Technology keys Brazil’s drive to oil self-sufficiency

Current work to link the floating production storage and offloading (FPSO) P-50 vessel to 16 production wells at the Albacora Leste field in Campos basin symbolizes Brazil’s plans to reach oil self-sufficiency by mid-2006, according to Sergio Gabrielli, president of state-owned oil company Petroleo Brasileiro SA (Petrobras).

The FPSO will process oil pumped from the field 150 km off Rio de Janeiro and reach peak production of 180,000 b/d by August, which represents around 10% of Brazil’s crude oil output, said Gabrielli in comments to OGJ. The P-50 will also be able to handle 6 million cu m/day of natural gas.

Petrobras, which produces 97% of Brazil’s oil production, saw domestic crude output reach 1.72 million b/d in 2005, just short of domestic demand.

The P-50 and P-34, also an FPSO, are to begin processing 20,000 b/d of oil at Jubarte field, also in Campos basin. They will thur raise national production to 1.9 million b/d in 2006, surpassing domestic needs and making Brazil reach oil self-sufficiency.

Petrobras’ portfolio includes 36 large production projects, current and planned for 2005-13, to reach production of 2.3 million b/d of oil by 2010, thus “ensuring long-term sustainable self-sufficiency,” said Gabrielli. Among the 36 large production projects are five production platforms-FPSOs and semisubmersibles-and five platforms undergoing technical and commercial evaluation. Petrobras has approved three refineries to be built by 2013. This goal will demand investment of $39 billion in exploration and production until 2010.

Ricardo Beltrão, production general manager at Petrobras’ research and development center (Cenpes), told OGJ that the most important technologies to sustain self-sufficiency and expand offshore oil production in the next 5-10 years include subsea boosting, separation, multiphase pumping systems, and water injection.

Beltrão also said that these technologies are very important in avoiding the accentuated decline in the production of giant oil fields.

Subsea separation systems

Cenpes is currently working on two different concepts of subsea separation systems.

The first is the continuation of the liquid-gas separation and pumping concept to reduce back pressure to the reservoir and thus increase the overall production of wells tied to it. The VASPS (vertical annular separation and pumping system) unit installed in Marimbá-1 well in 2001 is performing well, said Beltrão, ensuring 30-40% incremental production.

Petrobras’ R&D center is starting a new project to increase VASPS flow capacity and specifications to go to 1,500 m water to replace a floating unit that Petrobras wants to decommission.

The second concept is subsea water separation and reinjection which has the benefit of freeing water-handling capacity on existing platforms to allow Petrobras to bring in new wells. This project, under the program to research operations below 3,000 m water depth called Procap-3000, is in the basic engineering-design phase with three vendors following the heavy oil separation tests performed successfully in the field-scale lab-facility. The goal of the project is to apply this concept at Marlim field, within 2 years.

Between 2006 and 2010, Petrobras says, it will invest $1.3 billion in R&D, compared with $398 million in 2005 and $247 million in 2004.

Since 2000, the biggest differences in increased offshore production in Brazil have come from advances in well construction and application of large floating production units moored in deep and ultradeep waters.

“At present we are able to use horizontal wells that allow unprecedented injection and production rates per well, helping us to develop projects with fewer wells, thus reducing” capital expenditures, said Beltrão.

One of the subsea wells in Marlim Sul field produced 41,000 b/d of oil equivalent in 2001, he said, a record-breaking number for Petrobras. Reducing the number of wells is important to Petrobras because of drilling and completion costs imposed by very high daily rig rates.

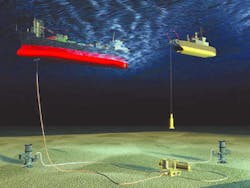

“Currently we deploy mooring systems, using polyester ropes and torpedo piles, which are much lighter and less expensive than traditional ones. It allows us to deploy the production unit with higher load capacity, faster and at lower costs. We believe mooring production units in water as deep as 3,000 m are technically feasible using these concepts,” he said.

Still challenging

Kazuioshi Minami, former coordinator of Cenpes’ Procap-3000 and currently technical manager of the Santos Basin business unit, said, “We have several projects under Procap-3000 such as the Self Standing Hybrid Risers (SSHR) and Tension Leg Riser to tackle the difficulties of heavy dynamic loads imposed on the risers and to comply with thermal insulation requirements.

“Both concepts were considered for the P-52 [semisubmersible] to process 180,000 b/d at Roncador field by 2007, and we have decided to go with the SSHR. We will continue working on the tension-leg riser under Procap-3000 to have a competing alternative.

“A more stable floating unit can make things a little easier for the risers, too. For that matter, we have developed hull concepts such as Mono-BR and FPSO-BR, which will minimize motions significantly,” he said.

The deepest offshore production unit to be installed in short term in Brazil is the P-52 in about 1,800 m of water. Petrobras will be using flexible risers and the SSHR for the 18-in. export pipeline, added Minami.

Test joints of drilling and completion risers are being purchased from Aker Kvaerner and ABB to evaluate their performance in actual rig work. They will be used in conjunction with standard riser joints in one of Petrobras, offshore platforms. It is to debut this month.

For both experts, the most recent technical milestones or recent advances in ultradeep water took place in spread mooring systems for ultradeepwater production platforms that use polyester ropes, as in FPSO P-43 (150,000 b/d Barracuda-Caratinga fields), FPSO P-48 (150,000 b/d Caratinga field), and P-50.

Torpedo anchors for large units such as P-50 have been used successfully. Another successful concept is the torpedo wellhead base. It replaces the conventional jetting technique that requires a rig to install the 30-in. conductor pipe in the first phase of the drilling.

The torpedo-shaped well base is taken to the well location on an anchor-handling boat and lowered to the sea floor by its winch. Once in position it is lowered at maximum winch speed onto the ground. The base is then hammered down to its final position with a steel piston inside the well base. It has been applied successfully in 18 subsea wells so far.

When talking about the major subsea challenges and issues across the different offshore basins in which Petrobras operates, Beltrão said that the company is well acquainted with Campos basin, offering no surprises.

For the Espírito Santo basin, however, “we have a combination of heavy oil and light oil in deepwater conditions, close to 1,400 m water depth, that brings a lot of challenges related to flow assurance.

“Wax deposition is a concern and so is hydrate, as some of self-inhibiting behavior of our heavy crude is not present in light crude. Another issue will be the tight emulsions that heavy oil tends to form with the produced water, increasing pressure drop and decreasing productivity,” said Beltrão.

“In Santos Basin we have different types of reservoirs and fluids, from nonconsolidated sandstones to tight carbonate reservoirs, and from gas-condensate to heavy oil. Reservoir depths vary significantly as well.

“We may have shallow reservoirs, below 2,800 m from the sea level, or very deep reservoirs, in excess of 6,000 m from sea level, yielding high pressures and high temperatures. In addition to differences in production conditions, we need to develop infrastructure in the area, as this is still a virgin area,” said Minami.

Petrobras tried to install its tension-leg-riser prototype (Boião in Portuguese, referring to the large buoy) at Campos basin at yearend 2005. Its objective is to decrease dynamic loads on the risers and umbilicals. The large buoy, installed at subsurface, will hold all the loads.

When minor damage occurred in one of the mooring guides during the trial installation, Petrobras had to take it back to the shipyard to be repaired. “Unfortunately we had an incident at the yard that caused a crane to drop over the buoy, damaging it further. We are discussing how to proceed on this project because the area is now needed to carry on other Petrobras fast track orders,” said Beltrão. “Therefore, we are putting this project on hold.”

Gulf challenges

Petrobras typically develops fields in waters between 1,000 and 2,000 m deep from a sandstone reservoir containing mid-API crude (20° to 30°) at 2,500 to 3,500 m vertical depth from the sea level. The weather conditions are mild.

Offshore Gulf of Mexico presents a completely new scenario for Petrobras technology: hurricane-force weather; tight reservoirs; high pressure, harsh-temperature conditions; ultradeep waters and ultradeep wells-close to 9,000 m.

Despite the differences, Cenpes’ experts believe there is a chance to use Petrobras’ domestic solutions for future field development there, such as the mono column platform, named Mono-GOM.

Models show good performances of this new hull for the gulf. The most likely scenario for Petrobras in the gulf is the development of ultradeepwater reserves of gas-condensate systems operating at high pressure and temperature.

“Definitely it is a new challenge for us, but the good news is that the US provides excellent technical and logistic infrastructure,” said Beltrão. ✦

Torpedo piles and polyester ropes enable newly designed mooring systems to be much lighter and less expensive than traditional ones. Photograph from Cenpes/Petrobras.