US PROPANE - FOURTH-QUARTER 2005 - FIRST-QUARTER 2006: Capacity recovers from storm damage; industry braces for active 2006 season

Dan Lippe, Petral Worldwide Inc., Houston

For US offshore oil and gas producers, midstream companies, refiners, and petrochemical companies, recovery and rebuilding dominated fourth-quarter 2005 and first-quarter 2006.

Hurricanes caused extensive damage to refineries and gas plants as well as to offshore production platforms and subsea pipelines. The loss of capacity from various facilities and the time required for repairs were the primary reasons for the slump in propane production during fourth-quarter 2005.

Refiners and petrochemical companies were able to complete most of the required repairs to their facilities during the quarter. Offshore producers also made progress during the quarter. These companies, however, will not complete repairs to offshore natural gas and crude oil production and distribution systems until later in 2006.

As a result, the shut-in volumes of natural gas production will continue to limit gas-plant operating rates and propane production in Louisiana during second and third quarters of 2006.

By early March 2006, data compiled by the US Energy Information Administration showed offshore companies had restored about 90% of oil and gas production that was shut in during October 2005. Progress, however, slowed to a crawl during first-quarter 2006, the latter 3 months of this 6-month review. Unless the pace of repairs accelerates during second-quarter 2006, 1 bcfd of natural gas production in the Gulf of Mexico will remain shut in when the 2006 hurricane season begins in June.

Since September 2005, various hurricane specialists have said repeatedly that the number and intensity of tropical storms and hurricanes in the Atlantic Basin vary in 20-30 year cycles. Hurricane activity in the Atlantic Basin was in the trough of the cycle 1970-95. Various meteorologists believe the Atlantic Basin has been in the high-activity period since 1995. During the past 10 years, most tropical storms and hurricanes remained in the open waters of the Atlantic or affected the US East Coast. In 2005, however, the paths for many storms took a substantially westerly shift into the gulf.

According to first official forecasts from the hurricane department at Colorado State University, the 2006 hurricane season will be another very active one, the probability for major storms in the Gulf of Mexico being about double the historic average.

Feedstock demand

Propane feedstock demand is one of the most important balancing elements of the overall propane market in North America. When colder weather pushes sales and consumption in retail markets steadily higher, ethylene producers on the Gulf Coast have substantial capability to reduce their consumption and effectively offset some or all of the impact of a colder-than-normal winter.

Typically, ethylene feedstock demand for propane declines during the fourth quarter but usually rebounds in the first quarter-especially when winter temperatures are warmer than normal. Furthermore, propane’s share of fresh feed also declines in the fourth quarter. Incremental ethylene feedstock economics are always a very strong influence on feedslates and feedstock demand sometimes diverges from “typical seasonal patterns.”

Three fundamental factors strongly influence economic relationships between propane and other feedstocks:

1. Motor gasoline prices determine the value basis for propylene and aromatics prices.

2. Octane values (determined by the price difference between unleaded premium and unleaded regular) strongly influence prices for light naphthas and natural gasoline.

3. Natural gas prices influence ethane prices. In 2005, spot prices for unleaded regular gasoline were abnormally strong. The value of incremental octane was also strong in October 2005. Most important, natural gas prices were very strong in the fourth quarter and ethane prices were also strong relative to other feeds.

As a result, feedstock economics were very favorable for propane throughout fourth-quarter 2005-especially in competition with ethane.

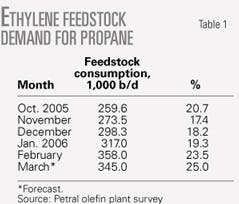

As measured by trends in percentage of fresh feed, feedstock demand for propane was relatively strong during fourth-quarter 2005. Based on Petral’s ongoing survey of ethylene plant feedslates, propane’s share of fresh feed averaged 21% in October and 17-18% in November and December. For the full quarter, propane accounted for about 19% of fresh feed. During fourth quarters 2000-04, propane share of fresh feed averaged 17.3%.

Notably, propane’s share of fresh feed to LPG crackers usually averages 20-22%, but propane accounted for 27% of fresh feed to LPG crackers during fourth-quarter 2005 and was at a record high of 31% in October 2005. The loss of ethylene production from two ethane-only crackers was an important reason for the jump in propane’s share of fresh feed to LPG crackers.

Although propane garnered a strong share of total fresh feed, Petral’s feedslate survey results showed that ethylene production was only 74% of pre-hurricane volumes in October and was only 86% of prehurricane output for fourth-quarter 2005. Due to the slump in ethylene plant production in this quarter, total feedstock demand for propane averaged only 277,000 b/d, or 30,000 b/d lower than in third-quarter 2005.

Petral forecasts ethylene plants to operate at 90-92% of capacity during second and third quarters 2006 and total feedstock demand to average 1.65-1.75 million b/d. Based on Petral economic analyses and forecasts, propane consumption in the ethylene feedstock market will average 340-360,000 b/d in second and third quarters 2006.

Fig. 1 shows historic trends in ethylene feedstock demand.

Retail demand

Propane’s use as a space-heating fuel in residential-commercial markets is the dominant retail end use during fourth and first quarters. Res-com propane demand began to increase during October and reached peak demand during December and January.

Based on heating-degree days, Petral estimates demand for all retail end uses averaged 700-725,000 b/d in fourth-quarter 2005 and 975,000-1 million b/d in first-quarter 2006. Consistent with the warmer-than-normal weather patterns for most of the winter, propane sales into the res-com sector were 40-50,000 b/d lower than in the previous winter.

In a typical year, propane demand for all retail end uses averages 1.2-1.4 million b/d December through February. Estimated total propane sales for all retail end uses averaged 1.20-1.25 million b/d during the peak demand months (December 2005 through February 2006). Propane sales into the retail sectors likely fell sharply in April 2006 and will average only 150-250,000 b/d during second and third quarters 2006.

Propane supply

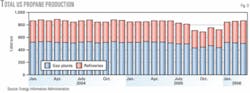

As expected, US propane production was below full recovery for both gas plants and refineries throughout fourth-quarter 2005. The low point for the quarter occurred in October.

EIA statistics from the Petroleum Supply Monthly showed total production from gas plants and refineries averaged only 694,000 b/d in October 2005. Production was 150-175,000 b/d below normal levels during October, but EIA statistics showed that production improved during November and December 2005.

For fourth-quarter 2005, US propane production averaged 727,000 b/d, or 58,000 b/d lower than in third-quarter 2005 and 140,000 b/d lower than in second-quarter 2005.

Most gas plants and refineries returned to full operations by December 2005, but a few gas plants in southeast Louisiana and two refineries remained out of service through end of first-quarter 2006.

Despite these remaining plant outages, Petral estimates total propane production averaged 850-860,000 b/d in first-quarter 2006. Petral forecasts show total propane production will average 840-860,000 b/d in second and third quarters 2006.

Based on EIA’s breakout for propane production from gas plants, propane production from gas plants in fourth-quarter 2005 averaged 452,000 b/d, or about 75,000 b/d lower than normal full industry volumes. With all plants operating and at full recovery, Petral estimates full industry volumes from gas plants are normally 520-530,000 b/d.

Gas-plant production remained below the industry’s full recovery capability during fourth-quarter 2005 because natural gas production was shut in, natural gas prices were high, and profit margins were well below breakeven for margin-based gas processors.

EIA production statistics indicate that the reduced volumes of natural gas available to gas plants in Louisiana accounted for 55,000 b/d of the overall decline in gas-plant production in fourth-quarter 2005. Gas producers and gas processors in other regions left about 20,000 b/d of propane in gas-plant residue gas streams due to the squeeze on profit margins.

Petral based its estimates for gas-plant production in first-quarter 2006 on the slow improvement in natural gas production in the Gulf of Mexico and the expected completion dates for repairs to many of the damaged gas plants in Louisiana. In addition, Petral based its estimates for gas-plant production in first-quarter 2006 on the improvement in gas-plant profitability. Based on these factors, Petral estimates that total gas-plant propane production averaged 475-500,000 b/d in first-quarter 2006. Petral forecasts gas-plant production to increase to 500-520,000 b/d in second quarter and third quarters 2006.

Fig. 2 shows trends in propane production from gas plants.

Refineries

In fourth-quarter 2005, EIA production statistics show propane production from refineries (net of propylene for propylene chemicals markets) averaged only 276,000 b/d. Production was at its lowest level in October 2005 when supply averaged only 249,000 b/d. Production from refineries in fourth-quarter 2005 declined by 30,000 b/d from refinery supply in third-quarter 2005 and was 65,000 b/d lower than full production volumes. Petral based its estimate of full refinery propane production on EIA statistics for 2003 and 2004.

As refineries recovered to normal operations and full-capacity operating rates, net refinery propane production increased to 290,000 b/d in December but remained 40-60,000 b/d below full output. Notably, high natural gas prices encouraged many refineries to use some of their propane production for refinery fuel to limit their purchases of natural gas.

Based on the decline in natural gas prices and the completion of repairs to most refineries, Petral estimates that net propane supply from refineries averaged 340,000 b/d in first-quarter 2006 or about 65,000 b/d more than in fourth-quarter 2005.For the second and third quarters 2006, Petral forecasts net refinery production will average 340-360,000 b/d.

Fig. 3 shows trends in total propane production (gas plants and refineries).

Imports

Consistent with the seasonal increase in retail propane sales, US propane imports from Canada typically increase to peak seasonal volumes of 180-220,000 b/d during the 6 months ending Mar. 31. Usually, US propane imports from outside North America tend to decline sharply after September or October.

In 2005, however, waterborne propane imports into the Gulf Coast averaged 219,000 b/d in October, 138,000 b/d in November, and 53,000 b/d in December, according to EIA. Total imports from all sources reached a record high of 395,000 b/d in October 2005, according to EIA and Bureau of Census statistics.

Imports from Canada averaged 157,000 b/d in fourth-quarter 2005, or 67,000 b/d more than in third-quarter 2005. Based on propane inventory statistics published by Canada’s National Energy Board and Petral’s estimates of Canadian propane consumption during first-quarter 2005, imports from Canada increased to 190-210,000 b/d during first-quarter 2006.

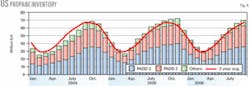

Inventory trends-general

Oct. 1 normally marks the beginning of the inventory liquidation season for propane markets in the US. Occasionally, propane inventories have not reached their seasonal peak until mid to late October.

For 2005, however, propane inventories continued to build through the end of November and into the first week of December, according to weekly statistics published by EIA. The late summer surge in waterborne propane imports and storm-limited feedstock demand during fourth-quarter 2005 were the primary reasons for the prolonged period of rising inventories.

Propane inventory in primary storage totaled 72 million bbl at the end of the first week of December. For North America overall, inventories reached a seasonal peak of 82.1 million bbl at the end of November, 1.7 million bbl higher than in all of 2004.

During a typical winter, propane marketers and retailers withdraw 40-44 million bbl of inventory from primary storage. When the market has 60 million bbl in storage at the beginning of the heating season, a typical seasonal draw of 40 million bbl pulls inventories to about 20 million bbl. When pipeline fills, brine availability, and other distribution system constraints are accounted for, inventories of 20 million bbl are at rock bottom levels. When inventories reach a peak of 65-70 million bbl (a comfortable volume for the current market), however, the typical seasonal draw does not pull inventory to rock bottom.

By mid March 2006, accumulation in primary totaled about 40 million bbl according to EIA weekly inventory reports.

Based on statistics published by the NEB, propane inventories in primary underground storage facilities in Canada totaled 5.6 million bbl at the end of February 2006. The cumulative withdrawal of inventory in Canada during the 2005-06 winter heating season totaled 5.4 million bbl. Withdrawals from Canadian storage usually total 8-11 million bbl during the winter heating season.

In a typical spring and summer, the cumulative increase in inventory in primary storage is about 40-45 million bbl. With 30 million bbl in storage on Apr. 1, normal seasonal accumulation rates will push inventories in primary storage to a seasonal peak of 70-75 million bbl on Oct. 1.

In Canada, the typical seasonal build will boost inventories to a peak of 14.0-14.5 million bbl on Sept. 1, 2006. Based on Petral supply-demand forecasts, total propane inventory in North America may increase to a peak of 85-90 million bbl on Oct. 1, 2006.

Fig. 4 shows trends in US propane inventory in primary storage.

Inventory trends-regional

Propane inventory in primary storage in the Petroleum Administration for Defense District for the US Midwest states (PADD 2) reached a peak of 24.2 million bbl on Nov. 1, 2005, a peak that was a month later than is typical for PADD 2. During November 2005 through March 2006, producers and marketers withdrew 13.5 million bbl from storage. The cumulative withdrawal was slightly below average and was 6 million bbl less than the 5-year high of 19.4 million bbl during the winter of 2002-03.

EIA data show that propane inventory in primary storage in PADD 2 on Apr. 1, 2006, was about 2.3 million bbl higher than in 2004 and 1.9 million bbl higher than the 5-year average. The seasonal inventory accumulation imperative is usually one of the most important factors affecting propane supply-demand trends in PADD 2 and inter-regional flows of supply between PADD 3 (Gulf Coast states) and PADD 2 during spring and summer.

For 2006, the task of rebuilding inventories to a normal seasonal peak of 23.5-25 million bbl will be somewhat easier than during 2000-04. But this year, the normal seasonal accumulation will push inventories to a peak of 26-27 million bbl on Oct. 1 or 3-4 million bbl more than average.

Propane inventory in primary storage in PADD 3 did not reach its seasonal peak of 40 million bbl until early December 2005. If we exclude refinery-grade propylene inventories in the inventory statistics for PADD 3, the propane inventory peak in PADD 3 was about 37 million bbl and inventories were 6 million bbl higher than year-earlier levels and nearly 9 million bbl higher than the 5-year average.

During the winter heating season, propane inventories in PADD 3 declined by 22.3 million bbl. In winter 2004-05, inventories declined by only 20.1 million bbl. During 2002-03 and 2003-04, however, inventories declined by 22.5-23.5 million bbl. The cumulative inventory draw for PADD 3 was somewhat surprising in view of the mild winter weather that dominated the Upper Midwest, Northeast, and Southeast.

Pricing, economics

During fourth-quarter 2005, supply disruptions affected the supply-demand balance, and strong natural gas prices distorted normal economic relationships among propane and ethane and light naphthas. Propane prices were nearly 9¢/gal higher in fourth-quarter 2005 than in third quarter, and the ratio of spot prices for propane vs. WTI averaged 74.25% in fourth-quarter 2005 vs. 64.6% in third quarter.

In first-quarter 2006, however, propane prices succumbed to the bearish impact of mild winter weather and weak retail sales. Mont Belvieu spot prices in this quarter were 12.4¢/gal lower than in fourth-quarter 2005. Propane’s ratio vs. WTI also fell sharply and averaged only 63% in the first-quarter 2006.

From the perspective of ethylene producers, production costs for propane were 6¢/lb lower production costs for ethane in fourth-quarter 2005 and were 0.4¢/lb lower than ethane in first-quarter 2006. Ethylene production costs for propane were 2.6¢/lb higher than for natural gasoline in fourth-quarter 2005 but were 2.3¢/lb lower than for natural gasoline in first-quarter 2006.

Gas pricing; recovery costs

Gas-plant recovery costs influenced trends in propane prices during fourth-quarter 2005, but the collapse in natural gas prices sparked a substantial improvement in gas processing economics in first-quarter 2006.

For example, propane-recovery costs for gas plants in Louisiana averaged 113.5¢/gal in fourth-quarter 2005 but declined to only 74¢/gal in first-quarter 2006. Propane-recovery costs in other major production basins (e.g., West Texas-New Mexico, Oklahoma-Kansas, and the Rocky Mountains) averaged 95-98¢/gal during fourth-quarter 2005 but were only 65-70¢/gal in first-quarter 2006.

Recent EIA weekly inventory reports show that natural gas inventories hit record high volumes on Apr. 1. Petral expects storage injection demand for natural gas to be 2-3 bcfd lower than average during the second and third quarters 2006. Based on this consideration, Petral forecasts natural gas prices to remain relatively weak during the spring and summer.

Based on this outlook for natural gas prices, Petral forecasts for gas-plant recovery costs for propane indicate that natural gas prices will be unlikely to influence propane prices during second and third quarters 2006.

Propane prices spring, summer

Petral forecasts WTI prices to increase during second and third quarters 2006 and to average $68-72/bbl by mid to late summer. On this basis and considering the outlook for light naphthas’ prices, ethylene feedstock values for propane prices in Mont Belvieu will increase to $1.05-1.15/gal.

Inventories of propane will be above average, gas plant and refinery production will recover to normal levels, and Petral also forecasts waterborne imports to reach peak volumes during third-quarter 2006. As a result, propane supply will be plentiful and spot prices in Mont Belvieu will be at the lower end of the feedstock value range.✦

The author

Dan Lippe ([email protected]) is president of Petral Cos., Houston. In 1974, he began working for Diamond Shamrock Chemical Co. in a variety of technical and plant-management positions. He began his consulting career at Pace Consultants in 1979 and was employed by Resource Planning Consultants as a partner 1981-86. After RPC’s merger with Bonner & Moore, Lippe served as manager of NGL studies until 1988. He holds a BS in chemical engineering from Texas A&M University and an MBA from Houston Baptist University. He is a member of GPA and chaired its NGL Market Information Committee 1992-94 and 1996-2000.