ARGENTINA OFFSHORE-1: Argentina’s offshore basins due modern exploration effort

Juan Carlos Pucci

Consulting Geologist

Buenos Aires

Since the Argentina Exploration Plan was launched in 1991, exploration in Argentina reached a peak between 1995 and 1997, later began to decline, and now has withered to the point that it threatens the country’s future oil and gas consumption.

This scenario is due to the lack of an exploration effort. Until the YPF privatization, the former state company carried out most exploration and was practically the only entity exploring frontier areas.

The energy secretary was not able to attract new exploration investments because tenders did not include sufficiently favorable fiscal terms.

It is urgent that new investment flow into exploration and transportation. The country is depleting more reserves and hence the reserves-to-production ratio is low. In addition, new pipelines are needed to transport natural gas to consumption centers.

Argentina is the only energy self-sufficient country in the southern cone and exports gas and oil. However, production is not being replaced, the number of wells being drilled has declined, and the number of producing wells has also fallen.

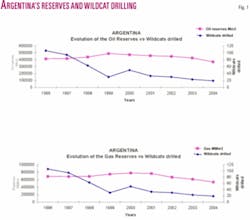

In addition, the number of wildcats also dropped dramatically and in 2004 reached the lowest in Argentina’s petroleum history (Fig. 1 and Table 1).

Since the privatization of YPF, exploration in areas outside productive blocks began to decrease and at present little exploration is reported.

The Kirchner administration, in an attempt to remedy the situation, created a new state energy company Energia Argentina SA in late 2005. ENARSA will get funds for new investments in exploration, exploitation, transportation, and electrical projects.

Due to this new scenario, the energy secretary awarded ENARSA all the offshore areas open for bids (Fig. 2). At present, the new state energy company has associated as a nonoperator with Petrobras, Repsol-YPF, Chile’s state Sipetrol, and Uruguay’s state PetroUruguay to explore some of Argentina’s offshore basins. ENARSA also expects to associate as a nonoperator with other companies in on land exploration and production areas.

Introduction

Argentina’s continental margin covers 3 million sq km to the base of the slope and includes 980,000 sq km ocean surface above the 200 m isobath, which corresponds to the edge of the continental shelf.

Studies of offshore Argentina began during 1957 and lasted until 1961. The Argentine Navy’s Hydrographic Service and the Lamont Geological Observatory carried out these surveys. Interpretation of refraction seismic surveys allowed researchers to draw the outlines and sedimentary thicknesses of the basins.

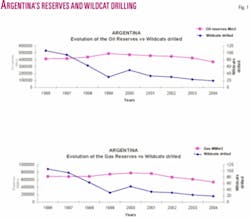

So far, operators have drilled 182 exploration wells, 108 of which were drilled in the Austral basin (Table 1).

Argentina’s offshore basins share a common origin related to the breakup of Gondwana and the separation of the South American and African plates. This episode led to the formation of a series of rift-drift basins along the continental margin.

South of the Gulf of San Jorge basin, the final rupture between the South American and the Antarctica plates and the development of the Andean cordillera produced distinctive and special characteristics mainly located in the south border of the Austral and Malvinas basins.1

Basin review

Salado basin

The Salado basin, which includes the Punta del Este basin off Uruguay, covers 85,000 sq km, 40% of which is offshore. The other 60% is Argentinean land territory (Fig. 2).

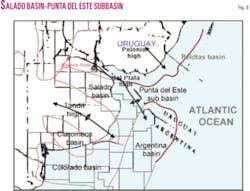

The Martin Garcia/del Plata high separates the Salado basin from the Punta del Este subbasin to the north. The Polonio high separates the Punta del Este subbasin from the Pelotas basin. To the south the Tandil high separates the Salado basin from the Colorado/Claromeco basin (Fig. 3).

Exploration began between 1937 and 1942, when YPF recorded the first refraction seismic data on land and found a thick sedimentary section. Not until 1968 were more seismic lines acquired and three offshore and six land wells drilled.

Sun Oil drilled the first offshore well in the Salado basin in 1969 with a total depth of 3,230 m below sea level.

Chevron initiated exploration in the offshore Punta del Este basin in the mid 1970s by acquiring seismic data and drilling two wells.

The last exploration in the Salado basin took place in 1992-95 when Amoco recorded 2,000 km of reflection seismic data and drilled the Dorado x-1 well and Repsol acquired 4,904 km of seismic lines.

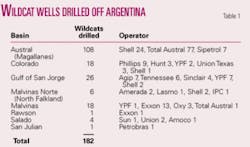

The Salado and Punta del Este basins, genetically related, have similar sedimentary sequences and structural styles. The sedimentary fill consists of 7,000 m at its thickest point of rocks of Mesozoic and Cenozoic age (Table 2).

For the synrift section it was postulated that lacustrine black shales were mature or overmature for oil and gas. Sandstones are abundant, but primary porosity decreases with depth where the potential traps are possibly located.

It is postulated that the oil migrated towards the basin margin where no traps were identified.

No exploratory plays or petroleum systems were found in the Salado basin. With this information, exploration potential is poor and geological risk is high. However, better exploration possibilities may exist on the continental slope2 and in the Punta del Este subbasin, where De Santana et al.3 identified leads and prospects.

Colorado basin

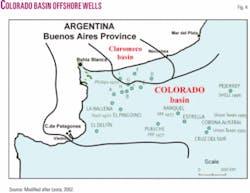

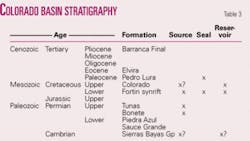

The east-west oriented Colorado basin covers 178,000 sq km offshore and 37,000 sq km on land. The Paleozoic section corresponds to the offshore extension of the Claromeco basin (Fig. 4 and Table 3).

A total of 43,361 km of seismic lines have been acquired in the Colorado basin; seven wildcats wells were drilled onshore and 18 wildcats offshore (Fig. 4).

The deepest parts of the offshore Colorado basin have more than 12,000 m of continental and marine sediments. Oil samples recovered in the Cruz del Sur x-1 well, showed evidence of an active petroleum system in the Upper Jurassic and Lower Cretaceous rift sequence. The occurrence of a regional seal rock, the Pedro Luro formation in the top of the Cretaceous and the base of the Tertiary, has been recognized.4

A Permian petroleum system has also been postulated. The Permian Pillahuinco Group crops out in the Claromeco basin. The unit consists of shales with TOC values of 3.4%.

The reservoirs with better characteristics correspond to sandstone levels in the upper part of the Cretaceous Colorado formation. Porosities range between 22 and 32%. In the Permian, the sandstones porosity values range between 5 and 11%.

Overlaps, folds, and stratigraphic traps and a series of potential Cretaceous traps that are connected by faults to the generation zone have been reported.

In addition, it is postulated that exploration potential may exist in the southern part of the Colorado basin and on the continental slope.2 5

Rawson basin

The Rawson basin covers 42,000 sq km, and the sedimentary fill penetrated by the only well drilled is 2,992 m (Fig. 2).

The basin was defined on the basis of 7,600 km of seismic recorded by YPF between 1976 and 1983. In addition, between 1987 and 1989 Exxon carried out 10,000 km of seismic lines.

Exxon drilled the Tayra x-1 well in 86 m of water. The well from spud to 1,350 m penetrated a Tertiary marine section made up of glauconitic sandstones and claystones. At 1,350-2,231 m it penetrated a rift-fill section consisting of fluviatile sandstones and clayey and silty sandstone. At 2,231-2,902 m the rift sequence is a monotonous alteration of sandstones and claystones. All the sections are resting on a prerift sequence of 90 m of indurate lithic sandstones. The seismic interpretation showed several prospects with four-way closures, but the main risk is the occurrence of source rock.

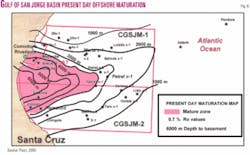

San Jorge Basin offshore

The Gulf of San Jorge basin covers 170,000 sq km, nearly 34,000 of which is offshore.

The offshore part of the basin has geological characteristics similar to the onshore, and hence the stratigraphic sequence (Table 4).

Exploration in the basin was carried out in two periods, the former between 1969 and 1970 with 15 wells drilled by Agip, Tenneco, and Sinclair, and the latter between 1978 and 1981 with 9 wells drilled by YPF and Shell.

The offshore campaign had negative results. Wells in the north flank showed a lack of structural closures and absence of source rock with generation capacity, while wells in the south flank found poor reservoir conditions and limited lateral development.

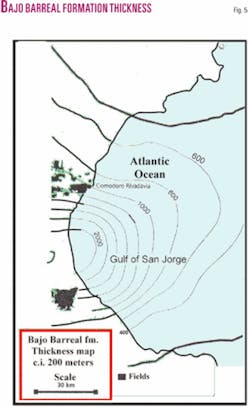

Fluvial sandstones of the Bajo Barreal formation comprise the main reservoir, which is well developed towards the land (Fig. 5), as well the source rock maturation zone (Fig. 6). In addition, the tuff and sandy tuff levels of the Castillo formation underlie this unit, and due to their deficient petrophysical properties the reservoir is of poor quality.

Although the hydrocarbons are likely to occur in shallow prospects, the risk is associated with the migration of the hydrocarbons towards the reservoir and to the fault system that controls oil entrapment.

The deep prospect model has the best exploration potential, but the risk is higher with drilling depths to 4,000-5,000 m, and gas is more likely to be discovered.

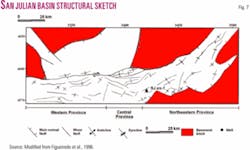

San Julian basin

The San Julian basin covers 14,325 sq km and has one well drilled by a consortium led by Petrobras (Fig. 2).

San Julian lies in the offshore, south of the Gulf of San Jorge basin. YPF first outlined the basin in 1979-80 after shooting 2,406 km of seismic lines. During 1991, Petrobras acquired 4,518 km of seismic lines and carried out 2,776 km of gravity and 2,430 km of magnetic surveys.

The basin has been divided into three main structural provinces: western, central, and northeastern (Fig. 7).

The seismic interpretation indicated several large prospects in the vicinities of the well location and smaller prospects to the northeast.

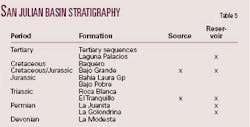

Before drilling, it was postulated that the stratigraphy of the San Julian basin was similar to the Gulf of San Jorge (Table 5). However, the well results demonstrated that the San Julian basin has more in common with the stratigraphy of the Deseado basin.

The San Julian es-1 well, which has a TD of 2,940 m, penetrated a section consisting of low grade metamorphic basement, overlain by 1,100 m of the Callovian to Oxfordian volcaniclastic Bahia Laura Group, followed up by sandy tuffs of the Bajo Grande formation, the Cretaceous Laguna Palacios formation, and towards the top a Tertiary sequence of marine sediments.

The best potential source is the 1,350-m interval that corresponds to the Bajo Grande formation. This sample is oil prone (Type I), contains 5.35% total organic carbon (TOC), and has a hydrogen index (HI) of 862 and a Tmax value of 445° C. However, burial history reconstruction and geochemical modeling indicated that this interval is immature throughout the depocenter. In addition, the lack of good reservoirs indicates that the basin has a high-risk prospectivity.

Future exploration effort has to be concentrated on in-depth studies in order to identify reservoir and source rocks even in Triassic and Paleozoic sediments that occur in the on-land Deseado basin.6

Next: Basins off southern Argentina include the country’s only offshore production. ✦

The author

Juan Carlos Pucci (jcp@ darcom.com.ar) has been active in international exploration for many years. His employers included GSI, Cities Service, and Mobil. He was the geologist representing the Secretary of Energy in privatizing Argentina’s upstream sector. At present, he is a consulting geologist specializing in South America and in organization of the upstream privatization process. He is also working on the definition of new major plays in South American basins. He has an MS in petroleum geology and a PhD in geology from the University of Buenos Aires.