OGJ Newsletter

General Interest - Quick Takes

Venezuela reclaims oil company acreage

Venezuela last month reclaimed more than 27,000 sq km formerly licensed by oil companies by requiring them to join new state-controlled joint ventures, El Tiempo newspaper reported.

Companies operating 32 oil fields were required to form ventures with the state oil company, Petróleos de Venezuela SA (PDVSA), as part of the Venezuelan government’s effort to boost its share of oil revenue (OGJ Online, Apr. 10, 2006).

Under the new terms, PDVSA took at least a 60% stake in each field, hiked taxes and royalties, and took back acreage, noting the areas were ones in which companies had failed to invest.

According to El Tiempo, Eulogio del Pino, a PDVSA director, said companies were compensated a total of $900 million in investment bonds that can be used in the new joint ventures under a program not yet fully defined.

Aramco, Sinopec sign oil supply agreement

Saudi Aramco Pres. and Chief Executive Abdallah S. Jum’ah and Sinopec Group Pres. Chen Tong Hai have signed a memorandum of understanding committing Aramco to supplying Sinopec and its affiliates with 1 million b/d of Arabian crude by 2010.

Sinopec and Aramco also reemphasized their interest in expanding their long-term business relationship.

The memorandum focuses on commercial and technical aspects of the companies’ collaboration in the areas of crude processing and commercial storage, natural gas exploration and production, petroleum products, and petrochemicals derivatives.

The MOU also covers the countries’ joint developments in China: the Fujian Refining and Ethylene Project and the Qingdao Refinery Project.

Aramco and Sinopec agreed to establish the Fujian Ethylene Joint Venture and the Fujian Marketing Joint Venture this year. They agreed that the Refining and Ethylene Integrated Project would begin production by early 2009.

For the Qingdao Refinery Project, the companies agreed to further their joint efforts to reach agreement on terms for Aramco’s participation and to meet the plant’s on stream date of 2008.

Japan, Qatar sign energy cooperation pact

Japan and Qatar have signed a cooperation agreement aimed in part at securing long-term energy supplies for the import-dependent Asian nation. Details of the pact weren’t announced.

“It’s a joint statement, a commitment for further strengthening between Japan and Qatar in the economic and industrial sectors,” said Toshihiro Nikai, Japan’s Minister for Economy, Trade, and Industry.

Qatar’s Second Deputy Premier and Minister of Energy and Industry Abdullah bin Hamad Al-Attiyah said the statement “is intended to boost economic bilateral ties between Qatar and Japan” but told reporters the agreement would not result immediately in projects or increased energy sales.

Apache to buy BP Gulf of Mexico shelf assets

Apache Corp. plans to pay $1.3 billion to acquire BP PLC’s interests in 18 oil and gas fields in shallow waters of the Gulf of Mexico. BP operates 11 of the fields.

The transaction covers 92 blocks with estimated proved reserves of 27 million bbl of liquid hydrocarbons and 185 bcf of natural gas. Apache also has identified 50 drilling prospects on the properties and an additional 4 million bbl of liquids and 26 bcf of gas in probable and possible reserves.

Some of the fields are subject to preferential purchase rights of other interest owners. The transaction, subject to government approvals, is expected to close by the end of the second quarter.

In early 2003, BP sold Apache its 96.14% stake in the UK North Sea’s Forties oil field as well as some shallow-water Gulf of Mexico properties for $1.3 billion (OGJ, Jan. 20, 2003, p. 32). The new sale covers BP’s remaining properties in the gulf’s shallow waters.

Upon completion of the latest transaction, the gulf shelf will account for 21% of Apache’s worldwide production and 15% of its reserves.

Apache expects the acquired assets to produce on average 7,100 b/d of oil, 1,500 b/d of gas liquids, and 108 MMcfd of gas from the Apr. 1 transaction date through yearend.

Production is expected to rise in 2007 as fields damaged by last year’s hurricanes resume flow.

DOE proposes SPR acquisition procedures

The US Department of Energy, in response to a provision of the Energy Policy Act of 2005, has proposed procedures for acquiring crude for the Strategic Petroleum Reserve.

Acquisitions may be by direct purchase, transfer of royalty oil from the Department of the Interior, or receipt of premium barrels resulting from deferral of scheduled deliveries, DOE said.

It said the SPR currently holds 687.3 million bbl. Comments on the proposal are due by May 24. ✦

Exploration & Development - Quick Takes

null

Noble Energy reports deepwater GOM discovery

Noble Energy Inc., Houston, reported “high quality pay” in one objective and identified pay in a second objective of its Redrock prospect in the Gulf of Mexico, Mississippi Canyon Block 204 No. 1.

The well was spudded in 3,334 ft of water on Dec. 30, 2005, and drilled to 23,365 ft TMD.

Noble is operator of the Redrock and adjacent Raton prospects with a 50% interest. Partners are Samson Offshore Co. and Energy Partners Ltd., 25% each.

While Noble performs reservoir modeling on Redrock, it is moving the rig to drill Raton on Mississippi Canyon Block 248. It will spud the well this month in 3,379 ft of water. The company plans to drill the Raton well to 20,000 ft TMD and complete drilling by late summer.

Dominion stakes three Alabama shale tests

The Black Warrior basin unit of Dominion Exploration & Production Co., Richmond, Va., staked three more exploratory tests to Floyd/Conasauga shale in north-central Alabama.

The company is operator of record on at least five locations, all in 13s-4e, in northern St. Clair County 15 miles southwest of Gadsden and 60 miles east of Black Warrior basin production.

The latest stakings, in sections 23, 27, and 35, are projected to 8,000 ft, reports the Southeastern Oil Review, Jackson, Miss., publication.

Dominion gauged a flow of 233 Mcfd of gas at a previous test in 34-13s-4e after frac on a 38⁄64-in. choke with 2 psi flowing tubing pressure from Floyd/Conasauga perforations at 5,206-5,592 ft (OGJ Online, Apr. 3, 2006).

GAIL, Arrow plan joint coalbed methane work

India’s energy conglomerate GAIL and Arrow Energy NL, Brisbane, signed a memorandum of understanding outlining areas for joint cooperation and investment in coalbed methane (CBM) projects in Australia and India. The proposed joint venture may also involve other parties.

The alliance will seek prospects for exporting gas to Asia as gas-to-liquids and compressed natural gas. Final terms will be completed in June.

GAIL will invest in and accelerate as many as 10 of Arrow’s CBM development projects in Queensland that are awaiting capital. Top priorities are the Clarence-Moreton basin in southeastern Queensland, the Styx River basin north of Rockhampton on the central east coast, and the Nagoorin Graben basin with Tertiary sediments farther south near Gladstone. Drilling has found good coal deposits in these areas.

Falcon to drill Pecan Station North prospect

Falcon Natural Gas Corp., Houston, and Edwin S. Nichols Exploration Inc., Meridian, Tex., plan to start drilling the Pecan Station North prospect 3 miles north of Pecan Station oil field in Nolan County, Tex.

Falcon says the prospect has multipay possibilities in the Palo Pinto Lime and the Harkey sand. Pecan Station field has produced over 1.1 million bbl of oil from the Palo Pinto Lime.

The first well will twin a 1960 hole that recovered gas on a drillstem test from 15 ft of pay in the Harkey sand. An offset well was not completed in the gas zone. Palo Pinto Lime will be a secondary objective in the new well.

A reentry well will target the Palo Pinto Lime as the primary candidate with the Harkey sand as a secondary objective.

In Pecan Station field, Palo Pinto Lime wells with log characteristics similar to those in the reentry candidate have had initial flows of 100-600 b/d of oil and have average cumulative production of 150,000 boe/well.

Falcon, which has purchased a 75% working interest, says Harkey sand wells are capable of producing 500 Mcfd-1 MMcfd of gas, with some wells exceeding 2 MMcfd.

Shale wildcat planned north of Philadelphia

A private Michigan independent plans to explore for natural gas in an organic shale of Jurassic age in a Mesozoic basin just north of Philadelphia.

Arbor Resources LLC, Traverse City, Mich., is acquiring leases in northernmost Bucks County in hopes of drilling an 8,000-ft wildcat, press reports said. The drillsite would be near a wildcat drilled in 1985 by Northwest Energy that cut 2,000 ft of pay in a Jurassic organic shale in the Newark Supergroup (see maps, OGJ, July 20, 1998, p. 94).

The drillsite is in the Nockamixon area near Riegelsville, Pa., along the Delaware River 35 miles northwest of Philadelphia. Nearest hydrocarbon production appears to be at least 100 miles northwest in and around Bradford County, Pa.

AED confirms oil discovery in Timor Sea

AED Oil Ltd., Melbourne, confirmed an oil discovery in two zones in its Puffin-9 exploration well in the Timor Sea.

The well encountered a 6 m thick upper oil sand and a 3.8 m thick sand lower in the section. Both sands are known to be oil-bearing in other parts of the geologically complicated Puffin structure.

Puffin-9 was drilled in a graben, whereas all other Puffin wells have been drilled on the horst block to the north. The discoveries are separate accumulations and a technical evaluation is under way to define the reserves.

Meanwhile, the Stena Clyde semisubmersible has been moved to drill the Puffin-7 development well to tap reserves in the original Puffin-1 well drilled by ARCO in the 1970s and the subsequent Puffin-5.

Puffin-7 will be brought on stream later this year via a subsea well and a floating production, storage, and offloading vessel supplied under a service agreement with Norwegian shipping company Frontline.

Original development plans called for the next well to be Puffin-8, which would tap reserves in a separate fault compartment found by the Puffin-2 well. However, this could change, depending on the evaluation of test and log data from Puffin-9.

Gippsland exploring Walton basin off Jamaica

Melbourne junior explorer Gippsland Offshore Petroleum Ltd. (GOP) has begun an exploration program in the Walton basin off southern Jamaica.

The company, in conjunction with Perth-based private company Finder Exploration Pty. Ltd., is running a 7,180 km, 2D seismic survey across its four permits, which encompass virtually the whole basin.

The survey should be completed in May and results known by September.

The long offset (8 km) streamer length is designed to acquire high-quality data beneath the extensive reef system in the basin where the company anticipates finding source rocks and deeper potential traps.

The information will be coupled with data from an aerial survey to be flown using BHP Billiton’s Falcon technology and used to map structure and lithology.

The Walton basin has not been licensed since the mid-1980s (see map, OGJ, Sept. 13, 2004, p. 49). GOP and Finder expect to identify drillable prospects by yearend or early 2007. ✦

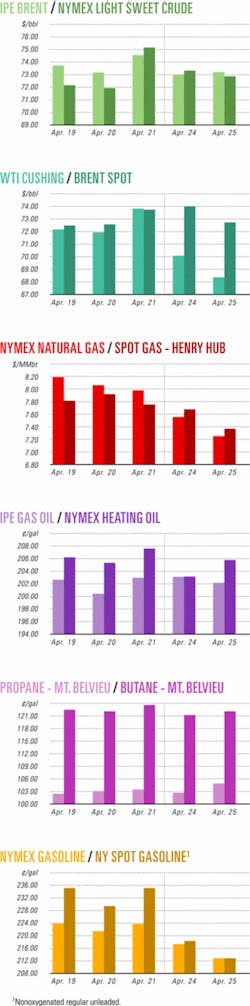

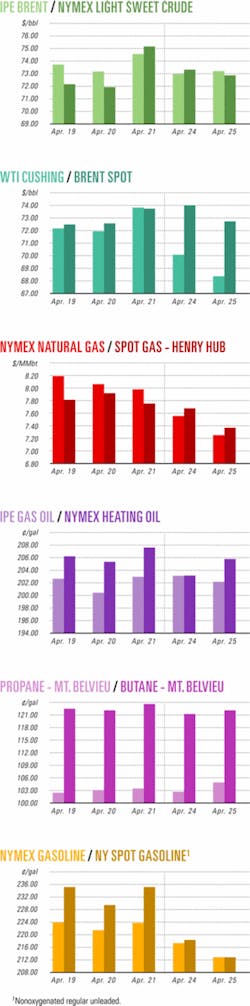

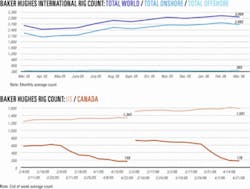

Industry Scoreboard

null

null

null

Drilling & Production - Quick Takes

null

Crosspoint to drill in Louisiana gas field

Crosspoint Group Inc., Las Vegas, plans to work over gas wells and drill at least 15 vertical and horizontal wells in Ebarb School-Converse gas field in Louisiana, in which it has agreed to take a 50% interest.

The transaction is expected to close by the end of May, pending financing.

Drilling in the 1,650-acre Sabine Parish field will be a joint venture of Suncoast Technical Services, Dallas; Fremont, Oklahoma City; and Public Gas Co. (NV), a subsidiary of Crosspoint. Suncoast and Fremont jointly own and operate the field, which has 16 active gas wells.

Huizhou 21-1 gas field on stream off China

Huizhou (HZ) 21-1 gas field in the eastern South China Sea has come on stream and is producing 54 MMcfd through four wells, partner CNOOC Ltd. said.

The field is in 115 m of water on Block 16/08 in the Pearl River Mouth basin. The gas will be processed and sent to a Zhuhai gas terminal through subsea pipelines. HZ 21-1 gas field is operated by CACT Operators Group. CNOOC holds 51% interest in the field.

CACT plans joint development of HZ 21-1 and Pan Yu 30-1 gas fields. The latter is expected to come on stream in 2007. HZ 21-1 field is expected to produce 19.7 bcf/year. CACT includes Agip SPA, Chevron Corp., and CNOOC.

Transocean reactivates semi for India work

Reliance Industries Ltd. awarded Transocean Inc. a 2-year, $248 million contract for the C. Kirk Rhein Jr. semisubmersible for drilling off India.

The contract is expected to commence in December following completion of a reactivation program, which has begun. The reactivation program does not involve an upgrade of the rig’s capabilities.

The C. Kirk Rhein Jr., which entered active service in 1976 and was upgraded to its current specifications in 1997, has been idle in the US Gulf of Mexico since March 2002. Transocean estimates a cost of $38 million to reactivate and mobilize the rig.

Contracts let for work off Saudi Arabia

Saudi Aramco has signed two lump-sum turnkey contracts with subsidiaries of J. Ray McDermott SA for detail design, procurement, fabrication, transportation, and installation of drilling, production, and pipeline facilities off Saudi Arabia.

One contract involves installation of two drilling support structures in Zuluf oil field and a wellhead production platform in Central Safaniya oil field to support production due on stream in May 2007.

Three additional wellhead platforms will be installed in Central Safaniya and Zuluf fields by December 2007. New associated flowlines will connect these platforms to existing offshore tie-in (manifold) platforms.

The contract also includes engineering, procurement, fabrication, and installation of the Safaniya TP-18 tie-in platform, due on stream in December 2007, and a 24-in. trunkline between the new platform and a subsea connection with a new 42-in. trunkline flowing to the onshore Safaniya GOSP-1 separation facility, installed under a separate contract.

The second contract is associated with the 22 km subsea portion of the new 66 km, 30-in. BKTG-1 pipeline, which will transport 220 MMscfd of gas from the Abu Ali Plant to the Khursaniyah Gas Plant. The subsea portion is to be installed by May 2007. ✦

Processing - Quick Takes

null

Ineos chief interested in refining growth

Ineos Group Holdings Inc., which bought BP PLC petrochemical subsidiary Innovene, is determined to expand in refining, an executive said.

Ineos took over the Grangemouth, Scotland, and Lavera, France, refining and petrochemical complexes late last year (OGJ Online, Oct. 7, 2005).

Ineos is contemplating refining acquisitions, and Ineos said 134 European refineries are in the consolidation.

The Grangemouth and Lavera refineries have a combined refining capacity of 425,000 b/d and chemical feedstock output of 2.2 million tonnes/year.

A new Lavera jet fuels process unit is due on stream in July. In addition, a new hydrogen unit is slated to come on stream in July. Ineos also is modernizing petrochemical units, but no capacity increases are planned.

Trinidad and Tobago ethylene project studied

Westlake Chemical Corp. and the government of Trinidad and Tobago have signed a memorandum of understanding for Westlake to build a $1.5 billion ethane-based ethylene, polyethylene, and derivatives complex.

The facility would produce 570,000 tonnes/year of ethylene from 37,500 b/d of ethane supplied by National Gas Co. of Trinidad & Tobago Ltd., which is participating in project evaluation along with National Energy Corp. of Trinidad & Tobago Ltd.

Trinidad and Tobago has expressed an interest in becoming a minority shareholder in the project.

The preliminary project schedule calls for construction to start in late 2007 and operations to start in 2010, NGC Pres. Frank Look Kin said.

China approves coal-to-oil project

China has granted approval to state-owned Yankuang Group, 58% owner of Yanzhou Coal Mining, to develop a coal-to-oil project in the northwestern province of Shaanxi.

The project will have an initial capacity of 1 million tonnes/year of oil products, according to Yangkuang Group Chief Financial Officer Wu Yuxiang. Capacity eventually will rise to 5 million tonnes/year.

Wu said Yankuang would participate mainly in the preliminary stage of the project and will later transfer development to Yanzhou Coal.

Other companies are becoming active in transforming coal into oil products to cope with rising oil demand in China.

A Shenhua Group Corp. Ltd.-led project to convert coal into 3.2 million tonnes/year of oil will be completed next year, while Japan plans to help Chinese companies liquefy coal (OGJ Online, Apr. 13, 2006).

Letter signed for Yansab petrochemical units

Saudi Basic Industries Corp. (Sabic) affiliate Yanbu National Petrochemical Co. (Yansab) has signed a letter of intent with Shaw Stone & Webster Inc. for the detailed engineering, procurement, and construction of a butene and aromatics plant at the large Yansab petrochemicals complex under development in Yanbu Industrial City, Saudi Arabia. This is the second draft deal with Shaw Stone & Webster for units at Yansab (OGJ Online, Feb. 15, 2006).

The plants would have capacities of 135,000 tonnes/year (tpy) of butene and 250,000 tpy of benzene, toluene, and xylene mixtures.

Sabic said this deal completes the contractual process for all Yansab plants, which are expected to go on stream by 2008, with total capacity exceeding 4 million tpy. This includes 1.3 million tpy of ethylene; 400,000 tpy of propylene; 900,000 tpy of polyethylene, 770,000 tpy of ethylene glycol; and 500,000 tpy and 400,000 tpy of polypropylene alongside butane, benzene, xylene, and toluene mixtures.

Automated pilot converts JP8 to hydrogen

Unitel Technologies Inc., Mount Prospect, Ill., has designed and built a fully automated pilot plant for making fuel-cell hydrogen from JP8 (kerosine jet fuel).

The unit produces 20 standard l./min of hydrogen, enough to generate about 975 w of fuel-cell power. It includes two gas delivery modules (air and nitrogen) and two liquid delivery modules (JP8 and water). All four feeds are controlled and monitored by computer. Continuous measurement and integration of outgoing products captures all data required for tight mass-balance calculations.

After mechanical tests, the pilot unit is scheduled to be shipped next month to the US Army Communications Electronics Command at Fort Belvoir, Va., which plans to fine-tune the process for converting a logistical fuel into hydrogen to operate a solid oxide fuel-cell stack. The objective is to generate “quiet power.” ✦

Transportation - Quick Takes

null

BTC Pipeline seeks Kazakh crude, faces costs

Baku-Tblisi-Ceyhan Pipeline Co. is holding talks with a number of oil producers in Kazakhstan aimed at securing crude for transmission through the line.

While oil blends with high sulfur content will not be moved through the 1,768-km line, a special rate would apply to other blends varying quality from Azeri Light, according to David Woodward, chief executive of BP-Azerbaijan, which holds 30.1% of the project.

“As for the blends acknowledged as capable for the transportation, a special scheme will be applied according to which if some blend is lower in quality than Azeri Light, for instance, by 5%, then at the exit of oil in Ceyhan the shipper will get 5% less oil,” he said.

Woodward also acknowledged that spending on the project would increase to $3.9 billion from the planned $2.95 billion, largely due to higher spending on filling the pipeline with oil, delays, and commercial issues with contractors.

In early April, officials in Azerbaijan acknowledged that the State Oil Fund’s expenditure on the Azerbaijani share of the project would exceed the sum agreed for this year-$41.7 million.

“We supposed that the pipeline construction would be completed quicker,” said Samir Sarifov, executive director of the fund. “However, there are delays in the pipeline’s Turkish section, which is being laid by Botas Co. Therefore, there is some growth in spending on the project.”

According to Turkish officials, the first tanker of crude oil from the line will be loaded on May 27 at the export terminal at Turkey’s Mediterranean port of Ceyhan.

ExxonMobil moves Canadian oil to Gulf Coast

Mobil Pipe Line Co., an affiliate of ExxonMobil Pipeline Co., has reversed flow and begun delivering Canadian crude through its 858-mile pipeline between Patoka, Ill., and Nederland, Tex.

Refineries around Beaumont began receiving crude from the pipeline early in April.

ExxonMobil Pipeline Pres. Mike Tudor said Canadian shippers had committed an average 50,000 b/d of crude for 5 years.

“In light of the high shipper interest, we anticipate that the pipeline will operate on average near its estimated capacity of 66,000 b/d in heavy crude service,” he said.

The 648-mile segment of the 20-in. pipeline between Patoka and Corsicana, Tex., had been idle for several years. The other segment had been moving mostly foreign crude from Nederland to Corsicana for delivery in Texas and Oklahoma. ✦