Oil supply challenges—1: The non-OPEC decline

The world faces challenges rather than impending doom with oil supply. The challenges include a sequence of supply crises likely to develop not when oil production peaks—the subject of much recent controversy—but earlier, when widening gaps appear between demand and sources of supply upon which the world has come to rely.

Attempts so far to predict world oil production have depended on assumptions about oil reserves and decline rates, both of which are subject to considerable uncertainty. Too close a reliance on published and proprietary databases of national and oil field reserves can lead to an overly pessimistic view of the world's oil reserves. There is more oil than the often conservative reporting suggests. Oil reserves also depend on oil price and technology developments as well as geology.

However, it is a mistake to assume that reserves of conventional oil can grow indefinitely and that abundant resources of unconventional oil resources, such as tar sands, can fully compensate for production declines. There is a fundamental difference between producing oil from a naturally flowing well and mining tar sands in Venezuela or Canada.

To assess future oil supply, this analysis divides world oil production into three components: the Organization of Petroleum Exporting Countries, the former Soviet Union (FSU), and the rest of non-OPEC. It shows that the remaining oil reserves and future oil production profile of the rest of non-OPEC—almost half of the world's future oil supply—can be predicted without recourse to uncertain oil reserves data and assumed decline rates.

It also shows that the onset of supply crises can be expected when non-OPEC oil production fails to meet most of the incremental demand, as it has done for the past 2 decades. Further crises can be expected when spare capacity becomes hard to maintain and when OPEC production fails to meet incremental demand. The feedback of tightening supplies through rising oil price will reduce demand growth and stimulate conservation and the development of alternative supply options. However, the crises will be real enough as markets rarely anticipate surprises, and many years will pass before material changes in behavior and alternative energy sources significantly impact demand for oil.

Practical limits

While all forecasts must avoid the inherent dangers of crying wolf, projections of oil supply must recognize the practical limits that apply not only to volumes of oil remaining in nature but also to the increases in recovery achievable from future exploration and improvements in technology and economics (Fig. 1).

Recoverable oil reserves are determined primarily by the physical properties of the reservoirs and the fluids within them. Technology and oil price have a secondary effect on increasing (or decreasing) recovery factors and adding to (or subtracting from) recoverable reserves.

Furthermore, the world's oil industry is mature in terms of exploration success and in terms of the age of most of its production. Discoveries peaked in the mid-1960s. In every year since 1985 the world has consumed more oil than has been discovered (Fig. 2).

The application of technology and the production of unconventional resources are not likely to significantly impact the peak of world oil production but will ameliorate the subsequent decline. Peak oil production from oil fields and petroleum basins comes from the best quality fields and reservoirs where the oil is cheap and fast to produce—the supergiant fields.

Most of the world's supergiant oil fields are in the Middle East and are more than 40 years old. Since nationalization in the 1970s, and OPEC's role as swing producer since 1982, these fields have been conserved at low offtake rates (ratio of plateau production to ultimate recoverable reserves). Consequently, they can probably sustain current production levels for quite a long time. However, their ability to produce at significantly higher levels for sustained periods remains to be tested.

There also are practical limits to maintaining peak oil production from a field and to the amount of oil that can be recovered. Horizontal and multilateral wells, 3D and 4D seismic, and smart infill drilling are techniques applied to capture bypassed oil and to optimize the sweep of the injected fluids through the reservoir. These techniques are primarily effective in easing the decline rate.

Logistic equation

While published oil reserves data are unreliable and inconsistent, they are useful in validating and constraining predictions based on the more reliable published oil production data. Reserves and production data from a finite resource can be modeled with the logistic equation (Fig. 3).

In 1956, King Hubbert used the logistic equation to predict that US oil production would peak between 1966 and 1971.1 This prediction was remarkably accurate as US production peaked at 9.1 million b/d in 1970.

The logistic equation defines the cumulative production in terms of the ultimate recoverable reserves QO and a rate constant λ. Provided sufficient production data are available, λ can be determined. If the production rate has passed the "turning-point," where the rate of its increase in production rate has reached a maximum (defined best by the derivative of the production rate), Q0 may also be constrained by the production data. Before this point, the production data cannot be used to accurately define the ultimate size of the resource Q0. Hubbert's success suggests that oil production data may be used together with reported reserves figures to constrain likely future world oil production.

Application of the logistic equation requires two assumptions to be met: 1. The success in finding oil is proportional to the remaining undiscovered oil, and 2. The oil resource is exploited in the most efficient technical and economic manner without external influences; i.e., reserves are put on production as soon as practical after they are discovered.

Based on worldwide exploration experience, the first assumption seems to be broadly met. The second assumption prevents the direct application of the logistic equation approach to global oil production after 1973, when OPEC started to manage production. It is also not possible to directly apply the logistic equation to analyze production from OPEC after 1973 or to the FSU after 1990, when economic collapse dried up investment and oil fields were prematurely shut in. However, the logistic equation should be directly applicable to production from the rest of non-OPEC (non-OPEC excluding the FSU), for which both assumptions are broadly satisfied.

The rest of non-OPEC accounts for nearly half of current world oil production. If the logistic equation can be used to constrain the future oil production profile and ultimate recoverable reserves of the rest of non-OPEC, then forecasts of future world oil production can be expressed in terms of the likely ranges in ultimate recoverable reserves and production potential of the FSU and OPEC and near-term world oil demand.

Approaching peak

In principle, the oil production profile of the rest of non-OPEC should not be influenced by external political and economic events because the resource has been exploited in the most efficient manner. When new oil fields are discovered they are placed on production at the most efficient economic rate as soon as practically possible without reference to external supply-demand issues. OPEC is left to manage the gap between non-OPEC supply and world oil demand.

The most striking observation of fundamental importance is that the rate of increase in oil production reached a turning point around 1980 and is now falling (Fig. 4). Production seems to be approaching a well-defined maximum in the quite near future (2005-07).

The production data are sufficient for the non-OPEC world excluding the FSU to define both the rate constant and the ultimate oil reserves without recourse to published oil reserves data. The logistic equation fitted by least squares to the data yields an ultimate recoverable oil resource QO of 976 billion bbl with a rate constant (l) of 0.054. Since 466 billion bbl were produced by the end of 2003, this implies some 510 billion bbl remain. The best-fit solution suggests a peak oil production rate of 36 million b/d in 2005. Allowing for the uncertainty in the information, it can be predicted with some confidence that oil production from non-OPEC without the FSU will probably peak at 35-38 million b/d sometime between 2005 and 2007.

This analysis also incorporates some 30 years of production from Canada's tar sands, and recoverable reserves from this resource should be at least partly accounted for in the 976 billion bbl.

This well-constrained prediction provides a platform for predicting world oil production. It also has implications for most of the world's international oil companies, which are limited by political factors to exploring and producing predominantly from non-OPEC countries. The non-OPEC pool is shrinking.

The FSU

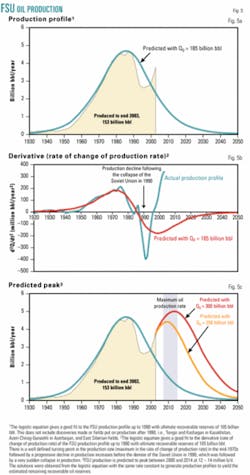

There is a popular misconception that the decline in oil production from the FSU occurred due to the collapse of the Soviet Union in 1990-91. In fact, oil production in the Soviet Union reached a well-defined turning point in the mid-1970s, after which the rate of increase in oil production started to decline. Oil production reached a maximum in the mid-1980s. A logistic equation fit to the production data up to 1990 yields ultimate recoverable reserves of 185 billion bbl and a high rate constant of 0.10 (Fig. 5a,b).

The recovery of FSU production after 1994 is partly due to investment in new fields such as Tengiz in Kazakhstan. However, there is also likely to be a significant contribution to recoverable reserves and production from investment and application of new technology in the older oil provinces such as West Siberia.

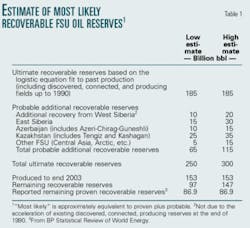

Future FSU production can be estimated within a likely range with some confidence, by combining the outcome of the analysis of past production performance with estimates of probable additional remaining recoverable reserves. Table 1 provides likely ranges in recoverable reserves of the FSU of 250-300 billion bbl, with remaining recoverable reserves of 100-150 billion bbl. These are broadly in line with the analysis of Laherrere.2

The Caspian region is an important source of incremental production in the medium term, but it does not have the resource or production potential of the Persian Gulf. The FSU Caspian is estimated to have remaining oil reserves of 50-70 billion bbl. The Persian Gulf has reported remaining oil reserves of about 700 billion bbl.

While important to the oil market in the short term, the FSU contributes only 10-15% to world production, so relatively large uncertainties in reserves do not translate to large uncertainties in the timing of the peak of world oil production. At current consumption rates the world uses approximately 60 billion bbl of oil every 2 years, so an uncertainty of 50 billion bbl in remaining reserves of the FSU translates to an acceptable error in this particular forecast.

Peak production from the FSU is expected between 2008 and 2014 at 11-14 million b/d (Fig. 5c).

Non-OPEC production

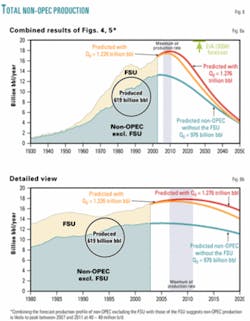

The most likely outcomes for non-OPEC oil production can be obtained by combining the forecasts for the FSU and the rest of non-OPEC (Fig. 6).

Non-OPEC oil production is predicted to reach a peak between 2007 and 2011 at a maximum rate of 48-49 million b/d. Allowing for short-range fluctuations in production, the maximum rate may just exceed 50 million b/d. The non-OPEC world had produced 619 billion bbl to the end of 2003. Remaining non-OPEC oil reserves are therefore 607-657 billion bbl.

The US Energy Information Administration forecasts non-OPEC oil production to rise to about 54 million b/d (about 20 billion bbl/year) by 2025.3 Based on the analysis presented here, non-OPEC oil production at this level in 2025 is highly unlikely. This analysis expects non-OPEC oil production to be falling in 2025 (from a peak around 2009) and most likely to be 33-37 million b/d. This represents a shortfall to the EIA forecast of non-OPEC supply of 20 million b/d in 2025.

The failure of non-OPEC to meet a large part of incremental demand, as it has done for more than 20 years, is likely to precipitate the first crisis in oil supply. Depending on demand and FSU supply, this crisis is practically upon us and is expected to be acute after 2005. After non-OPEC peaks (2007-11), OPEC will be required not only to maintain surplus capacity but also to meet all of the incremental oil demand, making up for the accelerating decline in non-OPEC supply.

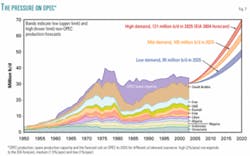

The predicted non-OPEC supply ranges in this paper can be combined with a range of likely near-to-medium-term oil demand forecasts to generate forecasts for the call on OPEC (Fig. 7). The rapid increase in the call on OPEC after 2010 is due to the widening gap between non-OPEC supply and forecast demand.

Spare capacity

The world's spare oil production capacity (essentially only OPEC maintains spare capacity) has declined steadily since the mid-1980s as OPEC has curtailed investment in the face of rising non-OPEC production. Surplus capacity has declined from 10 million b/d in 1987 to 3-4 million b/d in 2003 and to probably less than 1.5 million b/d in 2004.

Most analysts consider that spare capacity of 2-3 million b/d is required to ensure smooth global oil supply. At 2004 demand levels, spare capacity is well below this desired range. Investment in new OPEC capacity is urgently required. The planned addition of a few hundred thousand b/d in Saudi Arabia, Kuwait, and Iran is insufficient to even replace declines in installed capacity. Non-OPEC, excepting the FSU, has limited ability to add new capacity.

Depending on the rate of decline of OPEC's capacity (possibly as high as 4%/year), current spare capacity will be fully utilized sometime in 2005 if demand remains high or by end 2007 if demand moderates. Upside oil price volatility and supply shortages are the inevitable consequences of this decline in spare capacity. Companies and states will be required to keep larger stocks and utilize strategic reserves to counteract short-term shortages. Increased inventories and stockpiled oil will add to the cost to consumers.

Apart from political factors, the expansion of OPEC's production capacity will be constrained by the maturity of OPEC's fields and reserves and the scale of effort, investment and pace of decision-making required, primarily in the Persian Gulf countries. At capacity costs of $6,000-10,000/b/d, the investment required between now and 2020 to achieve the high demand case is $300-500 billion—a rate of $20-30 billion/ year. There is no indication that the major OPEC countries are embarking on oil production capacity investments on this scale. The lead times on major capacity expansion projects are 3-5 years. Unless the principal Persian Gulf producers initiate major capacity expansion within the next few years, there will be a further supply crisis later in this decade driven by the complete elimination of spare capacity.

The challenges facing OPEC and the main Persian Gulf producers to meet future demand will be examined in the next article in this series. F

References

1. Hubbert, M. King, Energy and Power, Scientific American book, 1971.

2. Laherrere, J., Is FSU oil growth sustainable? Petroleum Review, April 2002.

3. Energy Information Administration, US Department of Energy, International Energy Outlook 2004, Report No. DOE/EIA-0484, 2004.

Bibliography

BP, BP Statistical Review of World Energy, 2004.

Campbell, C.J., presentation at the Technical University of Clausthal, 2000. Web site www.hubbertpeak.com/de/lecture.html.

Campbell, C.J., and Laherrère, J.H., The End of Cheap Oil, Scientific American, 1998.

Department of Trade and Industry, UK, 2004. Web site www.dti.gov. uk/energy/.

Harper, F., reported in "Global oil and gas depletion" by Chris Skrebowski, Petroleum Review, April 2003.

Laherrere, J., Distribution and evolution of "recovery factor," presented at the International Energy Agency Oil Reserves Conference, Paris, Nov. 11, 1997.

Petroleum Review, Healthy global resource base as production rises, November 2004.

State of Alaska, Tax Division, North Slope Oil Production by Field from 1978 to 2003. Web site: www.tax.state. ak.us.

World Oil, World Crude Oil Production, by countries, by year, Feb. 15, 1951.

The author

Peter R.A. Wells is managing director of Neftex Petroleum Advisors Ltd. He has more than 25 years' experience in the international oil industry in the Middle East, former Soviet Union, West Africa, and Europe. He spent 12 years with Shell International in positions that included exploration manager for eastern Nigeria, followed by 4 years with BP PLC, where he was chief negotiator for Azerbaijan in 1992-93. He later spent 6 years with LASMO PLC as managing director for the Middle East and was a member of the executive board, leading LASMO's business development effort in the Middle East including Iran. Wells holds BSc and PhD degrees in geology from the University of Exeter (UK) and held a postdoctoral fellowship at the University of Oxford. E-mail: [email protected].