Land rigs in demand; fleet consolidations continue in the Americas

Demand for land rigs has pushed up utilization and day rates; additional increases should occur in 2005. Drilling contractors are adding rigs through strategic acquisitions and newbuild programs in order to accommodate rising demand. US land drilling permits increased 41% in January 2005 from a year ago.

Both operators and fleet owners can profit. Richard J. Mason challenged readers of The Land Rig Newsletter (Jan. 28, 2005) to dispute his assertion that operator profits are highest when day rates are highest. He points out that rig counts are generally highest when commodity prices are highest, and that day rates are not the primary determinant of operator profitability.

US rig counts, permits, demand

US land rig counts have risen steadily in the last 2 years. The Baker Hughes rig count was 772 in early February 2003 and 1,150 the week of Feb. 11, 2005, up from 995 rigs (16% increase) 1 year ago. Five states showed double-digit gains from February 2004: Texas (up 72 rigs, to 557); Colorado (up 26 rigs, to 69); Oklahoma (up 15 rigs, to 158); California and New Mexico (up 10 rigs each).

The Land Rig Newsletter reported 1,350 rigs drilling in December 2004.

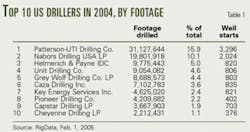

The top 100 US drillers drilled a total of 195,368,137 ft in 2004, according to RigData. The top 10 US drillers accounted for 51.2% of that total, led by Patterson-UTI Drilling Co. (15.9%) and Nabors Drilling USA LP (10.1%; Table 1).

Commenting on fourth-quarter 2004 results, Gene Isenberg, chairman and CEO of Nabors Industries Inc., said that margins for the US Lower 48 states' land drilling group improved more than expected, "as rig demand exceeded the readily available supply." Rates for Nabors' US land rigs increased about $500/day vs. the third quarter. Nabors has 401 rigs in the US land drilling fleet, plus 19 in Alaska.

"There is a burgeoning awareness that the market is not just tight, but tapped out when it comes to rig availability," wrote Mason in The Land Rig Newsletter, Dec. 30, 2004.

In December, Mason predicted that US day rates for the first half of 2005 might go over $10,000 for an intermediate rig (1,000-1,500 hp); $12-12,500 for a 1,500-hp rig; and $16-16,500 for premium rigs (e.g., 2,000 hp or greater, Helmerich & Payne FlexRigs, Rowan-style rigs).

RigData reported that the US land permit count was 1,230 during the week of Feb. 11, 2005, up 198 permits (19%) from the week prior, and up 181 permits (17%) from the 4-week average in February 2004.

International rig counts

The Baker Hughes international land rig count has increased gently during the past 2 years, to 626 in January 2005 from 568 in January 2004 and 521 in January 2003.

In January 2005, this included 24 land rigs operating in Europe, 37 in Africa, 109 in Asia Pacific, 210 in the Middle East, and 246 in Latin America.

In Africa, land drilling was most active in Algeria, with 19 rigs, followed by Libya with 9 rigs, and 2 each in Nigeria and Congo.

null

In Asia Pacific, there were 50 land rigs operating in India, 30 in Indonesia, eight in Myanmar, and seven in Australia.

In the Middle East, 34 land rigs were drilling in Oman, 31 in Iran, 29 in Saudi Arabia, 21 each in Syria and Egypt, 18 in Sudan, and 15 in Pakistan.

In Latin America, Mexico led the land drilling with 81 rigs, followed by Argentina (73), Venezuela (54), Colombia (14), and Brazil (10).

Acquisitions, an alliance

On Jan. 21, 2005, Calgary's Ensign Resource Service Group announced it completed the acquisition of Flint South America Inc.'s Venezuela and Ecuador operations. This adds 11 drilling rigs and 10 workover rigs in Venezuela and two workover rigs in Ecuador to Ensign's South American fleet. Ensign had existing operations in Argentina, with 5 drilling rigs and two workover rigs.

Robert H. Geddes, president of Ensign's Canadian operations, told OGJ that 80% of the company's South American rigs were under contract during the last year. He expects upward movement in Argentina, and says they will continue to operate in Venezuela because "where there's oil, there must be drilling."

On Jan. 18, 2005, Patterson-UTI Energy Inc. announced its acquisition of the US land drilling assets of Key Energy Services Inc. for $62 million. The company added 25 active and 10 stacked drilling rigs, related drilling equipment, four yard facilities, and a rig moving fleet of about 45 trucks and 100 trailers.

Cloyce A. Talbott, Patterson-UTI's chief executive officer, said the rigs acquired from Key Energy were active in the Permian Basin, Rocky Mountain region, and Four Corners area. Patterson UTI's land-based drilling fleet now stands at 396 rigs.

Dick Alario, Key Energy Services' chairman and CEO, said "we concluded that the contract drilling segment was not an area in which we maintained a competitive advantage." The company will focus on its well service business in the US and retains 44 rigs in Argentina and Egypt. It is in the process of moving to Houston from Midland.

In November 2004, San Antonio-based Pioneer Drilling Co. purchased Kenmare, N.D.-based Wolverine Drilling Inc. for $27.9 million (seven rigs, 500-1,000 hp). In early December 2004, Pioneer purchased Woodward, Okla.-based Allen Drilling Co. for $7.2 million. Allen Drilling had five mechanical rigs capable of drilling 8,000-11,500 ft, in the Texas panhandle, western Oklahoma, and Kansas.

In mid-2004, six US drilling equipment manufacturers formed a new strategic alliance, Source One Drilling Systems, to provide a single-source alternative for the drilling market.

Houston-based LeTourneau Ellis Williams Co. (Lewco), a subsidiary of LeTourneau Inc., held by Rowan Cos., supplies mud pumps, drawworks, top drives, rotary tables, traveling equipment, swivels, and hooks. Houston-based Cameron, a division of Cooper Cameron Corp., manufactures pressure control equipment, BOPs, choke manifolds, and valves. Derrick Equipment Co. produces mud-handling systems.

Tulsa-based Woolslayer Cos. Inc. supplies masts and substructures for land drilling and offshore derricks. OEM is a source for AC motors and drives, SCR drives, drilling instrumentation, auto drilling, and drilling cabins, and PC-based control and communications.

Dallas-based Hannon Hydraulics LP provides hydraulic cylinder applications such as BOP lifting cylinders, hydraulic power units, and wireline units.

Canada

The Petroleum Services Association of Canada (PSAC) expects an 8% increase in drilling in 2005 vs. last year's total of 22,696 wells. In the 2005 Canadian drilling activity forecast issued Jan. 25, PSAC predicted that 24,075 wells would be drilled this year, with 18,625 in Alberta, 3,950 in Saskatchewan, and 1,300 in British Columbia. Roger Soucy, PSAC president, said that the record activity level is expected based on "continued strong commodity prices, an ongoing emphasis on natural gas drilling, and a growing focus on coalbed methane."

Canadian land rig counts follow an annual pattern of low activity in May-June (about 150 rigs in 2003-04, according to Baker Hughes) to high activity in February-March (about 580 in 2003-04). For the week of Feb. 1, 2005, Baker Hughes counted 585 rotary land rigs operating in Canada, up from 583 a year earlier.

Calgary-based Ensign is building 10 new self-moving, coiled tubing rigs for their Canadian drilling fleet (Fig. 1). The ADR (automated drill rig)-1000-CT is an all hydraulic, DC-driven design. Ensign has 10 existing hydraulic rigs in the current fleet of 240 drilling rigs.

Ensign's Geddes told OGJ that the patented "coil over tubing" design is more efficient because the reel is located above the table. The pipe is only bent twice, instead of six times, resulting in less pipe fatigue. The new rigs can drill with 27/8-in. as well as larger 31/2-in. coiled tubing or jointed drill pipe.

Geddes said Ensign's strength is in designing and running its own products, watching over engineering, procurement, and construction. The company uses 10-15 different subcontractors in Canada and China in rig construction.

Suriname drilling

In its 5-year plan, announced Oct. 25, 2004, the managing director of Staatsolie Maatschappij Suriname NV (Staatsolie), Dr. S.E. Jharap, said the state oil company would drill 100 onshore exploration wells for an estimated cost of $18 million. The drilling would attempt to establish a minimum of 100 million bbl proven oil reserves in Saramacca.

Kailash Bisessar of Staatsolie told OGJ that the company uses two rigs for development drilling; one a company-owned Failing 2500, and the other leased from a contractor. In 2004, Staatsolie drilled 99 development wells in the Tambaredjo field using these rigs. The Tambaredjo field wells were all drilled vertically and the average depth is about 1,400 ft, Bisessar said.

null

Exploration and appraisal drilling in the marshy coastal area is accomplished using a rig on a swamp carrier. In 2004, Staatsolie drilled 4 wells in a pilot project in the Calcutta field using a swamp rig.

According to the 2003 annual report, Staatsolie drilled 12 exploration and appraisal wells and 97 development wells (86 completed, 11 dry) in 2003. Seven of the exploration wells were drilled in the Calcutta field in the Saramacca area onshore, and five in the Tambaredjo West area. In 2004, Staatsolie planned to drill 115 production wells and additional exploration wells including appraisal wells at Calcutta and delineation drilling (step-outs) along the western boundary of the Tambaredjo oil field. The company was also evaluating slant-hole and horizontal drilling.

In 2002, Staatsolie drilled 78 development wells (73 completed) of the 81 planned. In 2001, Staatsolie drilled 44 development wells (39 completed) and Koch Exploration Canada Ltd. drilled seven wells in the Wayombo block (four with shows) between July and October. Koch had signed a 20-year PSC in March 2000 for 140,000 acres, focused on heavy oil, but released the concession in 2003. Koch Petroleum Group Inc. is an affiliate of privately held Koch Industries Inc.

Staatsolie lost its swamp drilling machine (Rig V) and other related equipment in a fire on Aug. 30, 2004 (Fig. 2). The rig was being used for exploratory drilling north of the Tambaredjo field and caught fire following a natural gas blowout.

Suriname's offshore comprises about 170,000 sq km, which the country seeks to exploit with foreign partners. In the 2003-04 international bidding round, 13 blocks were offered. According to press releases in 2004, Staatsolie signed 30-year production sharing agreements with Spain's Repsol-YPF (April) and Denmark's Maersk Oil, part of the A.P. Moller-Maersk Group (November).

The Repsol PSC is for Block 30, covering 18,900 sq km, more than 100 km off the coast. The Maersk PSC is for Block 31, covering about 13,800 sq km, 30 km from the coast, in water 20-50 m deep. A 2D seismic survey off Suriname, using the Polar Venturer ship, began in October 2004.

Guyana drilling

ON Energy Inc., a Guyanese subsidiary of CGX Energy Inc. (84.6%, formed in 2003), will drill five land exploration wells in the 800,000 acre Berbice Block, onshore and near shore Guyana, at an estimated cost of $2 million each, including infrastructure development. In August 2004, Kerry Sully, president of CGX and chairman of ON Energy, said the prospects are on trend with and have "strong analogies" with Suriname's Tambaredjo and Calcutta fields, 200 km to the east, but later geochemical assays showed the oil to be lighter.

Drilling was supposed to have begun in late 2004, but the drilling rig is delayed in Trinidad until late February to early March 2005. In a drilling update released by CGX on Jan. 10, ON Energy's president, Warren G. Workman, said there was a "lack of qualified equipment in the region." CGX told OGJ in February that the wells will all be drilled by the same rig and are expected to take about 2 weeks each.

Venezuela, Colombia

Some scheduled drilling is on hold in Venezuela. State oil company Petróleos de Venezuela SA asked Harvest Vinccler CA (HVCA), the Venezuelan operating company for Houston's Harvest Natural Resources Inc., to reduce production in the South Monagas unit in eastern Venezuela's Delta Amacuro state (OGJ Online, Jan. 19, 2005). HVCA had two rigs under contract that were drilling in the Uracoa field in 2004, and had expected to use them to drill seven additional wells in 2005.

PDVSA is also delaying the 14-well development program planned by ConocoPhillips' unit Conoco Venezuela CA and partners in the Corocoro oil field, Gulf of Paria West, after finding that the revised business plan is $200 million less than originally planned. In mid-January, Rafael Ramírez, who serves as Venezuela's energy minister and president of PDVSA, said Venezuela wants to renegotiate contracts with overseas firms for projects such as Corocoro, contending that the terms are unfavorable for Venezuela, according to Business News Americas.

In Colombia, Occidental de Colombia plans 40 new development wells at Caño Limón, the country's second-largest oil field, on the northern edge of the Llanos Basin. Occidental has budgeted $30 million for the wells and 3D seismic survey under the amended 2004-07 work program, announced Jan. 17, 2005.

Farther south

Reuters reported on Jan. 21, 2005, that Petroecuador was seeking bids from 18 prequalified companies to provide an estimated $397 million in well services to raise crude oil output in four Amazon jungle fields: Shushufindi, Lago Agrio, Culebra-Yulebra, and Auca. The projected work includes drilling new wells, reconditioning existing wells, acquiring and interpreting seismic data, among other activities. Bids are due Mar. 25, 2005.

The 18 companies include: Brazil's Petrobras, Chile's Sipetrol, Ecuador's Tecpecuador, Argentina's CGC, Europe's Teikoku Oil, China's Chanquing Petroleum, Tecpetrol-Tecpecuador consortium, China's Sinopec Internacional, Ecuador's Dygoil, Ecuador's Schlumberger Surenco, Urazul, Colombia's SPLA consortium, Sweden's Skanska, Colombia's Hocol, Nuevo Cerro Dragón-Ecuapet consortium, Amazonic Sustainable, Cayman Internacional of the US, and Ecuador's Pluspetrol.

On Jan. 30, 2005, Chile's national oil company, Empresa Nacional de Petróleo (ENAP), called for bids to drill and provide services for a $10 million well in the Lago Mercedes area, Tierra del Fuego province. Bids will be due Mar. 15-16, 2005, according to Business News Americas.