API: Highway diesel led '04 surge in US oil demand

US petroleum demand grew at its strongest rate in 5 years during 2004, partially due to a nearly 7% demand increase for highway diesel fuel, the American Petroleum Institute said. Product deliveries grew 2.3% to an average 20.5 million b/d.

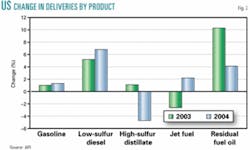

Economic growth in 2004 also was the strongest in 5 years, which strengthened petroleum demand, API officials said as they released the association's yearend statistics. Substantially higher prices for crude oil and petroleum products, including gasoline, dampened oil product demand growth in many instances, they said (Fig. 1).

Diesel fuel was an exception.

"The year's robust economy produced more goods, and they needed to be transported. That, in turn, spurred strong growth in diesel demand," said Ronald J. Planting, information and analysis manager in API's statistics department.

Demand growth for low-sulfur diesel, the grade required for highway use, was the strongest among any major petroleum product, he told reporters at a briefing in Washington, DC. Deliveries increased 6.8% year-to-year to an average 2.994 million b/d.

Overall distillate fuel oil demand rose by 3.5% as deliveries for heating oil and other products with more than 500 ppm sulfur fell by 4.7%.

Gasoline deliveries, meanwhile, rose by only 1.3% to an average 9.054 million b/d (Fig. 2).

"The improved economy would have spurred more demand growth, had it not been for higher retail prices," said Planting. "In fact, gasoline deliveries rose by the smallest percentage among all of the major product categories."

Consumers apparently reduced consumption during 2004 in response to gasoline prices that were 20% higher than in 2003, he continued. "That wasn't the case with diesel," Planting said.

Kerosine jet fuel demand grew 2.2% to an average 1.613 million b/d, while residual fuel oil deliveries climbed 4.1% to an average 804,000 b/d.

"For jet fuel, gains in air travel led to the first increase in deliveries since 2000, and higher-priced natural gas continued to push industrial and utility users toward residual fuel oil as an alternative," Planting said.

Refineries set records

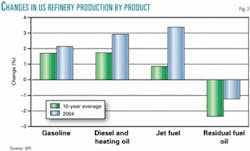

Refineries responded to stronger product demand by setting production records, according to API (Fig. 3).

"The industry also imported record amounts of gasoline and diesel fuel to augment this production to meet all-time high consumer demand," noted John C. Felmy, API's chief economist and director of policy analysis and statistics.

Even though operable domestic refining capacity rose by 0.9% to 16.902 million b/d, capacity utilization grew by 0.2 percentage point to an average 92.8% as input to crude distillation units increased 1.2% to an average 15.689 million b/d during 2004, API reported.

The statistics showed that the US refining system was pushed even harder during December as capacity utilization reached 94.9% and inputs climbed 2.9% from the same month of 2003 to an average 16.024 million b/d.

Other industries' plant capacity utilization rates average 80-82%, according to Felmy.

"The petroleum industry's infrastructure is stretched to the limit," he said. "Virtually all pipelines, terminals and other links to the supply chain are running at or near maximum capacity. Problems in one part of the system can cascade throughout the system."

Product imports grew by 9.9% during 2004 to an average 2.856 million b/d and by 25.4% in December to an average 2.945 million b/d. The biggest year-to-year jumps last month were 32.3% for gasoline and components to 943,000 b/d and 23.8% for kerosine jet fuel to 125,000 b/d.

Higher refinery production and imports during December have raised US oil-product inventories to January levels higher than 1-2 years ago, when prices broke their seasonal pattern and rose during the early months of 2004 and 2003. But Felmy cautioned that other variables, such as new product specifications and crude oil prices, could lead to higher retail prices.

"There's also the refining system," he continued. "We haven't built a new refinery since the 1970s, and the system is nearly stretched to the limit. The higher inventories are good news, but they're only part of the equation."

Production down

During 2004, domestic production of crude oil and condensate continued to fall, registering a 3.8% drop to an average 5.465 million b/d, according to API.

"Hurricane Ivan, which hampered offshore production in the Gulf of Mexico, was partly to blame," Planting said. "Also contributing were significant down-time in Alaska for scheduled maintenance and the Lower 48 states' ongoing decline trend."

That led to a 4% increase in average crude oil imports, which broke the 10 million b/d barrier for the first time last year, despite record high prices (not adjusted for inflation).

"At the international level, the market for crude experienced unexpected demand increases, and available excess production capacity evaporated," said Felmy.

He noted that members of the Organization of Petroleum Exporting Countries have made some investments to increase production capacity, "but we will have to see if they decide to use it to produce more oil."