DRILLING MARKET FOCUS: Industry players must align efforts for future success

Drilling contractors, technical service companies, and operators share concerns in today’s marketplace over staffing, financial performance, and planning.

Three plenary sessions punctuated the recent IADC/SPE drilling conference, “Achieving Our Goals: People, Planning, and Performance,” held in Miami, Feb. 21-23, 2006. As in 2005, the plenaries offered an engaging public dialogue among industry leaders.

The format provided opportunities for direct feedback and audience polling as well as follow-up questions on topics that touched business drivers, technical engineering innovation, contracting and partnering, and paradigm shifts in human resource management.

For the second and third plenary sessions, the audience was provided with voting touch pads similar to those used at the Amsterdam conference, February 2005 (OGJ, Apr. 4, 2005, p. 45; Apr. 11, 2005, p. 39).

Financials

The first session, “Wall Street Performance Expectations,” consisted of presentations and discussion of the changing expectations for the energy industry’s financial performance.

Allen Parks, a principal at Parks Paton Hoepfl & Brown Energy Investment Banking LP and a board member of the National Ocean Industries Association, moderated the session. Panelists were Larry Dickerson, president and chief operating officer of Diamond Offshore Drilling Inc.; Stephen Hadden, senior vice-president of Devon Energy Corp.; Jean-Marc Perraud, chief financial officer for Schlumberger Ltd.; M.A. (Pete) Miller, chief executive officer at National Oilwell Varco Inc.; and Jim Wicklund, Houston-based energy analyst at Banc of America Securities LLC.

Parks said that there are very few long-term investors on Wall Street. Most are short-term holders with a short-term focus. He pointed out the recent behavior of the oilfield service index (OSX) and the oil and gas stock index (XOI). Although about 40% of Wall Street income is from dividends, Parks said energy companies generally don’t pay dividends.

Wicklund said that factors analysts consider in their financial analysis of oil companies include:

• Reserves-how much, where, risk?

• How fast can reserves be produced to optimize net present value?

• How well is production being replaced-by acquisition or by drill bit?

• At what price will the reserves be sold?

Gas is driving North American activity, he said, but the US has half of the world’s rigs with only 3% of the world’s reserves. Reserves have been cheaper to purchase on Wall Street than to explore for, driving the recent acquisitions spree. Finding and development costs continue to rise in the face of industry consolidation.

Steve Hadden said that 86% of Devon stock is held by institutional investors and 34% by the top 10 investors. The company tries to “execute a commercial, high-impact, risk-balanced exploration program,” in which short-cycle, low-risk projects balance long-term, higher-risk projects. Devon’s reserves are predominantly (88%) in North America; consisting of 62% gas and 38% liquids.

Jean-Marc Perraud, CFO at Schlumberger, said that exploration and production expenditures were about $180 billion in 2005, up from less than $100 billion in 2000. He expects sustained growth in demand and outlined continuing challenges for the company to:

• Invest in long-term technology development.

• Maintain capital expenditure in a cyclical industry.

Perraud rues the long uptake time for innovative oil and gas technology to spread, citing MWD as an example. Developed in the late 1970s, this technology did not show companies returns for 13 years; industry-wide adoption took 15-25 years.

“Long-term shareholders, corporate management, and boards of directors dislike stock price volatility. However, the capital intensive E&P industry is inherently unable to make long-lead supply additions to smoothly match short-term demand volatility,” Perraud said.

Larry Dickerson, Diamond Offshore’s president and COO, talked about the nuts and bolts of dealing with Wall Street. With 26 analysts following the company, Diamond Offshore is constantly updating estimates and challenged to manage analysts’ expectations. Day rates used to be a closely guarded secret, he said, but now the data are more open and available. In 2004 the three biggest factors affecting drilling stocks were weather, product prices, and inventory; the first two were largely unmanageable. Rates began increasing in summer 2004 and earnings/share projections increased as well. Most contracts were short-term, he said.

Rates continued to increase in 2005, and contracts were being written for 6 months-1 year out. Announcements of new contracts boosted prices, and contractors began to focus on fleet expansions. But then term contracts began to be regarded negatively by the analysts, Dickerson said, calling it a “backlog.” Analysts began to focus on unbooked time.

In 2006, rates will continue to increase, earnings/share will continue to be revised upward, and new builds will begin to arrive against existing contracts. Dickerson warned of the dangers of cash flow misses (companies must hit previous projections), too many new builds (particularly those built on spec), potential construction problems, and cost escalation.

In the 1990s, he said, more than half of the rigs built had construction problems. From a safety perspective, more rigs at work suggest an increase in accidents and serious incident reviews.

Contractors may also worry about cash buildups. But NOV’s Pete Miller said that the industry does not have the capacity to overbuild immediately. With only 15 new jack ups to be delivered in 2007 and 150 new land rigs to be delivered this year, the increased worldwide demand will continue to absorb the new capacity, he said.

People

The second plenary session at the conference focused on the shortage of qualified industry workers during the current boom cycle: “People: Getting, Training, and Retaining Them.”

Dean Oliver, director and Eberly Chair Professor at the University of Oklahoma, moderated the session. The panel consisted of Carlos Morales Gil, director general of Pemex E&P; Robert Munoz, vice-president of Latin American operations at Halliburton; Gene House, senior vice-president of operations for Noble Corp. and division manager for Noble Mexico Ltd.; Mike Stice, vice-president at Conoco-Phillips and president of Global Gas LNG; and Kevin Lacy, vice-president of global drilling and completions for Chevron Corp.

Munoz said that Halliburton employs more than 50,000 people in 19 countries and has established long-term relationships with universities, particularly outside the US. He said that traditional hands-on training will be too slow to develop this new generation of workers and that training is increasingly relying on computer simulations to speed exposure and learning.

ConocoPhillips’s Stice said, “We are an industry in crisis.” Motivations are changing. Affluence gives more options and makes employee retention more complex. The demands of dual-income families and aging parents may restrict employees’ mobility.

Increasing demand for qualified workers has overshadowed previous concerns about aging in the workforce. Soft issues may pose the biggest challenges:

• Building engagement among staff.

• “Rerecruiting” your talent internally.

• Offering career development opportunities.

Noble’s Gene House reiterated that the offshore service industry is labor-intensive; Noble employs more than 5,500 people in 45 countries, averaging about 110 staff/rig. New technologies have raised hiring standards because they require specialized technical skill sets.

House said that first-year turnover is usually 18-20%, and the cost to the company is about 250% of each annual salary. Reducing turnover is key, therefore, and seems to improve with testing of applicants’ intelligence, personalities, and physical abilities. But it’s difficult to screen for work ethic and attitude, he said.

Old solutions to hiring are failing, House also said; poaching employees does not increase the size of the labor pool. Instead, the industry needs to market itself as an attractive, safe, and stable place to work and attract new workers. Stice said that many national oil companies appear to encourage employee poaching, expecting to have the employees return someday with increased technical knowledge.

Win-win

“Planning for a Successful Future,” the topic of the third and most animated plenary session, accentuated the importance of operators, service companies, and drilling contractors planning projects together. Rather than guessing at industry trends, service companies and drilling contractors will be better able to meet operators’ demands at predictable cost with more communication from operators. Project implementation would be streamlined and negotiations more likely to produce a win-win situation.

The plenary participants included Scott Sigurdson, BP PLC; Mark Phillips, Halliburton Corp.; Marion Woolie, GlobalSantaFe Corp.; Don Jacobsen, Shell International Exploration & Production; and George Dotson, Helmerich & Payne International Drilling Co., led by moderator Cary A. Moomjian, ENSCO International Inc.

Moomjian, vice-president, general counsel, and board secretary at ENSCO, set the stage for the session by stating that best interests did not always align and those controlling the purse strings still held the upper hand. Referring to recent contract negotiations with an operator, he said “I didn’t realize that win-win meant that they win twice.” An audience poll at the session start showed that 41% of attendees work for oil and gas operating companies, 20% for drilling contractors, 28% for service companies, 5% as consultants, and 5% in other capacities.

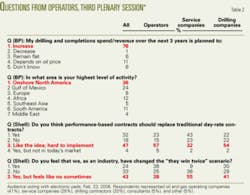

The audience uniformly agreed that it is extremely important for operators, drilling contractors, and service companies to coordinate planning for projects (Table 1). A surprising 78% of all respondents said they actively coordinate planning for projects with other parties; operators were most likely (87%), followed by drilling contractors (75%), and service companies (68%).

BP

Scott Sigurdson, manager of drilling and completions for BP’s deepwater production, pointed out a huge shift in capex budgets-drilling and completion expenses now consume about 70% of total project costs.

He said that BP would spend almost $5 billion on drilling and completions in 2006, up from $4 billion spent in 2005 and about $3 billion in 2003 and 2004. He attributed the increase to increased activity levels but alluded to the concomitant increase in rig rates. “Exploratory spending will drive increased development spending,” he said. In addition to the company’s existing profit centers, Sigurdson said BP is funding new projects in the deepwater Gulf of Mexico, Azerbaijan, and Angola.

Polling the audience, Sigurdson found that 76% believed their companys’ spending would increase over the next 3 years (Table 2). He also determined that onshore North America (36%) and the Gulf of Mexico (24%) were the areas of highest interest to conference attendees.

Halliburton

Mark Phillips said that Halliburton has billions of dollars deployed over thousands of assents, including large investments in niche technologies such as high-pressure high-temperature and shale gas. The lead-time required to build capital equipment is 9-18 months or longer, and there are often third-party suppliers involved. Operators therefore need to provide detailed specifications more than a year before they expect to begin a project. New pressure regimes, for example, approach 20,000 psi, up from 10,000 psi, requiring more pumping pressure for fracs and development of different proppants.

Phillips polled the audience: 25% said that 0-6 months’ lead-time was sufficient, 47% said 6-12 months was appropriate, and only 32% said 1 year or longer was necessary (Table 1). In a follow-up question asking whether service companies were doing a good job keeping up with demand, 31% said they were doing a good job, but 65% felt they were keeping up “somewhat.”

GSF

Marion Woolie, senior vice-president of operations for Sugar Land, Tex.-based GlobalSantaFe Corp., discussed investment commitments and the lead times necessary to meet demand for mobile offshore drilling units. There are two schools of thought regarding such investments:

• “If you build it, they will come.”

• Reticence from the sticker shock.

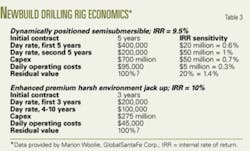

He said that nearly $28 billion have been allocated for new equipment scheduled for delivery 2006-09. About 60 new jack ups are under construction, including 11 in Gulf of Mexico yards, and about 20 new semisubmersibles. With the enormous investments involved, Woolie said, GlobalSantaFe would not build new rigs without contracts in place. The internal rate of return (IRR) for a new floater works out to 9.5%; for a new jack up 10%. Neither is high enough for a contractor to assume the financial risk without a committed work contract in place.

Polling the audience about the IRR expected at their companies, he found that most (42%) sought 10-15%, but service companies were skewed slightly higher than operators and drilling contractors (Table 1).

Table 3 provides Woolie’s economic analyses for building new floaters and jack ups. “Our industry is not prepared for the magnitude of the rising demand for people for deepwater project requirements,” he said. In order to maintain an injury-free workplace, it may be necessary to call a time-out and turn away projects if there are not enough people trained to perform the work safely.

Shell

Don Jacobsen, director of global well delivery for Shell E&P, said collaboration was important and presented several Shell-contractor-service company alignment case histories.

Developing the Pinedale field, Wyoming, requires intensive completion and hydraulic fracture programs. Shell aligned itself with a large, US-based land contractor to make capital investments and used a single contractor for fracture work to ensure reliable access and continuity. “Frac sand is getting to be a scarce commodity,” Jacobsen said.

Additional collaboration with the Rocky Mountains HSE council led to production growth 2002-06 and reduced drilling cycle time by 30%. Fracture efficiency improved to a point where 104 frac jobs were performed in 6 wells in 21 days.

A second example of Shell’s collaboration is in deepwater off Egypt. The project called for dual penetrations with coring and had a 36-day authorization for expenditure; Shell wanted to reduce the well time to 12 days. In an early planning meeting to reduce the well time, Shell presented a plan to optimize the drilling sequence for the contractor’s rig, which was being mobilized from Brazil. Jacobsen said that collaborating would increase the efficiencies and save money. The well was scheduled to spud at the end of first-quarter 2006, with an expected 18-19 day well time, about half of the initial planned time.

In a third example, Shell has modified its contracting procedures after developing new metrics and drilling performance indicators,. Jacobsen said that the new contracting procedures provide “clarity of expectations and relative performance” and that drilling contractors are ranked according to the new metrics.

H&P

George Dotson said that Helmerich & Payne focused on anticipating needs and recognized the rewards of alignment.

He cited a case of three tension-leg platforms in the Gulf of Mexico over 1996-2006. The rigs have been operated in a collaborative environment, remained on budget and on schedule, delivering “best value” in 26 rig-years, 4.7 million man-hr, and no lost-time accidents. “Safety is one of the best proxies for determining efficiency,” he said.

But H&P’s FlexRig development program ran counter to collaborative industry efforts. In 1985-95, the company anticipated future needs and had either to consolidate fleets from other companies or build new land rigs. Dotson said the company’s vision was to use technology and new ideas to add value in the drilling process.

By 1997, the company had built six FlexRig1 rigs for $42 million. By 2000, it built 12 FlexRig2 design for $96 million. In 2002-04, H&P built 32 FlexRig3s for about $360 million. The tactics employed in 1997-2004 were to build speculative rigs off-cycle and gain operator support.

The outcome was that the rigs appeared on budget, on-schedule, are now more than 98% active and provide better margins than if H&P had waited to build in the current boom cycle. But Dotson said they were criticized by the investment community and peers for adding to capacity in a slow market.

The field is different in 2006-07, although H&P will build 55 new FlexRigs for about $625 million. The company is now building in-cycle, with firm 3-year contracts in place, and expects that the new capacity will produce significant value to shareholders, he said.

Long-term contracts

Moderator Moomjian asked the operators if they were prepared to go forward with long-term contracts with long lead times regardless of the market. He said that in the mid-1980s, operators refused to honor term contracts.

Jacobsen said that Shell intended to honor term contracts and has a solid 5-year plan. The company has contractual commitments out to 2011 and even 2012 for one particular rig. The company’s future business plan focuses on work in ultradeepwater.

Sigurdson said that BP has a similarly solid 5-year plan. The company has scheduled projects out to 2015, although the business plan becomes a bit “fuzzy” after 2010.

Mark Childers, general manager of Atwood Oceanics Inc. and chair of the current IADC/SPE drilling conference, said that all the company’s rigs were contracted for 2006, almost all for 2007-08, and some for 2009. He said bid requests arrive daily and, although 12 new jack ups are coming in 2007, “there will be people who will not get their wells drilled.”

Jacobsen agreed that demand was likely to exceed the growing capacity, but that operators and drilling contractors could close that gap by increasing efficiency.

Woolie said that there were already bid requests in some markets with no capacity due to shortages of rigs and qualified personnel. He said that in the Rockies, rigs shut down or circulate because they don’t have people available to trip pipe. In the North Sea, a major oil company on a harsh environment jack up had to go to a 12-hr work schedule because it didn’t have enough completion engineers to work the project.

A “looming problem” in the Gulf of Mexico is risk management of long-term contracts. Woolie said that insurance brokers have said 200-400% increase in premiums, reduced level of coverage, and higher deductibles would be in place before the 2006 hurricane season. The financial implications may force some contractors to remove rigs from the Gulf of Mexico, and day rates will increase for those rigs that remain. Increased insurance costs may lead to under-insurance of rigs, as operators revise contracts to shift the risk to drilling contractors.

The industry may need step-changes to better share the risk, to make the contracting and purchasing process less cumbersome and simplify the supply chain, to benchmark drilling performance, to establish best practices, and perhaps to standardize equipment. ✦