Operators extend search to several nonproducing, underexplored basins

A sustained period of high oil and gas prices has led operators into exploration in more of the world’s remote, nonproducing, and underexplored areas.

The areas covered in this article are the Niger rift in West Africa, Rovuma basin in coastal and offshore Mozambique and Tanzania, Georgina basin in Australia, Marfa basin in Southwest Texas, Peten basin in Guatemala, and the Port Sandwich basin in Vanuatu in the Southwest Pacific islands.

Niger rift, West Africa

China National Petroleum Corp’s affiliate in Niger faces logistical challenges as well as geological risk in exploring the Tenere concession in Niger.

Demand for drilling equipment and services worldwide is so strong that the company has been unable to provide a certain date for drilling start-up.

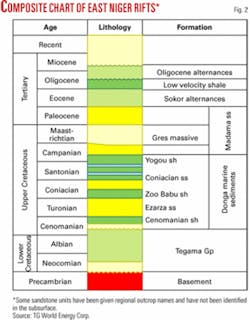

Its CNPC International Tenere Inc. unit is in partnership with TG World Energy Corp., Calgary, in exploring the 17.3 million acre block in the remote Termit-Tenere rift basin (Figs. 1 and 2).

The companies in March 2006 completed the acquisition of 912 line-km of 2D seismic data, bringing the total they have acquired to 2,598 line-km. A third seismic acquisition program is planned later in 2006.

Meanwhile, the seismic crew has moved to CNPCIT’s adjacent 100% owned Bilma block.

The companies laid groundwork for an operations base on the Tenere block and were mobilizing equipment to drill three commitment wells in China and elsewhere for transshipment to Niger via the port of Cotonou, Benin.

“CNPCIT has confirmed its intention to assemble a total equipment package in country, before the drilling program begins, in order to minimize disruption in operations once the exploration drilling program commences,” TG World said.

“CNPCIT has encountered some delays in acquiring certain equipment required to support the drilling program because of the international pressure on drilling services and supply resulting from the high level of international petroleum exploration activity.”

Meanwhile, TG World said the Niger government advised that Algeria’s state-owned Sonatrach International Petroleum Exploration & Production Corp. signed a new study agreement on the Tamesna Block in northwestern Niger adjacent to the border with Algeria. This is in addition to Sonatrach’s holding of the 23,700 sq km Kafra exploration block north of Tenere (OGJ Online, Aug. 8, 2005).

South of Tenere, affiliates of ExxonMobil Corp. and Malaysia’s Petroliam Nasional Bhd. were negotiating with Niger to extend the term of the Agadem Block in preparation for another drilling program, TG World said. ExxonMobil and Petronas have discovered an estimated 350 million bbl of oil equivalent on Agadem, but Niger has no hydrocarbon production as yet.

Negotiations for several other exploration blocks were reported to be under negotiation with the Niger government, TG World said.

Rovuma basin, Mozambique

Anadarko Petroleum Corp., Houston, said 3 years of analyses led it to recognize elements of the Niger Delta, Mahakam Delta, and Gulf of Mexico in the Rovuma basin in the Indian Ocean off Mozambique.

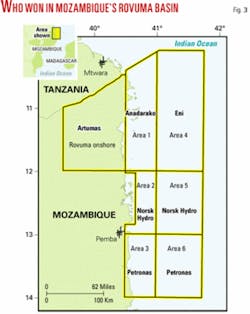

Anadarko in March won the bidding for exploration and production rights to the 2.64 million acre Offshore Area 1 in the underexplored basin. Finalization was expected by mid-2006 (OGJ Online, Mar. 9, 2006).

Meanwhile, Eni SPA won exploration rights to Offshore Area 4. This unexplored 17,646 sq km block, seaward of Anadarko’s block, lies 2,000 km northeast of Maputo in as much as 2,600 m of water. Eni said the area has high potential.

Anadarko’s block has 90,000 acres on land. From there it stretches 35 miles eastward into as much as 6,000 ft of water. The block extends 100 miles south from the border with Tanzania.

Anadarko said it analyzed seismic, well data, and other geologic data from the Rovuma Delta, where only two wells have been drilled. It called the basin “highly prospective” and said it had identified multiple leads across an area the size of 460 typical Gulf of Mexico blocks.

Anadarko’s bid included a 4-year initial exploration term with options to extend that phase another 4 years, and a 30-year production term following any commercial discoveries.

The company’s work commitment is to acquire new 2D and 3D seismic and drill seven wells in the initial exploration term. Anadarko will operate the block, initially with 100% working interest.

Mozambique has three gas discoveries, Temane, Pande, and Buzi, all near the coast in the southern part of the country. Gas deliveries began in February 2004 from the Temane fields through a $1.2 billion, 865 km pipeline to Secunda, South Africa. This is Mozambique’s only hydrocarbon production.

To the north in southernmost Tanzania, Artumas Group, London, is developing Mnazi Bay gas field and has been awarded the 15,000 sq km Rovuma block in northern Mozambique onshore southwest from Mnazi Bay (Fig. 3).

Agip SPA’s 1982 Mnazi Bay-1 discovery well went to TD 11,447 ft in late Cretaceous. It flowed 14 MMcfd of biogenic gas from deltaic sandstones of Oligocene age (see map, OGJ, Aug. 14, 2000, p. 40).

Artumas is to drill three wells in 2006 to develop Oligocene and Miocene formations.

Field startup is possible in May 2006. Produced gas will be processed in a plant shipped from Houston and transported through a 27-km, 8-in. pipeline to Mtwara, Tanzania.

The company has identified eight other prospective structural leads in the concession that include deeper potential hydrocarbon bearing structures in Eocene and Cretaceous formations. Consulting engineers put mean reserves at 670 bcf of gas in 2005 based on the discovery well alone.

Artumas owns 80% of the $97 million Mtwara Energy Project, and Netherlands Development Financial Institution has 20%.

On the Rovuma block in Mozambique, Artumas will follow up on Esso’s 1986 Mocimboa-1 well. The well encountered hydrocarbon shows in several intervals, and subsequent studies of the logs identified bypassed gas in Cretaceous. Potential exists for increased pay thickness updip on the structure, Artumas said.

Georgina basin, Australia

A small Calgary independent, Texalta Petroleum Ltd., with operations in the Williston basin in southeastern Saskatchewan, also holds a large acreage position in the Georgina basin.

The nonproducing basin, most of which is in Australia’s Northern Territory, stretches from west-central Queensland northwestward about 600 miles, or two thirds the distance to Darwin.

Georgina’s geology, Texalta said, is reminiscent of the North Dakota, Montana, and Saskatchewan parts of the Williston. Individual trapping situations could contain oil and gas reserves in excess of 100 million bbl, government researchers have estimated.

Incorporated in 1987, Texalta is operating partner and holds a 50% working interest in Exploration Permits 103 and 104. The permits cover a combined 5.5 million acres of prospective land in the southern Georgina basin northeast of Alice Springs. Australian partners own the other interest.

The company hopes to be able to begin operations as early as mid-2006. It reached a mutually satisfactory conclusion to long-term negotiations with the Central Land Council that represents Native title interests in December 2005. Formal agreements may be signed by June 2006.

Exploration history in the Georgina basin’s 150,000 sq km consists of eight exploration wells, 750 km of modern seismic coverage, and 20 government stratigraphic holes. The early wildcats uncovered a rich extensive source rock, several porous and permeable reservoir formations, and the prospect for structural and stratigraphic traps, Texalta said.

The southern part of the basin has as much as 15,000 vertical ft of accumulated sediment. Published geochemical data show that the Dulcie syncline in the west is oil prone while the deeper Toko syncline in the east is gas prone.

Reservoir columns as thick as 200 m probably occur in shoreline-barrier-tidal channel facies of the Upper Cambrian Steamboat sandstone, wrote a government geologist in a paper delivered in 2005.

“In addition to the Steamboat target, deeper plays are thought to exist in the association of a thick, rich source layer in the Basal Arthur Creek formation and a widespread porous dolostone reservoir called the Thortonia formation,” Texalta said.

Both the Williston and southern Georgina basins contain massive source rocks-the Bakken formation in the Williston basin and the Basal Arthur Creek formation (hot shale) in the Georgina basin may be capable of generating oil fields like Weyburn, Steelman, and Carnduff.

The Toko syncline is thought more similar to the Rocky Mountain foothills, where numerous gas fields have been discovered with reserves of 1 tcf or more, Texalta said.

All of the southern Georgina formations are thought to lie no deeper than 1,000 m.

Marfa basin, Southwest Texas

Several independents are beginning to chase a basin-centered gas play and other conventional objectives in the nonproducing Marfa basin.

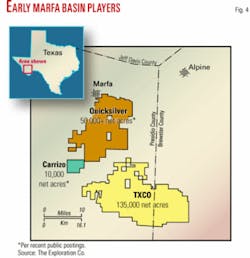

Courthouse records show that The Exploration Co., San Antonio, Quicksilver Resources Inc., Fort Worth, and Carrizo Oil & Gas Inc., Houston, have picked up acreage mostly in Presidio County. TXCO’s block extends into Brewster County (Fig. 4).

This play, northwest of the Ouachita thrust front, is southwest of the southern Delaware basin, where a larger group of companies is making a nascent play for gas in the Mississippian Barnett shale and Devonian Woodford shale. Only a few wells have been drilled so far.

No 3D seismic survey has been shot in the Marfa basin.

TXCO has determined that the Mississippian and Devonian parts of the basin fill consists of 400 to 1,200 ft of shale with total organic carbon values of 2 to 10 and thermal maturity values of 1.6 to 2.5, putting the acreage in the dry gas window.

The thermally mature area of the basin covers only about 300 sq miles but because of the shale thickness contains a potential 357 bcf/sq mile of gas in place.

TXCO in late March was discussing participation in its 135,000 net acres with other interested parties. The company plans to reenter an old El Paso well at 10,800 ft in late 2006 and might also drill a new well, said James E. Sigmon, president and chief executive officer.

TXCO plots the top of the Barnett at 10,000 ft and the base of Woodford at 16,000 ft on its acreage.

The acreage is 23 miles from the nearest gas transportation, a 6-8 in. line that serves Alpine and Marfa, and 70 miles from the large West Texas gas pipeline hub. The closer system has 6-8 MMcfd of spare capacity.

The Marfa basin had two small oil discoveries in the late 1990s. Steve Knox Oil Co., Edmond, Okla., completed a well 14 miles southeast of Marfa that produced 33.5° gravity sweet crude at 3,800 ft in the “Road Canyon” formation to open Riata field.

Montgomery wrote that the names Road Canyon and a deeper, wet “Skinner Ranch” section were “tentatively applied to an interval of interbedded sands and carbonates of Guadalupian (Permian) age, regionally equivalent to the San Andres-Grayburg/Cherry Canyon units of the Delaware basin” (see map and chart, OGJ, Nov. 10, 1997, p. 87).

Another well 40 miles west of Marfa made a 5 b/d oil completion in Cretaceous above 3,000 ft.

Peten basin, Guatemala

The Guatemalan part of the Peten basin is underexplored, says Calgary independent TrueStar Petroleum Corp.

Peten is one of three basins in which oil has been discovered in Guatemala. The other two, Amatique and Pacific, are not open to exploration at the moment.

TrueStar, through a 94% interest in Ceiba Petroleo SA, holds a 10% interest in Guatemalan oil production sharing contract 4-93.

The operator and holder of the other 90% interest is Cia. General de Combustibles, Buenos Aires, which filed for protection from creditors in late 2000. TrueStar has proposed to acquire the other 90% interest, which is subject to approval by the Ministry of Energy and Mines.

PSC 4-93 governs development of the 554,000-acre oil exploration block A-2-92 in the South Peten basin near the border with Mexico. Successful wells lie east, west, and north of the license area.

Spain’s former Hispanoil drilled the off-structure San Diego-1 discovery on A-2-92 in 1981 and produced more than 145,000 bbl of oil from Coban but exited the country before exploiting deeper proved undeveloped on-structure Coban oil.

TrueStar has delineated four closed Coban structures. One is Goliath, a large subsurface anticline with surface expression, identified by Landsat, aerial photography, and sidescan radar. It is among the shallowest in South Peten.

The company has estimated the cost of a 10,000-ft well at about $3 million.

All of Guatemala’s Peten basin fields produce from the Cretaceous Coban formation. The Jurassic Todos Santos formation is becoming developed in the Chiapas area of southern Mexico but has not yet produced in Guatemala.

Guatemala has 137 wells drilled, 76 of which are considered exploration wells. The Guatemalan part of Peten has 10 discoveries, most of which have produced from only 1-3 wells. The crude oil is 14-38° gravity, indicating a complex hydrocarbon generation system, TrueStar said.

Four fields-Rubelsanto, Chinaja, Caribe, and Tierra Blanca-lie north and west of TrueStar’s concession. None is fully developed. Combined cumulative production is 17 million bbl of oil.

Mexico’s Nazareth gas-condensate field, a 1986 Cretaceous discovery, and Lancantun, a 1990 oil find, are in the Sierra de Chiapas area 90 miles west of the Ceiba concession.

A 60,000-b/d pipeline currently ships less than 20,000 b/d of crude to the port of Puerto Barrios on the Caribbean Sea.

Port Sandwich basin, Vanuatu

The Port Sandwich basin holds promise for being one of the most compelling hydrocarbon plays in the South Pacific, wrote Floyd L. Cardinal, veteran geologist residing in Rancho Santa Fe, Calif.

The basin in the small country of Vanuatu has “indisputable indications and evidence of hydrocarbons including ocean bottom coring, core analyses, hydrocasts, Earth Satellite Corp. radar images of rated oil slicks, geochemical analyses of gas samples from fresh water pools in limestone outcrops, and reasonable TOC analyses,” Cardinal wrote.

“For decades the industry had overlooked the potential of indigenous source rock and carbonate reservoirs formed on the margins and shelves of forearc basins. Arc areas were mistakenly downgraded for the general lack of clean quartz-rich sands and the dominance of volcaniclastics of low permeability and porosity.

“However,” Cardinal said, “thanks to many years of experience and exploration in arc areas with tropical and subtropical Tertiary and Mesozoic histories, the industry now understands and appreciates the tectonics and sedimentation including biomass developments, burial mechanics, and source rock.

“These combinations create and establish the criteria necessary for the development of reefs, source rock, seals, traps, and reservoirs.”

Cardinal said carbonate buildups in the Tawoli and Port Sandwich beds provide reservoir and structural stratigraphic targets believed sourced by organic-rich sediments contained in the Port Sandwich sequence.

“Biomass from backreef and marginal environments of intense vegetative productivity provided substantial amounts of source rock. The marine environment provided additional hydrocarbon sources including phytoplankton, zooplankton, sea plants, and ocean dwelling organisms.

“Thermal heat flow throughout the Port Sandwich basin has been variable and complex,” Cardinal said. Published research indicates the Port Sandwich formation to be within the favorable oil and gas window, he added.

Cardinal’s Interwest (Vanuatu) Ltd. is seeking investors and operators to explore a large license area off Vanuatu. ✦