OGJ Newsletter

General Interest - Quick Takes

Chad delays oil flow halt in funds dispute

Chad has delayed its halt to oil production, a threat it made this month to protest the World Bank’s freezing of funds held by Citibank in London.

Communications Minister Hourmadji Moussa Doumgor said Chad would shut down its oil production at the end of April and not midmonth if the World Bank does not unfreeze its account.

“The Chadian government has decided to wait to turn off the taps until the end of American mediation,” Doumgor said in a statement.

Doumgor said Chad’s prime minister met with the US ambassador “to announce that the government gives a favorable reception to the offer of mediation from the American government and that it has decided to give more time for mediation according to the timetable set out by the US State Department-that is to say, until the end of April.” That statement appeared to countermand recent remarks by Oil Minister Mahamat Nasser Hassan who said that the crucial 1,000-km pipeline, which extends through Cameroon to the Gulf of Guinea, would be shut down on Apr. 18 unless an ExxonMobil Corp.-led consortium paid $100 million the government says it is owed.

That threat was understood to be a way around the impasse created by the World Bank’s freezing of the Citibank account.

The Chadian government originally set Apr. 18 as the date for stopping its oil production over the disagreement, which began in January when the World Bank suspended an aid package and then had the Citibank account frozen, in punishment for Chad’s change of a law which had allocated a share of the oil revenues for social spending (OGJ, Feb. 13, 2006, p. 19).

The government claimed it changed the law because it needed to access the funds more quickly to cover other priorities, including spending on security.

MMS requires more OCS incident reporting

The US Minerals Management Service has published a rule that will require oil, gas, and other producers working on the Outer Continental Shelf to report more operating incidents than they have until now.

Operators will have to report incidents that result in less serious consequences but have the potential for more serious outcomes, MMS said.

The new requirement, which takes effect July 17, will generate more information about causes of incidents and potential risks to human safety and the environment, according to the agency.

MMS said the revised regulations will continue to require operators, lessees, easement holders, pipeline right-of-way holders, and other permit holders to report all serious accidents, any death or serious injury, and all fires, explosions, and blowouts.

Pertamina oil supply woes force import lift

Indonesia’s state-owned PT Pertamina said it will increase its fuel oil imports to 7.4 million bbl in April from 6.4 million bbl in March.

Pertamina spokesman Muchammad Harun said the increase in imports comes after the recent shutdown of a major power supplier due to a shortage of fuel oil.

PT Perusahaan Listrik Negara (PLN)’s Muara Karang power plant shut down six generators due to delays in delivery of fuel oil from Pertamina.

Pertamina has also had difficulty meeting contracts with local firms for the supply of natural gas, although it plans to boost domestic gas deliveries when a new pipeline opens in July (OGJ Online, Apr. 11, 2006). ✦

Exploration & Development - Quick Takes

Aramco’s offshore gas strike due more tests

Saudi Aramco plans to test at least three more reservoirs in a Persian Gulf gas discovery 160 km north of Dhahran between Jurayd and Harqus oil fields (OGJ Online, Apr. 18, 2006).

The Karan-6 well flowed 40 MMcfd of gas through a 38/64-in. choke with 5,033 psi wellhead flowing pressure on an open-hole test of the Permian Khuff A reservoir at 10,888 ft. Flow was limited by capacity of the test string. Aramco said the well might produce 80 MMcfd with a normal completion.

It plans to evaluate and test the Khuff B, C, and D reservoirs, which logs indicate are “excellent quality” hydrocarbon-bearing reservoirs capable of producing at rates comparable to the initial test.

Aramco also plans to deepen the hole into and evaluate pre-Khuff clastics.

The Ensco 76 jack up is on the well, which is programmed to 17,000 ft. Karan-6 is the first of 11 deep-gas prospects

Aramco plans to test off Saudi Arabia over 5-6 years with the Ensco 76 and a second rig to begin work this year. Target depths of several of the tests, which involve high temperatures and pressures, exceed 20,000 ft. This is the first deep offshore gas exploration Aramco has conducted since the 1980s.

Occidental awarded Block 54 PSC in Oman

Oman has awarded a production-sharing contract (PSC) to a group led by Occidental Petroleum Corp. for Block 54, a 5,620 sq km area in southeastern Oman.

The PSC area is adjacent to Block 53, about 500 km southwest of Muscat, where Oxy operates Mukhaizna oil field, Oman’s sixth largest field. Block 53 is judged to have 2.4 billion bbl of 16-18° gravity original oil in place, from which Oxy hopes to recover 1 billion bbl with a large steamflood (OGJ, Aug. 1, 2005, p. 33).

OXY will operate Block 54 and hold a 70% interest. Mitsui E&P Middle East BV and Liwa Energy Ltd. will participate with 15% each. Liwa Energy is the oil and gas subsidiary of Mubadala Development Co., which is owned by the Abu Dhabi government.

PTTEP to receive Block 58 in Oman

Thailand’s PTT Exploration & Production PLC (PTTEP) submitted the winning bid for 2,264 sq km Block 58 in southwestern Oman. PTTEP expects to sign the exploration and production-sharing agreement (EPSA) for the acreage in June. PTTEP will own and operate the block.

Block 58 will be PTTEP’s second venture in Oman. The company plans to start production at midyear from Shams-4 field on Block 44, a 1,162 sq km tract 300 km west of Muscat (OGJ Online, Jan. 17, 2006).

The terms of EPSA for Block 58 were not disclosed. The Omani government reserved the right to a 20% interest if a commercial discovery is made.

Contract let for Shah Deniz platform placement

A BP PLC unit has let a contract to McDermott Caspian Contractors Inc. (MCCI) for platform placement in the first stage of development of Shah Deniz offshore gas and condensate field 100 km south of Baku (see map, OGJ, Oct. 18, 2004, p. 39).

The company will provide the Israfil Huseynov pipelay barge to support placement of the Shah Deniz TPG500 platform in 100 m of water.

MCCI has completed laying underwater pipelines as part of the first stage of development. MCCI laid three 90-km pipelines from the platform to the onshore Sangachal terminal: a 26-in. gas pipeline, a 12-in. condensate pipeline, and a 4-in. pipeline for chemical reagents.

Lukoil-Perm begins Gabyshevskoye development

Lukoil-Perm, the operating arm of Lukoil Overseas Holding Ltd., has started development of Gabyshevskoye oil field in the Oktyabrsky district in the south of the Perm region of Russia. It didn’t disclose drilling plans.

Lukoil-Permneft discovered the field in 1998 and has drilled four exploration and appraisal wells.

Analysis of a 1997-98 seismic survey identified three structural highs designated Gabyshevskoe, North-Gabyshevskoe, and Malo-Tartinskoe. Oil pay is of Famennian age. The field’s recoverable oil reserves are estimated at 187,000 tonnes. The field is producing 12.3 tonnes/day/well from three wells. Production is expected to peak at 20,000 tonnes/year in 2008.

Lukoil-Perm finds oil in Russia’s Perm region

Lukoil-Perm has discovered oil with an exploration well drilled to 1,800 m in the Oktyabrsky and Chernushinsky districts in the southern Perm region. It encountered oil in Verean, Lower and Mid-Visean, and Upper Devonian-Tournaisian age sands of a field it has designated Sharonovskoe.

Lukoil-Perm plans to bring the field on line in 2009. Peak production of 400 b/d is expected in 2012.

Toreador completes Dogu Ayazli-2 off Turkey

Toreador Resources Corp., Dallas, has completed the Dogu Ayazli-2 appraisal well 1,969 ft west-northwest of the Dogu Ayazli-1 discovery under development in the Black Sea off Turkey (OGJ Online, Mar. 9, 2006).

The appraisal was drilled to a measured TD of 4,778 ft. Logs indicate gas in 106 m of net pay in 10 zones in the Kusuri formations, which are productive in the Dogu Ayazli-1 well.

Dogu Ayazli-2 will be tested after being tied back to the Dogu Ayazli production tripod to be installed later this year. Operations on the appraisal well have been suspended. The Prometheus jack up will move 2.5 km to the east to drill the Bayhanli-1 exploration well on a separate prospect between the Dogu Ayazli and Akkaya discoveries.

Taiwan to develop its first offshore field

Taiwan’s state-run Chinese Petroleum Corp. (CPC) plans to start production in 2009-10 from its first offshore field, a gas-condensate deposit in the Taiwan Strait west of Kaohsiung, according to a CPC official.

The F structure gas field in the Taiwan trough 100 km offshore in 120 m of water is believed to contain 240 bcf of recoverable gas plus an undisclosed volume of condensate. The field was discovered years ago when gas prices were too low to support development.

Lee Tsung-lung, a deputy chief executive of CPC’s Natural Gas Division, said CPC plans to drill 10 wells. A platform will be connected by subsea pipeline to processing facilities at Yungan and will sustain commercial exploitation for up to 10 years, he said.

CPC has drilled 137 offshore wells off Keelung, Hsinchu, Lugang, Penghu, and Kaohsiung since 1972.

The country has 57 producing wells in onshore fields in western Taiwan that produced a combined 77 MMcfd of gas and 767 b/d of liquids in 2004. The fields are named Tiejhanshan, Cingcaohu, Jinshuei, Yongheshan, Baishatun, Chuhuangkeng, Bajhangsi, Sinying, and Guantian.

Pogo, Keeper to explore Vietnam block

Pogo Producing Co. and Keeper Resources Inc. have signed an exploration and production-sharing contract with state-owned PetroVietnam for Block 124 covering 1.48 million acres in the Phu Khanh basin northeast of Ho Chi Minh City.

Pogo and Keeper will acquire 850 sq km of 3D seismic data and drill two wells during the first 3 years of a 7-year exploratory phase. Additional terms of the contract offer two optional 2-year periods, during each of which a well must be drilled.

PetroVietnam retains the right to participate in any commercial discovery with up to a 20% working interest.

Pogo said existing 2D seismic data indicate several leads in Miocene and Paleozoic rocks.

Keeper said it will have an initial 25% working interest, and Pogo will hold 75% and operate the block. ✦

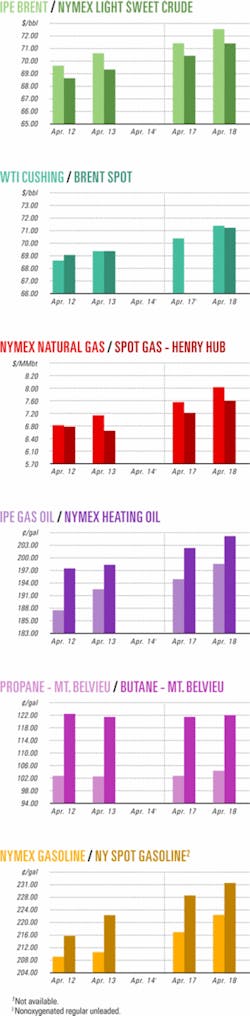

Industry Scoreboard

null

null

null

Drilling & Production - Quick Takes

Aramco’s offshore gas strike due more tests

Saudi Aramco plans to test at least three more reservoirs in a Persian Gulf gas discovery 160 km north of Dhahran between Jurayd and Harqus oil fields (OGJ Online, Apr. 18, 2006).

The Karan-6 well flowed 40 MMcfd of gas through a 38/64-in. choke with 5,033 psi wellhead flowing pressure on an open-hole test of the Permian Khuff A reservoir at 10,888 ft. Flow was limited by capacity of the test string. Aramco said the well might produce 80 MMcfd with a normal completion.

It plans to evaluate and test the Khuff B, C, and D reservoirs, which logs indicate are “excellent quality” hydrocarbon-bearing reservoirs capable of producing at rates comparable to the initial test.

Aramco also plans to deepen the hole into and evaluate pre-Khuff clastics.

The Ensco 76 jack up is on the well, which is programmed to 17,000 ft. Karan-6 is the first of 11 deep-gas prospects

Aramco plans to test off Saudi Arabia over 5-6 years with the Ensco 76 and a second rig to begin work this year. Target depths of several of the tests, which involve high temperatures and pressures, exceed 20,000 ft. This is the first deep offshore gas exploration Aramco has conducted since the 1980s.

Occidental awarded Block 54 PSC in Oman

Oman has awarded a production-sharing contract (PSC) to a group led by Occidental Petroleum Corp. for Block 54, a 5,620 sq km area in southeastern Oman.

The PSC area is adjacent to Block 53, about 500 km southwest of Muscat, where Oxy operates Mukhaizna oil field, Oman’s sixth largest field. Block 53 is judged to have 2.4 billion bbl of 16-18° gravity original oil in place, from which Oxy hopes to recover 1 billion bbl with a large steamflood (OGJ, Aug. 1, 2005, p. 33).

OXY will operate Block 54 and hold a 70% interest. Mitsui E&P Middle East BV and Liwa Energy Ltd. will participate with 15% each. Liwa Energy is the oil and gas subsidiary of Mubadala Development Co., which is owned by the Abu Dhabi government.

PTTEP to receive Block 58 in Oman

Thailand’s PTT Exploration & Production PLC (PTTEP) submitted the winning bid for 2,264 sq km Block 58 in southwestern Oman. PTTEP expects to sign the exploration and production-sharing agreement (EPSA) for the acreage in June. PTTEP will own and operate the block.

Block 58 will be PTTEP’s second venture in Oman. The company plans to start production at midyear from Shams-4 field on Block 44, a 1,162 sq km tract 300 km west of Muscat (OGJ Online, Jan. 17, 2006).

The terms of EPSA for Block 58 were not disclosed. The Omani government reserved the right to a 20% interest if a commercial discovery is made.

Contract let for Shah Deniz platform placement

A BP PLC unit has let a contract to McDermott Caspian Contractors Inc. (MCCI) for platform placement in the first stage of development of Shah Deniz offshore gas and condensate field 100 km south of Baku (see map, OGJ, Oct. 18, 2004, p. 39).

The company will provide the Israfil Huseynov pipelay barge to support placement of the Shah Deniz TPG500 platform in 100 m of water.

MCCI has completed laying underwater pipelines as part of the first stage of development. MCCI laid three 90-km pipelines from the platform to the onshore Sangachal terminal: a 26-in. gas pipeline, a 12-in. condensate pipeline, and a 4-in. pipeline for chemical reagents.

Lukoil-Perm begins Gabyshevskoye development

Lukoil-Perm, the operating arm of Lukoil Overseas Holding Ltd., has started development of Gabyshevskoye oil field in the Oktyabrsky district in the south of the Perm region of Russia. It didn’t disclose drilling plans.

Lukoil-Permneft discovered the field in 1998 and has drilled four exploration and appraisal wells.

Analysis of a 1997-98 seismic survey identified three structural highs designated Gabyshevskoe, North-Gabyshevskoe, and Malo-Tartinskoe. Oil pay is of Famennian age. The field’s recoverable oil reserves are estimated at 187,000 tonnes. The field is producing 12.3 tonnes/day/well from three wells. Production is expected to peak at 20,000 tonnes/year in 2008.

Lukoil-Perm finds oil in Russia’s Perm region

Lukoil-Perm has discovered oil with an exploration well drilled to 1,800 m in the Oktyabrsky and Chernushinsky districts in the southern Perm region. It encountered oil in Verean, Lower and Mid-Visean, and Upper Devonian-Tournaisian age sands of a field it has designated Sharonovskoe.

Lukoil-Perm plans to bring the field on line in 2009. Peak production of 400 b/d is expected in 2012.

Toreador completes Dogu Ayazli-2 off Turkey

Toreador Resources Corp., Dallas, has completed the Dogu Ayazli-2 appraisal well 1,969 ft west-northwest of the Dogu Ayazli-1 discovery under development in the Black Sea off Turkey (OGJ Online, Mar. 9, 2006).

The appraisal was drilled to a measured TD of 4,778 ft. Logs indicate gas in 106 m of net pay in 10 zones in the Kusuri formations, which are productive in the Dogu Ayazli-1 well.

Dogu Ayazli-2 will be tested after being tied back to the Dogu Ayazli production tripod to be installed later this year. Operations on the appraisal well have been suspended. The Prometheus jack up will move 2.5 km to the east to drill the Bayhanli-1 exploration well on a separate prospect between the Dogu Ayazli and Akkaya discoveries.

Taiwan to develop its first offshore field

Taiwan’s state-run Chinese Petroleum Corp. (CPC) plans to start production in 2009-10 from its first offshore field, a gas-condensate deposit in the Taiwan Strait west of Kaohsiung, according to a CPC official.

The F structure gas field in the Taiwan trough 100 km offshore in 120 m of water is believed to contain 240 bcf of recoverable gas plus an undisclosed volume of condensate. The field was discovered years ago when gas prices were too low to support development.

Lee Tsung-lung, a deputy chief executive of CPC’s Natural Gas Division, said CPC plans to drill 10 wells. A platform will be connected by subsea pipeline to processing facilities at Yungan and will sustain commercial exploitation for up to 10 years, he said.

CPC has drilled 137 offshore wells off Keelung, Hsinchu, Lugang, Penghu, and Kaohsiung since 1972.

The country has 57 producing wells in onshore fields in western Taiwan that produced a combined 77 MMcfd of gas and 767 b/d of liquids in 2004. The fields are named Tiejhanshan, Cingcaohu, Jinshuei, Yongheshan, Baishatun, Chuhuangkeng, Bajhangsi, Sinying, and Guantian.

Pogo, Keeper to explore Vietnam block

Pogo Producing Co. and Keeper Resources Inc. have signed an exploration and production-sharing contract with state-owned PetroVietnam for Block 124 covering 1.48 million acres in the Phu Khanh basin northeast of Ho Chi Minh City.

Pogo and Keeper will acquire 850 sq km of 3D seismic data and drill two wells during the first 3 years of a 7-year exploratory phase. Additional terms of the contract offer two optional 2-year periods, during each of which a well must be drilled.

PetroVietnam retains the right to participate in any commercial discovery with up to a 20% working interest.

Pogo said existing 2D seismic data indicate several leads in Miocene and Paleozoic rocks.

Keeper said it will have an initial 25% working interest, and Pogo will hold 75% and operate the block. ✦

Drilling & Production - Quick Takes

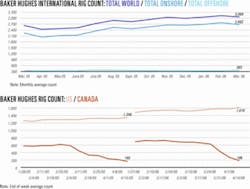

US drilling at new 20-year high

US drilling jumped to a new 20-year high, up by 31 units with a total of 1,610 rotary rigs working, Baker Hughes Inc. reported Apr. 13.

That’s up from 1,348 rigs working during the same period last year and the highest count since the week ended Jan. 24, 1986, when 1,671 rotary rigs were drilling in the US and its waters.

As usual, land operations accounted for the latest increase, up by 32 rigs to 1,494 working. Activity in inland waters increased by 1 rig to 22. Offshore drilling decreased by 2 rigs to 94 in US waters, however, including the decline of 1 rig to 90 in the Gulf of Mexico.

Cubic starts Louisiana well recompletions

Cubic Energy Inc., Dallas, has begun staged recompletions of five wells in Bethany Longstreet gas field in Desoto Parish, La.

The company is opening zones uphole from initial completions in the Taylor sand, the lowest zone of the Jurassic Cotton Valley. It plans new completions in higher Cotton Valley and Cretaceous Hosston intervals.

Cubic conducted a second stage completion in the Moseley 25-1 and the Moseley 26-1 wells, both of which are currently under testing or flowback (OGJ, Jan. 24, 2005, p. 40). It plans further completions in these wells as it prepares the Kraemer 24-1 for additional completion work. It plans similar operations for the Johnson 20-1 and the Johnson 29-1 wells.

Kinder Morgan eyes EOR for acquired assets

A unit of Kinder Morgan Energy Partners LP plans to evaluate carbon-dioxide enhanced oil recovery potential of oil and gas producing properties it has acquired from Journey Acquisition-I LP and Journey 2000 LP, primarily in the Permian basin.

The properties produce 850 b/d of net oil equivalent and include fields with EOR potential near Kinder Morgan CO2 operations.

Kinder Morgan CO2 Co. plans to divest assets in the acquisition that are not CO2 EOR candidates.

Saudi Aramco lets Shaybah expansion contracts

Saudi Aramco has signed five major contracts to expand production from Shaybah oil field in the Rub’ al Khali region on the eastern edge of Saudi Arabia’s vast Empty Quarter desert.

Currently, Shaybah has 141 wells that produce more than 500,000 b/d. The expansion will boost production by 250,000 b/d by yearend 2008.

Shaybah field, discovered in 1968 and brought on stream in 1998, is 13 km wide and 64 km long. The field produces 42o gravity Arab Extra Light crude oil from Shuaiba pay at an average depth of 4,650 ft. The crude is virtually sulfur-free and high in its gasoline fraction (OGJ, Apr. 5, 2004, p. 18).

Saudi Aramco hired SNC-Lavalin of Canada for engineering, procurement, and construction of the central producing facilities and Hyundai Heavy Industries for power generation. Three other contractors, all based in Saudi Arabia, received contracts for power transmission and site development, including a residential complex. Existing facilities consist of wells, flowlines, trunklines, crude transfer pipelines, and facilities to separate gas from oil prior to transport to Abqaiq.

The expansion provides a grassroots facility for gas and oil separation; gas gathering, compression, and injection facilities; crude oil-handling, air, and water utilities to support the process; and increased pipeline capacity. Additional permanent housing also will be constructed at the existing residential and industrial complex. ✦

Processing - Quick Takes

Japan eyes coal-to-liquid scheme for China

Japan plans to help Chinese companies liquefy coal in an effort to satisfy the soaring demand for energy in China.

An official of Japan’s New Energy and Industrial Technology Development Organization (NEITDO) said it is more economical to try the technology in China than in Japan, which has fewer available mines.

He said liquefaction experiments will start in Beijing this year. Chinese companies will eventually build plants near mines to turn coal into liquid fuels.

Under the scheme, a Chinese power company will start operating a liquefaction plant in 2010 to process 3,000 tons/day of coal mined in the Inner Mongolia Autonomous Region.

Also in 2010, a Chinese coal company will develop a mine in the Uighur autonomous region of Xinjiang and start testing a plant to process 2,500-3,000 tons/day of coal.

The NEITDO official said the project aims at meeting the demand for energy in China’s inland areas that are suffering shortages. ✦

Transportation - Quick Takes

Second BP pipe break reported in Alaska

A break in a 3-in. natural gas line at BP PLC’s Prudhoe Bay production facilities Apr. 6 released about 12 Mcf of gas-less than the amount mandated for reporting, said a company spokesman.

External corrosion probably was the cause, BP said. The leak followed last month’s 201,000 gal oil spill between two gathering facilities on Alaska’s North Slope (OGJ, Mar. 27, 2006, Newsletter).

The North Slope spill mostly has been cleaned up, Alaska’s Department of Environmental Conservation said. BP and the US Environmental Protection Agency are investigating that spill, tentatively attributed to internal corrosion.

BP spokesman Daren Beaudo said the EPA has subpoenaed a consulting firm that participated in the company’s corrosion control efforts.

Gov. Frank H. Murkowski has called for a corrosion conference and directed Alaska’s Department of Environmental Conservation to assemble an arctic pipeline technology team with the Department of Natural Resources, the Alaska Oil and Gas Conservation Commission, and the federal Office of Pipeline Safety.

The team is to work with professionals with expertise in arctic pipeline engineering on leak detection, corrosion prevention, monitoring, and inspection to ensure the integrity of the oil pipeline infrastructure.

NGPL seeks interest in gas line expansions

Kinder Morgan Inc. subsidiary Natural Gas Pipeline Co. of America (NGPL) is seeking shipper interest for a proposed expansion of capacity of its Gulf Coast and Louisiana natural gas pipelines by a combined 200,000 dekatherms/day.

NGPL has started a binding open season to run through May 2. Subject to shipper support and regulatory approvals, the expanded capacity is expected to be available in January 2008.

The project would increase horsepower at existing compressor stations, loop pipelines, and add metering equipment.

The Gulf Coast mainline carries gas from South Texas to Chicago. The Louisiana line runs from the Gulf Coast line at Montgomery County, Tex., to connections with other systems to the east.

Nazarbayev: CPC line capacity to be doubled

Kazakh President Nursultan Nazarbayev said his country and Russia will increase capacity of the Caspian Pipeline Consortium (CPC) pipeline from 28 million tonnes/year of crude oil to 67 million tonnes/year.

Nazarbayez did not indicate when the increase would take place. Russia’s Industry Ministry said CPC shareholder companies would meet with Kazakh representatives this month to settle technical issues.

Kazakhstan is aiming to raise its production of crude oil to 3 million b/d from 1.3 million b/d by 2015 and is seeking additional export routes.

Last December, Kazakhstan inaugurated the 614-mile, 32-in. Atsau-Alaskhankou crude oil pipeline to China, its first bypassing Russia (OGJ Online, Feb. 16, 2006).

Kazakhstan also is being urged to speed up talks on joining the Baku-Tbilisi-Ceyhan (BTC) pipeline project (OGJ Online, Mar. 14, 2006). Kazakh officials say the country could ship up to 30 million tonnes/year of crude oil through the BTC line.

CPC’s 1,500-km Tengiz-Novorossiisk pipeline carries crude oil from fields in western Kazakhstan to Russia’s Black Sea coast for onward transport by ship and pipeline. In 2005, the CPC increased oil exports by 35.5% to more than 30 million tonnes.

The proposed expansion project involves construction of 10 pumping stations, increased storage capacity for an additional 480,000 tonnes of crude oil, and additional port infrastructure on the Black Sea.

CPC stakeholders include Russia, 24%; Kazakhstan, 19%; Oman, 7%; Chevron Caspian Pipeline Consortium Co., 15%; LUKArco BV, 12.5%; Rosneft/Shell Caspian Ventures Ltd., 7.5%; Mobil Caspian Pipeline Co., 7.5%; Agip International (NA) NV, 2%; BG Overseas Holding Ltd., 2%; Kazakhstan Pipeline Ventures LLC, 1.75%; and Oryx Caspian Pipeline LLC 1.75%.

Cheniere offers Sabine Pass LNG capacity

Cheniere Energy Inc., Houston, is offering as much as 500 MMcfd of remaining long-term capacity at its Sabine Pass LNG receiving terminal and regasification plant in Cameron Parish, La. The offer will close May 15.

Sabine Pass LNG is under construction and expected to be operational in early 2008 with an initial rated capacity of 2.6 bcfd, which would be boosted in 2009 to 4 bcfd.

Cheniere said its terminal and pipelines groups plan to spend about $3 billion over 5 years to bring online the Sabine Pass terminal and two other LNG receiving terminals and associated pipelines in Texas and Louisiana (OGJ, Apr. 3, 2006, p. 20).

Affiliates of Total SA and Chevron Corp. currently hold 1 bcfd each of reserved capacity at the Sabine Pass terminal (OGJ, Dec. 12, 2005, Newsletter).

Cheniere LNG Marketing Inc. has entered into long-term terminal use agreements for 1.5 bcfd of capacity at Sabine Pass and for 1 bcfd at Cheniere’s 2.6 bcfd Corpus Christi, Tex., LNG receiving terminal.

Corpus Christi LNG received construction authorization in December 2005, and Cheniere plans to start site preparation in the second quarter. The terminal is expected to be operational in 2010.

Gazprom delivers its first LNG to the UK

Russia’s state-owned OAO Gazprom has delivered its first shipment of LNG to the UK-140,000 cu m purchased from Gaz de France and delivered to BP PLC.

It was the largest LNG shipment to reach the UK’s Isle of Grain terminal in north Kent, which has the capacity to receive and process up to 3.3 million tonnes/year of LNG.

A joint venture of BP and Algeria’s state-run Sonatrach has been formed to market LNG from the Isle of Grain terminal, which is expected to provide 5% of the UK’s supply needs. ✦