Quest under way for universal oil and gas reserves standard

An international effort is making progress toward a common framework for defining and estimating oil and gas reserves.

But the challenge is great, largely because of the imprecision inherent in reserves values and the many inconsistencies among existing procedures for evaluation and disclosure.

Participants in the current effort, which involves major professional associations, the Organization of Petroleum Exporting Countries, and the United Nations, seek guidelines that can be applied consistently and used by government regulators as well as oil company managers.

While most of them are optimistic, they say a set of universal standards for reserves reporting probably will take years to develop.

The need for change is evident in disparities between reserves disclosures required for investors and the estimates companies use for their own decisions. Oil companies with shares listed on US stock exchanges must report proved oil and gas reserves in unaudited sections of the financial reports they file with the US Securities and Exchange Commission (SEC). But most of them use different, internal estimates for daily management decisions.

Some oil companies and analysts, including Cambridge Energy Research Associates, contend SEC reserves standards need to be updated to accurately reflect technological advances, corporate value, and a company’s production growth potential (OGJ, Feb. 13, 2006, p. 26).

The SEC uses a definition for “proved reserves” that has changed little since 1978. Its definition differs from those of many other countries (OGJ, June 20, 2005, p. 20).

“No modern company runs its business on reserves as calculated by the SEC,” said Peter R. Rose, president of the American Association of Petroleum Geologists. He warned of a “false precision” projected by SEC filings (see sidebar).

“We deceive ourselves into thinking we’re going to get the exact answer, but we never know the number of reserves until the well is shut in,” Rose said.

SPE’s work

For decades, the Society of Petroleum Engineers has worked on reserves definitions and estimation standards through its Oil and Gas Reserves Committee (OGRC).

OGRC Chairman John E. Ritter, reserves manager for Chevron’s North American Upstream Operating Co., said the SPE is encouraged.

“There is a great desire among many players in the industry, including both technical and financial groups, to have a common set of definitions,” Ritter said.

The SPE, the World Petroleum Council (WPC), and the American Association of Petroleum Geologists are reviewing and updating petroleum reserves definitions approved in 1997 by the SPE and WPC, and the resource definitions and guidelines approved by all three in 2000 and 2001.

In January 2005, the OGRC posted an updated glossary, focusing on terms used in these documents, on SPE’s web site. The OGRC plans to outline its reserves definitions work during the SPE’s annual conference Sept. 24-27 in San Antonio.

Ronald Harrell, Ryder Scott Co. board advisor and chairman emeritus, is an observer for the Society of Petroleum Evaluation Engineers on the OGRC.

“I don’t predict uniformity in reserves reporting worldwide but rather that all regulators will eventually converge or harmonize their requirements with a common set of technical definitions, those created by SPE-WPC-AAPG and adopted by the UN,” Harrell said. “Any variations will warrant a disclosure.”

In January, the OGRC’s mapping subcommittee completed a lengthy comparison of the SPE-WPC-AAPG system with these reserves and resource classification systems:

• SEC definitions dating back to 1978.

• UK Statement of Recommended Practices from 2001.

• Canadian Security Administrators from 2002.

• Russian Ministry of Natural Resources from 2005.

• China Petroleum Resources Office from 2005.

• Norwegian Petroleum Directorate from 2001.

• US Geological Survey (USGS) from 1980.

• United Nations Framework Classification (UNFC) from 2004.

Ritter said, “By understanding the relationships between these different sets, it will be possible to identify and leverage best practices that could potentially be incorporated into a new set of definitions.”

An executive summary of the OGRC comparison reported “a high degree of commonality” among the overall structure of reserves definitions of the 1997 SPE-WPC definitions, the 2000 SPE-WPC-AAPG classification, the 2001 supplemental guidelines, and the 2005 SPE glossary.

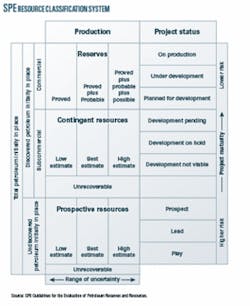

SPE found that all systems define major categories that can be mapped directly to SPE categories: undiscovered (prospective resources), discovered unrecoverable, discovered subcommercial (contingent resources), and discovered commercial (reserves).

For discovered and commercial volume estimates, the volumes generally were called proved, probable, and possible reserves. The Russian, UNFC, and USGS recognized similar certainty classes but used different terminology.

In any jurisdiction, regulators typically define a subset of the total classification for disclosure to investors and impose specific rules about technical and commercial certainty.

“The SEC guidance is the most restrictive, while the Canadian and UK regulations allow disclosures more closely aligned with assessments used for internal resource management,” the mapping subcommittee’s executive summary said. “The UNFC uniquely provides a high-level classification system that can be applied to all extractive industries,” including petroleum, coal, and uranium.

SPE subcommittee

After analyzing the eight classification systems, the subcommittee collated the following potential “best practices” for review by the OGRC subcommittee charged to recommend revisions to current SPE reserves and resource definitions:

• Use a consistent set of criteria to segregate discovered from undiscovered quantities without reference to ultimate commerciality. A discovery is a known accumulation. It has been penetrated by a wellbore, and analysis of well logs, cores, or formation tests indicates that significant hydrocarbons exist and are potentially recoverable. All discovered volumes initially should be categorized as contingent resources.

• Ensure that estimates clearly identify the development projects applied to specific reservoirs and their in-place hydrocarbon volumes. The “project-reservoir” intersect becomes the resource entity for which an uncertainty distribution of recoverable quantities is defined. The project maturity and chance of reaching production status are used to segregate reserves from contingent resources.

• To maintain consistency, apply the same class confidence hurdles-such as 90% probability (P90), 50% probability (P50), and 10% probability (P10)-to estimates whether assessment methods are deterministic (single value) or probabilistic (range of probabilities). Although the assessment can support either arithmetic summation or probabilistic aggregation, the guidelines need to clearly identify that these certainty guidelines apply to the project-reservoir entity.

• Include additional deterministic technical and commercial criteria for reserves classes (proved, probable, possible) or discrete estimates, which may have value in providing increased consistency in assessments, as guidelines, but do not embed them in the class definitions. The definitions should be broad enough to accommodate such criteria as imposed by regulatory agencies.

• Apply developed and undeveloped status to all reserves classes. Reserves that remain undeveloped beyond a reasonable period demonstrate lack of commitment and should be reclassified as contingent resources.

• Encompass in definitions all hydrocarbons, whether conventional or unconventional (gas, liquid, or solid phases), irrespective of the extraction method and processing applied.

• Ensure that the system provides for accounting of all components to support mass balance: that is, the sum of quantities sold, production and processing losses (including hydrocarbons consumed as fuel), and unrecoverable quantities should equal the estimate of initially-in-place hydrocarbons. Provide in the guidelines the option, subject to regulatory rules, of including hydrocarbons to be consumed as fuel in production and processing as reserves and contingent resources.

UN, OPEC

OGRC members, including Ritter, periodically meet with UN Economic Council of Europe (UNECE) representatives and UNECE’s Ad Hoc Group of Experts on Harmonization of Fossil Energy and Mineral Resources Terminology.

“We are pursuing the integration of the SPE-WPC-AAPG definitions into the UNFC, which relates to oil and gas classifications, as well as uranium and coal,” Ritter said.

Ritter and Harrell of Ryder Scott attended a 3-day meeting in Geneva in late 2005 to discuss the UN initiative.

“Organizations cooperating in this effort represent probably 20-30 countries, including the Organization of Petroleum Exporting Countries and Russia,” Harrell said. “It’s an admirable goal to have a framework whereby we have a common approach to how we classify and quantify unseen volumes below the surface of the Earth.”

Harrell believes “considerable progress will be made in the next few years” toward worldwide reserves reporting standards.

The OPEC Secretariat told Oil & Gas Journal that it has been represented at the UNECE reserves meetings since June 2002.

“The UNFC is only a harmonization tool and does not replace existing classifications, such as the SPE-WPC-AAPG definitions and guidelines for petroleum,” OPEC noted. “The secretariat has given support to an offer from the SPE to have its Oil and Gas Reserves Committee as a technical body in charge of developing specifications, guidelines, and case studies for the UNFC.”

Currently, OPEC members use proved oil and gas reserves as defined by SPE for internal OPEC studies and reports, the secretariat said. The same information is included in OPEC’s Annual Statistical Bulletin and distributed on its web site.

Common language

Separately, the International Accounting Standards Board (IASB), an independent standards body reviewing accounting principles, is looking at all types of industries, including the petroleum and mining industries.

The IASB of London promotes a consistent, common financial language-the International Financial Reporting Standards-enabling investors to compare financial results of private-sector companies operating worldwide. OPEC and its members’ state-owned oil companies are not involved.

IASB board member Robert P. Garnett, an observer on the SPE’s OGRC, said the research group is working with the SPE and WPC.

“It’s not that we have anything immediately on our agenda that we are going to change the world in the next 6 months,” Garnett said.

An extractive industry research group is looking at reserves and resources definitions and also at various ways to portray reserves in financial statements. About 20 countries are represented on that group.

“We are looking more broadly than just oil and gas. We also include mining,” Garnett said. The research group plans to publish a discussion paper in early 2007.

“For example, the paper will mention whether we think that the SEC’s very strict application of the SPE definitions is useful for financial reporting purposes or whether it needs to be modified in some way,” Garnett said.

He said the IASB seeks reserves definitions that are accepted by all oil and gas producers and that have universal support for both geological use and financial reporting. Garnett hopes the SPE definitions will prove to be a suitable base.

“But one of the questions always is whether or not that is going to be acceptable to the people in mining, and whether the definition is going to be acceptable to those that make investments in oil and gas companies,” he added. The IASB is talking with the US Financial Accounting Standards Board (FASB) about the possible convergence of groups’ accounting standards for all types of industries.

“Oil and gas is one area that hasn’t been featured predominantly in accounting standards,” Garnett said. “There is a little oil and gas accounting with FASB, but a lot of it is left to the regulators, like the SEC, to determine how the information is portrayed.”

The SEC is aware of the efforts of the IASB and the UN, an SEC spokesman said, adding that there is no proposal before SEC commissioners to change oil and gas reserves reporting requirements.

Nevertheless, Harrell remains optimistic about eventual progress on reserves reporting standards, in the US and beyond.

“That may be kind of a back door to getting reserves reporting changed in the US as a result of convergence with IASB,” he said, adding that a one-world orientation “probably is a good thing.”

“It’s like my light bulb in Houston ought to be able to screw into a socket in Sweden,” Harrell said. “It probably won’t, but it would be nice if it did. And it would be nice if we had reserves standards like that.” ✦