SAUDI PETROCHEMICALS-1: Saudi Arabia to become major petrochemical hub by 2010

Saudi Arabia’s position in the global petrochemical market will grow during the next 5 years due to an ongoing and significant growth wave that will add substantial petrochemical capacity. The country’s overall share of the world’s petrochemical output will increase to 13% by 2010 from a current level of 7%.

This growth, fueled by massive foreign and domestic investment inflow, coincides with a shift in the petrochemicals industry’s major production regions to best-cost areas with easy access to markets. The increasing involvement of industry’s major companies in the Saudi petrochemical industry demonstrates this trend.

This development is expediting the emergence of Saudi Arabia as a global hub for commodity petrochemical manufacturing.

The Saudi Arabian petrochemical industry has been the best-in-class cost performer due to bountiful and favorably priced hydrocarbon supplies and proximity to the burgeoning Asian markets. Ongoing structural and institutional reforms in Saudi Arabia will further enhance the industry’s competitiveness.

This article, the first part of two, discusses the historical development of the Saudi petrochemical industry, its current status, and plans for future petrochemical capacity expansion.

The conclusion, next week, will discuss five growth strategies that the industry is adopting, the role of the Saudi government within the petrochemical industry, and the effects of Saudi Arabia’s accession into the World Trade Organization.

Historical perspective

The petrochemicals industry in Saudi Arabia has evolved in three phases.

Phase 1 covers the pre-1983 years when the foundation for the industry was established. Key events occurred simultaneously in 1976:

• Establishment of the Royal Commission for Jubail and Yanbu to build and maintain a world-class infrastructure in the twin industrial cities at a capital cost of $22 billion.

• Development of the master gas system (MGS) by Saudi Aramco at an estimated capital cost of $12 billion. The MGS includes gathering systems, processing plants, fractionation plants, storage facilities, transmission pipelines, and an export terminal for NGLs.

• Establishment of Saudi Basic Industries Corp. (Sabic), a 100% government-owned enterprise to manufacture basic and intermediate petrochemicals, fertilizers, and metals. In 1984, 30% of Sabic’s ownership was offered to Saudi and Persian Gulf investors.

Phase 2, during 1983-99, includes the production of methanol by a Sabic Affiliate, Ar-Razi, in 1983 (OGJ, Aug. 16, 1999, p. 65).

Two key events occurred during this phase: The first was the commissioning in 1994 of the first flexible feed cracker by Arabian Petrochemical Co. (Petrokemya), a subsidiary of Sabic. This signaled the beginning of mixed feedstock cracking.

The second event occurred in 1995 when the upstream petrochemical sector was opened to private investors. This led to the start-up, in 1999, of the Saudi Chevron Phillips Co. plant in Al-Jubail, the first wholly owned private petrochemical venture in Saudi Arabia.

Phase 3, during 2000-05, also had key events, the first of which was a trend towards globalized production exemplified by Sabic’s acquisition of DSM Petrochemicals in 2002. Another key event was a shift to refinery integration as demonstrated by Rabigh Refining & Petrochemical Co. (PetroRabigh), a joint venture of Saudi Aramco and Sumitomo Chemical Co.

Petrochemical development

Unlike the case for industrialized countries, the development of the petrochemicals industry in Saudi Arabia was not in response to a surge in local demand or to a development of indigenous technologies. Instead, it is largely due to the abundant natural gas reserves in Saudi Arabia, of which 61% is associated gas (OGJ, Aug. 16, 1999, p. 65).

The associated gas is rich in ethane, which is the petrochemical industry’s most versatile and favorable feedstock. It has a typical ethane composition of 17 vol % vs. an ethane composition of around 4 vol % in the nonassociated gas.

The low boiling point of the associated gas renders its transportation uneconomical; it can therefore be flared, used as a fuel, or reinjected into the oil fields. These uses generate a low, or in some cases, even negative economic value.

Before the mid 1970s, all the associated gas was flared (Fig. 1). In 1975, the volume of flared gas was slightly more than 4 bcfd. Associated gas was flared at that time because there was no developed domestic market for it and exporting the gas would require substantial investment.

From that time onward, the Saudi government embarked on a program aimed at facilitating the development of a domestic market for the associated gas. Unlike other gas producers, therefore, Saudi Arabia does not export natural gas but instead uses it to support the rapid industrialization drive in the country, particularly the gas-based petrochemical industries, which present the best choice from economic and social perspectives.

More specifically, the petrochemical industry provided the best option to add value to the gas and its associated products, as well as protecting the environment by eliminating flaring.1

Saudi Arabia’s petchem landscape

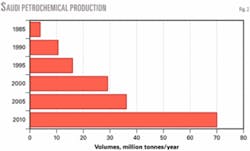

During the past 3 decades or so, the petrochemical industry in Saudi Arabia has maintained a steady and exponential growth pattern. Fig 2 shows the growth in the petrochemical production capacity during 1985-2010.

Petrochemical production capacity had increased about tenfold during the last 20 years, to 36 million tonnes/year currently from 3.7 million tonnes/year in 1985. This growth pattern will maintain its momentum in the short-term with the output exceeding 70 million tonnes/year by 2010.

Industry status

The petrochemical industry in Saudi Arabia is predominantly gas-based. The feedstock used to produce the basic petrochemicals is primarily methane, ethane, and NGLs, all derived from natural gas. In addition, modest volumes of light gasoline and naphtha are used as feedstocks.

The type of feedstock influences the basic petrochemical product mix, which in turn influences the type and volume of derivatives produced, and thereby determines the product slate.2

Table 1 shows the current production capacities of the key basic petrochemicals and their main derivatives in Saudi Arabia. It shows that almost all the current petrochemical plants in Saudi Arabia are back-integrated with most of the basic petrochemicals fully converted to their primary derivatives.

The current petrochemical product slate produced in 15 complexes in Jubail and Yanbu fall into three broad categories:

• Basic petrochemicals including: methanol, ethylene, propylene, butadiene, and benzene, which represents 48% of the current product mix.

• Chemicals and intermediates including: ethylene glycols, methyl tertiary butyl ether, cyclohexane, ethanol, pure terephthalic acid, 2-ethyl hexanol, dioctyl phthalate, styrene, ethylene dichloride, vinyl chloride monomer, and butene-1. This category represents 31% of the total product mix.

• Polymers including: polyethylene, polypropylene, polystyrene, polyvinyl chloride, and polyethylene terephthalate. This category represents 21% of the total petrochemical output.

Fig. 3 shows the current basic petrochemical product mix and the corresponding derivative distribution. Ethylene and methanol represent 80% of the basic petrochemicals. This is because ethylene and methanol are derived from ethane and methane, respectively, the two major components of natural gas.

The ethylene product chain in Saudi Arabia is the most developed. This unbalanced product mix at the basic petrochemicals level is reflected in the underdevelopment of product chains based on propylene, butylenes, and aromatics. Petrochemical producers will use more liquid feedstocks and this should help adjust the imbalanced products mix.3

Sabic is currently the dominant company in the petrochemicals industry, accounting for 95% of the current production capacity in Saudi Arabia. Although Sabic will maintain the lion’s share of petrochemicals output in the short-to-mid term, the private companies’ share will grow steadily during the next few years increasing to 25% by 2010 from 5% currently.4

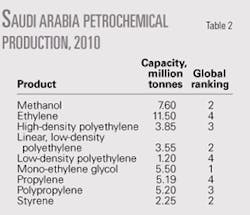

Saudi Arabia’s current annual petrochemical output accounts for about 7% of the world’s petrochemical output; by 2010, it will be about 13%. By then, Saudi Arabia will become one of the top four global producers for key commodity petrochemicals (Table 2).

This is a remarkable achievement, considering the short time span since production began in the early 1980s. It is still modest, however, considering the country’s current proven oil and gas reserve.

Industry growth

Short to midterm growth of the petrochemical industry in Saudi Arabia is obvious from different perspectives, the most notable of which are capacity additions and the level of investment.

Capacity additions

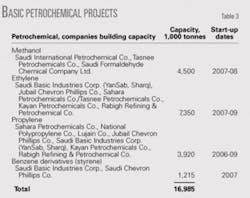

Petrochemical producers in Saudi Arabia are planning to add new production capacity that will total 35 million tonnes during 2004-10. Of the planned capacities, more than 17 million tonnes are basic petrochemicals.

Table 3 lists the next wave of basic petrochemicals capacities. Due to these new projects:

• The collective share of ethylene and methanol in the planned basic petrochemical capacity corresponds to 70% of the total capacity additions. This represents a significant decline from a current collective share of 80% of the total basic petrochemical production capacity.

• More than 7 million tonnes of ethylene produced in six planned world-scale crackers will be added. This represents 44% of the planned basic petrochemical capacity and indicates that the ethylene chain will remain the core business of the industry.

• Added propylene capacity accounts for 23% of the total planned basic petrochemical capacity. This represents a significant propylene expansion compared with its current share, which is 10% of the total basic petrochemical output. This is another indicator of the shift in Saudi Arabia’s petrochemical industry towards a more balanced product mix at the basic petrochemicals level.

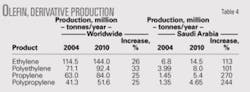

To put this capacity growth into its global perspective, Table 4 shows the growth in the world and Saudi Arabia’s production capacities for two key olefins: ethylene and propylene and their main derivatives (polyethylene and polypropylene) for the next 5 years.

This table shows that the percent change in global production capacities for these products are 25-33%. In comparison, the percent change in the production capacities for the outlined products is significantly higher in Saudi Arabia ranging from 101% for polyethylene to 270% for polypropylene during the same period.4

Investment

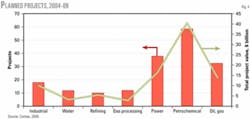

Planned capital investments in the hydrocarbon sub-sectors in Saudi Arabia are massive-$94.4 billion during 2004-09. Of this amount, the petrochemical industry will have the dominant share with a capital investment projected to exceed $40.6 billion.

Fig. 4 shows a breakdown of the capital investments for the various hydrocarbon subsectors in Saudi Arabia. There are 59 petrochemical projects in the pipeline, 74% of which are greenfield. ✦

References

1. Al-Falih, K., “The Saudi Gas Sector, Its Role and Growth Opportunities,” Symposium on the Future Vision for the Saudi Economy, Riyadh, October 2002.

2. Al-Sadoun, A.W., “Al-Tawon Al-Sinae in the Arabian Gulf,” Vol. 83, January 2001, pp. 6-33.

3. Al-Sadoun, A.W., “The Emerging Role of the Private Sector in the Saudi Petrochemicals Industry,” MEED’s Gulf Petrochemicals 2005 Conference, Bahrain, May 7-8, 2005.

4. Al-Sadoun, A.W., “Saudi Arabia’s Emergence as a Global Petrochemicals Hub,” International Strategic Forum on Opportunities in Saudi Arabia’s Petrochemicals Sector, Sept. 29, 2005, London.

The author

Abdulwahab Al-Sa’doun ([email protected]) is the director general, energy sector, for the Saudi Arabian General Investment Authority, Riyadh. He assumed the post in December 2004. During 1990-95, he was a research chemist for Saudi Basic Industries Corp, Riyadh. Al-Sa’doun joined the Gulf Organization for Industrial Consulting, Doha, in 1996. In November 2001, he joined Sharq Plastic Industries Co., Riyadh, as a senior vice-president. In December 2003 to December 2004, he was president of AWS Industrial Consulting. He holds a PhD in industrial chemistry from King’s College, University of London.