A recent global benchmarking study on petroleum supply-chain efficiency reveals that refiners have not kept pace with other industries in this area. Accenture’s benchmarking study, which includes 14 global integrated major companies and regional mid-tier companies, shows that the downstream energy industry lags in many areas when it comes to supply-chain excellence compared to retail and other industries (Fig. 1).

Although the study found “pockets” of leading practices, the downstream petroleum supply chain has a relative lack of analytical sophistication, organizational alignment, information integration, and technological sophistication. This article examines the characteristics of best-performing companies’ supply-chain strategies and opportunities to learn lessons from other industries and what will be required to implement them.

Downstream supply chain

The downstream petroleum industry has a huge stake in supply-chain efficiency; US refiners spend about $450 billion/year, according to data from the US Energy Information Administration. This exceeds the $400 billion spent in discount and superstores in the consumer retail industry.1 2

Although there have been numerous supply-chain innovations developed by the retail segment (e.g., collaborative planning, forecasting, and replenishment [CPFR], and radio frequency identification [RFID]), the downstream industry’s supply-chain capabilities have languished under outdated processes and inadequate technology (e.g., spreadsheets).

Given the stakes-characterized by elevated price levels, higher price volatility, and increased risk of supply disruptions from an uptick in hurricane activity-one would expect that the downstream petroleum industry to have advanced and, perhaps, lead in supply-chain practices.

Competitive advantage

Supply-chain capabilities are the set of processes, technology, and people that enable acquisition, inventory management, and distribution of a company’s products. The supply chain starts at crude acquisition and ends with the customer sale (Fig. 2); key non-back-office functions touch and influence the entire supply chain.

Because downstream companies have turned their focus on improving long-neglected supply-chain capabilities, it is natural for them to examine and use best supply-chain practices developed in other industries.

Some of the recent major areas of focus for supply-chain improvement have centered on:

• Collaboration. Supply-chain titans Dell and Wal-Mart popularized CPFR, which represents inter-enterprise processes and technologies that link the seller to supplier in nearly real time. For example, Wal-Mart directly communicates point-of-sale information to suppliers for automated replenishment.

There is much room for improving communication between jobbers, marketers, and pipeline and marine transportation providers, but unfortunately the current industry structure is not set up to take advantage of CPFR. For instance, retail stations-especially now that more are being sold to jobbers3-do not communicate directly with refiners and wholesale marketers in advance to relay impending demand.

The wholesale marketer-jobber relationship is defined by supplier-customer behavior vs. that of supply-chain partners.

• Inventory and logistics management. The introduction of RFID technology is another supply-chain innovation making headlines. The promise of RFID is a near-real-time look at inventory regardless of location with minimal human intervention. In the retail industry, this technology reduces lost sales that have resulted from an average 8-20% stock out rate.4

For most downstream companies, there is often a need for more accurate and timely inventory information, and many companies have launched initiatives in the past few years to upgrade their metering and third-party terminal communication systems. RFID, however, will likely have near-zero applicability in the downstream sector in the near future given the physics of the product.

• Application of advanced analytics. Companies continue to realize the value of advanced analytics in day-to-day business. The expectation is that “partnerships between mathematicians and computer scientists are bulling into whole new domains of business and imposing the efficiencies of math.”5

Supply-chain management is especially amenable to mathematical assistance whether it is specific formulas to optimize inventory levels or price optimization from forecasting and elasticity algorithms. The retail industry provides cutting-edge examples of this trend.

Better analytics around demand and inventory management are contributing to improvements that help retailers reduce inventory by large percentages. Longs Drug Stores, for example, reduced its warehouse inventory by 65%. Crate and Barrel recently claimed a 1-year pay back for implementing a supply-chain analytics system.6

This is an area that is especially lacking in most downstream company’s supply chains as they make do with antiquated processes and spreadsheets run by undertrained staff. The advantage is that with such a poor starting point, applying some rigorous mathematics offers rich opportunities to those refiners that can make the transformation.

All of these innovations provide valuable lessons for downstream petroleum supply-chain improvement. Downstream petroleum, however, is a unique industry with its own supply-chain challenges; therefore, simply copying the cutting-edge techniques developed in other industries will not be a panacea for downstream petroleum.

The most significant difference between downstream petroleum and other industries is that product price volatility complicates the simple goal of matching supply and demand. This creates a conflict between margin maximization and supply-demand matching.

Downstream petroleum needs innovations to incorporate these lessons in addition to creative solutions that fit its unique industry parameters and implementation strategies that recognize downstream petroleum’s relative starting point compared to other industries. Fortunately, some industry leaders have begun to tackle these issues and in the process provide some lessons learned and potential winning strategies:

- Developing supply-chain excellence-getting basic capabilities in place.

- Leveraging the connections between pricing and the supply chain.

- Integrating the supply chain and supply and trading.

- Linking the supply chain and channel management strategy.

Getting basics in place

Refining economics’ linear-programming (LP) planning models have dominated the downstream supply chain. These models take a simple, fairly fixed view of the supply chain outside of the refinery gate.

In the past, downstream supply-chain weaknesses could often be mitigated through the flexibilities afforded from a vertically integrated business model-refining to retail. In this model, downstream supply and marketing is viewed as an administrative arm to distribute product, created in the refinery, to the company’s retail sites vs. a stand-alone profitable enterprise.

This approach is increasingly becoming unsustainable because the major companies have begun shedding or sharing their terminal assets, divesting their retail distribution channels, and increasingly outsourcing logistics and trucking to third-party firms.

As third-party jobbers have stepped in to manage more retail distribution, they have placed major stress on downstream supply chains as they “game” their purchases based on price moves (swing optionality), ruthlessly optimize on regional pricing differentials (switching optionality), and “cheat” by selling unbranded product as branded (and vice versa).

During inverted markets (i.e., when branded product sells for less than unbranded), jobbers with both branded and unbranded stations will often take advantage of the unnatural price disparity to lift branded product to sell at their unbranded stations-in effect a free spread option.

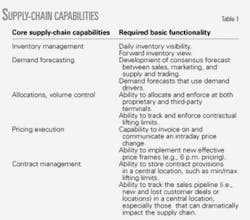

Given the long history of neglect, most downstream companies must start building the required foundation before they can progress to the next level of the supply chain (Table 1).

Although the basic capabilities generally will not provide a sustainable competitive advantage, it does not mean that they are without value to the supply chain. As markets continue to show high volatility and dynamic structural changes, downstream companies must master these core capabilities or risk finding themselves at a competitive disadvantage.

Next-order capabilities

Once foundational capabilities are in place, then companies can begin creating value by linking them with the commercial functions: marketing, pricing, and supply and trading.

Downstream suppliers have traditionally focused on reliability and protecting market share with less focus on optimizing gross margins. Linking supply-chain capabilities to commercial considerations allows companies to position themselves to generate sustainable above-market returns as traditional marketing objectives are evaluated and balanced against increasingly dynamic market opportunities.

Strategic pricing

Most downstream companies use competitor price-following behavior for spot and rack sales and index-based pricing for term sales. These traditional approaches often result in sub-optimal profits.

Strategic pricing-the concept adopted as a best practice at industry leaders like Wal-Mart, General Electric, and Southwest Airlines-combines the disciplines of finance and marketing and is focused on maximizing profits.7 Strategic pricing behavior in the downstream energy sector would include these behaviors:

For term deals:

- Risk-based pricing including the cost of jobber “gaming” behavior.8

- Pricing that includes the cost of providing jobbers with location optionality.

- Analytical methods to price contracts including differences in using Platts vs. OPIS indices.

- Differentiating pricing based on a defined channel management strategy.

- Decommoditizing term offers by providing customers unique products or services (e.g., fixed prices, various levels of reliability or ratability) based on advanced pricing capabilities.

For rack sales and spot deals:

- Using market foresight such as competitor price predictability.

- Pricing optimally by understanding day-to-day location and product price elasticity and demand forces.

- Having the systems in place to deal with market conditions to price multiple times every day.

- Having end-to-end, real-time supply-chain transparency (refinery to terminal) to recognize the organization’s ability to take on spot deals by balancing term deal reliability against near-term opportunities.

Based on implementations in several super-major companies, the benefits of enacting strategic pricing capabilities range from 10-25 points/gal of incremental gross margin.

Supply and trading

Downstream supply and trading organizations are typically responsible for managing inventories, replenishment planning, and refinery production schedules. Those groups with a trading focus also pursue arbitrage (time, basis, grade) and speculative opportunities.

A strong collaboration between marketing and supply is a demonstrated best practice from other industries but is often lacking in many downstream organizations. There is often an internal tension between marketing and supply due to misaligned performance measures and cultures. The “natural work team” has been created in response to this but has generally not solved the problem.

For example, it is common for marketing and supply to have a dysfunctional relationship around demand forecasting, resulting in multiple demand forecasts being used in different parts of the business. At one super major, the marketing department in pure disgust stopped providing a demand forecast altogether to supply and trading because they felt it was ignored upon arrival.

A second area of weakness is the inadequate data infrastructure that facilitates information sharing between marketing and supply and trading. Marketing-related information flows have been often designed for invoicing and financial reporting purposes, not for supporting information to optimize the supply chain. For instance, many companies only have lifting data (third party and proprietary) 1-2 days after the fact-hardly timely information to deal with a run on a terminal.

Best-practice downstream players have defined processes and key performance indicators that both encourage and enforce collaboration between marketing and supply and trading to align behavior throughout the value chain. These organizations also have invested in information technology to facilitate the dissemination of both nearer-time operational information (e.g., lifting patterns and inventory levels) and data that are core to the collaboration process (e.g., new sales coming online from marketing).

Channel management

The downstream market continues to bifurcate between branded and unbranded class of trades; the unbranded market is rapidly taking a larger percentage of the market.9 Some experts predict that unbranded market share will increase to more than 20% of all gasoline sales by yearend 2007.

This structural shift is stressing historic downstream business models around margin capture as the larger and more sophisticated players gain greater influence (e.g., Wal-Mart, Costco on the retail side, investment banks such as Morgan Stanley and Goldman Sachs on the wholesale side) and newer nontraditional players emerge (e.g., Home Depot10 and Walgreens on the retail side, hedge funds on the wholesale side).

Traditional channel management for most downstream companies has focused on reliability and access to product on a contractual basis. With the emergence of these new players, downstream marketers need to understand better both the unique business needs and their costs to serve these disparate players. This means having a robust cost-of-goods sold system that can tie cost back to product terminal and having the analytical and marketing savvy to enact differentiated service, product, and pricing strategies for each defined customer channel.

For example, hyper-marketers may be offered product at near-zero margins to ensure market share, or commercial and industrial customers taking unbranded discretionary sales may be cut off when prices surge. Whatever strategies are used, it is fundamental that there be an understanding of true product costs throughout the supply chain and the flexibility to optimize profits across all available buyers.

Technology players are ramping up activities, such as Vendavo’s 2006 partnership with SAP to extend petroleum specific channel management functionality specifically for the downstream sector.

Challenges, opportunities

The past 2 years have seen a spate of global supply-chain improvement programs initiated by the US and UK-based super majors. We are aware of at least four global supply-chain improvement programs launched at super majors during 2004-06, with a fifth on the cusp of launching one.

These programs have met with varying degrees of success, but each provides lessons for those other super majors and mid-tiers that follow.

These initiatives are not without risk as shown by a high profile failure of a global sales and operation planning project by a super major in the 1990s. The payoff, however, for those companies that are succeeding is impressive.

Recent research directly links supply-chain excellence to increased market capitalization;11 given the current market conditions, companies can expect downstream supply-chain projects to yield internal rates of return in the range of 35-50%.12

These levels make downstream investment attractive even when viewed against upstream projects of comparable risk.

References

- “US retail sales: Discount department stores,” NAICS 451102, 2005.

- “US retail sales: Warehouse clubs and superstores,” NAICS 45291, 2005.

- “BP to sell most company-owned sites to marketers,” Oil Express, Jan. 20, 2006.

- Brody, G., “The Smart, Sensor-Based RFID Network,” ASCET, 2005.

- “Math Will Rock Your World,” Business Week, Jan. 23, 2006.

- “Intelligent Supply Chain Comprehensive BI Tools Improve Inventory Turns,” RIS News, Nov. 2005.

- Nagle, T.T., and Hogan, J., “The Strategy and Tactics of Pricing,” Upper Saddle River, NJ: Prentice Hall Business Publishing, 2005.

- Foti, “Jobber “Gaming” Draws New Scrutiny in Petroleum Supply Chain,” OPIS Oil Express, Apr. 25, 2005, pp. 7-8.

- “U.S. Hypermart Petroleum Market Outlook: Emergence of the New Competitive Arena,” Energy Analysts International, 2003.

- “Home Depot Fuel Test Likely to Presage Bigger Rollout,” Oil Price Information Service, July 2005.

- “Connecting with the Bottom Line: A Global Study of Supply Chain Leadership and its Contribution to the High-Performance Business,” Accenture and INSEAD, 2003.

- Accenture research and Aspentech case studies at http://www.aspentech.com/includes/case.cfm?manufacturing=1.

The author

David A. Foti (david.a.foti@ accenture.com) is a senior manager of strategy and business architecture for Accenture’s downstream energy practice, Houston. He has also served as a manager of asset optimization and risk management at Enron. Foti holds a BBA (1992) in finance from the University of Texas, Austin, an MBA (2000) from the University of Houston, and an MS (2003) in financial engineering and risk management from the University of Illinois. He is a member of the Global Association of Risk Professionals.