INDIA GAS-1: Domestic projects pursued; import prospects limited

Development of India’s gas sector will depend on a number of key issues, including development of its pipeline infrastructure and domestic gas fields, potential piped gas imports, the establishment of LNG terminals, and gas pricing. This first of two articles examines India’s natural gas supply-demand balance, the likelihood of meeting future demand through import pipeline projects, and development of the country’s domestic pipeline infrastructure.

Part 2 will focus on developments in India’s rapidly evolving LNG market and the effect of the country’s natural gas pricing structure on both pipeline and LNG projects.

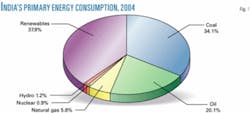

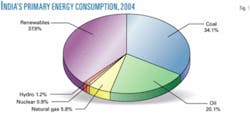

India’s consumption of natural gas has risen faster than its use of any other fuel. This growth is from a relatively limited base, however, as the share of natural gas in primary energy consumption stood at only 5.8% in 2004 (Fig. 1). Natural gas’ small share may be traced to limited gas availability and the dominance of coal in the power sector, as well as heavy use of renewable waste (Fig. 2).

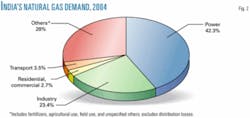

In recent years the power sector has supplanted the fertilizer sector as the main driver of gas demand, with its overall share also increasing. Near-term LNG imports will be used primarily in the industrial sector, replacing naphtha in refineries and other industries. Gas marketers realize, however, that the power sector offers the most promising prospects for long-term growth.

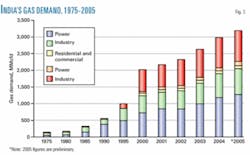

India consumed 2.458 bcfd of natural gas in 2002, 2.77 bcfd in 2003, and will consume 3.321 bcfd in 2005 (Fig. 3). New gas finds, expanded transmission and distribution, and the development of multiple LNG terminals will boost natural gas use through the next decade, to about 5 bcfd in 2010 and 6.8 bcfd in 2015.

Domestic supply issues

The western offshore area (Mombai High basin) supplies most of India’s gas. Assam, Andhra Pradesh, and Gujarat states also produce major volumes of gas. Tripura, Tamil Nadu, and Rajasthan produce less gas. About 60% of India’s natural gas is associated. The south basin and Tapti fields in the western offshore area, and the gas fields in Tripura and Andhra Pradesh (KG basin) produce most of India’s nonassociated gas.

India’s proven gas reserves at the beginning of 2004 stood at 30 tcf. A substantial gas find in the KG basin by Reliance Industries Ltd. increased these reserves significantly. RIL holds a 90% share in the find, with Niko Resources Ltd., Calgary, holding the balance. KG’s estimated reserves are more than 10 tcf, and RIL is confident that much more gas will be found.

Gujarat State Petroleum Corp. made an estimated 20 tcf discovery in the KG basin, potentially the biggest gas find in India. State-run Oil and Natural Gas Co. and Cairn Energy PLC also have found gas in the KG basin.

In addition to its KG find, RIL discovered gas in three Bay of Bengal wells off Orrisa. Initial reserves at the three wells are 1 tcf, although potential reserves could total 5 tcf. Niko has 10% equity in the discovery.

Import pipeline prospects

Project proposals aimed at importing piped gas into India have generally run into political roadblocks. Among the most commonly discussed projects are:

• Bangladesh-India pipeline. Current proven reserves of natural gas in Bangladesh are at least 14 tcf, but foreign firms involved in natural gas exploration there believe they are higher. The US Geological Survey estimates the country’s probable reserves at 32 tcf.

Unocal Corp. proposed a 1,350 km, 1-bcfd pipeline beginning near Rashidpur, Bangladesh, and ending at an interconnection with the Hazira-Bijaipur-Jagdishpur pipeline near Delhi. About 350 km of the pipeline would be in Bangladesh, with 1,000 km in India. Long-standing animosity between India and Bangladesh, however, has made the Bangladeshi government fearful that exporting gas will be seen domestically as giving away a national resource.

Foreign oil companies are reluctant to invest under these circumstances. Some have simply left and others have said they will limit exploration until government approval allows for exports to help recover costs. In the meantime, growing domestic sales and shortfalls in production have shifted Unocal’s development focus in Bangladesh from exports to domestic sales.

FACTS Inc. feels prospects for gas exports from Bangladesh are remote.

• Iran-India pipeline. Iran has the second largest gas reserves in the world and could export low-cost gas to western India. This project faces an uphill political battle, however, as most plans route it through Pakistan.

There are three routes under consideration for an Iran-India gas pipeline: deepwater, shallow-water, and overland. ENI Group unit Snamprogetti SPA is conducting a feasibility study for the deepwater route, while BHP Billiton studies the overland route, and OAO Gazprom studies the shallow-water route.

India-Pakistan relations have improved during the past few months, returning these discussions to prominence. India, Pakistan, and Iran have initiated talks at the ministerial level.

While resolving the tense political situation is the biggest hurdle this project faces, pricing, quality of gas, route of the pipeline, and legal issues are also potential roadblocks. Iran has indicated that it intends to supply lean gas, while India has voiced an interest in gas having a minimum 9,881 kcal/cu m. Iran also wants to charge the same price it would receive for regasified LNG, while India has suggested a delivered price of $2.25/MMbtu. Additionally, the US government strongly opposes the building of this pipeline as part of its opposition to Iran’s nuclear program, placing considerable pressure on both Pakistan and India as well.

We do not expect this project to succeed.

• Turkmenistan-Afghanistan-Pakistan pipeline. The government of Turkmenistan first floated the idea of a gas pipeline from Turkmenistan to Pakistan in 1991. The Asian Development Bank has provided financial assistance totaling $1 million for the TAP feasibility study. The proposed pipeline is 1,600 km long, originating in Turkmenistan’s Daulatabad gas fields (proven reserves, 23 tcf), passing through Afghanistan, and ending at the Pakistani seaport of Gwadar.

In February 2003, the TAP participants decided to invite India to join the project. The political situation in Afghanistan and Pakistan and the recent agreements committing a large amount of Turkmenistan’s gas for export to Russia via Kazakhstan, greatly undermine the feasibility of this project.

We consider it effectively dead.

• Myanmar-India pipeline. The recent discovery of 6 tcf of gas in Myanmar by GAIL, ONGC, Korea Gas Corp., and Daewoo International has prompted feasibility studies for bringing the gas to India. Daewoo favors sending the gas to India by pipeline. KOGAS feels Myanmar could export LNG to India. We do not believe the latter option is likely.

KOGAS has pursued the LNG option because Bangladesh does not want to install a pipeline from Myanmar to India across its territory. An undersea pipeline project between Myanmar and India across the Bay of Bengal, bypassing Bangladesh, has also been proposed. The Bangladeshi government, however, is reconsidering the original pipeline project, given the potential to earn substantial transit fees.

Even so, we do not expect this pipeline to be built before 2015.

The prospects for large volumes of imported pipeline gas reaching India in the near future appear limited. Although economics favor piped gas imports, politics seem destined to continue to preclude international pipelines. This is helping fuel interest in LNG imports to meet India’s growing gas demand.

Domestic infrastructure

India’ recent domestic gas finds will significantly effect both the development of its natural gas infrastructure and future prospects for LNG imports.

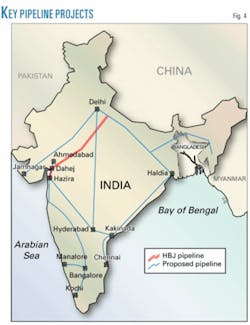

The Indian gas market has a relatively limited transmission infrastructure, with small regional pipelines and the Hazira-Bijaipur-Jagdishpur pipeline, operated by GAIL. The 2,300-km HBJ pipeline carries gas from the offshore Bombay High basin to fertilizer and power plants in northern India. Its capacity is about 1.18 bcfd, roughly 45% of India’s gas consumption in 2003.

The HBJ pipeline also is to carry LNG imports to the state of Gujarat.

Proposed infrastructure

The Ministry of Petroleum and Natural Gas has planned an aggressive expansion of India’s gas transmission and distribution network. GAIL is expanding the Dahej-Bijaipur section of the HBJ pipeline, and is also building the Dahej-Uran gas line, scheduled for completion by January 2006 but subsequently delayed.

GAIL is also developing the $4.4 billion National Gas Grid, an 8,000-km cross-country pipeline network. GAIL intends to build and operate an east-west trunkline linking the east-coast port of Kakinada (KG basin) and the Bay of Bengal to Hazira as part of the project. GAIL intends to implement the NGG project in phases during the next 6-7 years, and recently signed an agreement to conduct a feasibility study of the project. The US Trade Development Agency ($690,000) and GAIL ($230,000) will fund the study, scheduled for completion by June 30, 2006.

Reliance is hesitant to depend on GAIL for gas transport, however, and instead wants to build a 1,400-km pipeline from Kakinada to Ahmedabad in the northwest state of Gujarat, via Hyderabad in Andra Pradesh, and Uran in Maharashtra. The pipeline would transport the company’s reserves in the KG basin to the Gujarat power plants of state-owned utility National Thermal Power Corp.

Reliance won a 17-year supply contract to provide gas to these plants in 2004. Reliance also has plans to build a pipeline from Hyderabad to Delhi. But GAIL has objected to Reliance’s plans, citing exclusive rights to build interstate trunk gas pipelines longer than 100 km.

In addition to the major pipelines discussed above, several smaller projects are in the works. These include a 600-km pipeline from Visakhapatnam to Secunderabad in Andhra Pradesh, a 700-km pipeline from Mangalore in Karnataka to Madurai in Tamil Nadu, and a 575-km pipeline to connect the Kochi LNG terminal to Kerela.

Finally, while India reduced gas flaring to 7% of gross production in 2002 from 30% in the early 1990s, production of associated gas continues to exceed existing transport capacity. ONGC and Oil India Ltd. are setting up improved transportation facilities in an effort to further reduce flaring. ✦