OGJ Newsletter

General Interest—Quick Takes

E&P executives expect continuing M&A activity

Exploration and production executives in an informal survey said they expect oil and gas prices to remain strong and merger and acquisition activity to continue.

Wayne Andrews, a Houston analyst with Raymond James & Associates Inc., St. Petersburg, Fla., said he surveyed about 40 E&P and oil service executives during the North American Prospects Expo in Houston.

The group's forecast for the 2005 average gas price on the New York Mercantile Exchange was $6.52/Mcf, with a high of $8.80/Mcf and a low of $4.90/Mcf, Andrews said. The group's average 2005 oil price forecast was $44.22/bbl, with a high of $59.60/bbl and a low of $38/bbl.

Merger and acquisition activity experienced "a massive upsurge over the past 12 months," Andrews said.

"The general view was that such activity may not necessarily maintain last year's break-neck pace but that it would nonetheless continue. Most companies still emphasize asset deals, though corporate M&A remains an option for many large-capitalization and mid-capitalization producers," he said.

During the last year, both asset and corporate deals generally emphasized either the Rockies or the Permian basin.

Executives told Andrews that they are looking for a continuation of M&A activity because of huge amounts of cash being generated by E&P companies and because of companies' desires to boost prospect inventories.

Energy-transport security study sought

Five lawmakers have asked the US Government Accountability Office to assess the vulnerabilities of LNG vessels and oil tankers to terrorist attacks.

US Rep. Edward J. Markey (D-Mass.) released a Jan. 31 bipartisan letter to GAO that he helped organize. Signatures were from members of the House Energy and Commerce Committee and Homeland Security Committee.

"We know from the Sandia report that the potential hazard posed by a terrorist attack against an LNG tanker in Boston Harbor could be quite large," said Markey. "What we don't know is whether the federal government is doing everything it could be doing to mitigate this risk and to assist state and local governments in addressing post 9-11 concerns about the terrorist threat to LNG and other maritime energy transport."

In an assessment of LNG mishaps over water for the US Department of Energy's Office of Fossil Energy, Sandia National Laboratories said that beyond about 750 m for small spills and 1,600 m for large spills, "the impacts on public safety should generally be low" for most potential spills (OGJ, Jan. 3, 2005, p. 30).

The bipartisan letter asks GAO to "conduct a review of the vulnerabilities of foreign and domestic maritime energy transport, infrastructure to terrorist attack, and efforts by governmental and private sector entities to reduce these vulnerabilities through enhanced security, planning, and other prevention, preparedness, and response activities."

BLM to open limited Otero Mesa leasing

The US Bureau of Land Management has issued a plan for limited, environmentally sensitive oil and gas development on public lands in Otero and Sierra counties, New Mexico.

BLM said it will offer a limited number of leases on the Otero Mesa and Nutt grasslands. The plan amends a 1986 resource management plan that would have allowed leasing with few restrictions and without protections for grasslands and other sensitive areas developed in the BLM's current plan amendment.

"It is one of the most restrictive plans ever developed for oil and gas leasing on federal lands," a Jan. 24 BLM news release said. New Mexico Gov. Bill Richardson, a Democrat and energy secretary under former President Bill Clinton, opposes drilling in the area (OGJ, Jan. 26, 2004, p. 28).

New Mexico state officials argue that the BLM plan does not adequately protect fragile ecosystems in the mesa's Chihuahuan Desert, calling it a unique "eco-region" that is one of the most biologically diverse arid regions in the world.

BLM's amended plan will allow strictly regulated and carefully monitored activity, leading to a maximum surface disturbance of 1,589 acres from well pads, roads, and pipelines—less than one tenth of 1% of the total surface area. At most, there will be 141 exploratory wells drilled, resulting in as many as 84 producing wells, BLM said.

"We have the science, the tools, and the will to ensure that the very limited amount of exploration and development allowed under this plan is accomplished under today's strict environmental and social standards," said Linda Rundell, BLM New Mexico state director in Santa Fe.

Almost 36,000 acres of grasslands with the highest potential as habitat for the endangered Aplomado falcon will be closed to leasing and permanently protected. In addition to these measures and overall limits on development, leasing will not be allowed in six existing and eight proposed areas of critical environmental concern and four wilderness study areas—bringing the total to 124,000 protected acres.

Australia, Mexico sign energy accord

Australia and Mexico have signed a memorandum of understanding (MOU) for 10 years of energy cooperation.

The MOU establishes a framework for collaboration on energy matters, including the exchange of information on policies, development of technologies, and encouragement of bilateral trade.

Although the countries already cooperate on regional energy issues through the APEC Energy Working Group, Australia's Minister for Industry Ian Macfarlane said the MOU will strengthen the partnership by promoting greater sharing of technology, information, and investment.

BP to build wind farm near Amsterdam

BP PLC has begun construction of a 9 Mw wind farm at its oil and products import-export terminal at the Port of Amsterdam. The project is scheduled for completion in the first half of the year.

The project will consist of three wind turbines supplied by Vestas, each capable of generating 3 Mw of electricity. BP will sell the electricity in the Dutch grid.

BP seeks to install wind energy projects on existing industrial sites.

It operates a 22.5 Mw wind project at the 400,000 b/d Netherlands Refining Co. refinery near Rotterdam, in which it is a 69% partner with ChevronTexaco Corp.

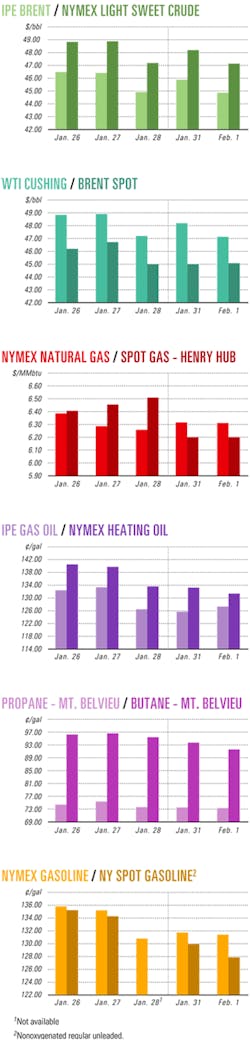

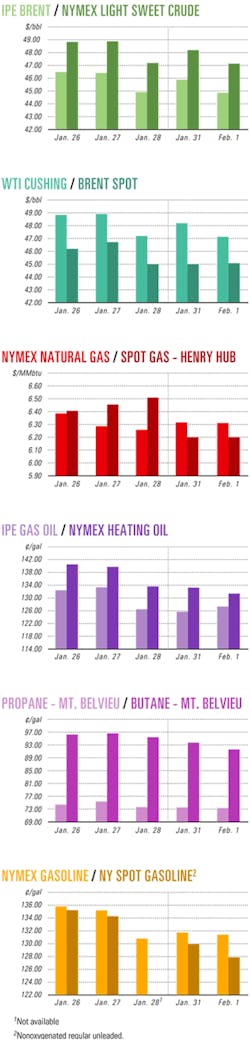

Industry Scoreboard

null

null

null

Statoil begins Snøhvit drilling

Statoil ASA has begun drilling carbon dioxide injection well F-2H, the first well in Phase I development of Snøhvit gas field in the Barents Sea. Statoil said it was taking cores in the reservoir at about 2,750 m. The well is to be drilled to 2,900 m TD.

The Transocean Inc. Polar Pioneer semisubmersible, on site since Dec. 7, is drilling the well. Statoil plans to inject into a nonproducing formation about 700,000 tonnes/year of CO2 separated from produced gas.

The next well, one of nine producers covered by the first 10-well drilling phase, is to be spudded by mid-February. Statoil expects to complete this initial drilling program by spring 2006.

An additional 10 producing wells will be drilled in Phases II and III scheduled for 2011 and 2014.

Lundin, partners to explore off Ireland

Lundin Exploration BV, Stockholm, and its partners have acquired Frontier Exploration License 1/05, covering 408 sq km about 70 km off northwestern Ireland.

The license includes Block 13/7 and part of Blocks 13/11 and 13/12.

Lundin; Ramco Donegal Ltd. (RDL), Abeerdeen; and Sunningdale Donegal Basin Ltd. previously held a licensing option in the area. The firms completed a technical evaluation program that identified a number of drilling targets.

The largest target, Inishbeg, is a four-way, dip-closed, anticlinal structure in about 320 ft of water. Inishbeg contains the Triassic Sherwood sandstone, the productive reservoir in Corrib gas field on trend to the southwest and under development.

The 15-year license mandates that an exploration well be drilled during 2005 targeting the Sherwood in the Inishbeg prospect.

Island Oil & Gas PLC and Petroceltic International PLC (PIP) have agreed to farm in to the exploration license by carrying the dry-hole and testing costs of an exploration well for RDL and Sunningdale.

The license interests are operator Lundin 35%; Island Assets Porcupine Ltd. 26%; RDL (carried through an exploration well) 19.25%; Lerida Trading Ltd., a subsidiary of PIP, 16.25%; and Sunningdale 3.5% (carried through an exploration well).

Petronas has oil discovery in Niger

Petronas Carigali Niger Exploration & Production Ltd. has encountered hydrocarbons on Agadem Block 1 in eastern Niger.

The Jaouro-1 exploration well—in the Termit basin about 1,000 km east of Niamey, the capital of Niger—was drilled to 2,462 m TD. Production tests resulted in a maximum flow of 2,540 b/d of oil.

The Petronas unit is operator of Agadem Block 1 and holds 50% equity in the project. Its partners in the consortium are two subsidiaries of ExxonMobil Corp.: Esso Exploration & Production Niger Inc. and Esso Deutschland GMBH.

Development starts at Sillaro field

Po Valley Energy Ltd., Rome, began civil works on its wholly held Sillaro field on the Crocetta Permit in northern Italy's Po Valley, following government approvals.

Sillaro, 25 km east of Bologna, is the company's largest gas field, with proven and probable reserves of 54 bcf contained in two zones between 2,000 m and 2,400 m.

Civil works should take about 40 days. A rig is due on the site in late February.

Contract let for Alvheim FPSO topsides

Marathon Petroleum Norge AS and partners have let an engineering, procurement, construction, installation, and commissioning contract to Vetco Aibel of Norway for all topsides work on a floating, production, storage, and offloading vessel to handle Alvheim oil field output off Norway.

The field holds reserves estimated at 180 million boe (OGJ Online, Nov. 12, 2004).

The $350 million contract covers the design and construction of production separators, gas compression and dehydration, water treatment, and power generation systems for the MST Odin multipurpose shuttle tanker, which will be converted to an FPSO.

Along with the Odin FPSO, the Alvheim project will include five subsea drill centers and associated flowlines, transportation of oil by shuttle tanker, and transportation of natural gas to the UK via a new 24-mile, 14-in. pipeline.

Recently, the Alvheim group reached an agreement to tie in the 46.9% Marathon-held Vilje oil discovery, formerly known as Klegg. The agreement is subject to approval of a development and operation plan for Vilje.

Washington state exploratory test spudded

EnCana Corp., Calgary, has spudded a rank wildcat in the Columbia River basin in nonproducing Washington state.

The well is on 6-14n-25e in Grant County where the company is making a play for unconventional gas discovered in the 1980s.

Five miles north-northeast, Shell Oil Co. and the former ARCO drilled the 1-9 BN on 9-15n-25e, to 17,518 ft. TD. The state's deepest hole, it encountered gas shows in roughly the lower one third of the well bore and flowed gas at rates as high as 3 MMcfd.

The drill site is 35 miles east-northeast of Yakima and 175 miles east-northeast of Mist gas field, Columbia County, Ore.

P-43 FPSO producing off Brazil; P-48 due

Petróleo Brasileiro SA (Petrobras), Brazil's state oil company, started production Dec. 22 from its P-43 floating production, storage, and off-loading vessel off Brazil.

Petrobras also expects the P-48 FPSO to start producing oil by mid-March. The vessels each have the capacity to produce 150,000 b/d of oil and 6 million cu m/day of natural gas.

The FPSOs form part of the $2.5 billion Barracuda-Caratinga project in the deepwater Campos basin off Rio de Janeiro state. Technical and financial problems leading to late delivery of the FPSOs delayed production expansion in the basin, Petrobras said. The project initially was scheduled to begin in 2003.

The P-48 currently is moored in Caratinga field in the Campos basin while connections are being made to the 12 wells it will operate.

Following 11 years of production growth averaging 8.6%/year, Petrobras's production declined by 3% in 2004.

Production from the Barracuda-Caratinga project was supposed to offset output declines.

Nevertheless, the Campos basin accounted for 80% of Petrobras's 2004 Brazilian oil output, which averaged 1.5 million b/d (OGJ, Aug. 9, 2004, p. 37).

Production starts in Zhengeldy oil field

Caspian Holdings PLC reported it has started production from Jurassic pay in three wells in Kazakhstan's onshore Zhengeldy oil field.

The wells, Nos. 114, 112, and 111, are part of a seven-well drilling program. Caspian Holdings did not disclose production rates.

Well 114, drilled to 600 m TD and completed last November, encountered 9 m of pay in two intervals: 348-354 m and 271-274 m.

Well 112, drilled to 400 m and completed in December, found 16 m of oil pay at 229-233 m and 299-311 m.

Well 111, also drilled to 400 m, found 13 m of oil pay at 211-212 m, 219-220 m, 225-233 m, and 303-306 m. It was completed this month.

An earlier well, No. 113 completed last August, was drilled to 630 m TD and encountered 13 m of oil pay at 308-302 m, 347-344 m, and 271-267 m.

The four wells were perforated at the lower levels to generate initial production volumes. Caspian expects to increase production rates as shallower intervals are brought into production and warmer weather allows construction of new flow lines and field equipment.

Caspian Holdings plans to drill deeper Triassic sections of the reservoir. The next four wells are slated for completion by the end of March. The company's goal is to increase production to 4,300 b/d by yearend.

BHP gets first gas from Minerva field

BHP Billiton Ltd., Melbourne, has started production from Minerva gas field on the offshore VIC/L22 Block in Australia's Otway basin.

Two subsea wells in 60 m of water 10 km offshore will initially produce 121-130 MMcfd of gas through a single buried flowline. A new 140 MMcfd gas processing plant at Port Campbell, Victoria, will recover 530-575 b/d of condensate (OGJ Online, Dec. 13, 2004).

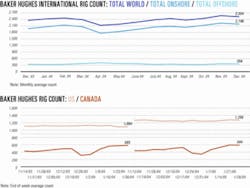

US, Canadian rig counts dip

Despite the addition of 5 rotary rigs working in the US the week ended Jan. 21, drilling activity slipped during the week ended Jan. 28, down by 7 units with 1,256 rotary rigs still working, said Baker Hughes Inc. That compared with a rig count of 1,084 during the same period a year ago.

Land operations accounted for the fallout, down by 11 rigs to 1,130 still active. Activity in inland waters increased by 1 rig to 24. Offshore drilling was up by 3 rigs to 102 in US waters as a whole, although the number of rigs working the Gulf of Mexico was unchanged at 95.

Canada's weekly rig count also dipped, down by 2 to 594 rotary rigs working. That was up from 585 last year.

Processing—Quick Takes

LaBarge plant acid-gas injection due

ExxonMobil Corp. plans to start acid-gas injection at its Shute Creek gas treatment plant in LaBarge, Wyo., this spring.

The $400 million project will hike inlet capacity of low-btu gas at the Lincoln County plant by almost 11%, reduce carbon dioxide venting and sulfur dioxide emissions, and cut sulfur-handling costs.

The Shute Creek plant treats the mostly nonhydrocarbon gas produced in ExxonMobil-operated federal units in Fogarty Creek, Lake Ridge, and Graphite fields, discovered in 1975-86 in the Green River basin. Fogarty Creek is the state's third largest gas field by full production volume.

ExxonMobil has 100% interest in the plant, which started up in 1986, and in the Mississippian Madison carbonate formation in the three fields.

The US operations of ExxonMobil, the world's largest wholesale marketer of helium, produced nearly 4 MMcfd of helium in 2003.

Upon the start of acid-gas injection later this year, Shute Creek plant inlet capacity will rise to 720 MMcfd.

Raw gas from the Madison at 16,000 ft is 22% methane, 65% CO2, 7.4% nitrogen, 5% hydrogen sulfide, and 0.6% helium. Individual well rates are 30-40 MMcfd.

ExxonMobil sells methane and helium from the plant. Of the plant's 250 MMcfd of CO2 output, 80% is sold to three operators of enhanced oil recovery projects in Wyoming and Colorado.

Anadarko Petroleum Corp. expects to take nearly all of the remaining available CO2 when it boosts injection into its Salt Creek and West Sussex oil fields in the Powder River basin later this year.

ExxonMobil has drilled two wells to be used to inject a combined 60-67 MMcfd of 65% CO2 and 35% H2S below the Madison gas-water contact at 17,500 ft. ExxonMobil will burn a CO2 mixture to power the injection compressors.

Injecting H2S will enable the company to shut down the aging sulfur recovery unit, which has high operating and maintenance costs, and exit the weak market for sulfur.

The extracted CO2 volumes will not increase because treatment severity and compression would be too costly.

Oronite closes Brazil additives plant

Chevron Oronite Co. LLC, Houston, is closing its 25-year-old Mauá fuel additives manufacturing plant in São Paulo state, Brazil. The plant, operated by subsidiary Chevron Oronite Brasil Ltda., makes performance additive products for fuels and lubricating oils.

Chevron Oronite has major facilities in Belle Chasse, La.; Gonfreville, France; and Singapore, which are supplemented by plants in Omaezaki, Japan; Chennai, India; and the Mauá operation.

Chevron Oronite will supply additives and packages to Brazil and other Latin American markets from its other global facilities.

ExxonMobil to add ethylene capacity

ExxonMobil Chemical plans to expand the ethylene capacity of its Singapore Chemical Plant by 75,000 tonnes/year to more than 900,000 tonnes/year by the fourth quarter of 2006.

The value of the expansion project was not disclosed.

Transportation—Quick Takes

ADB: TAP line feasible; field study due

Asian Development Bank (ADB)'s recent feasibility study for the proposed Turkmenistan-Afghanistan-Pakistan (TAP) natural gas pipeline has shown the $3 billion project to be economically and technically feasible, said ADB Director Marshuk Ali Shah.

Shah said ADB would submit the study to the three-nation steering committee meeting in Islamabad next month, which will discuss implementation of the project.

The 1,700 km TAP system would transport 1.5-2 bcfd of gas from Daulatabad gas field in Turkmenistan to Gwadar, Pakistan, via Afghanistan (OGJ Online, Aug. 28, 2003).

In addition to the pipeline, ADB has proposed that Pakistan use its depleting gas fields for underground storage to ensure an uninterrupted gas supply.

A separate study being conducted by ADB on natural gas storage in Pakistan will be available in 2-3 months. Shah said storage equal to 2-3 months of supply is required.

Turkmenistan, through an American consultant, is completing an audit of Daulatabad gas field and expects to have a report available for the committee meeting. Pakistan earlier had linked the project to certification of Daulatabad gas reserves. Shah said Pakistan will need to begin importing gas by 2008-09.

Amazon LPG line approved; gas line planned

Petróleo Brasileiro SA (Petrobras), Brazil's state-owned oil company, has closed a deal with V&M do Brasil, Rio de Janeiro, for the purchase of a natural gas pipeline that Petrobras will convert to carry liquefied petroleum gas.

Petrobras also will lay 293 km of 10-in. pipeline to connect with the existing line to deliver LPG from Urucu basin oil and gas fields to the Solimões terminal, in Coari, Amazonas state.

Petroberas expects pipeline construction, costing $400 million, to begin in June.

Faults postpone delivery of LNG vessel

The 75,000 cu m Gas-de-France-Energy LNG carrier, dedicated last November and due for delivery at the end of 2004, is being investigated for faults detected during tests at sea.

Delivery of the ship, built by Alstom Group's Chantiers de l'Atlantique at Saint-Nazaire, France, at a cost of 150 million euros, has been postponed indefinitely.

The secondary protective membrane, which doesn't come in contact with the LNG, has shown signs of leaks, and its materials have behaved abnormally under pressure.

The membrane technology was developed by Gaztransport et Technigaz (GTT), a joint affiliate of Gaz de France (GDF), Total SA, and Italy's Saipem SPA. Its new version, Cryogenic Cargo Containment System, was used for the first time on Gaz-de-France-Energy. Chantiers is using the technology in two 154,000 cu m LNG carriers ordered by GDF.

The first one, Provalys, is due for delivery at the end of 2005. At this stage, there is no talk of postponement. But GTT has sold its manufacturing license to LNG-carrier builders worldwide, and pinpointing weaknesses in the secondary membrane is a delicate task on a tanker that has been completed; it should take some time, according to GDF.

BG to supply LNG to ENEL

BG Group has signed an agreement to supply 2.4 million tonnes/year (t/y) of LNG to Ente Nazionale Energia Elettrica SPA (ENEL) at the 6 million t/y Brindisi LNG terminal under construction in southern Italy.

The LNG initially will come from the 3.6 million t/y Egyptian LNG Train 2 under construction at Idku, Egypt. BG holds a 38% interest in the train (OGJ, June 14, 2004, p. 58). Until the Brindisi LNG terminal is commissioned in 2008, the Egyptian output will go primarily to the import terminal in Lake Charles, La., in which BG LNG Services LLC holds 100% of the capacity rights (OGJ Online, July 2, 2003).

Brindisi LNG SPA, a joint venture of BG and ENEL, let an engineering, procurement, and construction contract for the Italian terminal to a consortium led by Tecnimont SPA and including Mitsubishi Heavy Industries Ltd, Grandi Lavori Fincosit SPA, Consorzio Cooperativa Costruttori, Sofregaz SA, and Vinci Construction Grands Projets SAS.