US, Canadian firms post big fourth-quarter profits

High oil and gas prices and improved refining and marketing margins, amplified by hurricane-related disruptions to processing capacity, bolstered quarterly earnings of US oil and gas companies in the fourth quarter of 2005.

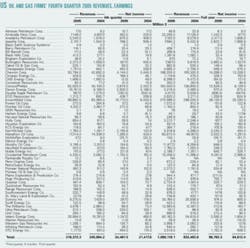

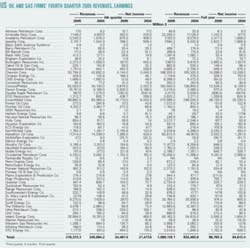

A sample of US oil and gas producers and refiners posted a 61% increase in earnings for the final 2005 quarter compared with the same quarter a year earlier. For the full year, earnings were up 53%.

A group of oil and gas firms based in Canada also showed a robust gain in fourth quarter net income. For the full year 2005, though, these companies’ earnings grew by a smaller margin.

Meanwhile, a group of US service and supply companies recorded a 376% earnings gain for the fourth quarter of 2005 and a similar jump in net income for the year.

Market factors

Average fourth quarter 2005 cash refining margins for all major refining centers in the US surged from a year earlier, boosting independent refiners’ and integrated oil companies’ earnings.

The East Coast margin for the fourth quarter of last year averaged $7.64/bbl, up 154% from the final quarter a year earlier. US Gulf Coast and Midwest margins each climbed about 130% from a year earlier, while the US West Coast refining margin gained 75%, averaging $23.18/bbl for the fourth quarter.

Margin averages, however, masked a decline over most of the quarter, which began with refining margins still extraordinarily high because of refinery damage from Hurricanes Katrina in August and Rita in September. At their peak, hurricane-related refining capacity outages totaled 4.9 million b/d-60% of the Gulf Coast total and 29% of total US capacity, according to the International Energy Agency.

The average refiners’ acquisition cost of crude was up 30% from the final 2004 quarter, and product prices increased at about the same rate. The US wholesale price of unleaded gasoline, which excluded tax, averaged $1.69/gal in the fourth quarter of 2005, up from $1.29/gal for the same year-earlier quarter.

Wellhead oil and gas prices also soared. The US wellhead price of oil in the fourth quarter of 2005 averaged $54.46/bbl, up from $42.40/bbl a year earlier. Meanwhile, the natural gas wellhead price jumped 72% from a year earlier to average $10.18/MMcf for the final quarter of last year.

Company results

While integrated oil companies posted healthy gains in fourth-quarter earnings, a handful of independent oil and gas producers, as well as large refiners, recorded the big percentage gains in net income as compared with the final quarter a year earlier.

Anadarko Petroleum Corp., Burlington Resources Inc., Frontier Oil Corp., and Kerr-McGee Corp. each reported that 2005 fourth quarter earnings more than doubled in comparison to net income recorded in the fourth quarter of 2004.

Anadarko’s net income increased 116% for the quarter and 54% for all of 2005.

“Revenues set an all-time quarterly record, while at the same time we reduced direct operating costs 21% from the prior-year period. As a result, we were able to continue expanding our cash margins, partly because of higher commodity prices, but also due to a restructured, more efficient asset base,” said Anadarko Chairman, Pres., and CEO Jim Hackett.

Although its sales volumes were little changed from a year earlier, Burlington Resources posted a 132% gain in fourth quarter earnings.

Burlington’s natural gas price realization in the recent fourth quarter averaged $9.43/MMcf, up from $5.97/MMcf in the prior year’s fourth quarter. Meanwhile, the company’s price realizations climbed 34% for natural gas liquids and for crude oil.

Frontier reported the most profitable annual and fourth quarter results in the company’s history, as its quarterly net income surged 70%.

Kerr-McGee reported net income for the 2005 fourth quarter of $2.2 billion, compared with $133.8 million for the 2004 fourth quarter.

Luke R. Corbett, Kerr-McGee chairman and chief executive officer, said, “We capitalized on strong commodity prices by divesting of lower-growth properties and redeploying funds to our vast inventory of higher-return, less capital-intensive properties.”

ExxonMobil Corp. reported that its fourth quarter net income was $10.7 billion, up 27% from 2004, due to higher oil and gas realizations and improved refining and marketing margins, while the company’s production decreased 1% from the fourth quarter of 2004.

Meanwhile, Marathon Oil Corp. recorded a 195% gain from a year earlier, mostly as a result of strong downstream margins and volumes. And Amerada Hess Corp.’s earnings for the quarter were up 97% from the same year-earlier period on higher oil and gas selling prices despite slightly lower production volumes.

Refiners

Holly Corp. and Valero Energy Corp. are among refiners that reaped the rewards of strong refining margins in a strong transportation fuel market last year.

Holly reported that its fourth-quarter earnings increased to $39.9 million from $7.4 million a year earlier principally due to higher product margins, which were offset partially by higher refinery operating costs and expenses. These same factors, in addition to higher production volumes, resulted in a doubling of the Dallas-based refiner’s 2005 annual earnings to $168 million.

Valero’s fourth quarter net income last year surged to $1.35 billion from $489 million a year earlier. The company benefited from higher product margins resulting from the refinery shutdowns due to hurricanes Katrina and Rita.

In the fourth quarter, Valero said, its throughputs exceeded 3 million b/d for the first time in the company’s history and would have been higher had its Port Arthur refinery not been down for part of October due to damage from Hurricane Rita and if not for an extended turnaround at the Delaware City, Del., refinery.

This was the first full quarter since Valero acquired four Premcor Inc. refineries, which contributed about $485 million to operating income.

Canadian firms

A sample of oil and gas producers, transporters, and service companies based in Canada posted a collective 54% increase in earnings during the fourth quarter of 2005. For the year, net income grew 22%.

Only EnCana Corp. recorded a decline in earnings for the quarter, and it was slight. Husky Energy Inc. and Talisman Energy Inc. are among companies that showed big gains over the fourth quarter of 2004.

Increased production and high commodity prices helped Husky Energy triple its quarterly earnings to $669 million (Can.). During the fourth quarter of 2005, Husky started oil production from its White Rose project off the east coast of Canada.

Also benefiting from a boost in production, Talisman Energy posted earnings of $533 million (Can.) in the final 2005 quarter vs. $121 million (Can.) a year earlier.

Talisman’s production in the 2005 fourth quarter averaged 516,000 boe/d, an increase of 14% over the same 2004 period. And on Nov. 18, 2005, the company acquired control of Paladin Resources PLC, which contributed an average of 5,650 boe/d for the year based on production from that date.

Service, supply firms

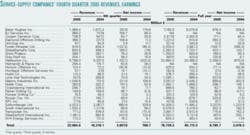

Among the groups of firms in the OGJ sample, the surge in fourth quarter 2005 was most pronounced for service and supply companies.

This group’s earnings for the quarter were nearly five times those of the fourth quarter of 2004. For the year 2005, these same firms recorded a similar jump in net income.

The group’s revenues for last year were up by a much smaller margin, though, increasing 26% for the final quarter and 18% for the year.

The forces behind these companies’ net income gains last year were stronger demand and higher prices for rigs and services.

GlobalSantaFe Corp. announced that the surge in demand and day rates for offshore contract drilling services helped lift its income and boost earnings in the fourth quarter of 2005 to $180.2 million on revenues of $603.5 million. This compares to a net loss of $7.6 million on revenues of $498.3 million in the fourth quarter of 2004.✦