OGJ Newsletter

General Interest - Quick Takes

S&P sees strong year for US drilling contractors

US drilling contractors will have higher day rates and greater pricing leverage for service costs this year compared with last year, Standard & Poor’s Ratings Services said in a Mar. 24 report.

“Many oil field services and drilling companies had solid cash flow generation in 2005, particularly during the second half of the year,” said S&P analyst Brian Janiak of New York.

He foresees continued trends “that should lead to stronger cash flow generation for many of the oil field services and drillers in 2006...especially if oil and gas prices remain above $45/boe and $6 Mcf [of gas] equivalent.”

In the last 6 months, drilling contractors reported rapid extension of contract durations and increasing day rates for midwater floating rigs. All product lines and geographic markets have backlogs.

“In particular, drilling bits, logging, directional drilling, wellhead equipment, drilling components, and aftermarket services have shown significant strength,” Janiak said.

For the longer term, he expressed concern about the increasing number of jack up rigs planned and currently under construction.

“To date, S&P is aware of 51 new jack up rigs under construction at an average cost of $130 million, and 17 semisubmersibles and 2 drillships at average costs of $450 million and $600 million, respectively,” Janiak said.

S&P views near-term fundamentals to be favorable, but it continues to monitor drilling contractors’ “more aggressive financial policies and growth incentives in the intermediate term” as new jack ups and semisubmersibles enter the market during 2007-08.

Venezuela charges oil firms with back taxes

Venezuela’s tax authority Seniat presented BP PLC Mar. 27 with a bill for $61.39 million in back taxes. The action is the latest in a string of demands for alleged taxes owed by international operators for 2001-04.

Seniat Director Jose Vielma said the demand for payment is against both BP Venezuela Holdings and its affiliate Boqueron. He said BP has 15 days in which to pay the debt or it will face fines of 25-200%.

The back taxes derive from the government’s recent ruling that the tax rate should be 50% rather than 36%, according to a 2001 law.

Vielma said a Caracas tribunal recently ruled that a requested freeze in Eni SPA’s operations in Venezuela was appropriate. Eni had been told to pay $46.3 million in unpaid taxes for 2001-04 but had not done so.

The ruling affects the company’s subsidiary Eni Dacion, which operates Dacion oil field and had agreed to a Petroleos de Venezuela SA-led joint venture contract.

Chevron Corp. also received a bill from Venezuela’s Seniat for $43.1 million. Seniat said the bill is the fifth to be levied against major oil companies operating under 32 production agreements in Venezuela.

Seniat spokesman Adolfo Gregermann said, “There is an outstanding amount due from the 22 companies whose taxes were reviewed of some $891 million.”

Venezuela’s tax assessor claims it only has received $54.4 million of the total $360 million demanded from the companies. Only Petroleo Brasileiro SA, Royal Dutch Shell PLC, Inemaka, West Falcon, and Samson have paid in full.

Two others, China National Petroleum Corp. and Eni, have paid nothing toward their allegedly overdue taxes.

Oxy offers Ecuador $1 billion in legal dispute

Occidental Petroleum Corp. is offering Ecuador’s government as much as $1 billion in disputed taxes, investments, and extra revenues to end a legal dispute (OGJ, Nov. 21, 2005, p. 34).

The row centers on whether the US firm in 2000 transferred part of a field to Canada’s EnCana Corp. without approval from the Ecuador authorities.

Oxy proposes giving Ecuador at least $600 million in extra revenues from the disputed area but denies any wrongdoing. The company faces the possibility of having its Ecuador license revoked.

Oxy currently produces 100,000 b/d of oil in Ecuador, South America’s fifth largest oil producer.

Oxy’s offer also includes $100 million for health and social development projects.

The company has further pledged to invest $110 million in new projects with Ecuador’s state oil firm Petroecuador. In addition it will pay a $50 million bonus for contract changes and $13 million toward the energy ministry’s plans to modernize its tax system.

Ecuador’s energy ministry is still studying the case.

Bolivia to nationalize oil and gas by July 12

The new Bolivian government said it intends to complete the nationalization of the country’s hydrocarbon resources by July 12.

President Evo Morales said oil and gas reserves will be nationalized through individual negotiations with license holders.

Edwin Miranda, a spokesman for Yacimientos Petroliferos Fiscales Bolivianos, the national oil and gas company, said contracts with companies operating in Bolivia are being renegotiated and should be completed by the deadline.

Twelve companies are active in Bolivia. The leading operators are Repsol YPF; Petroleo Brasileiro SA, the largest company in Bolivia; BG Group PLC; and Total SA.

The hydrocarbons law enacted in May 2005 requires them to sign new production-sharing contracts that impose taxes and royalties amounting to 50% of the value of production. Companies not signing the contracts will be forced to suspend operations. ✦

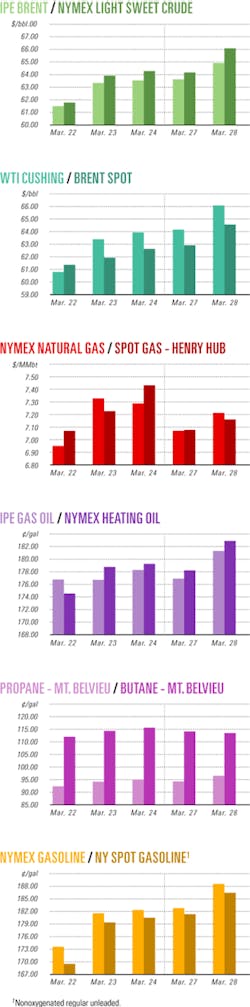

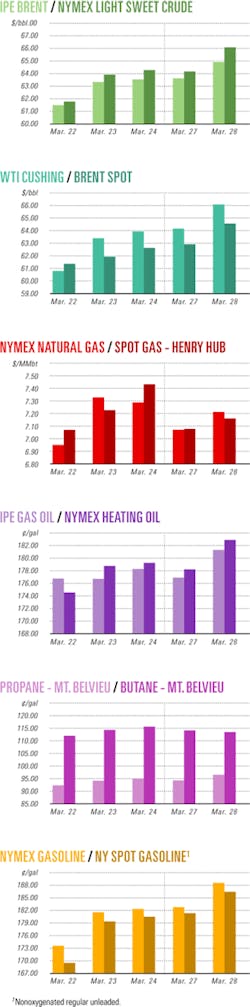

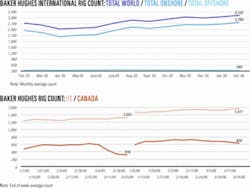

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Afghanistan resource base larger, USGS says

Afghanistan’s undiscovered oil and gas resource base is much larger than previously understood, said the US Geological Survey after a multiyear study.

The agency estimated mean undiscovered resources at 15.7 tcf of gas, 1.6 billion bbl of oil, and 562 million bbl of natural gas liquids. Most of the gas is indicated to be in the Amu Darya basin and most of the oil in the Afghan-Tajik basin.

The two basins cover a combined 200,000 sq miles in northern Afghanistan, and the USGS assessed 33,000 sq miles of that. It subdivided four petroleum systems into eight assessment units.

Formations with the greatest potential are, for gas, Upper Jurassic carbonate and reef reservoirs beneath an impermeable salt layer in relatively unexplored parts of northern Afghanistan and, for oil, Cretaceous to Paleogene carbonate reservoir rocks associated with thrust faulting and folding in the Afghan-Tajik basin.

A 1990 USGS report estimated that 4.74 tcf of gas and 80 million bbl of oil had been discovered in Afghanistan by 1980. It put estimated recoverables at 300 million bbl of oil, 9.6 tcf of gas, and 145 million bbl of condensate.

That report said most reservoirs would be 10,000-20,000 ft deep.

Part of that study sought to aggregate estimates of proved reserves in several fields discovered from 1957 to 1984. Most of the fields are no longer on production (see map, OGJ, Aug. 9, 2004, p. 32).

Afghanistan has sought to mount a licensing round, but no exploration is reported in the country in recent years.

DNO ASA to test Tawke-1 in northern Iraq

DNO ASA, Oslo, plans several tests of its Tawke-1 wildcat in northern Iraq.

The well, drilled under a production-sharing agreement with the Kurdistan regional government, is north of Mosul along the Mardin high east of Syria and near the Turkish border.

Spudded Nov. 28, 2005, the well reached 3,100 m Mar. 22 and was approaching TD. Late last year it encountered mobile 24˚ gravity oil in the top of three zones of interest (OGJ, Jan. 2, 2006, Newsletter).

DNO plans to suspend operations to evaluate data once drilling is complete and to move the rig to a new site for another well in the PSA area.

The PSA, signed in June 2004, does not involve Iraq’s formative central government (OGJ, Dec. 12, 2005, Newsletter). DNO signed a memorandum of understanding on training and cooperation with Iraq’s Ministry of Oil last April.

West Bengal wildcat tests discouraging

Discouraging test results of the first of four exploratory wells planned by India’s Oil & Natural Gas Corp. (ONGC) on the Bengal Block of West Bengal could result in abandonment of the WB-OSN-2000/1 well.

Transocean Inc.’s Transocean Nordic jack up drilled the $18 million well in the Sunderbans mangrove tidal swamp over 10 months, beginning in March 2005.

“This particular well had a strong gas show, and the seismic data as well as other prevailing conditions indicated the presence of a viable gas reserve,” said an ONGC senior official, speaking on condition of anonymity. “We know there is gas; the problem is that we have to establish it.”

Though final testing results are not yet known, the company called for a “failure analysis” to evaluate the well’s potential and ensure adoption of best practices in future drilling.

Gudrun appraisal tests oil, gas off Norway

Statoil ASA has completed a successful appraisal well on its Gudrun oil, gas, and condensate prospect in the Sleipner area of the Norwegian North Sea (OGJ Online, Nov. 4, 2005).

The appraisal well, about 190 km off Norway in 109 m of water, was drilled to 4,180 m TD and tested successfully from two intervals, said Gudrun partner Marathon Petroleum Co. (Norway).

A lower zone was tested at restricted rates of 6,300 b/d of oil and 18 MMcfd of gas, while an upper sand interval was tested at 4,000 b/d and 12 MMcfd, Marathon reported.

The appraisal well improves the overall potential for commercial development, Marathon noted. To date, four exploration and appraisal wells have been drilled on the Gudrun structure. Statoil is operator of Gudrun with a 46.8% interest; Marathon holds 28.2%; and BP PLC and Gaz de France hold 12.5% each.

Statoil drilling Morvin appraisal well

Statoil has started drilling appraisal well 6506/11-8 on the Morvin structure in the Norwegian Sea.

Morvin is an oil discovery on the Halten Terrace. Smedvig’s West Alpha semisubmersible is drilling the appraisal.

The well, expected to take just over 4 months to drill, will be drilled to 4,800 m subsea. Morvin lies in 380 m of water on Production License 134b, about 10 km from Statoil-operated Kristin field. Like Kristin, Morvin is a high-pressure, high-temperature reservoir. A Statoil wildcat found light crude at the top of the Morvin structure in 2001.

If proved commercial, Morvin could be a subsea development phased in to Kristin or Asgard, Statoil said.

Statoil has a 50% interest in PL 134b. The other licensees are Eni SPA 30%, Norsk Hydro AS 14%, and Total SA 6%.

Beach to speed work on permit off Australia

Beach Petroleum Ltd. said it will “expedite exploration and possible development” of the VIC/P46 exploration permit in the Otway basin off western Victoria, Australia.

It will become operator of the permit under a farmout agreement with Essential Petroleum Resources Ltd. that raises its interest to 50% from 17.5%. Essential Petroleum, the previous operator, retains a 25% interest. Mittwell Energy Resources Pty. Ltd., a subsidiary of Mitsui & Co. Ltd., holds the remaining 25%.

Essential Petroleum said it will be “substantially carried” by its partners through a 3D seismic acquisition and drilling program expected to cost more than $20 million.

It said it identified “numerous prospects and leads” on VIC/P46, which covers a large offshore area between Portland in the west to the border of South Australia.

Beach said drilling will begin in 2007. It said a commercial gas discovery would have a distribution outlet through a grid connection to the main Seagas pipeline north of Portland or to the eastern states’ network via existing connections around Warrnambool.

TUSK to develop light oil in NW Alberta

TUSK Energy Corp., Calgary, plans to develop light oil discoveries in the Mega-Venus focus area of Alberta 300 km northwest of Edmonton. Logs at the most recent well, Gutah 6-17-100-6-w6m, indicated 7.7 m of oil pay in a 13.5-m zone of gross porosity in Devonian Keg River. The well flared gas and flowed oil from Keg River during drilling and coring. TD is 2,425 m.

The well flowed more than 800 b/d of 46° gravity oil on a 9⁄32-in. choke. On a 5⁄32-in. choke, the flow was 345 b/d and 180 Mcfd of gas with 8,000 KPa flowing tubing pressure with less than 5% pressure drawdown. Alberta regulations will limit production to 125 b/d. Gutah is 4 miles south of the TUSK Mega light oil discovery of January 2004. A 6-in. pipeline built from the Mega area to regional infrastructure is being extended to Gutah.

The third discovery in the area was the Venus 6-36-101-9w6m gas-condensate find in the 2005 winter.

TUSK holds interest in the Gutah discovery and six other sections believed prospective. It concluded a 3D seismic survey of all lands believed prospective earlier this month. ✦

Drilling & Production - Quick Takes

South East Mananda oil field comes on stream

Oil Search Ltd., Sydney, started production from its $145 million South East Mananda oil field development project in the southern highlands of Papua New Guinea. Oil Search received development approval for the field early last year (OGJ, Feb. 14, 2005, Newsletter).

The field started flow from one well. Oil Search will link three other wells to the gathering system to raise production to 7,000 b/d of oil by May.

Development of South East Mananda has had to overcome a number of technical and commercial challenges, including complex geology, high-altitude drilling, and the laying of 16 km of parallel oil, gas-lift, and chemical pipelines in a remote, high-rainfall area.

Oil Search built an innovative 470-m cable suspension bridge to carry the bundle of pipelines across 400-m deep Hegigio Gorge, which separates South East Mananda from Agogo field facilities, the nearest entry into the Kutubu production hub.

Oil is mingled with production from other highland fields and piped south to the Kumul loading facilities in the Gulf of Papua.

South East Mananda was discovered in 1991. The development was the first for Oil Search as operator. Oil Search has 72.27% of the field, while AGL Gas Developments has 11.9%, Merlin Petroleum 7.93%, and Petroleum Resources Kutubu 7.9%.

Heavy oil flow system due test in India

Cairn Energy PLC has let a contract to Oilflow Solutions Ltd. to conduct field trials for a system to improve flow characteristics of heavy oil in Rajasthan oil field in northwestern India. The trials follow recent laboratory trials that reduced the pour point of the crude to less than 18° C. from 45° C.

The contract involves additional development work in the UK and the field trial using a field test flow loop. Project preparation has begun, and the field trial is planned for mid-2006 after pilot trials in Aberdeen during April.

Oilflow is a joint venture of Vienco Oil & Gas Ltd., Aberdeen, and AGT Energy Ltd., a commercial spinoff from Bradford University, UK.

P-50 FPSO en route to Albacora Leste field

Petroleo Brasileiro SA (Petrobras) reported that the P-50 floating production, storage, and offloading vessel is en route to Albacora Leste oil field in the Campos basin off Brazil (see map, OGJ, Aug. 9, 2004, p. 37).

Petrobras said the vessel has been undergoing sea trials to test various systems for the past 30 days. It expects to put the unit on stream to handle about 180,000 b/d of oil next month.

The P-50 will be tied into 16 production wells and will take some 6 months to reach its full capacity.

Four operators join Aussie multiwell program

Peak Group, Aberdeen, has secured a rig and associated contracts and has begun its first multiwell, multioperator well management program off Australia.

The $100 million (Aus.) program covers eight wells and four operators. It developed from a Peak contract for drilling in AED Oil Ltd.’s Puffin oil field on the Ashmore Cartier Permit AC/P22 in the Timor Sea.

Other operators in the program are Santos Ltd., Eni SPA, and ConocoPhillips.

The Stena Clyde semisubmersible on Mar. 8 began drilling the first of three wells for AED, the low-angle Puffin 9 exploratory well to be drilled to 3,000 m below the seabed. It will drill two development wells, Puffin 7 with a 460 m horizontal lateral and Puffin 8, still under design. The development wells will be completed subsea and tied back to a floating production, storage, and offloading vessel (OGJ, Mar. 6, 2006, p. 20).

For the AED wells, Peak is providing complete well construction project management and procurement service. For that and its work for the other operators in the program, Peak will hold the contracts for the drilling rig, supply vessels, third-party service contracts, and logistics and supply base services.

Rigless installation called region’s first

BJ Tubular Services has completed off Ivory Coast what it said is the region’s first rigless conductor installation.

It did the work for CNR International (Cote d’Ivoire) SARL under a contract to preinstall 12 conductors and supply cold cutting services for West Espoir oil field (OGJ, May 19, 2003, Newsletter).

The conductors were installed in more than 400 ft of water with 440 ft of mudline penetration. ✦

Processing - Quick Takes

Supply contract let for Serb biodiesel plant

The Victoria Group of Novi Sad, Serbia, has let a contract to Lurgi AG, Frankfurt, for the supply of equipment for a 100,000 tonne/year biodiesel plant and a related vegetable oil plant of the same size to be built in Sid near Belgrade.

The plants will process sunflower oil, soybean oil, and rapeseed oil into edible oils or biodiesel, depending on market conditions. They are to go on stream in early 2007.

Neste, OMV plan biofuels plant in Austria

Neste Oil Corp. and OMV AG have signed a memorandum of understanding to jointly build a 200,000 tonne/year biodiesel plant at OMV’s 208,600 b/cd Schwechat refinery in Austria.

The plant will be based on Neste Oil technology for producing high-quality diesel from renewable raw materials, such as vegetable oil and animal fat. It is an effort to meet the European Union’s challenge for member states to increase biofuel usage to 5.75% of all gasoline and diesel used in traffic by 2010. The facility is expected to start production as early as yearend 2008.

Port Jerome/NDG complex due maintenance

Esso SAF’s Port Jerome/NDG 233,000 b/d refining and petrochemical complex near Le Havre in Normandy, France, will be shut down for maintenance costing €25 million through mid-April, according to Dominique Badel, Esso’s chairman and chief executive.

The refinery operated at a record of 90% capacity last year. ✦

Transportation - Quick Takes

Group forms company for Algerian LNG plant

Repsol YPF SA, Gas Natural SDG SA, and Sonatrach agreed to form a new company, Soc. de Licuefaccion, to build and operate a liquefaction plant based on natural gas from Gassi Touil field in eastern Algeria.

Plans call for the 4 million tonne/year LNG plant to come on stream in 2009. Repsol YPF holds 48% of the new company, Gas Natural 32%, and Sonatrach 20%.

Centurion, Shell to pursue Nile Delta LNG

Two Egyptian units of Royal Dutch Shell PLC took a farmout from Centurion Energy International Inc., Calgary, to acquire 50% interest in the West El Manzala and West El Qantara concessions onshore in the Nile Delta.

Shell and Centurion will cooperate in developing LNG opportunities if threshold quantities of gas are discovered on the concessions, subject to government approvals. Centurion remains operator.

Shell will pay Centurion $15 million and provide 50% of all future exploration and development costs as long as the two companies own the concessions. Shell will pay Centurion $20 million more if it continues after drilling five wells. Centurion spudded the first of the five wells on Feb. 7.

The concessions, which cover a combined 800,000 acres, surround Centurion’s wholly owned El Wastani and South El Manzala development leases that are producing 200 MMscfd of gas and 6,500 b/d of liquids.

Extensive 3D seismic has confirmed several prospects and leads on the two blocks in plays similar to those on Centurion’s nearby development leases. Fifteen exploration and appraisal wells are planned in the 2006 capital program for the two concessions.

Each concession has an initial 3-year exploration term with the option to extend the exploration term by two further 3-year terms.

Suez signs memo for supply from Brass LNG

Suez LNG Trading SA has signed a memorandum of understanding with Brass LNG to buy 2 million tonnes/year of Nigerian LNG for 20 years. First delivery of LNG is expected in 2010.

Brass LNG includes Nigerian National Petroleum Corp., which holds 49%, and partners Eni SPA, ConocoPhillips, and Chevron Corp., which hold 17% each.

The LNG is destined primarily for North America, including the Suez Neptune project 22 miles off Boston, planned for 2010 operations. Suez Neptune will consist of a buoy system for mooring specially designed LNG ships equipped to store, transport, and vaporize LNG and discharge the natural gas through a subsea pipeline into the existing pipeline system (OGJ, Oct. 24, 2005, Newsletter).

The US Coast Guard deemed the deepwater port application complete in October 2005, Suez said. Suez also has the option to divert cargos to other locations.

The LNG supply will come from Brass LNG’s new 10 million tonne/year, two-train liquefaction plant. ✦