of the 1,219-km gas pipeline linking East Kalimantan to Central Java following a 1-month delay (OGJ Online, May 4, 2006).

Qatar’s Nakilat orders new LNG carriers

Qatar Gas Transport Co. (Nakilat) has ordered six, 265,000 cu m LNG carriers from South Korean firms Daewoo Shipbuilding & Marine and Samsung Heavy Industries. Each yard will build three vessels.

Qatar Liquefied Gas Co. will lease the carriers to transport LNG from the Qatargas II project to Europe and the US.

Qatargas II, a joint venture of Qatar Petroleum (70%) and ExxonMobil Corp. (30%), comprises Trains 4 and 5, each with a planned production capacity of 7.8 million tonnes/year. Train 4 is scheduled to start production in 2008 and Train 5 in 2009.

Nakilat, which has received four carriers over the past 2 years, intends to invest $16 billion to have a fleet of 61 carriers by 2010.