Mexico adopts new tax structure for oil, gas exploration, production

On Jan. 1 of this year, Mexico initiated a new fiscal regime for its oil and gas industry, primarily to ensure the financial stability of Petróleos Mexicanos (Pemex), the national oil company. Under a former oppressive and unsustainable tax regime that taxed total sales rather than profit and required an implicit tax rate of 105% on net cash flow, Pemex had suffered net losses for almost a decade and was faltering in its ability to continue exploration and production expansions in its most promising-but costly to develop-structures, to properly maintain its existing facilities and systems, and to retire its mounting debt. The new tax structure, among other things, is designed to turn that around.

Achieving sustainability

Promoting oil and gas activity in any country requires reaching an acceptable balance between the royalties and taxes received by the host country and the return on capital for the companies developing the hydrocarbons.

At a minimum, oil and gas companies should obtain a return equal to their weighted average cost of capital-the interest and dividends paid to lenders and investors.

Mexico’s national oil and gas company is no exception. Pemex must achieve a return on investment at least comparable to its weighted average cost of capital. Otherwise it is not sustainable.

Previous fiscal regime

Pemex suffered losses on its production and distribution of refined and petrochemical products when income was consolidated under the previous fiscal regime “RED,” which translates literally as “Net.” RED is the mechanism devised for payment of duties under the old fiscal regime, which consisted of applying a unitary rate on all products sold to third parties. It thus covered all of Pemex’s activities. The mechanism also ensured the collection of all additional export income generated by crude prices higher than those contained in the annual budget.

The global tax rate stood at 60.8% of total sales. Under such a fiscal charge, Pemex found most new projects associated with these activities to be nonprofitable after duties and taxes.

Typically the tax rate for refined and petrochemical products is applied to profit before taxes rather than total sales.

Such an excessive tax burden might lead most companies to close operations, but for Pemex this was not possible; even though it would generate losses, Pemex was required to continue producing and distributing refined and petrochemical products to comply with its legal obligation to satisfy the nation’s demand.

Another important disadvantage of the previous fiscal regime was the double taxation generated when crude oil was exported or when refined or petrochemical products were imported. On the one hand, crude oil exports were taxed as part of total sales; on the other hand, the income derived from selling imported products was also taxed as part of total sales, even though import tariffs on these products had already been paid.

When Pemex imported natural gas or products, only 39.2% of their total cost was recovered; although these products were obtained at a price linked to international references, total sales derived from them were consolidated with Pemex’s remaining total sales and were therefore taxed at 60.8%.

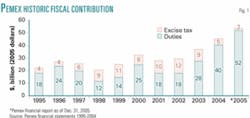

Moreover, total fiscal contribution as a proportion of income before taxes had been volatile because it was mainly a function of prices. Under high oil price scenarios, an excess gains duty equivalent to 39.2% of total crude export sales was applied, thus bringing the total duty to 100% of sales (Fig. 1). Under these high crude oil prices, Pemex was unable to obtain additional resources to either invest in profitable projects or even diminish its outstanding debt.

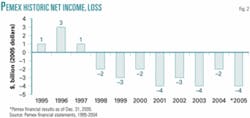

As a result, during the last 8 years, Pemex’s taxes and duties have been higher than its net income before taxes and duties; therefore, the company has registered net losses since 1998, largely as a result of its fiscal charge (Fig. 2).

Under this tax scheme, many exploration and production investment projects, which displayed positive internal rates of returns before taxes and duties, were not profitable after taxes. Thus, Pemex decided not to allocate resources to many relevant projects, which resulted in a reduction of the country’s hydrocarbon production potential.

Revised fiscal regime

Under the newly approved tax regime, the “Ley Federal de Derechos”(Federal Rights Law) will govern Pemex Exploration & Production, and the “Ley de Ingresos de la Federación” (Income Law of the Federation) will continue to govern the tax regime of other subsidiaries.

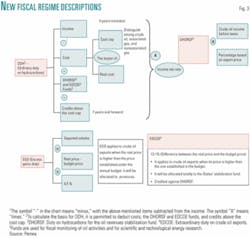

The new fiscal regime for Pemex Exploration & Production consists of five duties (Fig. 3):

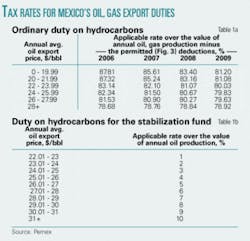

- Ordinary duty on hydrocarbons. During 2006-09, a variable tax rate will apply, depending on the average Mexican crude oil export price and the specific year (Table 1a). The rate will vary from 78.68% to 87.81% in 2006 and stabilize at 79% in 2010 and thereafter. This duty applies to the value of extracted production, net of certain permitted deductions (including specific investments, some costs and expenses, and the other duties).

- Duty on hydrocarbons for the oil revenues stabilization fund. The rate of this duty will be 1-10% of the value of the extracted oil, depending on the average Mexican oil export price. It will apply only if the export price for the oil exceeds $22/bbl (Table 1b). The rules for the transfer of these funds are defined in the federal budget. The oil revenues stabilization fund existed previously and received funds when crude prices were higher than projected and actual income exceeded income projected in the annual budget.

- Extraordinary duty on crude oil exports. The rate will be 13.1% of the realized value of oil exports exceeding the estimated value of oil exports budgeted by Congress. This duty is to be credited against the duty for hydrocarbons for the oil revenues stabilization fund. Proceeds will be distributed to states through a stabilization fund for states’ revenues. This fund existed previously, receiving funds when actual income exceeded the income estimated in the annual budget.

- Duty on hydrocarbons for the Fund for Scientific and Technological Research on Energy. The rate will be 0.05% of the value of produced oil. Based on the federal budget, the proceeds will go to the Mexican Petroleum Institute to be used for energy-related research.

- Duty on hydrocarbons for fiscal monitoring of oil activities. The rate will be 0.003% of the produced oil’s value. Based on the federal budget, the proceeds will help fund the federal auditing entity.

A very important characteristic of the new fiscal regime is the income tax applicable to downstream activities-refining, gas processing, and petrochemicals production. The new tax law designates profit as the tax base, and the tax rate is comparable to the rate applied to other industrial activities.

The special tax on gasoline and diesel consumption will continue under the new fiscal regime, however, as gasoline and diesel prices are controlled. In 2006, prices will be adjusted by a rate equal to the expected inflation rate plus 1%. For these products, the IEPS tax (Special Tax on Products and Services) acts as a buffer. When crude and refined product prices are high, the tax rate for refiners decreases. And when prices are low, the tax level increases. The result is a controlled variation of prices for the main refined products.

New regime advantages

Since 2001, the average tax rate was 105% of net cash flow, but under the new regime that figure is reduced to 79%, a major improvement.

Pemex’s new fiscal regime is now competitive with the various tax systems of countries having geological characteristics similar to Mexico’s and comparable finding, lifting, and development costs. The new fiscal regime allows deduction of taxes and duties payments as well as exploration costs. Consequently, it is expected to lead to an increase in exploration and production investment, which should result in higher reserves replacement rates and enhanced hydrocarbon production in Mexico.

The new fiscal regime also promotes adequate maintenance of facilities because it allows deduction of such costs. In addition, it will allow Pemex Exploration & Production to reach its production and reserve replacement rate goals gradually, under economically feasible conditions.

Pemex’s new fiscal regime distinguishes hydrocarbon exploration and production from refining, gas processing, and petrochemical production. Under the new fiscal regime these downstream activities are taxed on the basis of profit and are more similar to the income tax structure applied to conventional companies.

In addition, under the new system, Pemex’s investment decisions will no longer be distorted by the tax regime as they had been in the grip of the previous fiscal structure; projects’ rankings will no longer be altered in analyses of the internal rate of return before or after taxes and duties.

Furthermore, under the former, more repressive tax structure, Pemex Exploration & Production was inclined to refrain from entering most exploration and exploitation projects if they were costly to develop, even if they were in reservoirs and basins holding large volumes of hydrocarbon reserves and prospective resources. This occurred because Pemex’s net present value was either negative or near zero.

Under the new system, the reserve volume in the E&P portfolio increases by 25% as many projects increase their net present value and therefore are now feasible and profitable.

A new effectiveness

Pemex’s new fiscal regime is now competitive and enhances the profitability of exploration and exploitation. The program enables the Mexican government to guarantee a lease-royalty return without affecting its public finances, taxes oil and gas refining and petrochemical production based on profits, and taxes E&P on the basis of net cash flow.

As a result, Pemex investment and operating decisions are unimpeded, and the lower tax and duty rates enable it to create value along the industry’s entire activity chain.

The new regime directs a constant flow of additional resources to promote strategic investments and fosters the financial sustainability of the company.

The authors

Juan Jose Suarez Coppel has been chief financial officer of Petroleos Mexicanos (Pemex) for the past 5 years. Previously, he served as chief of staff for Mexico’s Secretary of the Ministry of Finance and Public Credit during December 2000-February 2001 and was corporate treasury director of Grupo Televisa in 1995. He also served as director of the derivatives trading desk at Banco Nacional de México SA and as chief of staff for the undersecretary of income in Mexico’s Ministry of Finance and Public Credit. Suarez received his BA in economics from Instituto Technológico Autonomo de México (ITAM) and his master and doctorate degrees in economics from the University of Chicago. During 1986-91 he was a professor at the Universidad Autonoma de Barcelona, España, at Brown University in Providence, RI, and at ITAM.

Ariel Yepez is chief economist for Pemex. His responsibilities include leading the company-wide dialogue in areas such as energy reform, pricing policies, and project evaluation. Prior to his current post, he worked for the Mexican Ministry of Finance as the general director of revenues and pricing policies. His responsibilities included coordinating and supervising the pricing policies of all government-owned enterprises (electricity, roads, airports, oil). In addition, he was involved in deregulation and privatization of the natural gas and petrochemical industries. Earlier he worked as Pemex business development manager. Yepez has been professor at the Universidad Nacional Autonoma de Mexico, at ITAM, and at the University of Chicago. Yepez holds a doctorate from the Department of Economics at the University of Chicago.